Paris Club

Club de Paris Paris Club |

||||

|---|---|---|---|---|

|

||||

|

||||

| Secretariat | Paris, France | |||

| Languages | Engish, French | |||

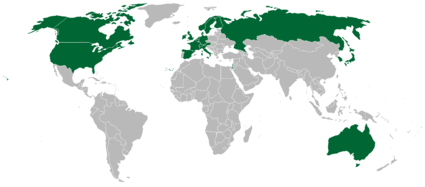

| Membership | Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Israel, Italy, Japan, the Netherlands, Norway, the Russian Federation, South Korea, Spain, Sweden, Switzerland, the United Kingdom and the United States of America | |||

| Leaders | ||||

| • | Chairperson | Odile RENAUD BASSO | ||

| • | Co-Chairperson | Guillaume CHABERT | ||

| • | Vice-Chairperson | Cyril ROUSSEAU | ||

| • | Secretary General of the Paris Club | Geoffroy CAILLOUX | ||

| Establishment | 1956 | |||

The Paris Club (French: Club de Paris) is a group of officials from major creditor countries whose role is to find coordinated and sustainable solutions to the payment difficulties experienced by debtor countries. As debtor countries undertake reforms to stabilize and restore their macroeconomic and financial situation, Paris Club creditors provide an appropriate debt treatment. Paris Club creditors provide debt treatments to debtor countries in the form of rescheduling, which is debt relief by postponement or, in the case of concessional rescheduling, reduction in debt service obligations during a defined period (flow treatment) or as of a set date (stock treatment).[1]

The Paris Club was created gradually from 1956, when the first negotiation between Argentina and its public creditors took place in Paris. The Paris Club treats public claims, that is to say, those due by governments of debtor countries and by the private sector, guaranteed by the public sector to Paris Club members. A similar process occurs for public debt held by private creditors in the London Club, which was organized in 1970 on the model of the Paris Club is an informal group of commercial banks meet to renegotiate the debt they hold on sovereign debtors.

Creditor countries meet ten times a year in Paris for Tour d'Horizon and negotiating sessions. To facilitate Paris Club operations, the French Treasury provides a small secretariat, and a senior official of the French Treasury is appointed chairman.[2]

Since 1956, the Paris Club has signed 433 agreements with 90 different countries covering over US$583 billion.[3]

History

Since 1956, the Paris Club has remained a central player in the resolution of developing and emerging countries' debt problems.[4]

In 1956, the world economy was emerging from the aftermath of the Second World War. The Bretton Woods institutions were in the early stages of their existence, international capital flows were scarce, and exchange rates were fixed. Few African countries were independent and the world was divided along Cold War lines. Yet there was a strong spirit of international cooperation in the Western world and, when Argentina voiced the need to meet its sovereign creditors to prevent a default, France offered to host an exceptional three-day meeting in Paris that took place from 14 to 16 May 1956.[5]

Today, the Paris Club provides debt treatments to debtor countries in a totally different world. Most countries are active players in the world economy and are interdependent through goods and capital flows. Financial globalization has created new opportunities for developing and emerging countries but has brought with it new risks of crisis. Sovereign debt is a minor source of borrowing for emerging economies given the development of emerging bond markets. But the low-income countries generally do not have access to these markets and assistance from bilateral and multilateral donors remains vital for them. Non-Paris Club creditors are becoming an increasingly important source of financing for these countries. Yet despite the fact that Paris Club creditors now have to deal with far more complex and diverse debt situations than in 1956, their original principles still stand.[6]

The Early Years (1956-1980)

From 1956 to 1980, the Paris Club's activity level was low. The number of agreements signed with debtor countries never exceeded four per year. The Paris Club took advantage of these early years to gradually standardize its negotiation process and agreements.[7]

