Signature BioScience

| Private | |

| Industry | BioPharmaceutical Discovery and Development |

| Founded | 1998 |

| Defunct | 2003 |

| Headquarters | San Francisco (initially Richmond), USA |

Key people | Mark McDade who was succeeded by Robert J. Zimmerman |

Number of employees | approximately 100 |

Signature BioScience Inc. was the first biotechnology company based in San Francisco. It was formed in 1998 but closed in 2003 due to lack of funding. Before Signature was dissolved, it had just completed Phase II trials on Digitoxin, which the company was pursuing as an anti-cancer compound. However, the company's core competency was developing biotechnology tools that would be used to identify highly qualified pre-clinical leads.

History

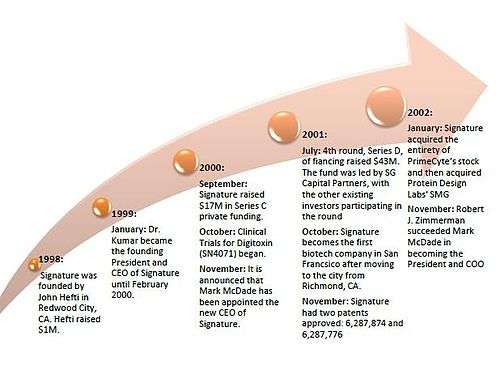

Timeline

Signature BioScience (Signature) was founded by John Hefti, a theoretical physicist who received his doctorate from UC Berkley and studied medicine at Stanford. Signature’s main business model was to become a drug development company with preclinical leads available for licensing to pharmaceutical and biotech partners. Their main focus area was cancer, although they were in the process of developing some compounds in other therapeutic areas. Andrew Sandham later became president of the company and John Hefti became the CTO, with Mark McDade taking over as the CEO in late 2000.[1][2] Towards the end of 2002, Robert J. Zimmerman succeeded Mark McDade, who left Signature to go to Protein Design Labs. Zimmerman became the President and a member of the Board of Directors, while maintaining his position as the COO; he had also formerly held the positions of EVP of Research & Development at Signature.[3][4] (See Key People below for more about others in the company.)

In September 2001, Signature entered into a collaboration agreement with Micralyne, a leading company in microfluidics and “lab-on-a-chip.”[5] Signature acquired the entirety of PrimeCyte’s stock in the beginning of January 2002. PrimeCyte was a private oncology-based company located in Seattle, WA, that focused on drug discovery. Signature wanted the newly acquired company to help advance its detection-based, cell-oriented drug discovery program WaveScreen.[6] Signature then acquired Protein Design Labs’ Small Molecule Group (SMG) at the end of January, 2002.[7] (See Acquisitions and Partnerships for the complete list of companies.)

Signature became the first biotechnology company in San Francisco after acquiring 67,000 square feet (6,200 m2) of office and space in the city. They signed a 10-year lease in October 2001.[8][9] Before all the employees and equipment moved into the new facility in May 2002, Signature increased its lease space to 100,000 square feet.[10] In April 2003, Signature decided to cease all operations when investors decided not to give the company a $10 million bridge loan. This loan was supposed to be used until the company completed a $30 million private equity from S.G. Capital Partners.[11] (See Financing below.)

Key People

- Dr. Amit Kumar - Founding President and CEO

- Mark McDale, MBA (CEO) - Graduated from Dartmouth College; received his MBA from Harvard.

