Capital in the Twenty-First Century

.jpg) Hardcover edition | |

| Author | Thomas Piketty |

|---|---|

| Original title | Le Capital au XXIe siècle |

| Translator | Arthur Goldhammer |

| Language | French |

| Subject | Capitalism, economic history, economic inequality |

| Genre | Non fiction |

| Publisher | |

Publication date | August 2013 |

Published in English | April 15, 2014 |

| Media type | Print (Hardback) |

| Pages | 696 pp. |

| ISBN | 978-0674430006 |

Capital in the Twenty-First Century is a 2013 book by French economist Thomas Piketty. It focuses on wealth and income inequality in Europe and the United States since the 18th century. It was initially published in French (as Le Capital au XXIe siècle) in August 2013; an English translation by Arthur Goldhammer followed in April 2014.[1]

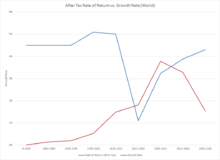

The book's central thesis is that when the rate of return on capital (r) is greater than the rate of economic growth (g) over the long term, the result is concentration of wealth, and this unequal distribution of wealth causes social and economic instability. Piketty proposes a global system of progressive wealth taxes to help reduce inequality and avoid the vast majority of wealth coming under the control of a tiny minority.

On May 18, 2014, the English edition reached number one on the New York Times Best Seller list for best selling hardcover nonfiction[2] and became the greatest sales success ever of academic publisher Harvard University Press.[3] As of January 2015, the book had sold 1.5 million copies in French, English, German, Chinese and Spanish.[4]

At the 2016 Cannes Film Festival it was announced that the book is to be made into a feature documentary film, directed by New Zealand filmmaker Justin Pemberton.[5]

Publication and initial reception

When initially issued in French in August 2013, it was characterized by Laurent Mauduit as “a political and theoretical bulldozer.”[6][7] As news spread of its thesis in the English-speaking world, it was hailed by Paul Krugman as a landmark,[8] while former senior World Bank economist Branko Milanović considers it "one of the watershed books in economic thinking".[9] In response to widespread curiosity abroad aroused by reviews of the original French edition published by Seuil in September 2013, it was translated rapidly into English and its publication date was pushed forward to March 2014 by Belknap. It proved an overnight sensation[10] and ousted Michael Lewis’s financial exposé, Flash Boys: Cracking the Money Code, from the top of the US best-seller list.[11] Within a year of its publication, Stephanie Kelton spoke of a "Piketty phenomenon",[12] and in Germany three books had been published specifically dealing with Piketty's critique.[13][14][15]

Contents

The central thesis of the book is that inequality is not an accident, but rather a feature of capitalism, and can only be reversed through state interventionism.[16] The book thus argues that, unless capitalism is reformed, the very democratic order will be threatened.[16]

Piketty bases his argument on a formula that relates the rate of return on capital (r) to economic growth (g), where r includes profits, dividends, interest, rents and other income from capital and g is measured in income or output. He argues that when the rate of growth is low, then wealth tends to accumulate more quickly from r than from labor and tends to accumulate more among the top 10% and 1%, increasing inequality. Thus the fundamental force for divergence and greater wealth inequality can be summed up in the inequality r > g. He analyzes inheritance from the perspective of the same formula.

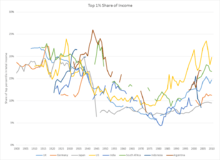

The book argues that there was a trend towards higher inequality which was reversed between 1930 and 1975 due to unique circumstances: the two world wars, the Great Depression and a debt-fueled recession destroyed much wealth, particularly that owned by the elite.[17] These events prompted governments to undertake steps towards redistributing income, especially in the post-World War II period. The fast, worldwide economic growth of that time began to reduce the importance of inherited wealth in the global economy.[17]

The book argues that the world today is returning towards "patrimonial capitalism", in which much of the economy is dominated by inherited wealth: the power of this economic class is increasing, threatening to create an oligarchy.[18] Piketty cites novels by Honoré de Balzac, Jane Austen and Henry James[17] to describe the rigid class structure based on accumulated capital that existed in England and France in the early 1800s.

