Banknotes of the Canadian dollar

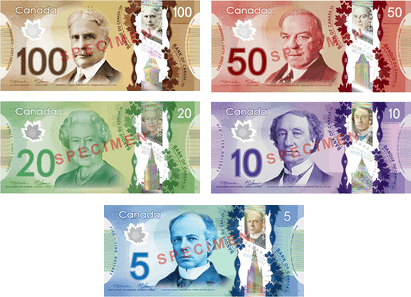

Banknotes of the Canadian dollar are the banknotes or bills (in common lexicon) of Canada, denominated in Canadian dollars (CAD, C$, or $ locally). Currently, they are issued in $5, $10, $20, $50, and $100 denominations. All current notes are issued by the Bank of Canada, which released its first series of notes in the year of 1935. The current series of polymer banknotes as we know them now were introduced into circulation between November 2011 and November 2013.[1] Banknotes issued in Canada can be viewed at the Currency Museum of the Bank of Canada in Ottawa.

History

The first paper money issued in Canada denominated in dollars were British Army notes, issued between 1813 and 1815 in denominations between $1 and $400. These were emergency issues due to the War of 1812. The first banknotes were issued in 1817 by the Montreal Bank.

Chartered Banks

Large numbers of chartered banks were founded in the 1830s, 1850s, 1860s and 1870s, although many issued paper money for only a short time. Others, including the Montreal Bank (later called the Bank of Montreal), issued notes for several decades. Until 1858, many notes were issued denominated in both shillings/pounds and dollars (5 shillings = $1 therefore 1 pound = $4). A large number of different denominations were issued, including $1, $2, $3, $4, $5, $10, $20, $25, $40, $50, $100, $500 and $1000. After 1858, only dollar denominations were used. The Bank Act of 1871 limited the smallest denomination the chartered banks could issue to $4, increased to $5 in 1880. To facilitate purchases below $5 without using Dominion notes, some charted banks issued notes in unusually domesticated denominations, such as the $6 and $7 notes issued by the Molsons Bank in 1871.

Colonial Governments

Prior to Canadian confederation, dollar-denominated notes were issued by the governments of British Columbia, Canada, Nova Scotia, and Prince Edward Island. Of these, the Province of Canada, established in 1841, was the most prolific issuer of paper money. Notes were produced for the government by the Bank of Montreal between 1842 and 1862, in denominations of $4, $5, $10, $20, $50 and $100. In 1866, the Province of Canada began issuing its own paper money, in denominations of $1, $2, $5, $10, $20, $50, $100 and $500. The Dominion of Newfoundland issued notes denominated in Newfoundland dollars from 1901 until it joined confederation in 1949.

Government of Canada

For a temporary period following confederation in 1867, Province of Canada notes served as the Dominion of Canada's first national currency, and notes were dispatched from Ontario and Quebec to the other provinces. In 1870, the first Dominion of Canada notes were issued in denominations of 25¢, $1, $2, $500 and $1000. $50 and $100 notes followed in 1872. The bulk of later government note production was of $1 and $2 notes, with a $4 denomination added in 1882. $5 notes were issued starting in 1912. The last 25¢ notes, known as shinplasters due to their small size, were dated 1923. Special notes called Bank Legals were issued by the Dominion of Canada only to banks for transferring large sums of money in denominations of $500, $1000, $5000, and $50,000.[2] Issuance of all Dominion notes ceased in 1935, after the establishment of the Bank of Canada.

Other public issuers

Some municipalities also issued dollar-denominated notes. This was most prevalent in the 1930s, when depression scrip was issued in an attempt to alleviate the effects of the Great Depression on local citizens. The province of Alberta also launched its own scheme in 1936 by issuing prosperity certificates.

