Société Nationale d'Investissement

| Industry | Holding company |

|---|---|

| Founded | 1966 |

| Founder | Moroccan state |

| Headquarters |

60, rue d'Alger 20000 Casablanca, Morocco |

Key people |

Hassan Bouhemou Mounir Majidi (Director of SIGER) Mohammed VI |

| Revenue |

|

|

| |

| Total assets |

|

| Total equity |

|

| Owner |

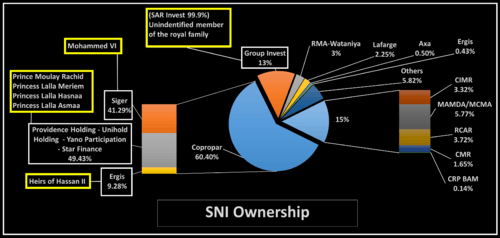

Mohammed VI Members of the Alaouite royal family |

Société Nationale d'Investissement (SNI) or National Investment Company, is a large private Moroccan holding company controlled by the Moroccan royal family. The holding company used to be the majority shareholder of the now defunct ONA Group, until the activities of the latter were absorbed into the SNI and subsequently disposed of.

In 2012, the company's consolidated turnover was 53 billion MAD and its net income was 5 billion MAD

History

The conglomerate registered a consolidated net income of MAD 2.3 billion in 2009. In March 2010, the decision was taken to merge by the two companies, during a meeting of their management boards.[3] In 2009, SNI invested an overall amount of MAD 5.52 billion, mainly in acquiring 10% of Attijariwafa Bank's capital from the Spanish bank Santander.[4]

Despite the unfavourable global context, the company's performance increased 365% in 2009, with a turnover of MAD 3.42 billion, compared to the previous year.

Restructuring and merger with ONA Group

In March 2010, the boards of the two companies announced[3] the reorganisation of their activities, as the group moved away from a conglomerate structure controlling the activities of its subsidiaries to an investment fund company incubating, developing and disposing of companies and projects present in the Moroccan economy. This reorganisation has transformed the conglomerate into an investment company that gives larger autonomy to its subsidiaries in the management of their affairs, once these companies have reached a large size. As a result of this merger, the two companies have been delisted from the Casablanca stock market, pending the enlargement of the free float of its subsidiaries on the stock exchange.

Activities and partnerships

The group has a large footprint on the Moroccan economy, estimated to be worth 3% of GDP, with investments in companies holding #1 positions in banking and mass retail. Its main activities encompass financial services with Attijariwafa Bank mass distribution with Marjane Holding, telecoms with Wana Corporate and mining with Managem Group. Societe Nationale d'Investissement has invested as well in renewable energy, tourism and real estate. It has partnered as well with foreign investors such as Lafarge in Lafarge Maroc and Arcelor Mittal in Sonasid.

It has exited in 2012 and 2013 from the historic ONA Group agri-business activities, with sales of its stakes in leader companies in edible oil, milk and dairy, sugar and biscuits to international leaders such as Sofiprotéol, Danone, Wilmar International and Mondelēz International.

Subsidiaries

- Agma Lahlou-Tazi

- Attijariwafa Bank

- Bimo

- Centrale Laitière

- Cosumar

- Lafarge Maroc

- Lesieur Cristal

- Managem

- Marjane

- Nareva

- ONAPAR

- OPTORG

- SOMED

- SONASID

- Sotherma

- Wafa Assurance

- Wafa Cash

- Wafa Capital

- Wana Corporate (Inwi)

Monopoly Status and Corruption Allegations

The Societe National d'Investissement and its former holding arm (Omnium Nord Africain) have been accused of monopolistic market practices and of corruption on several occasions. The fact that the largest shareholder remains the Moroccan Royal family to this day has enabled the SNI to use significant political and economic pressure on its rivals and acquisition targets. Recent Wikileaks cables[5] divulged on December 2010 reveal the reports of US diplomats casting doubts on the integrity of the dealings of the SNI (and ONA) and on the transparency of the King's business affairs.

See also

References

- 1 2 "SNI2013_Conso" (PDF). cdvm.gov.ma. Retrieved 24 July 2014.

- 1 2 3 "SNI_2012" (PDF). cdvm.gov.ma. Retrieved 24 December 2013.

- 1 2 http://www.moroccobusinessnews.com/Content/Article.asp?idr=18&id=1456

- ↑ "Santander vend 10% de ses parts d'Attijariwafa Bank". yabiladi.com.

- ↑ "US embassy cables: Moroccan sacking exposes king's business role". the Guardian.