Institute of Chartered Accountants of India

| भारतीय सनदी लेखाकार संस्थान | |

Emblem of ICAI as given by Sri Aurobindo | |

| Abbreviation | ICAI |

|---|---|

| Motto | Ya Aesh Suptaeshu Jagriti |

| Formation | 1 July 1949 |

| Objective | Regulate the auditing and financial accounting profession in India |

| Headquarters | ICAI Bhawan, Post Box No. 7100, Indraprastha Marg, New Delhi 110002, India |

| Coordinates | 28°37′40″N 77°14′32″E / 28.627815°N 77.242135°E |

| Region served | India |

| Membership | (approx.) 2,70,000 (1st November,2016)[1] |

| Students | Approx. +11,75,000[2] |

| Member's designations | A.C.A. and F.C.A. (A.T.C. also available with IPCC level) |

| Official languages | English, Hindi |

| President | CA. M. Devaraja Reddy |

| Vice President | CA. Nilesh Vikamsey |

| Secretary | Shri V. Sagar[3] |

| Governing body | Council |

| IFAC member since | 7 October 1977 |

| Regional Offices |

New Delhi (NIRC) Mumbai (WIRC) Kolkata (EIRC) Chennai (SIRC) Kanpur (CIRC) |

| Branches | 146 Indian Branches and 26 Overseas Chapters |

| Website |

www |

The Institute of Chartered Accountants of India (ICAI) is the national professional accounting body of India. It was established on 1 July 1949 as a body corporate under the Chartered Accountants Act, 1949 enacted by the Parliament (acting as the provisional Parliament of India) to regulate the profession of Chartered Accountancy in India. ICAI is the second largest professional Accounting & Finance body in the world in terms of membership, after American Institute of Certified Public Accountants. ICAI is the only licensing cum regulating body of the financial audit and accountancy profession in India. It recommends the accounting standards to be followed by companies in India to The National Financial Reporting Authority (NFRA) and sets the accounting standards to be followed by other types of organisations. ICAI is solely responsible for setting the auditing and assurance standards to be followed in the audit of financial statements in India. It also issues other technical standards like Standards on Internal Audit (SIA), Corporate Affairs Standards (CAS) etc. to be followed by practicing Chartered Accountants. It works closely with the Government of India, Reserve Bank of India and the Securities and Exchange Board of India in formulating and enforcing such standards.

Members of the Institute are known as Chartered Accountants. However, the word chartered does not refer to or flow from any Royal Charter. Chartered Accountants are subject to a published Code of Ethics and professional standards, violation of which is subject to disciplinary action. Only a member of ICAI can be appointed as statutory auditor of an Indian company under the Companies Act, 2013. The management of the Institute is vested with its Council with the president acting as its Chief Executive Authority. A person can become a member of ICAI by taking prescribed examinations and undergoing three years of practical training. The membership course is well known for its rigorous standards. ICAI has entered into mutual recognition agreements with other professional accounting bodies world-wide for reciprocal membership recognition. ICAI is one of the founder members of the International Federation of Accountants (IFAC), South Asian Federation of Accountants (SAFA), and Confederation of Asian and Pacific Accountants (CAPA). ICAI was formerly the provisional jurisdiction for XBRL International in India.

The Institute of Chartered Accountants of India was established under the Chartered Accountants Act, 1949 passed by the Parliament of India with the objective of regulating accountancy profession in India.[4] ICAI is the second largest professional accounting body in the world in terms of membership second only to AICPA.[5] It prescribes the qualifications for a Chartered Accountant, conducts the requisite examinations and grants license in the form of Certificate of Practice. Apart from this primary function, it also helps various government agencies like RBI, SEBI, MCA, CAG, IRDA, etc. in policy formulation. ICAI actively engages itself in aiding and advising economic policy formulation. For example, ICAI has submitted its suggestions on the proposed Direct Taxes Code Bill, 2010. It also has submitted its suggestions on the Companies Bill, 2009. The government also takes the suggestions of ICAI as expert advice and considers it favorably. ICAI presented an approach paper on issues in implementing Goods and Service Tax in India to the Ministry of Finance. In response to this, Ministry of Finance has suggested that ICAI take a lead and help the government in implementing Goods and Services Tax (GST).[6] It is because of this active participation in formulation economic legislation, it has been designated by A. P. J. Abdul Kalam Azad as a "Partner in Nation Building".