Piketty proposes that a progressive annual global wealth tax of up to 2%, combined with a progressive income tax reaching as high as 80%, would reduce inequality,[17] although he concedes that such a tax "would be politically impossible."[19]

Without tax adjustment, Piketty predicts a world of low economic growth and extreme inequality. His data show that over long periods of time average return on investment outpaces productivity-based income by a wide margin.[17] He dismisses the idea that bursts of productivity resulting from technological advances can be relied on to return sustained economic growth; we should not expect "a more just and rational order" to arise based on "caprices of technology,"[17] and return on investment can increase when technology can be substituted for people.[19]

Reception

The book's exceptional success was widely attributed to "being about the right subject at the right time", as The Economist put it. Piketty himself recognized that there is a common sense "that inequality and wealth in the United States have been widening." The Occupy movement's "We are the 99%" slogan made talk of inequality "the zeitgeist of our age – an age of seemingly permanent crisis and austerity," as Adam Booth put it.[20]

British author Paul Mason dismissed charges of "soft Marxism" as "completely misplaced", noting that Marx described social relations trying to unveil capitalism's inner tendencies, where Piketty solely relies on social categories and historical data. Piketty rather "placed an unexploded bomb within mainstream, classical economics," he concludes.[21]

Appraisal

Paul Krugman called the book a "magnificent, sweeping meditation on inequality"[22] and "the most important economics book of the year—and maybe of the decade."[18] He distinguishes the book from other bestsellers on economics as it constitutes "serious, discourse-changing scholarship".[23] Krugman also wrote:

At a time when the concentration of wealth and income in the hands of a few has resurfaced as a central political issue, Piketty doesn’t just offer invaluable documentation of what is happening, with unmatched historical depth. He also offers what amounts to a unified field theory of inequality, one that integrates economic growth, the distribution of income between capital and labor, and the distribution of wealth and income among individuals into a single frame. [...] Capital in the Twenty-First Century is an extremely important book on all fronts. Piketty has transformed our economic discourse; we’ll never talk about wealth and inequality the same way we used to.[22]

Steven Pearlstein called it a "triumph of economic history over the theoretical, mathematical modeling that has come to dominate the economics profession in recent years", but also added: "Piketty’s analysis of the past is more impressive than his predictions for the future are convincing."[17]

Branko Milanović, a former senior economist at the World Bank, called the book “one of the watershed books in economic thinking.”[24][25]

British historian Andrew Hussey called the book "epic" and "groundbreaking" and argues that it proves "scientifically" that the Occupy movement was correct in its assertion that "capitalism isn't working".[26]

According to Robert Solow, Piketty has made a "new and powerful contribution to an old topic: as long as the rate of return exceeds the rate of growth, the income and wealth of the rich will grow faster than the typical income from work".[27]

French historian and political scientist Emmanuel Todd called Capital in the Twenty-First Century a "masterpiece" and "a seminal book on the economic and social evolution of the planet".[28]

The book has been described as “a political and theoretical bulldozer” in the French press.[29]

The Economist wrote: "A modern surge in inequality has new economists wondering, as Marx and Ricardo did, which forces may be stopping the fruits of capitalism from being more widely distributed. Capital in the Twenty-First Century [...] is an authoritative guide to the question."[30]

Will Hutton wrote: "Like Friedman, Piketty is a man for the times. For 1970s anxieties about inflation substitute today's concerns about the emergence of the plutocratic rich and their impact on economy and society. [...] the current level of rising wealth inequality, set to grow still further, now imperils the very future of capitalism. He has proved it."[31]

Clive Crook, while being strongly critical of the book, acknowledged that "it's hard to think of another book on economics published in the past several decades that's been praised as lavishly".[32]

Criticism

Critique of the normative content

One strand of critique faults Piketty for placing inequality at the center of analysis without any reflection on why it matters.