Few countries were granted debt treatments. They were mainly located in Latin America (Argentina, Brazil, Chile and Peru) and in Asia (Indonesia, Pakistan, Turkey and Cambodia). The first African country to conclude a debt treatment agreement with the Paris Club was Zaire (now Democratic Republic of Congo) in 1976. Countries that had gained their independence in the 1960s were in a period of debt accumulation, whereas some “older” countries were already experiencing balance of payments problems. After 1976, some African debtor countries approached the Paris Club for one or more debt treatments (Sierra Leone, Togo, Sudan and Liberia), but at a relatively slow pace compared with the subsequent period.[8]

During these early years, Paris Club agreements were fairly simple. They were based on standard “Classic terms” which were the sole terms of treatment used by creditors from 1956 to 1987. Under Classic terms, debtor countries were granted a rescheduling of credits (whether ODA or non-ODA) at the appropriate market rate with a repayment profile negotiated on a case-by-case basis (generally a ten-year repayment period including a three-year grace period). The Paris Club offered non-concessional flow relief to support IMF adjustment programs. In many cases, several Paris Club debt treatments were required in fairly quick succession to help the debtor country to exit the cycle of rescheduling.[9]

Dealing with the Debt Crisis (1981-1996)

1981 marked a turning point in Paris Club activity. The number of agreements concluded per year rose to more than ten and even to 24 in 1989. This was the famous “debt crisis” of the 1980s, triggered by Mexico defaulting on its sovereign debt in 1982 and followed by a long period during which many countries negotiated multiple debt agreements with the Paris Club, mainly in sub-Saharan Africa and Latin America, but also in Asia (the Philippines), the Middle East (Egypt and Jordan) and Eastern Europe (Poland, Yugoslavia and Bulgaria). Following the collapse of the Soviet Union in 1992, Russia joined the list of countries that have concluded an agreement with the Paris Club. So by the 1990s, Paris Club activity had become truly international.[10]

From 1981 to 1987, creditors continued to apply the same rules despite the growing number of countries facing payment difficulties. Classic terms, designed for dealing with temporary liquidity problems, were systematically used for debt treatment. Amounts treated were generally small, corresponding to one or two years of installments due to creditors and to the implementation period for an IMF-supported program.[11]

Yet in the mid-1980s, growing concerns about the ability of poor countries to repay their debts led creditors to consider new terms of treatment. In 1987, Paris Club creditors adopted Venice terms (non-concessional terms that provide debtor countries with longer deferral and repayment periods).[12]

In October 1988, Paris Club creditors agreed to implement Toronto terms, which introduced for the first time a partial cancellation of the debt of the poorest and most heavily indebted countries . Twenty poor countries were granted Toronto terms from 1988 to 1991 and a total of 26 agreements were signed on these terms during the period.[13]

The Toronto terms were designed for the poorest and most heavily indebted countries, while the Classic terms were to remain the treatment used for other debtors. The debt crisis also hit lower middle-income countries. So in September 1990, the Paris Club creditors decided to adopt new debt treatment rules for some of these countries facing high indebtedness and a stock of official bilateral debt totaling at least 150% of their private debt. These new treatment terms were called "Houston terms". They introduced three significant improvements compared with Classic terms. To date, 35 agreements have been concluded with 19 countries under Houston terms.[14]

Given the lasting impact of the debt crisis on the poorest and most heavily indebted countries, the Paris Club creditors agreed in December 1991 to raise the level of debt cancellation from 33.33%, as defined in the Toronto terms, to 50%. Thus were born London terms. A total of 23 countries were granted the London terms from 1991 to 1994, when these terms were replaced by Naples terms.[15]

The adoption of Naples terms in December 1994 made two substantial improvements to London terms. The level of debt cancellation was raised to at least 50% and a maximum of 67% of eligible non-ODA credits . Secondly, the Paris Club made the ground-breaking decision that stock treatments could be implemented on a case-by-case basis for countries with a satisfactory track record with both the Paris Club and the IMF, provided there was ample confidence in the ability of the debtor country to meet its obligations under the debt agreement. Eligibility for Naples terms is assessed on a case-by-case basis . The adoption of Naples Terms marked a major turning point in Paris Club history. For the first time ever, Paris Club creditors agreed to consider major levels of debt reduction extending beyond flow treatments to include stock treatments. This development reflected a growing understanding within both the official and private creditor community that the poorest countries' debt burdens were unsustainable.[16]

