Gold repatriation

Gold repatriation refers to plans of various governments to bring home their gold stored outside the home country.

Many countries use foreign vaults for safe-keeping of part of their gold reserves and there is a growing tendency not to trust the foreign custodian.[1][2]

Background

In past, nations from across the globe have stored their gold at the Federal Reserve Bank of New York (FRBNY) for numerous reasons;

- During World War II Germany confiscated as much gold as they could from nations they occupied, other vulnerable nations anticipated by shipping their gold to the US;

- After World War II there was the threat of the USSR to seize sovereign gold reserves as spoils of any Cold War action;

- Under the Bretton Woods System (1944 -1971) it was agreed the US dollar was the world reserve currency, backed by gold. It was thus convenient to store gold in New York for trade settlements; additionally dollars that were converted into gold were credited to FRBNY foreign gold accounts;

- After the Bretton Woods system, when gold was officially removed from the monetary system, gold was often sold or leased by central banks, facilitated by their accounts at FRBNY.

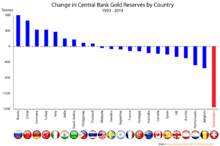

In the aftermath of the financial meltdown in 2008 central banks again realized the importance of gold as an anchor in the monetary system; European central banks stopped selling gold; Asian and South-American central banks increased official purchases, and central banks from all continents began to worry if storing gold abroad was wise when the global financial crisis evolved.

There are rumors that US has sold a portion of this gold to underpin the US dollar hegemony in recent decades. Edmund Moy, former Director of the United States Mint (Fort Knox), quoted on June 13, 2014: "Finally, more countries are repatriating their gold. For them, an audit is not enough. They would like their gold back. Azerbaijan, Ecuador, Iran, Libya, Mexico, Romania and Venezuela is a short list of countries that have requests into their custodians to transfer some or all their gold back to their countries."

Venezuela

Venezuela, which has the 15th largest holdings in the world according to the World Gold Council, held 211 tons of its 365 tons of gold reserves in U.S., European, and Canadian banks as of August, 2011. President Hugo Chávez in August 2011 ordered the central bank to repatriate the country's gold reserves as a safeguard against instability in financial markets.

By January 30, 2012, within two months, Venezuela had brought 160 tons of gold valued at around $9 billion back to Caracas, Venezuela.[3]

The President of Venezuela's central bank, Nelson Merentes said Venezuela will leave about fifteen percent of its reserves, or around fifty tons, outside of Venezuela for financial transactions. On January 3, 2012 this quantity was modified to fifteen tons.

A central bank report released in August showed that Venezuela held gold reserves with the Bank of England, JPMorgan Chase, Barclays, and Standard Chartered among other banks.

"This was the largest type of operation to transport this type of metal in the last 15 years," Merentes said. "The repatriation of our gold was an act of financial prudence and sovereignty."

The Netherlands

In November 2014, The Netherlands repatriated 122.5 tonnes or almost 4 million ounces with a market value of US$5B of Dutch gold from the Federal Reserve Bank of New York (FRBNY) back to the Dutch central bank (DNB) in Amsterdam. This will reduce the exposure of the Dutch Central Bank to the US financial system to just 31% of its gold, stored in the vault of the Fed, down from 51%. Also of note is that the Netherlands and Germany used a different approach. Whilst Germany widely publicised its attempt to repatriate the gold, the Netherlands was more discreet, repatriating it before announcing the fact. Netherlands repatriated a large part of the gold which was stored in New York but did not touch gold stored in Canada and London.[4]

The Netherlands (and likely Germany as well) made concrete plans in 2012 to switch to a new currency in the event that the euro crashed. Not long after the emergency currency (Florijn) was ready the Dutch began repatriating 122.5 tonnes of gold from New York. This may be very important as there is still a possibility the Eurocrisis will ignite again.[5]

Germany

In January 2013, the German central bank (Deutsche Bundesbank) announced plans to repatriate 300 tonnes of its 1,500 tons of gold from the US and 374 tonnes from France by 2020, in order to have half (1,695.3 tonnes) of its official gold reserves stored in Frankfurt.[6][7][8][9][10][11][12] The gold in the U.S. was earned by West Germany through trade surpluses in the 1950s and 1960s and was never moved out of the United States due to fear of invasion by the Soviet Union.[13][14][15] In 2013, a mere 5 tonnes were shipped due to logistical difficulties; However, in 2014, the Bundesbank shipped 85 tons of gold from New York (and 35 tonnes from Paris) to Frankfurt.[16][17][18][19][20][21] In 2015 Germany shipped 110.5 t from Paris and 99.5 t from New York. [22]

France

Marine Le Pen, leader of the Front National party of France, penned an open letter on Nov 26, 2014 to Christian Noyer, governor of the Bank of France, requesting that the country’s gold holdings be repatriated.[23]

Belgium

In an interview with Belgium broadcaster VTM Nieuws Sunday, Luc Coene, governor of Belgium’s central bank, confirmed that the bank is looking at how they can bring their gold reserves back into the country.

According to IMF data compiled by the World Gold Council, Belgium holds 227.4 metric tons of gold, representing 34.2% of its official foreign reserves. According to reports, most of the gold is held outside of the country with the Bank of England, the Bank of Canada and the Bank for International Settlements.[24]

Switzerland

Save our Swiss Gold motion was a citizen movement that called for the central bank to hold at least 20 per cent of its assets in gold, prohibit selling any gold in future and bring all its reserve of gold back in the country.[25][26][27] This referendum was held on November 30, 2014, but was lost.