- John Hefti, MD (CTO) - Founder

- Andrew P. Sandham (President and CBO)

- Richard Neele, PhD, J.D. - Executive Vice President of Intellectual Property

- David Balaban, PhD - Vice President of Informatics and Computational Biology

- Mark Rhodes, PhD - Vice President of Advanced Technologies

- Joseph Heanue, PhD - Vice President of Product Engineering

- David C Spellmeyer, PhD (CSO) - Vice President of Drug Discovery

- Alfred Pan, PhD - Senior Director of R&D Operations

- Nancy E.Pecota – Senior Director of Finance and Administration[12]

- Frances K. Heller, J.D., MA – Vice President, Corporate Development and Legal Affairs

- J.D. from Golden gate Univ school of law, an MA in biology from American Univ and BS in biology from Tulane University (Jan 2002)[13]

Acquisitions and Partnerships

MDS Inc. and Signature BioScience Inc. MDS Inc., a company focused on products and services for development of drugs, diagnosis and treatment of diseases. It has departments which work on analytical instruments, molecular imaging, and contract research. MDS paid an upfront fees of $10 million and undisclosed milestone and royalty payments to Signature BioScience in exchange for its MCS technology. The product development work was divided between the two companies. MDS was solely responsible for sales, marketing and service of the instrumentation. MDS’ products will have Signature’s WaveSpec technology as part of their product line. This partnership was done in August 2001.

Micralyne and Signature BioScience Inc. Micralyne, microfluids or lab-on-chip company and Signature Bioscience entered into a collaboration agreement where Micralyne will give microfluidic and micromachining technology and development services to Signature for it to develop miniaturized platforms for certain drug discovery allplications. The deal was done in September 2001.

Cambridge and Signature BioScience Signature bought Cambridge Discovery Chemistry (CDC) from Millennium to strengthen its drug discovery infrastructure in July 2001.

Primecyte Inc. and Signature BioScience Signature BioScience acquired 100% of the stock of PrimeCyte Inc., a drug discovery company focused on cancer. PrimeCyte’s Cytection technology was for producing high throughput drug discovery screens that use primary cells. Signature was getting a pipeline of several compounds with anti-tumor activity. Signature also got a drug candidate PC4071 which was in Phase II clinical trials then for treatment of ovarian cancer and sarcomas. (Jan 2002)

Protein design labs and Signature BioScience Signature BioSciences acquired Protein Design Lab’s Small Molecule Group access its high throughput screening and small molecule drug discovery efforts. (Jan 2002)

Sunesis Pharmaceuticals and Signature BioScience Signature BioSciences formed a collaboration with Sunesis Pharmaceuticals to access their small molecule inhibitors for protein-protein interaction within inflammation pathways.[14][15]

Financing

After leaving his work at Stanford and filing a patent, John Hefti raised $1 million in funding from Prospect Venture Partners (PVP) and Abingworth Management Inc.[16] In September 2000, Signature raised $17 million in a Series C private funding, which was led by Atlas Venture, and included CIBC Capital Partners and Coral Ventures as well as the company's original investors, ProspectVenture Partners and Abingworth Management.[17] In July 2001, Signature raised $43 million in a 4th round (Series D) of financing. The fund was led by SG Capital Partners, with the other existing investors participating in the round including PVP, Atlas Venture, Abinworth Management, CIBC Capital Partners, and Coral Ventures. The new investors in this round included SG Capital Partners, Vulcan Ventures Inc., MDS Capital Corp, China Development Industrial Bank, Tallwood Venture Capital, Lehman Brothers, Lotus Bioscience Ventures Ltd., and IRR. At this point, the company had raised a total of $64 million since its beginning in 1998.[18] Signature had assumed that their revenues, which would include the fees from pharmaceutical device companies, would reach $10 million at the end of 2001 and expected the numbers to skyrocket to $100 million by 2004.[19] However, the company dissolved after it failed to obtain a necessary bridge loan in 2003.

Technology and Products

WaveScreen

Signature’s detection-based, cell-oriented drug discovery platform, WaveScreen, integrates Signature's portfolio of complementary screening technologies; including its proprietary spectroscopy, MCS, and Cytection with assays. The technologies evaluates both cellular and molecular responses to compounds at the beginning of the drug discovery process. The company used WaveScreen to drive lead compound discovery for pharmaceutical and biotech partnership opportunities, while globally commercializing its MCS-based WaveSpec instrumentation in collaboration with its partner MDS Sciex.[20]

Cytection

Cytection assays were a part of Signature’s drug discovery and development program. The technology was based on their proprietary screening platform which was used to rapidly discover and efficiently optimize highly qualified small molecules. Cytection used diseased and normal patient-derived primary cells, rather than immortalized cell lines, to identify compounds that were selectively active against diseased tissues compared to normal tissues. Signature used the platform for hit identification when screening potential drug compounds as well as for structure activity relationship (SAR) lead optimization.