Bank of Canada

In 1934, with only ten chartered banks still issuing notes, the Bank of Canada was founded and began issuing notes in denominations of $1, $2, $5, $10, $20, $25, $50, $100, $500 and $1000. In 1944, the chartered banks were prohibited from issuing their own currency, with the Royal Bank of Canada and the Bank of Montreal among the last to issue notes. From that point forward, the Bank of Canada has been the sole issuer of bank notes denominated in Canadian dollars. A liability of more than $12 million remains on the Bank of Canada's books up to the present day, representing the face value of Dominion of Canada, provincial, and chartered bank notes still outstanding.[3]

Production

Notes are issued by the Bank of Canada, but the actual production of the banknotes is outsourced to the Canadian Bank Note Company and BA International Inc (part of Giesecke & Devrient of Germany) in accordance with the specifications and requirements of the Bank of Canada. All wording on the notes appears in both of Canada's official languages, English and French. Bank notes were printed on paper composed of pure cotton. In March 2010 the government of Canada announced that beginning in 2011, cotton fibre will be discontinued and replaced by a synthetic polymer.[4]

Other bank notes include denominations that are no longer issued but continue to be legal tender. Bank notes in circulation are non-interest-bearing liabilities and are due on demand.

In accordance with the Bank of Canada Act, the Bank has the sole authority to issue bank notes for circulation in Canada. As of 2014 the new series of polymer notes now constitutes some 75 per cent of notes in circulation. A breakdown by denomination is presented below.: "Bank of Canada annual report 2014" (PDF). p. 7,90.

| $ Millions | Denomination |

|---|---|

| $1,188.0 | $5 |

| $1,275.6 | $10 |

| $17,801.4 | $20 |

| $11,233.9 | $50 |

| $37,323.9 | $100 |

| $1,200.7 | Other bank notes |

| $70,023.5 | Total Bank notes in circulation |

Counterfeiting

Efforts to reduce counterfeiting in recent years have sharply reduced the number of counterfeit notes in circulation. The number of counterfeit notes passed annually in Canada peaked in 2004, when 553,000 counterfeit notes were passed. Counterfeiting has decreased annually since that peak, with only 53,536 notes passed in 2010.[5] The new Frontier Series of banknotes significantly improves security primarily by using a polymer substrate to make up the note instead of the previously used fabric. Even as Canada’s counterfeiting problem escalated, the shift to polymer was viewed as too expensive. A polymer note costs 19 cents to produce, compared to 9 cents for a typical cotton-paper note.

Counterfeiting is measured using a system borrowed from chemistry known as parts per million (PPM). Normally used to judge the potency of molecules in a solution, PPM in the counterfeit sense refers to the number of fake banknotes found in circulation for every one million genuine notes. In 1990, Canada's counterfeit ratio was just 4 PPM, ranking its currency among the most secure in the world. By the late 1990s, the rise of powerful and affordable home computers, store-bought graphics software, easy-to-use scanners and colour ink-jet printers were breeding a new generation of counterfeiters. The number of fake Canadian bills rose as high as 117 PPM by 1997. In 2004 Canada’s counterfeit rate had ballooned to 470 PPM. In 2008, the counterfeiting rate had fallen to 76 PPM. Most G20 nations used 50 PPM as their benchmark to stay below.[6]

Withdrawn denominations

The 1935 series was the only series to have included $25 and $500 denominations. Both denominations were short lived. The $25 note was withdrawn on May 18, 1937. Stacks of unissued 1935 $500 notes were destroyed in February 1938, and issued $500 notes were recalled and withdrawn from circulation five months later.

Some of the most significant recent developments in Canadian currency were the withdrawal of the $1, $2, and $1,000 notes in 1987, 1996, and 2000 respectively. The $1 and $2 denominations have been replaced with coins, colloquially referred to as the "loonie" and "toonie" respectively. In 2000, the $1,000 note was removed at the request of the Solicitor General of Canada and the Royal Canadian Mounted Police, as it was reported that they were largely being used for money laundering and organized crime.

List of Bank of Canada bank note series

1935 Series

The Bank of Canada was created in 1934 and given responsibility, through an Act of Parliament, to regulate the country's money supply and to "promote the economic and financial welfare of Canada." Accordingly, it was given the exclusive right to issue bank notes in Canada. On 11 March 1935, the Bank of Canada issued its first series of bank notes.

1937 Series

The creation of a second series of bank notes, only two years after the first issue, was prompted by changes in Canadian government legislation requiring the Bank of Canada to produce bilingual bank notes. Another contributing factor was the death of King George V on 20 January 1936 and the subsequent abdication of Edward VIII.