International Affiliations

ICAI is a founder member of the International Federation of Accountants(IFAC),[7] South Asian Federation of Accountants (SAFA),[8] and Confederation of Asian and Pacific Accountants (CAPA).[9] ICAI was formerly the provisional jurisdiction for XBRL International in India. It promoted eXtensible Business Reporting Language (XBRL) India as a section 25 company(now section 8 of Companies Act, 2013) to take over this responsibility from it.[10]

Motto and mission

The motto of the ICAI is Ya Aeshu Suptaeshu Jagruti [Sanskrit].[11] The motto literally means "a person who is awake in those that sleep". It is a quotation from the Upanishads (Kathopanishad). It was given to the ICAI at the time of its formation in 1949 by Sri Aurobindo[12] as a part of its emblem. CA. C. S. Shastri, a Chartered Accountant from Chennai went to Sri Aurobindo and requested him through a letter to give an emblem to the newly formed Institute of which he was an elected member from the Southern India. In reply to this request, Sri Aurobindo gave him the emblem with a Garuda, the mythical eagle in the centre and a quotation from the Upanishad:Ya Aeshu Suptaeshu Jagruti. The emblem along with the motto was placed at the first meeting of the Council of the Institute and was accepted amongst many other emblems placed by other members of the Council.

Apart from its emblem, ICAI also has a separate logo for its members. As a part of a brand building exercise, ICAI introduced this separate new CA logo for the use of its members in 2007.[13] The logo is free for use by all members of ICAI subject to certain conditions.[14] The logo was launched by the then Minister of Corporate Affairs, Prem Chand Gupta at the occasion of the Chartered Accountant Day (1 July) in the presence of the then President of ICAI Sunil Talati. Members of ICAI cannot use the ICAI emblem, but they are encouraged to use the CA logo instead on their official stationery.

The Mission of the ICAI as stated by it is: “The Indian Chartered Accountancy profession will be the Valued Trustees of World Class Financial Competencies, Good Governance and Competitiveness.”[15]

History

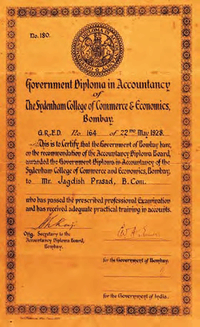

The Companies Act, 1913 passed in pre-independent India prescribed various books which had to be maintained by a Company registered under that Act. It also required the appointment of a formal Auditor with prescribed qualifications to audit such records. In order to act as an auditor a person had to acquire a restricted certificate from the local government upon such conditions as may be prescribed. The holder of a restricted certificate was allowed to practice only within the province of issue and in the language specified in the restricted certificate. In 1918 a course called Government Diploma in Accountancy was launched in Bombay (now known as Mumbai). On passing this diploma and completion of three years of articled training under an approved accountant, a person was held eligible for grant of an unrestricted certificate. This certificate entitled the holder to practice as an auditor throughout India. Later on the issue of restricted certificates was discontinued in the year 1920.

In the year 1930 it was decided that the Government of India should maintain a register called the Register of Accountants. Any person whose name was entered in such register was called a Registered Accountant.[16] Later on a board called the Indian Accountancy Board was established to advise the Governor General of India on accountancy and the qualifications for auditors. However it was felt that the accountancy profession was largely unregulated, and this caused lots of confusion as regards the qualifications of auditors. Hence in the year 1948, just after independence in 1947, an expert committee was created to look into the matter.[17] This expert committee recommended that a separate autonomous association of accountants should be formed to regulate the profession. The Government of India accepted the recommendation and passed the Chartered Accountants Act in 1949 even before India became a republic. Under section 3 of the said Act, ICAI is established as a body corporate with perpetual succession and a common seal.