According to Financial Times columnist Martin Wolf, he merely assumes that inequality matters, but never explains why. He only demonstrates that it exists and how it worsens.[33] Or as his colleague Clive Crook put it: "Aside from its other flaws, Capital in the 21st Century invites readers to believe not just that inequality is important, but that nothing else matters. This book wants you to worry about low growth in the coming decades not because that would mean a slower rise in living standards, but because it might [...] worsen inequality."[32]

Professor Hannes H. Gissurarson sees Piketty to be seemingly replacing American philosopher John Rawls as the essential thinker of the left. Apart from questioning common measures of wealth distribution, he however criticizes Piketty as, unlike Rawls, being "much more concerned with the rich than with the poor." Hannes admits the "rapid rise in the income of the super-rich of the world," but doesn't see anything wrong about it as long as the poor doesn't get poorer.[34]

American libertarian George Leef attacked Piketty's work as "an apology for the use of state coercion to take property away from some people who supposedly have too much," which in the words of Frédéric Bastiat he calls "legal plunder". Diverting more resources from the voluntary, "generally efficient" private sector and into the coercive, "generally inefficient" government sector, he says, was a bad trade-off, especially for poorer people.[35]

Methodological critique

Lawrence Summers criticizes Piketty for underestimating the diminishing returns on capital, which he believes will offset the return on capital and hence set an upper limit to inequality. Summers challenges another of Piketty's assumptions: that returns to wealth are largely reinvested. A declining ratio of savings to wealth would also set upper limits on inequality in society.[36] Of 400 wealthiest Americans in 1982, only one in ten remained on the list in 2012, and an increasing share of wealthiest people have not increased their fortunes. Moreover, top 1% incomes are now mostly salaries, not capital incomes. Most other economists explain the rise of top 1% incomes by globalization and technological change.[37]

James K. Galbraith criticizes Piketty for using "an empirical measure that is unrelated to productive physical capital and whose dollar value depends, in part, on the return on capital. Where does the rate of return come from? Piketty never says". Galbraith also says: "Despite its great ambitions, his book is not the accomplished work of high theory that its title, length and reception (so far) suggest."[38]

Daron Acemoğlu and James A. Robinson used the economic histories of Sweden and South Africa to show that social inequality depends much more on institutional factors than Piketty's factors like the difference between rate of return and growth. Cross-country analysis also shows that the top 1%'s share of income does not depend on that difference. The professors write that general laws, which is how they characterize Piketty's postulations, "are unhelpful as a guide to understand the past or predict the future because they ignore the central role of political and economic institutions in shaping the evolution of technology and the distribution of resources in a society".[39]

Paul Romer criticises that while the data and empirical analysis is presented with admirable clarity and precision the theory is presented in less detail. In his opinion the work was written with the attitude "Empirical work is science; theory is entertainment" and therefore an example for Mathiness.[40]

Critique of Piketty's basic concepts

German economist Stefan Homburg criticizes Piketty for equating wealth with capital. Homburg argues that wealth does not only embrace capital goods in the sense of produced means of production, but also land and other natural resources. Homburg argues that observed increases in wealth income ratios reflect rising land prices and not an accumulation of machinery.[41] Joseph E. Stiglitz endorses this view, pointing out that "a large fraction of the increase in wealth is an increase in the value of land, not in the amount of capital goods".[42]

This idea is furthered by Matthew Rognlie, then a graduate student at M.I.T., who published a paper in March 2015 with the Brookings Institution that argues that Piketty did not take the effects of depreciation into account enough in his analysis of the growing importance of capital. Rognlie also found that "surging house prices are almost entirely responsible for growing returns on capital."[43][44]

Marxist academic David Harvey, while praising the book for demolishing "the widely-held view that free market capitalism spreads the wealth around and that it is the great bulwark for the defense of individual liberties and freedoms," is largely critical of Piketty for, among other things, his "mistaken definition of capital", which Harvey describes as:

[...] a process, not a thing [...] a process of circulation in which money is used to make more money often, but not exclusively through the exploitation of labor power. Piketty defines capital as the stock of all assets held by private individuals, corporations and governments that can be traded in the market no matter whether these assets are being used or not.