Multipole Coupling Spectroscopy[21]

Signature also developed a cellular detection system based on its proprietary Multipole Coupling Spectroscopy (MCS) technology. The MCS technology was used for applications in drug discovery and is based upon dielectric spectroscopy.[22] MCS uses microwave and radio frequencies which can be used to scan proteins and cells. The response signal indicates whether there's an interaction, the change in the structure of the protein or cell and the resulting change in function.[23] Signature used the technology to look at the effect on a given protein or a given cell caused by the addition of another molecule. The system operates in real time with no labels or tags necessary. Compounds can be profiled against many cellular systems, in primary cells, in immortalized cells with the target in its native state, or in cell lines in which the target is artificially introduced. The system allows detection of physical and biological properties of molecules and cells, including target drug receptors and the interactions of two molecules with each other in real time (such as the binding of a test compound to a target drug receptor. ) Signature's patent portfolio relating to MCS consisted of five issued patents: four in the United States, one in the United Kingdom.

MDS Sciex

In 2003, MDS Sciex, a Toronto-based manufacturer of mass spectrometers, bought the MCS technology and hired 12 former Signature employees. After two years of continued research and development, the bioimpedance technology was launched as a radically new cellular assay for drug discovery.[24] It is now marketed as the CellKey 384 System. Four former Signature employees - Vivian Liu, Chris Fuller, Eric Nehrlich, and Simon Pitchford - received the 2008 PolyPops Award from the Society for Biomolecular Sciences (SBS) for the development of CellKey.[25]

CellKey 384 System

- After, mammalian cells are seeded onto a custom 96-well microtiter plate that contains electrodes at the bottom of each well. The CellKey System then supplies a constant voltage, producing a current that at low frequencies flows both around and between cells (extracellular current, Ziec) and at high frequencies through cells (transcellular current, Zitc).[26] Impedance changes can then be linked to changes in cell-substrate adherence, changes in cell shape and volume, and changes in cell-cell interactions. These factors individually or collectively affect the flow of extracellular and transcellular current, influencing the magnitude and characteristics of the signal measured. Activation of cell receptors results in characteristic bioimpedance measurements corresponding to the signaling pathway being activated. These are unique to the main subsets of G protein coupled receptors (GPCRs) and tyrosine kinase receptors (TKRS).

Pharmaceutical Compounds

The company had a pipeline of potential pharmaceuticals focusing primarily in oncology. One of the compounds, SN4071, was in Phase II clinical trial for soft tissue sarcoma when the company failed. Other compounds that were being evaluated were SN 2347600 and SN 25017808. SN 2347600 was undergoing preclinical evaluation in ovarian cancer and melanoma. This compound showed to be highly active and selective against lung adenocarcinoma, malignant melanoma, ovarian cancer and sarcoma. SN 25017808 is a compound with activity against human lung and breast cancer cell lines, including chemo-resistant cell lines, and had entered preclinical evaluation. Based on both the NCI 60 panel results as well as biochemical analyses, this compound appeared to have a dual mechanism: an antagonist of topoisomerase II and an inhibitor of microtubulin polymerization. Signature also had multiple hit-stage chemical series that were awaiting optimization.[21]

