State Board of Equalization (California)

The State Board of Equalization (BOE) is a public agency charged with tax administration and fee collection in the state of California in the United States. The authorities of the Board fall into four broad areas: sales and use taxes, property taxes, special taxes, and acting as an appellate body for franchise and income tax appeals (which are collected by the Franchise Tax Board).[1] The BOE is the only publicly elected tax commission in the United States.[2]

The board is made up of four directly elected members, each representing a district for four-year terms, along with the State Controller, who is elected on a statewide basis, serving as the fifth member. The current board members are:

George Runner (R)

George Runner (R)

(First District) Fiona Ma (D)

Fiona Ma (D)

(Second District) Jerome Horton (D)

Jerome Horton (D)

(Third District) Diane Harkey (R)

Diane Harkey (R)

(Fourth District)

The terms of all five members, including the State Controller, began on January 5, 2015.[3] As of 2008, the agency employed approximately 3,950 people throughout the state.[4]

History

The State Board of Equalization was created in 1879 by an amendment to the California Constitution. Its original mandate was to ensure that property tax assessments were uniform and equal across all counties in the state.[1]

Prior to the creation of the state income, sales, and fuel taxes in the 1930s, California's state government was almost completely supported by property taxes, which were and still are assessed at the county level by elected assessors. Of course, assessors were tempted to boost their popularity with county voters by undervaluing voters' property (and thereby lowering their taxes). This presented the risk of counties with honest assessors paying more than their fair share of the burden of operating the state government, so the Board of Equalization was created to equalize the burden.

Equalization districts

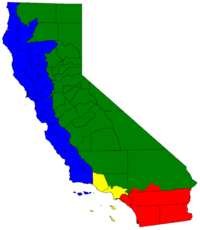

| First District | Second District |

| Third District | Fourth District |

For the purposes of tax administration, the BOE divides the state into four Equalization districts, each with its own elected board member.[5] Following the 2011 redistricting, the new districts have been in effect since January 1, 2015.[6]

First district

The first Equalization District is made up of the following counties: Alpine, Amador, Butte, Calaveras, El Dorado, Fresno, Inyo, Kern, Kings, Lassen, Madera, Mariposa, Merced, Modoc, Mono, Nevada, Placer, Plumas, Sacramento, San Joaquin, Shasta, Sierra, Siskiyou, Stanislaus, Sutter, Tulare, Tuolumne, Yuba, a portion of Los Angeles, and a portion of San Bernardino. Before 2015, most of this area was the second district.

Second district

The second Equalization District is made up of the following counties: Alameda, Colusa, Contra Costa, Del Norte, Glenn, Humboldt, Lake, Marin, Mendocino, Monterey, Napa, San Benito, San Francisco, San Luis Obispo, San Mateo, Santa Clara, Santa Cruz, Solano, Sonoma, Tehama, Trinity, Yolo, and Santa Barbara. Before 2015, most of this area was the first district.

Third district

The third Equalization District is made up of Ventura County and a portion of Los Angeles County, including the cities of Agoura Hills, Alhambra, Arcadia, Artesia, Avalon, Baldwin Park, Bell, Bell Gardens, Bellflower, Beverly Hills, Burbank, Calabasas, Carson, Cerritos, City of Industry, Commerce, Compton, Covina, Cudahy, Culver City, Diamond Bar, Downey, El Monte, El Segundo, Gardena, Glendale, Glendora, Hawaiian Gardens, Hawthorne, Hermosa Beach, Hidden Hills, Huntington Park, Inglewood, La Cañada Flintridge, La Habra Heights, La Mirada, La Puente, Lakewood, Lawndale, Lomita, Long Beach, Los Angeles, Lynwood, Malibu, Manhattan Beach, Maywood, Monrovia, Montebello, Monterey Park, Norwalk, Paramount, Pasadena, Pico Rivera, Redondo Beach, Rosemead, San Gabriel, San Marino, Santa Fe Springs, Santa Monica, Sierra Madre, Signal Hill, South El Monte, South Gate, South Pasadena, Temple City, Torrance, Vernon, Walnut, West Covina, West Hollywood, Westlake Village, and Whittier.