Austria

Austria currently holds 80% of their 280 tons of gold in London, 17% in Austria, and 3% in Switzerland. Citing a need for risk diversification, Austria announced they will be repatriating gold from London during 2015. After the repatriation process has completed, 50% of Austria's gold will be held in Austria, 20% in Switzerland, and the remaining 30% in London.[28][29]

India

India's central bank bought 200 metric tons of gold from the International Monetary Fund in 2009, in the first major move by a major central bank to diversify its foreign-exchange reserves.[30]

Mexico

In 2011, Mexico quietly purchased nearly 100 tons of gold bullion, as central banks embarked on their biggest bullion buying spree in 40 years. China, Russia and India had acquired large amounts of gold in recent years, while Thailand, Sri Lanka and Bolivia had made smaller purchases.[31]

Bangladesh

On September 9, 2010 The International Monetary Fund (IMF) announced the sale of 10 metric tons of gold to the Bangladesh Bank, the central bank of Bangladesh.[32]

See also

- Fiat currency

- Gold as investment

- Gold standard

- "The Spaniards will never see their gold again, just as they don't see their ears," Joseph Stalin 1936.

References

- ↑ "Gold Repatriation and The Monetary Crisis: Austria, Belgium and The Netherlands Want Their Gold Back". Global Research.

- ↑ Matthew Lynn. "Europeans want their gold back, and why that's bad for the euro". MarketWatch.

- ↑ Bloomberg News

- ↑ "The Real Reason Why The Netherlands Repatriated Its Gold".

- ↑ "The Netherlands Planned To Introduce New Currency In 2012". Koos Jansen.

- ↑ "Deutsche Bundesbank's new storage plan for Germany's gold reserves". bundesbank. 2013-01-16. Retrieved 9 October 2015.

- ↑ Fontevecchia, Agustino (Jan 16, 2013). "Germany Repatriating Gold From NY, Paris 'In Case Of A Currency Crisis'". forbes. Retrieved 9 October 2015.

- ↑ "Germany's Bundesbank brings gold reserves home". reuters. reuters. Jan 16, 2013. Retrieved 9 October 2015.

- ↑ EWING, JACK (Jan 16, 2013). "Germany to Move 674 Tons of Gold". Retrieved 9 October 2015.

- ↑ Jordans, Frank (January 17, 2013). "Germany reclaims $36B in gold from U.S., France". usatoday. AP. Retrieved 9 October 2015.

- ↑ Bradshaw, Anthony (January 21, 2013). "METAL COMMODITIES". cnbc. Retrieved 9 October 2015.

- ↑ Randow, Jana (January 16, 2013). "Bundesbank to Repatriate 674 Tons of Gold to Germany by 2020". bloomberg. Retrieved 9 October 2015.

- ↑ "Germany repatriating its US gold reserves in mini-shipments". Archived from the original on December 18, 2014.

- ↑ Smyser, W. R. (2003). How Germans Negotiate: Logical Goals, Practical Solutions. United States Institute of peace. p. 179.

- ↑ "Bundesbank still fending off suspicions about gold vaulted in U.S.: Germany Repatriating Its US Gold Reserves in Mini-Shipments". gata.org. Retrieved 9 October 2015.

- ↑ "The German gold reserves". bundesbank.de. bundesbank. Retrieved 9 October 2015.

- ↑ Durden, Tyler (2015-01-20). "Germany's Bundesbank Resumes Gold Repatriation; Transfers 120 Tonnes Of Physical Gold From Paris And NY Fed". Retrieved 9 October 2015.

- ↑ Silver, Vernon (February 5, 2015). "Almost half of Germany's gold is stored in vaults under the streets of Manhattan. Or is it?". Bloomberg. Retrieved 9 October 2015.

- ↑ ‘Secret’ Gold Repatriation: The Banksters’ Newest Bullion Scam

- ↑ Jansen, Koos (7 September 2014). "German Gold Repatriation Accelerating". BullionStar.com. Retrieved 10 December 2014.

- ↑ "Analysis Dutch Gold Repatriation: Why, How And When". Koos Jansen.

- ↑ "Deutsche Bundesbank - Press releases - Frankfurt becomes Bundesbank's largest gold storage location". www.bundesbank.de. Retrieved 2016-02-22.

- ↑ "French leader Le Pen calls for gold reserves to be repatriated". The Bullion Desk.

- ↑ Belgium Central Bank Looking At Repatriating Gold

- ↑ Neil MacLucas (24 October 2014). "Swiss Vote on SNB Gold Holdings too Close to Call, Poll Shows". WSJ.

- ↑ Chiara Albanese And Ese Erheriene (29 October 2014). "Markets Nervous Ahead of Swiss Gold Vote". WSJ.

- ↑ "Sober Look".

- ↑ "Gold Repatriation and The Monetary Crisis: Austria, Belgium and The Netherlands Want Their Gold Back". Global Research.

- ↑ http://www.krone.at/Oesterreich/Nationalbank_holt_Goldschatz_heim_nach_Wien-Neue_Strategie-Story-454565

- ↑ Abhrajit Gangopadhyay and Elisabeth Behrmann (4 November 2009). "India Buys 200 Tons of IMF's Gold Allotment". WSJ.

- ↑ Mexican Central Bank Quietly Buys 100 Tons of Gold

- ↑ "Press Release: IMF Announces Sale of 10 Metric Tons of Gold to the Bangladesh Bank".