Exchange-rate regime

| Foreign exchange |

|---|

| Exchange rates |

| Markets |

| Assets |

| Historical agreements |

| See also |

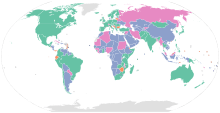

An exchange-rate regime is the way an authority manages its currency in relation to other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors.

The basic types are a floating exchange rate, where the market dictates movements in the exchange rate; a pegged float, where a central bank keeps the rate from deviating too far from a target band or value; and a fixed exchange rate, which ties the currency to another currency, mostly reserve currencies such as the U.S. dollar or the euro or a basket of currencies.

Float

Floating rates are the most common exchange rate regime today. For example, the dollar, euro, yen, and British pound all are floating currencies. However, since central banks frequently intervene to avoid excessive appreciation or depreciation, these regimes are often called managed float or a dirty float.

Pegged float

Pegged floating currencies are pegged to some band or value, either fixed or periodically adjusted. During the 1950s and most of the 1960s, for example, the United States pegged the dollar to gold ($35.00 was equal to one ounce of gold), and most other countries had pegged their currencies to the dollar (the German Mark was fixed at four marks equal to one dollar for much of this time). The U.S. government would buy or sell gold at $35.00 per ounce to foreign governments on demand, and the German government would buy and sell dollars at a price of four marks per dollar Pegged floats are:

- Crawling bands

- The rate is allowed to fluctuate in a band around a central value, which is adjusted periodically. This is done at an unannounced rate or in a controlled way following economic indicators.

- Crawling pegs

- The rate itself is fixed, and adjusted as above.

- Pegged with horizontal bands

- The rate is allowed to fluctuate in a fixed band (bigger than 1%) around a central rate. One version of the "pegged with horizontal bands" is E. Ray Canterbery's delayed peg. Fluctuations occur within a 2 percent band, sufficiently wide to allow some trade adjustments and considerable short-term capital flows, but narrow enough to avoid unusually large fluctuations. The wide bank is allowed to move in the case of large official foreign exchange losses.[1] China's current "floating band" is essentially a delayed peg.[2]

Fixed

Fixed rates are those that have direct convertibility towards another currency. In case of a separate currency, also known as a currency board arrangement, the domestic currency is backed one to one by foreign reserves. A pegged currency with very small bands (< 1%) and countries that have adopted another country's currency and abandoned its own also fall under this.

Currency board

Dollarization

Dollarization occurs when the inhabitants of a country use foreign currency in parallel to or instead of the domestic currency. The term is not only applied to usage of the United States dollar, but generally to the use of any foreign currency as the national currency. Zimbabwe is an example of dollarization since the collapse of the Zimbabwean dollar.

See also

Further reading

- Edwards, Sebastian & Levy Yeyati, Eduardo (2003) "Flexible Exchange Rates as Shock Absorbers," NBER Working Papers 9867, National Bureau of Economic Research, Inc. ().

- Kiguel, Andrea & Levy Yeyati, Eduardo (2009) "Back to 2007: Fear of appreciation in emerging economies" ().

- Tiwari, Rajnish (2003): Post-Crisis Exchange Rate Regimes in Southeast Asia, Seminar Paper, University of Hamburg. (PDF)

- Levy-Yeyati, Eduardo & Sturzenegger, Federico & Reggio, Iliana (2006) "On the Endogeneity of Exchange Rate Regimes," Working Paper Series rwp06-047, Harvard University, John F. Kennedy School of Government. ()

- Nenovsky. N, K. Dimitrova(2006). „Exchange Rate and Inflation: France and Bulgaria in the interwar period“.International Center for Economic Research Working Paper, Torino, No 34, 2006

- Nenovsky. N, G. Pavanelli and Dimitrova, K(2007). Rate Control in Italy and Bulgaria in the Interwar Period: History and Prospectives“.International Center of Economic Research Working Paper,Torino, No 40, 2007

- Roberto Frenkel and Martín Rapetti, A Concise History of Exchange Rate Regimes in Latin America, Center for Economic and Policy Research, April 2010

- Coudert, Virginie and Cécile Couharde, Currency Misalignments and Exchange Rate Regimes in Emerging and Developing Countries. , 2008.