Unlike most other commonwealth countries, the word chartered does not refer to a royal charter, since India is a republic. At the time of passing the Chartered Accountants Act, various titles used for similar professionals in other countries were considered, such as Certified Public Accountant.[18] However, many accountants had already acquired membership of the Institute of Chartered Accountants in England and Wales and other Chartered Societies of Great Britain and were practising as Chartered Accountants. This had created some sort of brand value. This designation inherited a public impression that Chartered Accountants had better qualifications than Registered Accountants.[19] Hence the accountants were very stern in their stand that, the Indian accountancy professionals should be designated only as Chartered Accountants. After much debate in the Indian Constituent Assembly, the controversial term, chartered was accepted. When the Chartered Accountants Act, 1949 came into force on 1 July 1949, the term Chartered Accountant superseded the title of Registered Accountant. This day is celebrated as Chartered Accountants day every year.[20]

Membership

Members of the Institute are known as Chartered Accountants. Becoming a member requires passing the prescribed examinations, three years of practical training (known as articleship) and meeting other requirements under the Act and Regulations. A member of ICAI can use the title CA before his/her name.[21] A member of ICAI may either be an Associate Chartered Accountant (A.C.A.) or a Fellow Chartered Accountant (F.C.A.) based on his experience. Further based on holding Certificate of Practice, they may also be classified as practising and non-practicing Chartered Accountants. As of 1 April 2014, the Institute has 2,50,000 members out of which 152,899 are Associates and 76,247 are Fellows.[22]

Associates and fellows

Any person who is granted membership of the Institute becomes an Associate Chartered Accountant and is entitled to use the letters A.C.A. after his name. Generally, associates are members of the Institute with less than 5 years of membership after which they become entitled to apply for being a fellow member. Some associate members, particularly those not in practice, often voluntarily chose not to apply to be a fellow due to a variety of reasons.

An associate member who has been in continuous practice in India or has worked for a commercial or government organisation for at least five years and meets other conditions as prescribed can apply to the Institute to get designated as a "Fellow". A fellow Chartered Accountant is entitled to use the letters FCA. after his name. Responsibilities and voting rights of both types of members remain the same but only fellows can be elected to the Council and Regional Councils of ICAI. Fellows are perceived as enjoying a higher status due to their longer professional experience.

Practicing Chartered Accountants

Any member wanting to engage in public practice has to first apply for and obtain a Certificate of Practice from the Council of ICAI.[23] Only members holding a Certificate of Practice may act as auditors or certify documents required by various tax and financial regulatory authorities in India. Once a member obtains a Certificate of Practice, his responsibility to the society increases manifold. The ethical principles applicable to a practising CA provided in first and second schedule of the Chartered Accountants Act, 1949 are more rigorous than the ones applicable to non-practicing CAs or both.

In India an individual Chartered Accountant or a firm of Chartered Accountants can practice the profession of Chartered Accountancy. After the enactment of the Limited Liability Partnership Act, 2008 it is expected that in the near future a Limited Liability Partnership (LLP) will be legally allowed to practice. A Bill has already been introduced in the Indian Parliament to give effect to the same.[24] Corporation, companies and other bodies corporate are prohibited from practising as Chartered Accountants in India.

Role of Chartered Accountants

Chartered Accountants enjoy a statutory monopoly in audit of financial statements under the Companies Act, 2013, Income Tax Act, 1961 and various other statutes in India.[25] Financial statements audited by a chartered accountant are presumed to have been prepared according to GAAP in India (otherwise the audit report should be qualified). However, not all Chartered Accountants work in audit. Firms of accountants provide varied business services, and many accountants are employed in commerce and industry. Their areas of expertise include Financial Reporting, Auditing and Assurance, Corporate Finance, Investment Banking, Financial Modelling, Equity Research. Fund Management, Credit Analysis, Capital Markets, Arbitration, Risk Management, Economics, Strategic/Management Consultancy, Management Accounting, Information Systems Audit, Corporate Law, Direct Tax, Indirect Tax and valuation of businesses. The Government of India is now planning to open up a new field of practice in social audit of government welfare schemes like MGNREGA and JnNURM. Apart from the field of professional practice, many CAs work in the industry and commerce in financial and general management positions such as CFO and CEO.