1954 Series

The third series of banknotes of the Canadian dollar issued by the Bank of Canada was the 1954 series. The banknotes were designed in 1952 following the accession of Elizabeth II to the throne after the death of her father George VI.[7] Her portrait appeared on all denominations in the series. The banknote designs differed significantly from the 1937 series, though the denomination colours and bilingual printing were retained.[7] The design changes were made to portray themes more typical of Canada.[8] This was the first series to include the Canadian coat of arms, which appeared centrally in the background of the obverse.

The banknote series became known as the "Devil's Head" series, because the hair behind the Queen's head looked somewhat like a grinning demon. [9] This led to design modifications for all denominations. The second variant of the series was issued in 1956.[7]

1969 Scenes of Canada Series

Because of a growing concern over counterfeiting, the Bank of Canada began to release a new series of bank notes in 1969.

This series represented another complete departure in design from earlier issues:

- colourful, wavy patterns were introduced;

- a new series of Canadian scenic vignettes was created;

- portraits of former Canadian prime ministers were re-introduced. Both Laurier and Macdonald were on the 1935 and 1937 series, but now joined by King and Borden.

1986 Birds of Canada Series

In 1986 the Bank of Canada introduced new banknotes called the Birds of Canada Series. The design on the back of each note features a bird indigenous to Canada with a background representing the typical landscape for that bird. The portraits on the front of the note were made larger than those of previous series, and a metallic patch was introduced on the larger notes. Each banknote weighs 1 gram.[10] This series was the first to include a bar code with the serial number. This allows the visually impaired to distinguish notes with the use of a hand-held device that tells the note's denomination.

This was also the last series that the $2 and $1,000 notes were issued. The $2 note was withdrawn in 1996 and replaced by the $2 coin known as the toonie. The $1,000 note was withdrawn by the Bank of Canada on 12 May 2000 at the request of the Royal Canadian Mounted Police (RCMP) as part of a program to reduce organized crime.[10] At the time, 2,827,702 of the $1000 bills were in circulation; by 2011, fewer than 1 million were in circulation, most held by organized crime.[10]

2001 Canadian Journey Series

Beginning in 2001, the Bank of Canada introduced a new series of notes called "Canadian Journey", featuring images of Canadian heritage and excerpts from Canadian literature. The $10 was first issued on January 17, 2001; the $5 on March 27, 2002; the $100 note on March 17, 2004, the $20 on September 29, 2004, and the $50 on November 17, 2004.

The $20, $50, and $100 notes introduce watermark security features for the first time on Canadian currency since the four-dollar Dominion notes; they also boast significantly expanded holographic security features. Also among the new features are a windowed colour-shifting thread woven into the paper, a see-through number, and enhanced fluorescence under ultraviolet lighting. These features are designed to help Canadians protect themselves by detecting counterfeit notes. All post-2001 series notes also include the EURion constellation, on both sides of the note. The new notes have a tactile feature, which is a series of raised dots (but not Braille) in the upper right corner on the face of each note to aid the visually impaired in identifying currency denominations.

The newer security features on the $20, $50, and $100 notes were added to an updated version of the $10 note released on 18 May 2005, and the Bank of Canada began issuing a $5 note with upgraded security features on 15 November 2006 as part of its ongoing effort to improve the security of Canadian bank notes. The illustrations on the front and back of the upgraded notes are the same as those on the $5 and $10 notes issued in 2001 and 2002.

The "Canadian Journey" literary excerpts are printed in English and French, with the English versions being:

- $5: The winters of my childhood were long, long seasons. We lived in three places—the school, the church, and the skating-rink—but our real life was on the skating-rink. (Roch Carrier (born 1937) from his short story Le chandail de hockey (The Hockey Sweater))

- $10: In Flanders Fields the poppies blow / Between the crosses, row on row, / That mark our place, and in the sky / The larks, still bravely singing, fly / Scarce heard amid the guns below. (John McCrae (1872–1918), from his poem In Flanders Fields)

- $20: Could we ever know each other in the slightest without the arts? (Gabrielle Roy (1909–1983) from her novel La Montagne secrète (The Hidden Mountain))

- $50: All human beings are born free and equal in dignity and rights (from Article 1 of the Universal Declaration of Human Rights, 1948)

- $100: Do we ever remember that somewhere above the sky in some child's dream perhaps Jacques Cartier is still sailing, always on his way always about to discover a new Canada? (Miriam Waddington (1917–2004) from her poem Jacques Cartier in Toronto)

Canadian Journey banknotes (2004 style) incorporates background color and consists of series years 2001, 2003, 2003A, 2004, 2004A and 2006. All the notes except the $100 note have additional series years 2007, 2008, 2009 and 2009A (some banknotes only). The $100 2009 series began issuing to the public in early 2010 and was printed in 2009 before they were issued. The 2004-2009 series of the $100 note was withdrawn from the circulation in November 2011. The $50 note was withdrawn on March 26, 2012 and $5–$20 notes would be withdrawn in the next 2 years before it will be officially announced.