The International Monetary Fund (IMF) researched the basic thesis put forth by the book -that when the rate of return on capital (r) is greater than the rate of economic growth (g) over the long term, the result is concentration of wealth - and found no empirical support for it. IMF economist Carlos Góes found that in fact, an opposite trend was identified in 75% of the countries studied in depth.[45][46][47][48]

Critique of the proposed measures

Harvey further argues that Piketty's "proposals as to the remedies for the inequalities are naïve if not utopian. And he has certainly not produced a working model for capital of the twenty-first century. For that, we still need Marx or his modern-day equivalent". Harvey also takes Piketty to task for dismissing Marx's Das Kapital without ever having read it.[49]

In a similar vein, philosopher Nicholas Vrousalis faults Piketty's remedies for misconstruing the kind of political "counter-agency" required to remove the inequalities Piketty criticizes and for thinking that they are compatible with capitalism.[50]

Critique of the conventional paradigm

Norwegian economist and journalist Maria Reinertsen compares the book to the 2014 book Counting on Marilyn Waring: New Advances in Feminist Economics, by Ailsa McKay and Margunn Bjørnholt, arguing that, "while Capital in the Twenty-First Century barely touches the boundaries of the discipline in its focus on the rich, Counting on Marilyn Waring challenges most limits of what economists should care about".[51]

Allegation of data errors

On May 23, 2014, Chris Giles, economics editor of the Financial Times (FT), identified what he claims are "unexplained errors" in Piketty's data, in particular regarding wealth inequality increases since the 1970s.[52] The FT wrote in part:

The data underpinning Professor Piketty’s 577-page tome, which has dominated best-seller lists in recent weeks, contain a series of errors that skew his findings. The FT found mistakes and unexplained entries in his spreadsheets, similar to those which last year undermined the work on public debt and growth of Carmen Reinhart and Kenneth Rogoff.

The central theme of Prof Piketty’s work is that wealth inequalities are heading back up to levels last seen before the World War I. The investigation undercuts this claim, indicating there is little evidence in Prof Piketty’s original sources to bear out the thesis that an increasing share of total wealth is held by the richest few.[53]

Piketty wrote a response defending his findings and arguing that subsequent studies (he links to Emmanuel Saez and Gabriel Zucman's March 2014 presentation, The Distribution of US Wealth, Capital Income and Returns since 1913) confirm his conclusions about increasing wealth inequality and actually show a greater increase in inequality for the United States than he does in his book.[54] In an interview with Agence-France Presse, he accused the Financial Times of "dishonest criticism" and said that the paper "is being ridiculous because all of its contemporaries recognise that the biggest fortunes have grown faster".[55]

The accusation received wide press coverage.[56][57][58][59] Some sources said the Financial Times has overstated its case. For example, The Economist, a sister publication to the Financial Times, wrote:

Mr Giles's analysis is impressive, and one certainly hopes that further work by Mr Giles, Mr Piketty or others will clarify whether mistakes have been made, how they came to be introduced and what their effects are. Based on the information Mr Giles has provided so far, however, the analysis does not seem to support many of the allegations made by the FT, or the conclusion that the book's argument is wrong.[60]

Scott Winship, a sociologist at the Manhattan Institute for Policy Research and critic of Piketty, claims the allegations are not "significant for the fundamental question of whether Piketty's thesis is right or not [...] It's hard to think Piketty did something unethical when he put it up there for people like me to delve into his figures and find something that looks sketchy [...] Piketty has been as good or better than anyone at both making all his data available and documenting what he does generally".[55]

In addition to Winship, the economists Alan Reynolds, Justin Wolfers, James Hamilton and Gabriel Zucman claim that FT's assertions go too far.[61][62] Paul Krugman noted that "anyone imagining that the whole notion of rising wealth inequality has been refuted is almost surely going to be disappointed".[62] Emmanuel Saez, a colleague of Piketty and one of the economists cited by Giles to discredit him, stated that "Piketty's choice and judgement were quite good" and that his own research supports Piketty's thesis.[63] Piketty released a full point-by-point rebuttal on his website.[64]

Historian Phillip W. Magness of the libertarian Institute for Humane Studies and Austrian School economist Robert P. Murphy challenge many of Piketty's empirical findings and think that these may actually be the book's greatest weakness.[65] In particular, Magness and Murphy allege false figures for minimum wages and tax rates, missing data points and data that have been merely constructed. In their judgement, Piketty cherry-picks those data which sustain a preconceived narrative.