Council of the Institute

The management of the affairs of the Institute is undertaken by a Council constituted under the Chartered Accountants Act, 1949.[4] The Council consists of 32 elected fellow members and up to 8 members nominated by the Government of India. The elected members of the council are elected under the single transferable vote system by the members of the institute. The Council is re-elected every 3 years. The Council elects two of its members to be president and vice-president who hold office for one year. The president is the chief executive Authority of the Council.[26]

Presidents

ICAI's first president was CA G.P. Kapadia (1949 to 1952) CA M. Devaraj Reddy is the current president of ICAI and CA Nilesh Shivji Vikamsey is current vice president.[27][28]

Regional Councils

The Institute also has five Regional Councils & Five overseas Chapters that assist it in its functions:

- The Northern India Regional Council (NIRC)

- The Western India Regional Council (WIRC)

- The Central India Regional Council (CIRC)

- The Eastern India Regional Council (EIRC)

- The Southern India Regional Council (SIRC)

- Overseas Chapters : Africa-Middle East, Asia, Australasia-Oceania, Europe, North America

The Council maintains a register of all members of the Institute.

Code of Ethics

The Institute has a detailed code of ethics and actions in contravention of such code results in disciplinary action against the erring members. The Institute publishes a Members Hand book containing the Chartered Accountants Act 1949, Chartered Accountants Regulation 1988, Professional Opportunities for Members – an Appraisal, Code of Ethics and Manual for members. These together form the basis of regulation of the profession. The Council also has a Peer Review Board that ensures that in carrying out their professional attestation services assignments, the members of the Institute (a) comply with the Technical Standards laid down by the Institute and (b) have in place proper systems (including documentation systems) for maintaining the quality of the attestation services work they perform.[29]

Disciplinary process

The Disciplinary Directorate, the Board of Discipline, and the Disciplinary Committee form the foundation of the disciplinary process of the Institute. These entities are quasi-judicial and have substantial powers like that of a Civil Court to summon and enforce attendance or require discovery or production of documents on affidavit or otherwise.[30] The Disciplinary Directorate is headed by an officer designated as Director (Discipline). On receipt of any information or complaint that a member has allegedly engaged in any misconduct, the Director (Discipline) shall arrive at a prima facie opinion whether or not there is any misconduct. If the Director (Discipline) is of the opinion that the misconduct is covered by the items listed in the first schedule of the Chartered Accountants Act, 1949, he shall refer the case to the Board of Discipline. If he is of the Opinion that the case is covered by the Second Schedule or both schedules of the CA Act, he will refer the case to the Disciplinary Committee. If the Board of Discipline finds a member guilty of professional or other misconduct, it may at its discretion reprimand the member, remove the name of the member from the register of members for up to three months or impose a fine up to ₹1,00,000/-. If the Disciplinary Committee finds a member guilty of professional or other misconduct, it may at its discretion reprimand the member, remove the name of the member from the register of members permanently or impose a fine up to ₹5,000/-. Any member aggrieved by any order may approach the Appellate Authority.

It should be born in mind that this disciplinary proceeding is not in lieu of or alternative for criminal proceedings in a court. Criminal proceedings against a Chartered Accountant and disciplinary action by ICAI are two separate issues and one need not wait for another to be completed first.[31]

Recent actions

One of the most recent (2009–10) public actions of The ICAI Disciplinary Committee was proceedings for professional misconduct against two auditors from the firm Price Waterhouse partners for wrongly auditing and inflating the financial statements of Satyam Computer Services Limited. The Supreme Court of India (November 2010) rejected a plea by the two charged auditors to stay the proceedings by the ICAI Disciplinary committee. The court's order came in response to the pleas of the charged auditors seeking a stay on the disciplinary proceedings against them on the ground that it violated their fundamental right against self-incrimination under Article 20 (3) of the Constitution of India.

