Ecobank

| |

|

Public Company GSE: ETI NSE: ETIT BRVM: ETI | |

| Industry | Financial Services |

| Founded | 1985 |

| Headquarters | 2365, Boulevard du Mono, B.P.3261, Lomé, Togo[1] |

Key people |

Emmanuel Ikazoboh[2] Chairman Ade Ayeyemi Group CEO[3] |

| Products |

List

|

| Revenue |

|

|

| |

| Total assets |

|

| Total equity |

|

Number of employees | 19,565 (2014) |

| Website | Homepage |

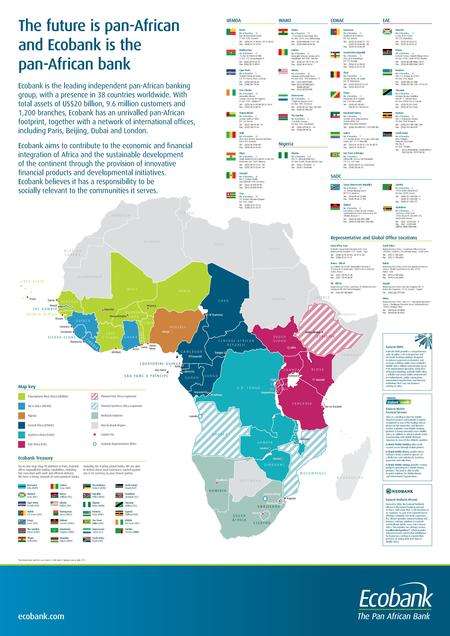

Ecobank, whose official name is Ecobank Transnational Inc. (ETI), is a pan-African banking conglomerate, with banking operations in 36 African countries. It is the leading independent regional banking group in West Africa and Central Africa, serving wholesale and retail customers. It also maintains subsidiaries in Eastern Africa, as well as in Southern Africa. ETI has representative offices in Angola, China, Dubai, France, South Africa and in the United Kingdom.

Overview

ETI is a large financial services provider with offices in 39 countries around the world, and presence in 36 sub-Saharan countries. As of December 2012, ETI's customer base was estimated at 13.7 million, with 9.6 million (70.2%), located in Nigeria, the continent's most populous nation. At that time, the group's total assets were valued at US$20.0 billion, with shareholders' equity of US$2.176 billion.[5] ETI's branch network numbered 1,305, with 1,981 networked ATMs. The bank had 19,565 employees, in 39 countries, in Africa, Asia and Europe, at the end of March 2014.

Group network

As of June 2014, Ecobank Transnational had banking operations in 36 African countries, with representative offices in Angola, Beijing, Dubai, Ethiopia, South Africa and the United Kingdom:[6]

Ecobank Transnational has operational bank subsidiaries in the following countries, as of July 2013:

- Africa

- Ecoboank Angola - (Representative office in Luanda)

- Ecobank Benin

- Ecobank Burkina Faso

- Ecobank Burundi

- Ecobank Cameroon

- Ecobank Cape Verde

- Ecobank Central African Republic

- Ecobank Chad

- Ecobank Congo Brazzaville

- Ecobank Côte d'Ivoire

- Ecobank Democratic Republic of the Congo

- Ecobank Ethiopia - (Representative office in Addis Ababa)

- Ecobank Equatorial Guinea

- Ecobank Gabon

- Ecobank Gambia

- Ecobank Ghana

- Ecobank Guinea

- Ecobank Guinea-Bissau

- Ecobank Kenya

- Ecobank Liberia

- Ecobank Malawi

- Ecobank Mali

- Ecobank Mozambique

- Ecobank Niger

- Ecobank Nigeria (includes Oceanic Bank)[7]

- Ecobank Rwanda

- Ecobank São Tomé and Príncipe

- Ecobank Senegal

- Ecobank Sierra Leone

- Ecobank South Africa (Representative office in Johannesburg)

- Ecobank South Sudan[8]

- Ecobank Tanzania [9]

- Ecobank Togo

- Ecobank Uganda

- Ecobank Zambia[10]

- Ecobank Zimbabwe

- Outside Africa

- Paris, France - Affiliate office

- London, United Kingdom - France affiliate representative office

- Dubai, United Arab Emirates - Representative office

- Beijing, China - Representative office

History

ETI, a public limited liability company, was established as a bank holding company in 1985 under a private sector initiative spearheaded by the Federation of West African Chambers of Commerce and Industry, with the support of the Economic Community of West African States (ECOWAS). In the early 1980s the banking industry in West Africa was dominated by foreign and state-owned banks. There were hardly any commercial banks in West Africa owned and managed by the African private sector. ETI was founded with the objective of filling this vacuum.

The Federation of West African Chambers of Commerce promoted and initiated a project for the creation of a private regional banking institution in West Africa. In 1984, Ecopromotions S.A. was incorporated. Its founding shareholders raised the seed capital for the feasibility studies and the promotional activities leading to the creation of ETI.