Implementing the HIPC Initiative

In 1996, the international financial community realized that the external debt situation of a number of mostly African low-income countries had become extremely difficult. This was the starting point of the Heavily Indebted Poor Countries (HIPC) Initiative.[17]

The Evian approach

The HIPC Initiative demonstrated the need for creditors to take a more tailored approach when deciding on debt treatment for debtor countries. Hence in October 2003, Paris Club creditors adopted a new approach to non-HIPCs: the “Evian Approach”.[18]

Members of the Paris Club

There are currently 21 Permanent Members of the Paris Club:[19]

Creditor delegations are generally led by a senior delegate from the Ministry of Finance.

Ad hoc participants

Other official creditors can also participate in negotiation sessions or in monthly "Tours d'Horizon" discussions, subject to the agreement of permanent members and of the debtor country. When participating in Paris Club discussions, invited creditors act in good faith and abide by the practices described below. The following creditors have participated in some Paris Club agreements or Tours d'Horizon in an ad hoc manner: Abu Dhabi, Argentina, Brazil, People's Bank of China, Kuwait, Mexico, Morocco, New Zealand, Portugal, South Africa, Trinidad and Tobago, Turkey.

Observers

Observers are invited to attend the negotiating sessions of the Paris Club but they cannot participate in the negotiation itself, nor sign the agreement that formalizes the result of negotiation.[20]

There are three categories of observers:

1) representatives of international institutions:

- International Monetary Fund (IMF)

- World Bank

- Organisation for Economic Co-operation and Development (OECD)

- United Nations Conference on Trade and Development (UNCTAD)

- European Commission

- African Development Bank

- Asian Development Bank

- European Bank for Reconstruction and Development (EBRD)

- Inter-American Development Bank (IADB)

2) representatives of permanent members of the Paris Club which have no claims concerned by the debt treatment (for example creditors whose claims are covered by the de minimis provision) or that are not creditors of the debtor country concerned but nevertheless want to attend the negotiation meeting;

3) representatives of non Paris Club countries which have claims on the debtor country concerned but are not in a position to sign the Paris Club agreement as ad hoc participants, provided that permanent members and the debtor country agree on their attendance.

Organisation

The Secretariat

The Secretariat was established to prepare more effectively negotiating sessions. The Secretariat is composed of a dozen people from the Treasury of the French Ministry of Finance and Public Accounts.

The Secretariat's role is primarily to safeguard the common interests of creditor countries participating in the Club, and to facilitate the reaching of a consensus between them at each level of the discussions. To achieve this, the Secretariat prepares negotiating sessions according to a specific method.

In the early stages of discussions, the Secretariat analyses the debtor country's payment capacity and provides creditors with a first proposal for a treatment. This proposal is discussed by the creditors (whose positions during the negotiation are transcribed in the so-called "magic table"). The Secretariat is also responsible for drafting the minutes of negotiation.

The Secretariat also helps to ensure compliance with the various covenants contained in the minutes and maintains external relations with third States creditors and commercial banks, in particular to ensure the greatest possible respect of comparability clause treatment.

The Chair

Since 1956, the Presidency of the Paris Club is ensured by the French Treasury.

The Chairperson of the Paris Club is Odile Renaud Basso, Director General of the French Treasury. The co-Chairman is the head of the Department of Multilateral Affairs and Development Treasury (Guillaume Chabert). The Vice-Chairman is the Deputy in charge of Multilateral Financial Affairs and Development at the Treasury (Cyril Rousseau). One of these three co-Chairmen must chair every meeting of the Paris Club.

In particular, during negotiation sessions, the Chairman of the Paris Club plays the role of intermediary between creditors, who elaborate debt treatment proposals, and the representative of the debtor country, usually the Minister of Finance. He is responsible for submitting to the debtor's delegation terms agreed upon by creditors. If the debtor - which is common - refuses the first offer of creditors, the actual negotiation begins, the Chairman acting as a shuttle between the debtor and creditors.