Market Assessment

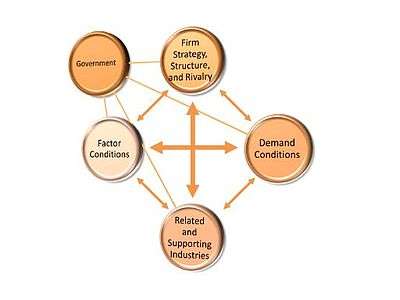

Diamond Model

Firm Strategy, Structure and Rivalry Signature’s strategy was to leverage their drug discovery technology to become a FIBCO while acquiring more companies that could enhance their technology platform. They also considered collaborating with other companies that could help them move their drug discovery plans forward in the short term. Drug discovery targets were limited to those that could serve the oncology market, which has intense competition because of its market size. There are several competitors with various alternative technologies trying to serve the drug discovery market as well. Even the simple idea of moving assays from 385-well microtiter plates to 1536-well plates can significantly reduce reagent and labeling costs while decreasing the time needed to screen compounds.[27] Signature’s technology eliminated the need for reagents and labels which gave the company a competitive advantage; however, in the current form marketed by MDS, the device still conforms to either a 96 or 384 well standard.

Demand Conditions The major customer of Signature BioScience was anticipated to be large pharmaceutical companies as well as biotech firms. The key goal of Signature was to reduce the discovery time required by a pharmaceutical company by clustering lead molecules, using molecule’s biologic activity which could be directly examined by WaveScreenTM. There is a great amount of pressure to find new lead molecules and reduce the time it takes to get through the discovery process. The Discovery and Development process is extremely costly and pharmaceutical industries spend a significant amount of time and energy looking for ways to shorten the process and, thus, decrease their expenses. Therefore, there was a great amount of pressure for Signature to improve their quality and to create innovative products that would have distinguished them from competitors.

Related and Supporting Industries Signature aimed to become a Fully Integrated Biotechnology Company (FIBCO.) However, the original company was based on screening tools used to speed up the drug discovery process for FIBCOs. This means that it wanted to become its main supporting industry by leveraging its platform technology as a competitive advantage.

Factor Conditions Porter argues that the key factors of production are skilled labor, capital, and in this particular case, science and technology.

- Skilled Labor Signature BioScience had some of the top people in their management team. John Hefti, the founder of the company, was a theoretical physicist who received his doctorate from UC Berkeley and studied medicine at Stanford. While at Stanford, Hefti observed the limitations of existing techniques for observing proteins; he recognized these techniques to be very slow, expensive, and done under mock conditions that do not show how proteins actually act in nature. As a new physician, Hefti chose to take a two year hiatus to find a superior method to the one being used at the time.[28] From January 1999 to February 2000, Dr. Amit Kumar was the founding President and Chief Executive Officer of Signature BioSciences Inc. Dr. Kumar did his graduate studies at Stanford University and the California Institute of Technology and received his Ph.D. from Caltech in chemistry in 1991. Later, he did is post-doctoral fellowship at Harvard University, where he developed patented techniques for building biochips and related devices. Furthermore, he had a great deal of experience working in the biotech industry and developing company’s platform technologies.[29] In November 2000, Mark McDade succeeded Dr. Kumar as the CEO. Mark McDade was the co-founder of Corixa in September 1994, had served on Corixa’s board since March 1999 and as the chief operating officer and director since 1994.

- Capital By 2001, Signature had raised $64 million since its inception in 1998.[30] (See Financing section.) However, in 2003 Signature was unable to get a $10M bridge loan and was forced to liquidate its assets.

- Science and Technology Signature BioScience’s goal was to deliver highly qualified pre-clinical leads for potential treatment of cancer and other diseases. In order to do so, the company integrated its complementary screening technologies, MCS and CytectionTM, with chemistries and informatics, creating a novel drug discovery platform, WaveScreenTM. WaveScreenTM which allowed for the direct examination of a wide range of biologic activities and access was offered on a fee-for-service basis. Signature also used the platform internally to discover drug candidates, which they planned to out-license to pharmaceutical and biotech partners prior to the clinical development stage. Signature's drug discovery efforts focused on three research-stage programs: two in cancer and one against an infectious disease target. In addition, Signature was working on PC4071, a compound that was being studied in two Phase II trials investigating the drugs effect on ovarian cancer and soft tissue sarcoma. Furthermore, Signature also globally commercialized its MCS-based WaveSpecTM instrumentation in collaboration with its partner MDS Sciex.[31]

Potential Reasons for Dissolving the Venture

The company became impaired due to: (1) the quick turnover of management, (2) overly aggressive business strategy, (3) market conditions for their particular industry, and (4) the company’s poorly projected performance and expected cash needs.