Other publicized actions included, the SEBI referred case of brokerage firm, Karvy, in which the internal auditors, Haribhakti & Co (an associate of BDO). were held guilty of negligence for failing to detect thousands of demat accounts being opened with the same address. The Committee has also taken action against members for alleged irregularities in the books of Maytas Properties and Maytas Infra and the role played by their auditors.[32] The names of the members found guilty of misconduct are published in ICAI's website. The ICAI website lists 35 as the number of cases in which inquiry was completed by the Disciplinary Committee in the past one year since February 2010. The list of members held guilty of professional or other misconduct is published periodically.[33]

Request for more power

Many of the recent financial frauds and scams relate to organisations that had multinational accounting firms as their auditors. These multinational firms cannot legally practice in India but they are practising in India by surrogate means, operating through tie-ups with local firms, though the partners involved are from India, since only a member of the Institute can be an auditor of an Indian entity. The example for this is an elaborate list, Price Waterhouse in case of Global Trust Bank Scam, again Price Waterhouse in Satyam Computer Services Limited scam, Ernst and Young in the Maytas case. ICAI lacks jurisdictional powers to punish these or for that matter any firm, as under its current regulations it only has the power to proceed against individual members. The Institute has asked the Ministry of Corporate Affairs, Government of India to grant additional powers so that it may proceed against firms whose partners or employees are frequent offenders.[34] ICAI also has sent a proposal to the Government of India to amend the Chartered Accountants Act, 1949 in order to enable to it to impose a fine of ₹1,00,00,000/- on audit firms if they are found guilty of colluding with companies to commit a fraud.[35]

Qualification

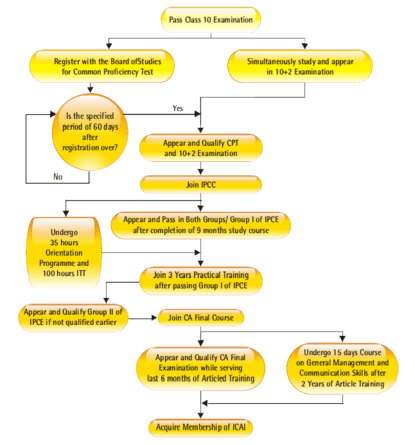

A person is eligible to apply for membership either by passing all three levels of examinations prescribed by ICAI and completing three years of practical training or by availing themselves of exemptions under mutual recognition agreement&& (MRAs).[36]

Examination

The CA course is designed to combine theoretical study with practical training. The Chartered Accountancy course is considered to be one of the toughest professional courses both in India and Worldwide [37] with only 3–8% of the students passing in every attempt in Inter and Final Level, though earlier it was mostly in 1-2% range. At Present, pass rate in Foundation is Approx 15%, Inter 5-8 %, Final 3-8 %, that means students who take admission in CA Course, only 0.0225% to 0.096% actually pass CA. For instance,in the November 2013 CA Final exam, the pass percentage was merely 3.11% (Both Groups)[38] As of April 2014,the Institute has 11,75,000 students, studying various levels of the Chartered Accountancy Course.[39] The Chartered Accountancy examinations are divided into three levels.

[40] CPT covers four basic subjects viz. Fundamentals of Accounting, Mercantile Laws, Economics and Quantitative Aptitude. Fundamentals of Accounting carries 60 marks, Mercantile Laws carries 40 marks and Economics & Quantitative Aptitude carries 50 marks each. A person can register for CPT after completing Grade 10 and take the exam after completing High School (Grade 12). Every incorrect answer on the CPT exam carries a 0.25 negative mark. A candidate is considered to have cleared CPT if he/she obtains in a sitting 30% in each of the 4 sections and a 50% aggregate in the entire examination.[41] This amendment was enforced by ICAI on 16 August 2012.The amendment was made public vide ICAI's website notification. CPT exams are held in June and December in paper pencil mode. Mock test/Model test papers are available on the institute website.