List of chairpersons Incomplete list:[21]

- Jean-Claude Trichet (1985-1993)

- Christian Noyer (1993-1997)

- Jean-Pierre Jouyet (2000-2005)

- Xavier Musca (2005-2009)

- Ramon Fernandez (fr) (2009-May 2014)

- Bruno Bézard (fr) (since June 2014)

Paris Club principles

• Solidarity: All members of the Paris Club agree to act as a group in their dealings with a given debtor country and be sensitive to the effect that the management of their particular claims may have on the claims of other members.

• Consensus: Paris Club decisions cannot be taken without a consensus among the participating creditor countries.

• Information sharing: The Paris Club is a unique information-sharing forum. Paris Club members regularly share views and information with each other on the situation of debtor countries, benefit from participation by the IMF and World Bank, and share data on their claims on a reciprocal basis. In order for discussions to remain productive, deliberations are kept confidential.

• Case by case: The Paris Club makes decisions on a case-by-case basis in order to tailor its action to each debtor country's individual situation. This principle was consolidated by the Evian Approach.

• Conditionality: The Paris Club only negotiates debt restructurings with debtor countries that: 1) need debt relief. Debtor countries are expected to provide a precise description of their economic and financial situation, 2) have implemented and are committed to implementing reforms to restore their economic and financial situation, and 3) have a demonstrated track record of implementing reforms under an IMF program. This means in practice that the country must have a current program supported by an appropriate arrangement with the IMF (Stand-By, Extended Fund Facility, Poverty Reduction and Growth Facility, Policy Support Instrument). The level of the debt treatment is based on the financing gap identified in the IMF program. In the case of a flow treatment, the consolidation period coincides with the period when the IMF arrangement shows a need for debt relief. When the flow treatment extends over a long period of time (generally more than one year), the Paris Club agreement is divided into phases. The amounts falling due during the first phase are treated as soon as the agreement enters into force. Subsequent phases are implemented following completion of conditions mentioned in the Agreed Minutes, including non-accumulation of arrears and approval of the reviews of the IMF program.

• Comparability of treatment: A debtor country that signs an agreement with its Paris Club creditors should not accept from its non-Paris Club commercial and bilateral creditors terms of treatment of its debt less favorable to the debtor than those agreed with the Paris Club.

Meetings

Paris Club creditor countries generally meet 10 times per year. Each session includes a one-day meeting called a “Tour d'Horizon” during which Paris Club creditors discuss debt situations of debtor countries, or methodological issues regarding the debt issues more broadly.[22] The session may also include negotiation meetings with one or more debtor countries.

Negotiations

A debtor country is invited to a negotiation meeting with its Paris Club creditors when it has concluded an appropriate programme with the International Monetary Fund (IMF) that demonstrates that the country is not able to meet its external debt obligations and thus needs a new payment arrangement with its external creditors (conditionality principle). Paris Club creditors link the debt restructuring to the IMF programme because the economic policy reforms are intended to restore a sound macroeconomic framework that will lower the probability of future financial difficulties.[23]

The twenty permanent members of the Paris Club may participate in the negotiation meetings, as participating creditors if they have claims towards the invited debtor country, as observers if not.[24] Other official bilateral creditors may be invited to attend negotiation meetings on an ad-hoc basis, subject to the agreement of permanent members and of the debtor country.[25] Representatives of international institutions, notably the IMF, the World Bank and the relevant regional development bank also attend the meeting as observers.[26] The debtor country is usually represented by the Minister of Finance. They generally lead a delegation comprising officials from the Ministry of Finance and the Central Bank.[27]

Steps in a negotition

After a few words from the chairman to welcome everybody and to open the meeting, the official meeting begins with a statement by the minister of the debtor country, who presents in particular the requested debt treatment.[28]

This statement is followed by statements by the IMF and the World Bank, and, if appropriate, by representatives of other international institutions.[29]