Fourth district

The fourth Equalization District is made up of the following counties: Imperial, Orange, Riverside, San Diego, a portion of Los Angeles, and a portion of San Bernardino.

Members of the Board of Equalization

| Year | 1st District | 2nd District | 3rd District | 4th District | State Controller |

|---|---|---|---|---|---|

| 1879 | James L. King | Moses M. Drew | Warren Dutton | Tyler D. Heiskel | Daniel M. Kenfield |

| 1880 | |||||

| 1881 | |||||

| 1882 | |||||

| 1883 | Charles Gildea | L. C. Morehouse | C. E. Wilcoxon | John Markley | John P. Dunn |

| 1884 | |||||

| 1885 | |||||

| 1886 | |||||

| 1887 | Gordon E. Sloss | John T. Gaffey | |||

| 1888 | |||||

| 1889 | |||||

| 1890 | |||||

| 1891 | J. S. Swan | Richard H. Beamer | James R. Hebbron | Edward P. Colgan | |

| 1892 | |||||

| 1893 | |||||

| 1894 | |||||

| 1895 | A. Chesebrough | George L. Arnold | |||

| 1896 | |||||

| 1897 | |||||

| 1898 | |||||

| 1899 | J. G. Edwards | Alexander Brown | Thomas O. Toland | ||

| 1900 | |||||

| 1901 | |||||

| 1902 | |||||

| 1903 | William H. Alford | Frank Mattison | |||

| 1904 | |||||

| 1905 | |||||

| 1906 | A. B. Nye | ||||

| 1907 | Joseph H. Scott | Richard E. Collins | Jeff McElvaine | ||

| 1908 | |||||

| 1909 | |||||

| 1910 | |||||

| 1911 | Edward M. Rolkin | John Mitchell | |||

| 1912 | |||||

| 1913 | John S. Chambers | ||||

| 1914 | |||||

| 1915 | John C. Corbett | ||||

| 1916 | |||||

| 1917 | |||||

| 1918 | |||||

| 1919 | Phillip D. Wilson | ||||

| 1920 | |||||

| 1921 | Ray L. Riley | ||||

| 1922 | |||||

| 1923 | Harvey G. Cattell | ||||

| 1924 | |||||

| 1925 | |||||

| 1926 | |||||

| 1927 | John C. Corbett | Fred E. Stewart | |||

| 1928 | |||||

| 1929 | |||||

| 1930 | |||||

| 1931 | |||||

| 1932 | |||||

| 1933 | |||||

| 1934 | |||||

| 1935 | Orfa Jean Shnotz | ||||

| 1936 | |||||

| 1937 | Harry B. Riley | ||||

| 1938 | |||||

| 1939 | George R. Reilly | Eric Mont | |||

| 1940 | |||||

| 1941 | |||||

| 1942 | |||||

| 1943 | James H. Quinn | ||||

| 1944 | |||||

| 1945 | |||||

| 1946 | Thomas Kuchel | ||||

| 1947 | Jerrold L. Seawell | ||||

| 1948 | |||||

| 1949 | |||||

| 1950 | |||||

| 1951 | |||||

| 1952 | |||||

| 1953 | Robert C. Kirkwood | ||||

| 1954 | Paul R. Leake | ||||

| 1955 | Robert E. McDavid | ||||

| 1956 | |||||

| 1957 | |||||

| 1958 | |||||

| 1959 | John W. Lynch | Richard Nevins | Alan Cranston | ||

| 1960 | |||||

| 1961 | |||||

| 1962 | |||||

| 1963 | |||||

| 1964 | |||||

| 1965 | |||||

| 1966 | |||||

| 1967 | Houston I. Flournoy | ||||

| 1968 | |||||

| 1969 | |||||

| 1970 | |||||

| 1971 | William M. Bennett | ||||

| 1972 | |||||

| 1973 | |||||

| 1974 | |||||

| 1975 | Kenneth Cory | ||||

| 1976 | Iris G. Sankey | ||||

| 1977 | |||||

| 1978 | |||||

| 1979 | Ernest J. Dronenburg Jr. | ||||

| 1980 | |||||

| 1981 | |||||

| 1982 | |||||

| 1983 | Conway H. Collis | ||||

| 1984 | |||||

| 1985 | |||||

| 1986 | |||||

| 1987 | William M. Bennett | Conway H. Collis | Ernest J. Dronenburg, Jr. | Paul B. Carpenter | Gray Davis |

