Scheduled bank

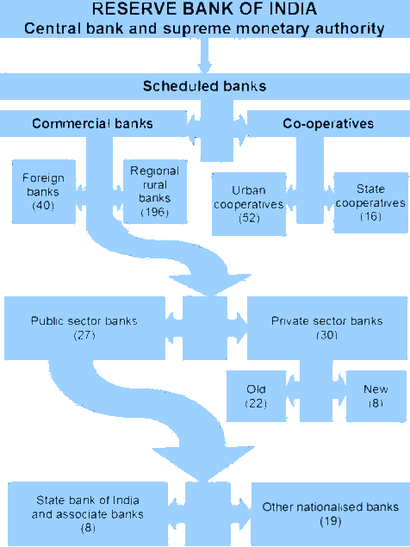

Structure of the organised banking sector in India.

A scheduled bank, in India, refers to a bank which is listed in the 2nd Schedule of the Reserve Bank of India Act, 1934. Banks not under this Schedule are called non-scheduled banks.[1] Scheduled banks are usually private, foreign and nationalised banks operating in India. However, cooperative banks are allowed to seek scheduled bank status if they satisfy certain criteria.[2] A scheduled bank is eligible for loans from the Reserve Bank of India at bank rate. They are also given membership to clearing houses.[3]

Classification

The further classification of scheduled banks is as follows:[1]

- Scheduled commercial banks

- Nationalised banks

- State Bank of India and its associates

- Regional Rural Bank (RRBs)

- Foreign banks

- Other Indian private sector banks

- Scheduled State Co-operative Banks

- Scheduled Urban Co-operative Banks

- Foreign Private Banks

See also

References

- 1 2 "Business Financing: Banks". Government of India. Retrieved 3 March 2015.

- ↑ "Urban co-operative banks permitted to seek scheduled status". Live Mint. 27 September 2013. Retrieved 3 March 2015.

- ↑ "Bharatiya Mahila Bank included in second schedule to RBI Act". Live Mint. 21 May 2014. Retrieved 3 March 2015.

Further reading

- "Reserve Bank of India Act, 1934: The Second Schedule" (PDF). Reserve Bank of India. p. 91-100.

This article is issued from Wikipedia - version of the 10/21/2016. The text is available under the Creative Commons Attribution/Share Alike but additional terms may apply for the media files.