The representatives of creditor countries may then request additional information or clarification from the minister regarding the situation in the debtor country.[30]

After responding to any questions, the delegation of the debtor country then leaves the main room and stays in another room during the entire session.[31]

Creditors then discuss among themselves a proposed debt treatment. Once creditors agree on a treatment, the chairman of the meeting will then present this proposed treatment to the delegation of the debtor country. If the debtor country disagrees and asks for amendments to the creditors' proposal, the chairman will then convey this request to the creditors, who discuss it and consider a new proposal. This process continues until a common agreement between creditors and the debtor country is reached.[32]

Once an agreement is reached on the terms of the treatment, a document called the Agreed Minutes formalizes the accord in writing in French and in English. This agreement is drafted by the Paris Club Secretariat and then approved by the creditors and the debtor.[33]

The delegation of the debtor country then returns to the main room and the Agreed Minutes are signed by the Chairman, the minister of the debtor country and the head of delegation of each participating creditor country.[34]

A press release mutually agreed to by the creditors and the debtor country representatives is released for publication upon completion of the negotiation session.[35]

Paris Club Terms

On October 8, 2003, Paris Club members announced a new approach that would allow the Paris Club to provide debt cancellation to a broader group of countries.[36] The new approach, named the “Evian Approach” introduces a new strategy for determining Paris Club debt relief levels that is more flexible and can provide debt cancellation to a greater number of countries than was available under prior Paris Club rules.[37] Prior to the Evian Approach’s introduction, debt cancellation was restricted to countries eligible for IDA loans from the World Bank under Naples Terms or HIPC countries under Cologne terms.[38] Many observers believe that strong U.S. support for Iraq debt relief was an impetus for the creation of the new approach.[39]

Instead of using economic indicators to determine eligibility for debt relief, all potential debt relief cases are now divided into two groups: HIPC and non-HIPC countries. HIPC countries will continue to receive assistance under Cologne terms, which sanction up to 90% debt cancellation.[40] Non-HIPC countries are assessed on a case-by-case basis.[41]

Non-HIPC countries seeking debt relief first undergo an IMF debt sustainability analysis.[42] This analysis determines whether the country suffers from a liquidity problem, a debt sustainability problem, or both. If the IMF determines that the country suffers from a temporary liquidity problem, its debts are rescheduled until a later date.[43] If the country is also determined to suffer from debt sustainability problems, where it lacks the long-term resources to meet its debt obligations and the amount of debt adversely affects its future ability to pay, the country is eligible for debt cancellation.[44]

Policies for heavily indebted poor countries

The great difficulties of some developing countries to break the cycle of debt led creditor countries of the Paris Club to adopt more ambitious policies.

In October 1988, creditors decided to implement a new treatment for the debt of the poorest countries. This new treatment called " Toronto terms " implements for the first time a reduction of the stock of debt of poor countries. The level of reduction was defined as 33.33%. 20 countries benefited from Toronto terms between 1988 and 1991.

In December 1991, creditors decided to increase the level of cancellation of 33.33% as defined in Toronto, to 50% under the "London terms". These agreements benefited to 23 countries.

Going even further, in December 1994, creditors decided to implement a new treatment called "Naples terms", which can be implemented on a case by case basis. Thus, for the poorest and most indebted countries, the level of cancellation of eligible credit is increased to 50% or even 67% (as of September 1999, all treatments carry a 67% debt reduction). In addition, stock of treatments can be applied in each case for countries that have complied satisfactorily previous commitments. Up to 2008, 35 of 39 countries have reached the completion point of the Heavily Indebted Poor Countries HIPCs.

Finally, in September 1996, the joint proposal of the Development Committee of the World Bank and the IMF Interim Committee, the international financial community has recognized that the debt situation of a number of very poor countries, of which three quarters are located in sub-Saharan Africa remained extremely difficult, even after having used traditional mechanisms. A group of 39 countries,[45] were identified as being potentially eligible for the Heavily Indebted Poor Countries HIPCs.