| 1988 | |||||

| 1989 | |||||

| 1990 | |||||

| 1991 | Brad Sherman | Matt Fong | |||

| 1992 | |||||

| 1993 | |||||

| 1994 | |||||

| 1995 | Johan Klehs | Dean Andal | Brad Sherman | Kathleen Connell | |

| 1996 | |||||

| 1997 | John Chiang | ||||

| 1998 | |||||

| 1999 | Claude Parrish | ||||

| 2000 | |||||

| 2001 | |||||

| 2002 | |||||

| 2003 | Carole Migden | Bill Leonard | Steve Westly | ||

| 2004 | |||||

| 2005 | Betty Yee | ||||

| 2006 | |||||

| 2007 | Michelle Park Steel | Judy Chu | John Chiang | ||

| 2008 | |||||

| 2009 | |||||

| 2010 | Barbara Alby / Sean Wallentine | Steve Shea / Jerome Horton | |||

| 2011 | George Runner | Jerome Horton | |||

| 2012 | |||||

| 2013 | |||||

| 2014 | |||||

| 2015 | George Runner | Fiona Ma | Jerome Horton | Diane Harkey | Betty Yee |

| 2016 | |||||

| 2017 | |||||

| 2018 |

Tax and fee programs

The State Board of Equalization administers the following tax and fee programs:[7][8]

Sales and Use Tax Programs

For more information on sales and use taxes in California, see the "California" section of Sales taxes in the United States.

- Sales and Use Tax

- Bradley-Burns Uniform Local Sales and Use Tax

- District Transactions (Sales) and Use Tax

Special Tax and Fee Programs

- Electronic Waste Recycling Fee

- Environmental Fees

- Hazardous Substances Tax

- Marine Invasive Species Fee (formerly Ballast Water Management Fee)

- Occupational Lead Poisoning Prevention Fee

- Excise Taxes

- Alcoholic Beverages Tax

- Alternative Cigarette Tax Stamp Program (ACTS)

- California Tire Fee

- Cigarette and Tobacco Products Tax

- Cigarette and Tobacco Products Licensing Program

- Emergency Telephone Users Surcharge

- Energy Resources Surcharge

- Insurance Tax

- Integrated Waste Management Fee

- Natural Gas Surcharge

- Fuel Taxes

- Aircraft Jet Fuel Tax

- Childhood Lead Poisoning Prevention Fee

- Diesel Fuel Tax

- International Fuel Tax Agreement (IFTA)

- Interstate User Diesel Fuel Tax

- Motor Vehicle Fuel Tax

- Oil Spill Response, Prevention, and Administration Fees

- Underground Storage Tank Maintenance Fee

- Use Fuel Tax

Property Tax Programs

- County Assessed Properties Division

- Private Railroad Car Tax

- State-Assessed Property Program

- Timber Yield Tax

Tax Appellate Programs

- Bank and Corporation Tax Law

- Personal Income Tax

- Homeowner and Renter Property Tax Assistance Law

- Publicly Owned Property Assessment Review Program

- Taxpayers' Bill of Rights Law

See also

| Wikimedia Commons has media related to State Board of Equalization (California). |

References

- 1 2 State Board of Equalization, About BOE

- ↑ State Board of Equalization, Board Members

- ↑ "California State Board of Equalization Members Assume Office". Retrieved 6 January 2015.

- ↑ State Board of Equalization, 2007-2008 Annual Report, Profile, "Governance" p. 3.

- ↑ http://wedrawthelines.ca.gov/maps-final-draft-board-of-equalization-districts.html

- ↑ http://www.boe.ca.gov/info/new_boundaries.htm

- ↑ State Board of Equalization, 2007-2008 Annual Report, Profile, "Tax and Fee Programs, 2007-2008" pp. 2.

- ↑ State Board of Equalization. "Special Taxes". Retrieved May 21, 2006.