- The company likely failed due to its quick turnover in management. Over the course of only five years, the company had four different CEO’s, including the original founder, John Hefti. The rapid turnover of CEO’s caused a lack of consistency that severely damaged the company’s business strategy. In addition, it is likely that this high turnover rate would take a toll on the company morale, as the employees were likely to feel that each new CEO would only stay a year or two with any company.

- Signature aimed to become a Fully Integrated Biotechnology Company (FIBCO). Given that the original core competency of the company was based on screening tools used to speed up the drug discovery process for FIBCO’s, it seemed that Signature may have tried to accomplish too many projects at once, making it very difficult to implement every objective.

- The oncology market was fraught with intense competition. As a company new to the drug discovery space, Signature should have considered looking at a disease area where the market had a high barrier to entry. Although it may be difficult to discover a cure for certain diseases, i.e. Alzheimer’s Disease, AIDS, and certain orphan diseases, it probably would have been beneficial for Signature to have at least attempted to enter a disease area with less players than that of the oncology space. On the other hand, the company could have simply acknowledged possible weaknesses in becoming a drug discovery company and could have reverted to their original business plan of focusing on screening tools. Signature may have needed to refocus their efforts entirely, though, if choosing this course given the other competitors attempting to reduce R&D costs and time to market, i.e. microtiter plates with more wells. Signature did not seem to look at the big picture of their competitors' landscape.

- Signature failed to secure a final venture capital (VC) bridge loan that likely contributed to Signature’s collapse. The company needed $10 million to continue operating but never received the funds. A bridge loan is essential as a pre-public stage before a company receives its IPO and goes public. For Signature to have not received the bridge loan, it is likely that the company did not achieve some of the benchmarks for which the VC firms aimed. These could have involved Signature’s inability to eliminate competitors and the VC’s fear that Signature would be quickly taken over by another firm. Also, Signature had assumed that their revenues would reach $10 million at the end of 2001 and expected the numbers to catapult to $100 million by 2004. The company also assumed too much space in their newly acquired San Francisco building before any great success was seen in the company, thereby increasing spending unnecessarily.

References

- ↑ Huggett, B. “Signature Raises $17 M Privately For PhenoDynamic Technology.” Bioworld Today Archives. September 7, 2000.

- ↑ “Signature Bio” 10/10/08 <http://www.archives.org.> Archived webpage: <http://signaturebio.com>

- ↑ “Signature BioScience CEO Goes to Protein Design Labs.” San Francisco Business Times. November 5, 2002.

- ↑ Article reference number: 112943. “Signature BioScience Announces Management Team Changes.” Biomedical NewsSearcher. November 5, 2002.

- ↑ Article reference number: 92485. "Micralyne and Signature BioScience Announce Research and Development Agreement"

- ↑ Start-up/Emerging. "KE Biomedical Deals." January 8, 2002.

- ↑ "Signature Acquires Protein Design Labs’ Small Molecule Group." Biomedical NewsSearcher. January 29, 2002.

- ↑ Article reference number: 47955. "Signature Acquires Protein Design Labs’ Small Molecule Group." Biomedical NewsSearcher. January 29, 2002.

- ↑ Bishop, A. "Signature BioScience Signs 475 Brannan Lease." San Francisco Business Times. October 22, 2001.

- ↑ Doherty, B. "San Francisco Seeks Biotech Buy-In." San Francisco Business Times. March 1, 2002.