Since the start of the HIPC initiative, debt relief granted to the 36 post-decision point countries at end-2011 amounts to almost 35 percent of these countries’ 2010 GDP, around USD 128 Bn in nominal terms. The total debt relief effort provided under the HIPC initiative is shared by multilateral creditors (44.5%), the Paris Club (36.3%), non-Paris Club bilateral creditors (13.1%) and private creditors (6.1%). Hence, the HIPC initiative represents a genuine and significant financial effort from Paris Club member countries, especially considering that they indirectly contribute to debt relief granted by multilateral creditors, as they are major shareholders of these international financial institutions.

According to the IMF and the World Bank, debt relief granted since the beginning of the HIPC Initiative reduced beneficiary countries’ debt burden by about 90 percent relative to pre-decision point levels. Debt relief has also allowed beneficiary countries to reduce their debt service and to increase social spending. According to the IMF and the World Bank, for the 36 post-decision point countries, poverty reducing spending increased by more than 3 percentage points of GDP, on average, between 2001 and 2010, while debt service payments declined by a similar amount. Such progress is consistent with the HIPC initiative’ objective, namely, to reallocate the increased spending capacity towards the fight against poverty and to accelerate progress toward the United Nations Millennium Development Goals.

Apart from the HIPC initiative, the Paris Club adopted a new framework for debt restructuring in 2003, the Evian approach. Through the Evian framework, the Paris Club’s goal is to take into account debt sustainability considerations, to adapt its response to the financial situation of debtor countries, and to contribute to current efforts to ensure an orderly, timely and predictable resolution of economic and financial crises. The approach aims at providing a tailored response to debtor countries’ payment difficulties. Countries with unsustainable debt may be granted a comprehensive debt treatment, provided that they are committed to policies that will secure an exit from the Paris Club process,[46] in the framework of their IMF arrangements.

Paris Forum

The Paris Forum is an annual event, jointly organized by the Paris Club and the rotating Presidency of the G20, since 2013. The conference gathers representatives from creditor and debtor countries, and is a forum for frank and open debate on the global evolutions in terms of sovereign financing and on the prevention and resolution of sovereign debt crises. As international financial markets and capital flows are increasingly integrated, non-Paris Club official bilateral creditors are representing a larger share in the financing of developing and emerging countries. The objective of the Forum, in this context, is to foster close and regular dialogue between stakeholders, in order to create an international financial environment favorable to sustainable growth in developing countries. In particular, the Paris Forum aims at enhancing the involvement of emerging countries, be they creditors or debtors, in international debates on sovereign financing, in order to make discussions as open and frank as possible. The Paris Forum annually gathers more than thirty representatives from sovereign creditors and debtors, of which the members of the G20, the members of the Paris Club, and countries from the different regions of the world.

2013 Paris Forum The first edition of the Paris Forum was held on October 29, 2013 in Paris, and was jointly organized by the Paris Club and the Russian Presidency of the G20. The closing remarks were made by Ms. Christine Lagarde, Managing director of the IMF.

2014 Paris Forum The second edition of the Paris Forum was held on November 20, 2014 in Paris, and was jointly organized by the Paris Club and the Australian Presidency of the G20. Closing remarks were made by M. Angel Gurria, Secretary General of the OECD.[47]

2015 Paris Forum

2016 Paris Forum

Accomplishments

The Paris club has played a role in debt crisis resolution for a period greater than 50 years, in emerging and developing countries.[48] The rules and principles that are established for negotiations of different types of debt treatments have proven to be highly efficient towards resolving of various debt crises. Pragmatism and flexibility are important features in the past activity of the Paris club, with the decisions of the group influenced primarily by and technical criteria,[49] although sometimes also by political criteria.

Milestones:

- 1956 (May 16): First Paris Club Agreement (Argentina)

- 1966: First Paris Club Agreement with an Asian country (Indonesia)

- 1976: First Paris Club Agreement with an African country (Zaire)

- 1981: First Paris Club Agreement with a European country (Poland)

- 1982: The Mexican crisis triggers the “debt crisis” of the 1980s.