2011 Frontier Series

Beginning in 2011, the Bank of Canada introduced a new series of polymer banknotes. The $100 note was issued on November 14, 2011; the $50 was issued on March 26, 2012; the $20 banknote was issued on November 7, 2012, and the $10 and $5 denominations were issued on November 7, 2013.

These are the first Canadian notes produced on polymer. In place of a watermark are two visual features: a translucent maple leaf and a transparent window. The leaf includes a security feature that, when viewed close to the eye with a single-point light source behind, produces a circular image displaying the note's denomination. The window is fringed by maple leaves; at its top is a smaller version of the portrait, and at its bottom a light-refracting metallic likeness of an architectural feature from the parliament buildings. The portraits on the face are more centred on the note. The backs of the notes introduce new cultural and thematic imagery, but the literary quotation is not continued. The polymer notes continue the tactile feature, from the Canadian Journey series.[11]

2018 series

A new series of banknotes will be issued by 2018. On International Women’s Day 2016, Prime Minister Justin Trudeau announced that an 'iconic' Canadian woman would be featured on one of the upcoming notes.[12]

Commemorative Issues

| Commemorative Issues | |||||||

|---|---|---|---|---|---|---|---|

| Image | Value | Main Colour | Description | Date of | |||

| Front | Back | Front | Back | printing | issue | ||

| |

|

$25‡ | Purple | King George V and Queen Mary | Windsor Castle | May 6, 1935 | |

| $1‡ | Dark Green | Elizabeth II | Old parliament buildings in Ottawa - destroyed by fire in 1916 | 1967 | 3 January 1967+ | ||

| $20 | Green | Elizabeth II | Canadian National Vimy Memorial | 2015 | 9 September 2015 | ||

| These images are to scale at 0.7 pixels per millimetre. For table standards, see the banknote specification table. | |||||||

‡ Withdrawn from circulation. Currency withdrawn from circulation is still legal tender. Despite the introduction of new notes, older notes are still in use.

+ Two varieties were printed, the first with conventional serial numbers, the second with the double date "1867-1967" appearing twice instead. Neither type is scarce. Both varieties also have on the obverse a stylized maple leaf with the double date below it.[13]

All notes of 1954 series or later measure 152.4 mm by 69.85 mm (6 by 2¾ inches).

See also Withdrawn Canadian banknotes.

Myths

A number of myths have circulated regarding Canadian banknotes.

- An American flag is flying over the Parliament buildings on Canadian paper money. This is not the case. The Birds series notes depict a Union Flag flying over Parliament on the $100; a Canadian Red Ensign (a former Canadian flag) on the $5, $10, and $50; and the modern maple-leaf flag was on the $2 notes. (The $20 depicts the Library of Parliament, with no flag visible.) Those fooled by the rumour were likely fooled by the notes with the Red Ensign, as the flags are very small and not shown in full colour, and the Ensign with its contrasting canton somewhat resembles the American flag.[14]

- When a note depicts a past prime minister, the Parliament buildings behind him are flying whichever flag Canada was using at the time of his tenure. The face of the Birds series featured images of prime ministers (or the Queen) and the houses of Parliament. However, as noted above, the $10 note featured the Red Ensign alongside Sir John A. Macdonald, who became prime minister 25 years before the Red Ensign was approved for use on the Merchant Marine and more than 50 years before it was used on government buildings.[15] Also, the Union Flag is on the $100 with Sir Robert Borden, who came after Laurier who appears with the Red Ensign. This is sometimes explained by the fact that Borden governed during World War I.[16] The views of the Houses of Parliament on the current Canadian Journey series do not feature any flag.