In October 1985, ETI was incorporated with an authorised capital of US$100 million. The initial paid up capital of US$32 million was raised from over 1,500 individuals and institutions from West African countries. The largest shareholder was the ECOWAS Fund for Cooperation, Compensation and Development (ECOWAS Fund), the development finance arm of ECOWAS. A Headquarters’ Agreement was signed with the government of Togo in 1985 which granted ETI the status of an international organisation with the rights and privileges necessary for it to operate as a regional institution, including the status of a non-resident financial institution.

ETI has two specialised subsidiaries: Ecobank Development Corporation (EDC) and eProcess International (eProcess). EDC was incorporated with a broad mandate to develop Ecobank’s investment banking and advisory businesses throughout the countries where Ecobank operates. EDC operates brokerage houses on all 3 stock exchanges in West Africa and has obtained licences to operate on the two stock exchanges in Central Africa: the Douala Stock Exchange in Cameroon and the Libreville Exchange in Gabon. The mandate of eProcess is to manage the Group’s information technology function with a view to ultimately centralising the Group’s middle and back office operations to improve efficiency, service standards and reduce costs.[11]|

Subsidiaries

The Specialized subsidiary companies of Ecobank include the following: [12]

- EBI SA Groupe Ecobank - Paris, France

- EBI SA Representative Office - London, United Kingdom

- Ecobank Development Corporation (EDC) - Lomé, Togo

- EDC Investment Corporation - Abidjan, Côte d’Ivoire

- EDC Investment Corporation - Douala, Cameroon

- EDC Securities Limited - Lagos, Nigeria

- EDC Stockbrokers Limited - Accra, Ghana

- Ecobank Asset Management - Abidjan, Côte d’Ivoire

- e-Process International SA - Accra, Ghana

- Ecobank Asset Management Company P/L - Harare, Zimbabwe

The Ecobank Nedbank alliance

With more than 1,500 branches in 35 countries, the Ecobank-Nedbank Alliance is the largest banking network in Africa. The alliance was formed in 2008 between the Ecobank Group and the Nedbank Group, one of South Africa's four largest financial services providers, with a growing footprint of operations across the Southern African Development Community.[13]

Ownership

The shares of Ecobank Transnational Inc., the parent company of Ecobank, are traded on three West African stock exchanges, namely: the Ghana Stock Exchange (GSE), the Nigeria Stock Exchange (NSE) and the BRVM stock exchange in Abidjan, Ivory Coast.[14] As of December 2014, the ten largest shareholders in Ecobank Transnational were as follows:[15]

| Rank | Name of Owner | Percentage Ownership |

|---|---|---|

| 1 | Nedbank Group Limited | 20.7 |

| 2 | Qatar National Bank | 17.4 |

| 3 | Government Employees Pension Fund | 13.8 |

| 4 | IFC Capitalization (Equity) Fund, L.P | 5.4 |

| 5 | International Finance Corporation | 5.2 |

| 6 | Social Security and National Insurance Trust | 4.0 |

| 7 | IFC ALAC Holding Company II | 2.3 |

| 8 | JP Morgan Bank Luxemburg | 2.0 |

| 9 | Africa Capitalization Fund Ltd | 1.5 |

| 10 | B.I.D.C | 1.0 |

| 11 | Other Investors | 26.6 |

| Total | 100.0 | |

See also

References

- ↑ "Ecobank Transnational Inc. - Company Snapshot". alacrastore.com.

- ↑

- ↑ http://www.bloomberg.com/news/articles/2015-06-08/citigroup-s-ayeyemi-quits-to-join-ecobank-as-ceo-essien-retires

- ↑ "Ecobank Group – Annual Report 2014" (PDF). Ecobank Group. 31 December 2014. Retrieved 3 September 2015.

- ↑ December 2012 Financial Highlights

- ↑ "allAfrica.com: Nigeria: Ecobank Increases Sub-Saharan Africa Offices to 35". allAfrica.com.

- ↑ "News and Events". ecobank.com.

- ↑ "allAfrica.com: Zimbabwe: Ecobank Opens in South Sudan". allAfrica.com.

- ↑ Ecobank Opening in Tanzania in January 2010

- ↑ Antersite. "African Financial Markets: Provider of African Business and Economy information and research". africanfinancialmarkets.com.

- ↑ "About Us". ecobank.com.

- ↑ Ecobank Specialized Subsidiaries

- ↑ About The Ecobank-Nedbank Alliance

- ↑ "Ecobank". ecobank.com.

- ↑ "Ecobank Group – Annual Report 2014" (PDF). http://www.ecobank.com/. Ecobank Group. 31 December 2014. Retrieved 3 September 2015. External link in

|website=(help)

External links

| Wikimedia Commons has media related to Ecobank. |

- Official website

- (French) Ecobank official site

- Ecobank Transnational Incorporated at Nigerian Stock Exchange

- Ecobank Nigeria at Nigerian Stock Exchange

- (English) Modern Ghana, article 'Ecobank Takes over BICA in CAR'

- "Ecobank Bank Plc 2007 annual report". African Financials.

- Company Profile At Bloomberg.com

- Nigeria: Qatari Bank Acquires N36 Billion Amcon's Stake in Ecobank