- 1987: First Paris Club Agreement under the Venice terms (Mauritania)

- 1988: First Paris Club Agreement implementing the Toronto terms (Mali)

- 1990: First Paris Club Agreement implementing the Houston terms (Morocco). First debt swap clause in a debt treatment agreement

- 1991: Exceptional exit treatments granted to Poland and Egypt. First Paris Club Agreement implementing the London terms (Nicaragua)

- 1992: First Paris Club Agreement with Russia (deferral)

- 1995: First Paris Club Agreement implementing the Naples terms (Cambodia)

- 1996: Heavily Indebted Poor Countries Initiative (HIPC)

- 1997: Russia joins the Paris Club. First early repayment operation (Argentina)

- 1998: First Paris Club Agreement implementing the Lyon terms under the HIPC initiative (Uganda)

- 1999: Enhanced HIPC Initiative. First Paris Club Agreement implementing the Cologne terms under the HIPC initiative (Mozambique)

- 2000: Uganda is the first HIPC-eligible country to reach the Enhanced HIPC Initiative Completion Point

- 2001: Exceptional debt treatments granted to the Former Republic of Yugoslavia

- 2003: Paris Club creditors approve the Evian Approach

- 2004: First debt treatment under the Evian Approach (Kenya). Phased exit treatment granted to Iraq

- 2005: Exceptional treatment granted to countries hit by the tsunami (Indonesia and Sri Lanka). Exit treatment granted to Nigeria

- 2006: 50th anniversary of the Paris Club

- 2007: First buyback operations at market value below par (Gabon, Jordan)

The Paris Club granted in November 2004 a cancellation of 80% of the stock of debt owed by Iraq, cancelling nearly 30 billion of dollars of claims, also granting a moratorium payment until 2008. In February 2006, the United States announced a relief Afghanistan's debt of 108 million of dollars.

In 2005, after the tsunami which affected the countries bordering the Indian Ocean, the Paris Club decided to temporarily suspend some of repayments of affected countries. In January 2010, the Paris Club also canceled Haiti's debt to help it overcome the consequences of the earthquake of 12 January.

Russia had, in May 2005, begun to repay its debt to Paris Club countries. On 21 August 2006, Russia repaid the remainder of its debt to the Paris Club. Gabon and Jordan both bought their debt back, in 2007, at market value.

In January 2013, the Paris Club treated 10 billion of dollars of debt owed by Myanmar to the Paris Club, canceling 50% of arrears and rescheduling the rest over 15 years, including 7 years of grace.

There are many other contributions of Paris Club which are deemed notable. The recent deal with the creditors of the Paris Club and the Argentinean Government on 28 and 29 May 2014, is a landmark deal, where an arrangement was made to clear the debt in the arrears which are due to the creditors of the Paris Club in a span of 5 years. The deal covers some amount of 9.7 billion of dollars of debts by 30 April 2014. Additionally, there is flexible structure to get the arrears cleared with a minimum of 1,150 million of dollars by May 2015, with the payment due to be paid by May 2016. The debt accumulated for Argentina is due to the 2001-02 Argentinean default crises, where there is default amount of 132 billion of dollars.[50]

Criticism of the Paris Club

Critics argue that the Paris Club is not transparent. In 2006, a significant number of non-governmental organizations have requested the change of rules of the Paris Club, especially for transparency.[51]

The Paris Club has since created a new website in 2009, which reiterates the terms of all treatments given to 90 debtor countries. Since 2008, the Paris Club also publishes an annual report, which includes detailed data on claims that its members hold foreign states. The total amount of debt to Paris Club, excluding late interest, amounted to end 2013 to 373.1 billion of dollars, including 165.8 billion of dollars representing ODA debts and 207.3 billion of dollars in debts non-ODA.