IPCC or Integrated Professional Competence Course is the second level of Chartered Accountancy examinations. A person can take the IPCC Examination after passing CPT and nine months of study. IPCC has two groups of seven subjects. Group – I consists of four subjects and Group – II of three subjects.

Group I:

- Paper 1 : Accounting

- Paper 2 : Business Laws, Ethics and Communication

- Paper 3 : Cost Accounting and Financial Management

- Paper 4 : Taxation

Group II:

- Paper 5 : Advanced Accounting

- Paper 6 : Auditing and Assurance

- Paper 7 : Information Technology and Strategic Management

A passing grade in IPCC is awarded if the candidate obtains 40% marks in each subject (each subject is attributed 100 marks) and an aggregate of 50% in the aggregate in each group(or 50% of total marks in case of both groups). Benefit of set-off is also available if the candidate appears for both groups together and obtains 50% collectively in both groups, even if he fails to obtain an individual aggregate of 50% in the each group independently.

CA Final Examination is the last and final level of Chartered Accountancy Examinations. It is considered as one of the toughest exams in the world.[37] Any person who has passed both the groups of IPCC, during the last six months of articleship can take the Final Examination. This exam consists of two groups of four subjects each.

Group I:

- Paper 1 : Financial Reporting,

- Paper 2 : Strategic Financial Management,

- Paper 3 : Advanced Auditing and Professional Ethics,

- Paper 4 : Corporate and Allied Laws,

Group II:

- Paper 5 : Advanced Management Accounting,

- Paper 6 : Information Systems Control and Audit,

- Paper 7 : Direct Tax Laws

- Paper 8 : Indirect Tax Laws.

The passing grade for this exam is the same as the second level, i.e. IPCC, as mentioned above.

ICAI conducts CPT exams in June and December, IPCC and Final examinations in May and November each year. Examinations are conducted in major cities in India and other countries such as Abu Dhabi (U.A.E.), Dubai (U.A.E.) and Kathmandu (Nepal). ICAI updates the content and format of examinations periodically keeping in view the technical progress and changes in practice of the profession. The ICAI last revised its training course for membership in 2008.[42]

Several institutions conduct online and offline coaching classes for the CA examinations.

Changes in the CA CPT Exam to be applicable from 2017

The entrance exam CPT will be termed as CA Foundation course. CPT was a MCQ based exam but CA Foundation exam will be partially subjective. CA Foundation Exam will be of 400 marks. As the CA Foundation exam will be partially subjective more time gap is given to students for preparation. So the students shall register for CA Foundation exam 9 months prior to the exam which was 6 months for CPT. Two new subjects have been added and the marking scheme and exam pattern has also been changed.[43]

Articled and industrial training

After passing Group – I of IPCC, a candidate must undergo a rigorous 3-year on-the-job training as article or audit assistant, articleship. Only members in practice are entitled to engage such assistants. The Institute strictly governs through Regulations,[36] the stipends, working hours and working conditions of such assistants. Articles provide CA firms a steady supply of motivated assistants while providing the students with invaluable on-the-job training. Audits are normally conducted by partnering senior and junior assistants with a supervising partner of the firm. This provides steady increase in the depth and variety of experience to the Articled Assistants. During the last year of articleship, a student may opt for industrial training instead. Industrial training can be for a period of 9 to 12 months and has to be completed under the supervision of an existing CA member employee of a financial, commercial or industrial organization. Over the years several cases of abuse of the system such as articles being made to work long hours, work without pay/delayed payments, or being made to perform personal tasks for their Principals, some faking their training (also called dummy articles, i.e. not going to the office but spending time studying at home or in coaching classes) led the institute to start enforcement of rules and regulations in the interest of the profession.[44] Chartered Accountants may not provide coaching classes during working hours, as students are expected to apply themselves wholly to practical training in that time.[45] An article may complain to the Disciplinary Committee against a member or firm for non-compliance with regulations.