Awards and honours

- 2014 Financial Times and McKinsey Business Book of the Year Award[66]

- 2014 National Book Critics Circle Award (General Nonfiction) finalist[67]

Editions

- Le Capital au XXIe siècle, Éditions du Seuil, Paris, 2013, ISBN 978-2021082289 (French)

- Capital in the Twenty-First Century, Harvard University Press, 2014, ISBN 978-0674430006

See also

References

- ↑ "Piketty's Capital: An Economist's Inequality Ideas Are All the Rage" by Megan McArdle, Bloomberg Businessweek, May 29, 2014

- ↑ "Best Sellers May 18, 2014". New York Times. 18 May 2014. Retrieved 29 January 2015.

- ↑ Marc Tracy (24 April 2014). Piketty's 'Capital': A Hit That Was, Wasn't, Then Was Again: How the French tome has rocked the tiny Harvard University Press. The New Republic. Retrieved 27 April 2014.

- ↑ "French economist and best-selling author Thomas Piketty on Thursday refused France's highest honour – the Légion d'Honneur.". France 24. 1 January 2015. Retrieved 29 January 2015.

- ↑ "Thomas Piketty's 'Capital In The 21st Century' set for doc adaptation". May 12, 2016. Retrieved July 31, 2016.

- ↑ Laurent Mauduit, ‘Piketty ausculte le capitalisme, ses contradictions et ses violentes inégalités,’ Mediapart, 03 Septembre 2013: ‘un bulldozer théorique et politique’

- ↑ Thomas B. Edsall, 'Capitalism vs.Democracy.' New York Times, 28 January 2014.

- ↑ Paul Krugman. America’s Taxation Tradition,’ in New York Times, 27 March 2014 .

- ↑ John Cassidy, ‘Forces of Divergence:Is surging inequality endemic to capitalism?,’ in The New Yorker, 31 March 2014

- ↑ 'Thomas Piketty’s blockbuster book is a great piece of scholarship, but a poor guide to policy,' Economist 3 May 2014.

- ↑ John Lanchester ‘Flash Boys’ in London Review of Books Vol. 36 No. 11, 5 June 2014 pages 7-9

- ↑ Heidi Moore, 'Why is Thomas Piketty's 700-page book a bestseller?,' The Guardian 21 September 2014-09-21

- ↑ Heinz-J. Bontrup, Pikettys Krisen-Analyse. Warum die Reichen immer reicher und die Armen immer ärmer werden, pad-verlag. Bergkamen 2014, ISBN 978-3-88515-260-6.

- ↑ Albert F. Reiterer, Der Piketty-Hype – "The great U-Turn". Piketty's Kapital und die neoliberale Vermögenskonzentration, pad-Verlag, Bergkamen 2014, ISBN 978-3-88515-259-0.

- ↑ Stephan Kaufmann, Ingo Stützle, Kapitalismus: Die ersten 200 Jahre. Thomas Pikettys "Das Kapital im 21. Jahrhundert": Einführung, Debatte, Kritik, Bertz + Fischer Verlag, Berlin 2014, ISBN 978-3-86505-730-3.

- 1 2 Ryan Cooper (March 25, 2014). "Why everyone is talking about Thomas Piketty's Capital in the Twenty-First Century". The Week.

- 1 2 3 4 5 6 7 Steven Pearlstein (March 28, 2014). "'Capital in the Twenty-first Century' by Thomas Piketty". The Washington Post.

- 1 2 Paul Krugman (March 23, 2014). "Wealth Over Work". The New York Times.

- 1 2 "Bigger than Marx.". The Economist. May 3, 2014. Retrieved December 23, 2015.

- ↑ Booth, Adam (29 August 2014). "Piketty's Capital and the spectre of inequality". In Defence of Marxism. Retrieved 1 May 2015.