See also

References

- ↑ http://www.clubdeparis.org/en

- ↑ https://www.fas.org/sgp/crs/misc/RS21482.pdf

- ↑ http://www.clubdeparis.org/en

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/historical-development

- ↑ http://www.clubdeparis.org/en/communications/page/permanent-members

- ↑ http://www.clubdeparis.org/en/communications/page/observers

- ↑ Lex Rieffel. Restructuring Sovereign Debt: The Case for Ad Hoc Machinery. Brookings Institution Press, (2003). ISBN 081577446X

- ↑ http://www.clubdeparis.org/en/communications/page/paris-club-meetings

- ↑ http://www.clubdeparis.org/en/communications/page/paris-club-meetings

- ↑ http://www.clubdeparis.org/en/communications/page/paris-club-meetings

- ↑ http://www.clubdeparis.org/en/communications/page/paris-club-meetings

- ↑ http://www.clubdeparis.org/en/communications/page/paris-club-meetings

- ↑ http://www.clubdeparis.org/en/communications/page/paris-club-meetings

- ↑ http://www.clubdeparis.org/en/communications/page/steps-in-a-negotiation-meeting

- ↑ http://www.clubdeparis.org/en/communications/page/steps-in-a-negotiation-meeting

- ↑ http://www.clubdeparis.org/en/communications/page/steps-in-a-negotiation-meeting

- ↑ http://www.clubdeparis.org/en/communications/page/steps-in-a-negotiation-meeting

- ↑ http://www.clubdeparis.org/en/communications/page/steps-in-a-negotiation-meeting

- ↑ http://www.clubdeparis.org/en/communications/page/steps-in-a-negotiation-meeting

- ↑ http://www.clubdeparis.org/en/communications/page/steps-in-a-negotiation-meeting

- ↑ Rieffel, Alexis. “The role of the Paris Club in managing debt problems”. Princeton: Princeton University.

- ↑ https://www.fas.org/sgp/crs/misc/RS21482.pdf

- ↑ https://www.fas.org/sgp/crs/misc/RS21482.pdf

- ↑ https://www.fas.org/sgp/crs/misc/RS21482.pdf

- ↑ https://www.fas.org/sgp/crs/misc/RS21482.pdf

- ↑ https://www.fas.org/sgp/crs/misc/RS21482.pdf

- ↑ https://www.fas.org/sgp/crs/misc/RS21482.pdf

- ↑ https://www.fas.org/sgp/crs/misc/RS21482.pdf

- ↑ https://www.fas.org/sgp/crs/misc/RS21482.pdf

- ↑ https://www.fas.org/sgp/crs/misc/RS21482.pdf

- ↑ Afghanistan, Benin, Bolivia, Burkina Faso, Burundi, Cameroon, Central African Republic, Chad, Comoros, Côte d’Ivoire, Democratic Republic of Congo, Eritrea, Ethiopia, Gambia, Ghana, Guinea, Guinea-Bissau, Guyana, Haiti, Honduras, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Nicaragua, Niger, Republic of Congo, Rwanda, Sao Tome and Principe, Senegal, Sierra Leone, Somalia, Sudan, Tanzania, Togo, Uganda, Zambia

- ↑ L’Angevin, Clotilde, « Debt Relief as a Development Tool: The Role of the Paris Club", ECDPM. 2013. GREAT Insights, Volume 2, Issue 1. January 2013

- ↑ http://www.oecd.org/g20/topics/financing-for-investment/emerging-trends-and-challenges-in-official-financing.htm

- ↑ Trichet, J-C (2014-06-21), Celebrating the 50th anniversary of the Paris Club (PDF)

- ↑ Courbe, T (2014-06-21), Paris Club’s role in the financing of development

- ↑ Argentina in deal with Paris Club to pay $10bn debts, BBC News, 2014-06-21

- ↑ http://journal.probeinternational.org/2006/06/06/civil-society-statement-paris-club-50-illegitimate-and-unsustainable/

External links

Articles

- Paris Club Agrees On Iraqi Debt Write-Off (washingtonpost.com)

- Paris Club agrees to cancel Liberian debt