- ↑ Levine, D. "Signature Bio’s Burnout Singes City’s Ambition." Business Times. April 28, 2003.

- ↑ Business Wire ( May 1, 2001) 10/10/08 <http://findarticles.com/p/articles/mi_m0EIN/is_2001_May_1/ai_73880681>

- ↑ “Signature BioSciences” - Knowledge Express 2008 10/12/08 <http://www.knowledgeexpress.com/resultlist.asp?ListIndex=49&SourceFilter>

- ↑ “Signature BioSciences” - Knowledge Express 2008 10/12/08 <http://www.knowledgeexpress.com/resultlist.asp?ListIndex=49&SourceFilter>

- ↑ Daniel Levine, “Signature Bioscience to shut down” San Francisco Business Times. April 17, 2003 <http://www.bizjournals.com/sanfrancisco/stories/2003/04/14/daily46.html>

- ↑ Huggett, B. “Signature Raises $17 M Privately For PhenoDynamic Technology.” Bioworld Today Archives. September 7, 2000.

- ↑ "Signature BioScience Raises $17 million." San Francisco Business Times. September 6, 2000

- ↑ Article reference number: 35208. "Signature Closes $43 million Series D Financing Round." Biomedical NewsSearcher. July 9, 2001.

- ↑ Smith, L. "The Innovators: Meet the 65 Companies and Their Owners Who Have Conjured up the Latest Wave of Products, Services, and Technologies." (May 1, 2001.) 10/10/08 <http://www.cnnmoney.com>

- ↑ "Signature to Acquire PrimeCyte, Inc. to Rapidly Advance its Drug Discovery Platform, WaveScreen" New England Partners. (1-8-02) Retrieved on 10/11/2008 <http://www.nepartners.com/news/1-8-02_signaturebio.html>.

- ↑ Hefti, J., Pan, A., and Kumar, A., 1999. Sensitive detection method of dielectric dispersions in aqueous-based, surface-bound macromolecular structures using microwave spectroscopy. Applied Physics Letters 75(12):1802-1804.

- ↑ "Signature BioScience." Knowledge Express 2008.10/11/2008 <http://www.knowledgeexpress.com/recordview.asp?rid=4509&dbid=56&ListLoc=23&SourceFilter=>.

- ↑ "MARK MCDADE - SIGNATURE BIOSCIENCE: TWST." 10/11/2008 <http://www.twst.com/notes/articles/nah364.html>.

- ↑ "Welcome to CellKey.com." 10/11/2008 <http://www.cellkey.com/>

- ↑ "SBS Journal." 10/11/2008 <http://www.sbsonline.org/sbscon/2008/tech/awards.php>

- ↑ “CellKey - Technology.” 10/11/08 <http://www.cellkey.com/technology.html>

- ↑ Garyantes TK. "1536-well assay plates: When do they make sense?" Drug Discov Today. 2002;7(9):489.

- ↑ Smith, L. "The Innovators: Meet the 65 Companies and Their Owners Who Have Conjured up the Latest Wave of Products, Services, and Technologies." (May 1, 2001.) 10/12/08 <http://www.cnnmoney.com.>

- ↑ “Acacia Research Names Dr. Amit Kumar as Vice President, Life Sciences; Medical Industry Entrepreneur Will Manage New San Francisco Area Office” Business Network (July 17, 2000) 10/11/08 <http://findarticles.com/p/articles/mi_m0EIN/is_2000_July_17/ai_63493789>

- ↑ Article reference number: 35208. "Signature Closes $43 million Series D Financing Round." Biomedical NewsSearcher. July 9, 2001.

- ↑ “Signature BioScience Signs With geneticXchange for Its discoveryHub Data Integration Solution.” Business Network. (June 4, 2002) 10/11/08 <http://findarticles.com/p/articles/mi_m0EIN/is_2002_June_4/ai_86679283>

- Levine, Daniel (April 17, 2003). "Signature BioScience to shut down". San Francisco Business Times. Retrieved 2008-10-10.