- ↑ Mason, Paul (28 April 2014). "Thomas Piketty's Capital: everything you need to know about the surprise bestseller". Retrieved 1 May 2015.

- 1 2 Paul Krugman (May 8, 2014). Why We’re in a New Gilded Age. New York Review of Books. Retrieved April 14, 2014.

- ↑ Paul Krugman (April 24, 2014). The Piketty Panic. The New York Times. Retrieved April 26, 2014

- ↑ John Cassidy (March 31, 2014). Forces of Divergence: Is Surging Inequality Endemic to Capitalism? The New Yorker. Retrieved April 13, 2014.

- ↑ Branko Milanovic (October 2013). The return of "patrimonial capitalism": review of Thomas Piketty's "Capital in the 21st century", Munich Personal RePEc Archive. Retrieved April 20, 2014.

- ↑ Andrew Hussey (April 12, 2014). Occupy was right: capitalism has failed the world. The Guardian. Retrieved April 21, 2014.

- ↑ Robert M. Solow. Thomas Piketty Is Right. The New Republic.

- ↑ Emmanuel Todd (September 14, 2013). Piketty décrypte le come-back des héritiers. Marianne.

- ↑ Thomas B. Edsall (January 28, 2014). Capitalism vs. Democracy. The New York Times. Retrieved April 15, 2014.

- ↑ All Men Are Created Unequal, The Economist, Print Edition, January 4, 2014.

- ↑ Will Hutton (April 12, 2014). Capitalism simply isn't working and here are the reasons why. The Guardian. Retrieved April 22, 2014.

- 1 2 "The Most Important Book Ever Is All Wrong". Bloomberg View. Retrieved 22 April 2014.

- ↑ Martin Wolf, “‘Capital in the Twenty-First Century’, by Thomas Piketty”, Financial Times, April 15, 2014, .

- ↑ Gissurarson, Hannes H. (1 December 2014). "A Latter-Day Jacobin with a Lot of Data". The Journal of Ayn Rand Studies. 14 (2): 281–290. Retrieved 30 January 2015.

- ↑ Leef, George (21 May 2014). "Piketty's Book – Just Another Excuse For Legal Plunder And Expanding The State". Forbes. Retrieved 29 January 2015.

- ↑ Summers, Lawrence (May 16, 2014). "Thomas Piketty Is Right About the Past and Wrong About the Future". The Atlantic.

- ↑ The Inequality Puzzle, Lawrence H. Summers, Democracy Journal, Issue #33, Summer 2014.

- ↑ Galbraith, James K. (Spring 2014). "Kapital for the Twenty-First Century?". Dissent. Retrieved April 28, 2014.

- ↑ The Rise and Decline of General Laws of Capitalism, Daron Acemoglu and James A. Robinson, Abstract and pages 1, 10, and 19.

- ↑ Paul Romer, Mathiness in the Theory of Economic Growth, American Economic Review: Papers & Proceedings 2015, Vol. 105, Issue 5, p. 89–93, doi:10.1257/aer.p20151066

- ↑ Homburg, Stefan (2015). "Critical remarks on Piketty's Capital in the Twenty-first Century". Applied Economics. 47 (14): 1401–1406. doi:10.1080/00036846.2014.997927.

- ↑ Stiglitz, Joseph E. (January 3, 2015), "Thomas Piketty gets income inequality wrong", Salon.com, San Francisco: Salon Media Group Inc., retrieved 2015-04-17

- ↑ Rognlie, Matthew (2015). "Deciphering the Fall and Rise in the Net Capital Share: Accumulation, or Scarcity?" (PDF). Brookings Papers on Economic Activity. Forthcoming.

- ↑ "Through the roof". The Economist. March 28, 2015.

- ↑ Góes, Carlos. "Testing Piketty's Hypothesis on the Drivers of Income Inequality: Evidence from Panel VARs with Heterogeneous Dynamics" (PDF). International Monetary Fund.

- ↑ Talley, Ian. "'No Empirical Evidence' for Thomas Piketty's Inequality Theory, IMF Economist Argues". Retrieved 2016-08-13.