- The Canadian Journey series $10 note is being recalled because there is a misprint in the poem In Flanders Fields. The first line as printed, "In Flanders fields the poppies blow," startled many people, who believed the last word should be "grow". John McCrae wrote two versions which were both published, but his original manuscript, the one used by the government and widely used for Remembrance Day ceremonies, reads "blow". (The last two lines are "We shall not sleep, though poppies grow/In Flanders fields.")[17][18]

See also

Notes

- ↑ Bank of Canada.

- ↑ Canadian Paper Money.

- ↑ Statistics Canada 2009.

- ↑ Pulfer 2010.

- ↑ Royal Canadian Mounted Police 2010.

- ↑ Robertson 2011.

- 1 2 3 Collections Canada.

- ↑ Montreal Gazette 1953, p. 13.

- ↑ Bank of Canada values and prices of 1954 with the devil's face banknotes

- 1 2 3 Humphreys 2012.

- ↑ Bank of Canada 2011b.

- ↑ "Trudeau says new bank note will feature an iconic Canadian woman". CTV News. CTVNews.ca. March 8, 2016. Retrieved 19 March 2016.

- ↑ Bank of Canada values and prices of 1967 banknotes

- ↑ Snopes: Red Ensign Scare 2011.

- ↑ Canadian Paper Money Forum 2007.

- ↑ Canadian Paper Money Forum 2007b.

- ↑ GuelphArts.

- ↑ Snopes: In Flanders Fields 2011.

References

- Cross, W.K., ed. (1997). The Charlton Standard Catalogue of Canadian Government Paper Money (10th ed.). Toronto: The Charlton Press. ISBN 0889681902.

- Graham, R.J. (July 2008). Canadian Bank Notes (6th ed.). Charlton Press.

- Humphreys, Adrian (15 November 2012). "The hunt for Canada's $1,000 bills: There are nearly a million left, most in the hands of criminal elites". National Post. Postmedia Network. Retrieved 1 March 2014.

- Pulfer, Jamie (5 March 2010). "Canadian paper money going plastic". CFTR-AM Radio. 680News.com. Archived from the original on 27 September 2011. Retrieved 18 November 2011.

- Robertson, Grant (3 December 2011). "Funny money: How counterfeiting led to a major overhaul of Canada's money". The Globe and Mail. The Globe and Mail. Retrieved 24 November 2013.

- "Bank notes". Bank of Canada.

- "Bank of Canada Issues $100 Bill – First Canadian Polymer Bank Note" (Press release). Bank of Canada. 14 November 2011. Retrieved 18 November 2011.

- "Bank of Canada Unveils Polymer Bank Note Series: Celebrating Canada's Achievements at the Frontiers of Innovation" (Press release). Bank of Canada. 20 June 2011. Retrieved 18 November 2011.

- "2012 Annual Report" (PDF). Bank of Canada. 2012.

- Bank legals, Canadian Paper Money, retrieved 4 March 2014

- "The Flag on the $10". Canadian Paper Money Forum. 2 June 2007. Retrieved 18 November 2011.

- "The Flag on the $100". Canadian Paper Money Forum. 2 June 2007. Retrieved 18 November 2011.

- "1954 Series". Bank Note Series, 1935 to present. Bank of Canada (archived at Collections Canada). Retrieved 4 March 2014.

- "In Flanders Fields — The Poem". GuelphArts.ca. Archived from the original on 20 February 2012. Retrieved 18 November 2011.

- "Canadian scenes to be portrayed for banknotes". Montreal Gazette. 22 April 1953.

- "Currency Counterfeiting Statistics (2010)". Royal Canadian Mounted Police. 20 April 2010. Archived from the original on 4 November 2011. Retrieved 18 November 2011.

- "In Flanders Fields". Snopes.com. 16 May 2011. Retrieved 18 November 2011.

- "Red Ensign Scare". Snopes.com. 16 May 2011. Retrieved 18 November 2011.

- "Bank of Canada note liabilites". Statistics Canada. 11 September 2009. Archived from the original on 3 February 2012. Retrieved 18 November 2011.

External links

- Canadian Bank Notes Price Guide

- Canadian Paper Money

- Canadian Currency (in French)

- The Online Canadian Paper Money Museum

- The Where's Willy? Currency Tracking Project

- Bank of Canada Currency Museum