Card security code

A card security code (CSC; also called card verification data [CVD], card verification number, card verification value [CVV], card verification value code, card verification code [CVC], verification code [V-code or V code], card code verification,[1] or signature panel code (SPC)[2]) is a term for a security feature for "card not present" payment card transactions instituted to reduce the incidence of credit card fraud.

The CSC is in addition to the bank card number which is embossed or printed on the card. The CSC is used as a security feature, in situations where a PIN cannot be used. The PIN is not printed or embedded on the card but is manually entered by the cardholder during a point-of-sale (card present) transactions. Contactless card and chip cards may electronically generate their own code, such as iCVV or Dynamic CVV.

CSC was originally developed in the UK as an 11 character alphanumeric code by Equifax employee Michael Stone in 1995. After testing with the Littlewoods Home Shopping group and NatWest Bank, the concept was adopted by APACS (the UK Association of Payment Clearing Services) and streamlined to the 3 digit code known today. MasterCard started issuing in 1997 and Visa in the United States issued them by 2001. American Express started to use the CSC in 1999 in response to growing internet transactions and card member complaints of spending interruptions when the security of a card has been brought into question.

In 2016 a new e-commerce technology called Motioncode was introduced, designed to automatically refresh the CVV code to a new one every hour or so. [3]

Description

The codes have different names:

- "CID" or "Card Identification Number" - Discover

- "CID" or "Unique Card Code" - American Express

- "CSC" or "Card Security Code" - Debit Card

- "CVC2" or "Card Validation Code" - MasterCard

- "CVD" or "Card Verification Data" - Discover, sometimes used as the common acronym for this kind of code

- "CVE" or "Elo Verification Code" - Elo - Brazil

- "CVN2" or "Card Validation Number 2" - China UnionPay

- "CVV2" or "Card Verification Value 2" - Visa

Types of codes

There are several types of security codes:

- The first code, called CVC1 or CVV1, is encoded on track 2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card s actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid. (See Credit card fraud: Skimming.)

- The second code, and the most cited, is CVV2 or CVC2. This code is often sought by merchants for card not present transactions occurring by mail, fax, telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

- Contactless cards and chip cards may supply their own electronicallyk-generated codes, such as iCVV or Dynamic CVV.

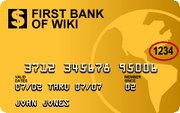

Location of code

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card. On American Express cards, the card security code is the four digits printed (not embossed) on the front towards the right. The card security code is not encoded on the magnetic stripe but is printed flat.

- American Express cards have a four-digit code printed on the front side of the card above the number.

- Diners Club, Discover, JCB, MasterCard, and Visa credit and debit cards cvv no open security code have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

- New North American MasterCard and Visa cards feature the code in a separate panel to the right of the signature strip.[4] This has been done to prevent overwriting of the numbers by signing the card.

Security benefits

As a security measure, merchants who require the CVV2 for "card not present" payment card transactions are required by the card issuer not to store the CVV2 once the individual transaction is authorized.[5] This way, if a database of transactions is compromised, the CVV2 is not included, and the stolen card numbers are less useful. Virtual terminals and payment gateways do not store the CVV2 code, therefore employees and customer service representatives with access to these web-based payment interfaces who otherwise have access to complete card numbers, expiration dates, and other information still lack the CVV2 code.

The Payment Card Industry Data Security Standard (PCI DSS) also prohibits the storage of CSC (and other sensitive authorisation data) post transaction authorisation. This applies globally to anyone who stores, processes or transmits card holder data.[6] Since the CSC is not contained on the magnetic stripe of the card, it is not typically included in the transaction when the card is used face to face at a merchant. However, some merchants in North America, such as Sears and Staples, require the code. For American Express cards, this has been an invariable practice (for "card not present" transactions) in European Union (EU) countries like Ireland and the United Kingdom since the start of 2005. This provides a level of protection to the bank/cardholder, in that a fraudulent merchant or employee cannot simply capture the magnetic stripe details of a card and use them later for "card not present" purchases over the phone, mail order or Internet. To do this, a merchant or its employee would also have to note the CVV2 visually and record it, which is more likely to arouse the cardholder's suspicion.

Supplying the CSC code in a transaction is intended to verify that the customer has the card in their possession. Knowledge of the code proves that the customer has seen the card, or has seen a record made by somebody who saw the card.

Limitations

- The use of the CSC cannot protect against phishing scams, where the cardholder is tricked into entering the CSC among other card details via a fraudulent website. The growth in phishing has reduced the real-world effectiveness of the CSC as an anti-fraud device. There is now also a scam where a phisher has already obtained the card account number (perhaps by hacking a merchant database or from a poorly designed receipt) and gives this information to the victims (lulling them into a false sense of security) before asking for the CSC (which is all that the phisher needs).[7]

- Since the CSC may not be stored by the merchant for any length of time[5] (after the original transaction in which the CSC was quoted and then authorized), a merchant who needs to regularly bill a card for a regular subscription would not be able to provide the code after the initial transaction. Payment gateways, however, have responded by adding "periodic bill" features as part of the authorization process.

- Some card issuers do not use the CSC. However, transactions without CSC are possibly subjected to higher card processing cost to the merchants, and fraudulent transactions without CSC are more likely to be resolved in favour of the cardholder.

- It is not mandatory for a merchant to require the security code for making a transaction, hence the card may still be prone to fraud even if only its number is known to phishers.

Generation of CSC

The CSC for each card (form 1 and 2) is generated by the card issuer when the card is issued. It is calculated by encrypting the bank card number and expiration date (2 fields printed on the card) with encryption keys known only to the card issuer, and decimalising the result.[8][9]

See also

- Credit card fraud

- ISO 8583 (Data element #44 carries the Security Code response)

References

- ↑ "Authorize.Net - Developer Frequently Asked Questions:". Retrieved 2009-03-29.

- ↑ "CIBC MasterCard - MasterCard SecureCode". Archived from the original on 24 April 2014. Retrieved 2012-07-12.

- ↑ http://www.thememo.com/2016/09/27/oberthur-technologies-societe-generale-groupe-bpce-bank-this-high-tech-card-is-being-rolled-out-by-french-banks-to-eliminate-fraud/

- ↑ "Card Security Features" (PDF). Visa. Archived from the original (PDF) on 2012-02-16.

- 1 2 "Rules for Visa Merchants" (doc). p. 1.

- ↑ "Official Source of PCI DSS Data Security Standards Documents and Payment Card Compliance Guidelines". Pcisecuritystandards.org. Retrieved 2011-12-25.

- ↑ "Urban Legends Reference Pages: Visa Fraud Investigation Scam". Snopes.com. Retrieved 2011-12-25.

- ↑ "z/OS Integrated Cryptographic Service Facility Application Programmer's Guide". IBM. March 2002. p. 209.

- ↑ "z/OS Integrated Cryptographic Service Facility Application Programmer's Guide". IBM. March 2002. p. 258.