- ↑ David, Javier E. (2016-08-06). "An IMF economist thinks Piketty's inequality theories don't really hold water". CNBC. Retrieved 2016-08-13.

- ↑ Andrew Mayeda amayeda Subscribe. "Wealth Inequality May Not Work the Way Piketty Thinks". Bloomberg.com. Retrieved 2016-08-13.

- ↑ David Harvey (May 20, 2014). Taking on ‘Capital’ Without Marx: What Thomas Piketty misses in his critique of capitalism. In These Times. Retrieved May 20, 2014.

- ↑ Vrousalis, Nicholas (September 1, 2014), Piketty's Grandchildren, Social Science Research Network, retrieved January 23, 2015

- ↑ Reinertsen, Maria (July 4, 2014), "Bør morsmelk regnes med i bruttonasjonalprodukt? (English: "Should milk be included in the gross domestic product?")" (pdf), Morgenbladet (26): 6–7, retrieved January 23, 2015

- ↑ Giles, Chris (May 23, 2014). "Thomas Piketty's exhaustive inequality data turn out to be flawed". Financial Times. Retrieved May 23, 2014.

- ↑ Weissmann, Jordan (May 23, 2014). "Financial Times: Piketty's Data Is Full of Errors". Slate. Retrieved May 25, 2014.

- ↑ Thomas Piketty (May 23, 2014). Piketty response to FT data concerns. Financial Times. May 23, 2014

- 1 2 Jennifer Rankin (May 26, 2014). Thomas Piketty accuses Financial Times of dishonest criticism. The Guardian. Retrieved May 26, 2014.

- ↑ Mark Gongloff (May 23, 2014). Thomas Piketty's Inequality Data Contains 'Unexplained' Errors: FT. The Huffington Post. Retrieved May 23, 2014.

- ↑ Kevin Drum (May 23, 2014). Chris Giles Challenges Thomas Piketty's Data Analysis. Mother Jones. Retrieved May 23, 2014.

- ↑ Irwin, Neil (May 23, 2014). "Did Thomas Piketty Get His Math Wrong?". The New York Times. Retrieved May 25, 2014.

- ↑ Doward, Jamie (May 24, 2014). "Thomas Piketty's economic data 'came out of thin air'". The Guardian. Retrieved May 25, 2014.

- ↑ R.A. (May 24, 2014). "A Piketty problem?". The Economist. Retrieved May 25, 2014.

- ↑ Alan Reynolds (July 9, 2014). Why Piketty’s Wealth Data Are Worthless. The Wall Street Journal. Retrieved July 11, 2014.

- 1 2 Mark Gongloff (May 27, 2014). Economists Rip Apart FT's Piketty Takedown. The Huffington Post. Retrieved May 27, 2014.

- ↑ Ryan Grim (May 27, 2014). The Economists FT Relied On For Its Thomas Piketty Takedown Don't Buy It. The Huffington Post. Retrieved May 28, 2014.

- ↑ Ryan Grim (May 29, 2014). Thomas Piketty Rebuts FT Charges: 'Criticism For The Sake Of Criticism'. The Huffington Post. Retrieved May 29, 2014.

- ↑ Phillip W. Magness und Robert W. Murphy

- ↑ Andrew Hill (11 November 2014). "Thomas Piketty's 'Capital' wins Business Book of the Year". Financial Times. Retrieved November 12, 2014.

- ↑ "National Book Critics Circle Announces Finalists for Publishing Year 2014". National Book Critics Circle. January 19, 2015. Retrieved January 29, 2015.

External links

| Library resources about Capital in the Twenty-First Century |

- The book's official website

- Text from Introduction to Capital in the Twenty-First Century

- All the raw data from the book

- Newsnight's explainer about Capital on YouTube on BBC Newsnight (3:10)

- Video of Thomas Piketty describing Capital in the Twenty-First Century on YouTube

- Piketty's talk about Capital in the Twenty-First Century on YouTube at TED in Berlin in June 2014.

- A handy summary of the book with six charts by John Cassidy

- 3 Business Best-Sellers Show Inequality Is Now The Hot Topic. NPR, December 19, 2014.