Advanced ITT

Earlier students were required to undergo ITT training before commencing their articleship, but on 14-10-2014, ICAI announced that students who have registered for Practical Training on or after August 1, 2012 were required to complete 100 hours of Advanced IT Training before admission to the Final Examination. But due to lack of infrastructure,the Council of the Institute decided to defer the implementation date of Regulation 29(c)(iv) from August 1, 2012 to February 1, 2013[46]

CPT Exemption for Graduates

With effect from 1 August 2012 onward, CPT is exempted for the following class of Individuals[47]

- Commerce Graduates with more than 55% marks from a recognized university

- Non-Commerce Graduates with more than 60% Marks

- Any Candidate who has passed the Intermediate Exam conducted by the Institute of Cost Accountants of India or by the Institute of Company Secretaries of India

Those Candidates who are exempted from clearing CPT Exam[48] can also directly register for articleship without clearing IPCC Group 1 as is the case with those candidates who have registered for the CA Course through the CPT Route.

Other qualifications and certifications

With the introduction of IPCC scheme of exams, ICAI also introduced the Accounting Technician Course.[42] Any person who passes Group-I of IPCC and completes one year of practical training under a member can apply for an Accounting Technician Certification. After obtaining the certificate the person can designate himself as an Accounting Technician. This Certification was introduced to help a large number of students who were unable to complete the CA Final Examinations and obtain membership.

ICAI has entered into agreements with various universities such as the Indira Gandhi National Open University, Bharathiar University and Netaji Subhas Open University to help CA students acquire a Bachelor of Commerce (B.Com) degree, writing a few papers to supplement the IPCC.

Mutual recognition agreements[49]

The second method of obtaining membership is through mutual recognition agreements or MRAs. ICAI has entered into MRAs with several institutes globally, of equivalent standing, to enable members of those institutes to acquire membership of ICAI and to enable the members of ICAI to gain membership of its counterpart in other country.This is done by granting some exemptions in the regular scheme of examination and training.

ICAI currently has MRAs with following professional accounting bodies:

- Institute of Chartered Accountants in England and Wales (since 20 November 2008)[50]

- Institute of Chartered Accountants in Australia (since 2009)

- The New Zealand Institute of Chartered Accountants[51]

- CPA Australia(originally signed in February 2009 and re-signed in September 2014)[52][53]

- Institute of Chartered Accountants of Nepal[54]

- Institute of Certified Public Accountants in Ireland (since October 2010)[55][56]

- Canadian Institute of Chartered Accountants (since 2011)[57]

ICAI is also in process of negotiating MRAs with Hong Kong Institute of Certified Public Accountants and Certified General Accountants Association of Canada.

Memorandum of Understanding[58]

The Institute of Chartered Accountants of India (ICAI) has signed Memorandum of Understanding (MOU) with professional accounting bodies of various countries. These MOUs aim at establishing mutual co-operation between the two institutions for the advancement of accounting knowledge, professional and intellectual development, advancing the interests of their respective members and positively contributing to the development of the accounting profession.

Currently ICAI has MOUs with following professional accounting bodies:

- Accounting and Auditing Standards Board of Bhutan, Bhutan (signed on 22 November 2013)[49]

- The Vietnam Association of Certified Public Accountants, Vietnam[59]

- Saudi Organization for Certified Public Accountants (SOCPA), Saudia Arabia (since 2014 for a period of 3 years)[60]

- Higher Colleges of Technology, UAE (signed on 4 January 2011)[61]

- College of Banking and Financial Studies, Oman[62]

Courses for members

ICAI provides various professional certifications for its members. Some of them are as follows:

| Accounting |

|---|

|

|

Major types |

|

Selected accounts |

|

People and organizations

|

|

Development |

|

|

Certificate Courses on Enterprise risk management, Corporate governance, International taxation, Forensic accounting & Fraud detection using IT[63] & CAATs, International Financial Reporting Standards, Forex and Treasury Management, Derivatives, Valuation and Arbitration.

Post Qualification Courses such as Diploma Information Systems Audit (ISA), CPE Course on Computer Accounting and Auditing Techniques (CAAT), Trade Laws & World Trade Organisation (ITL & WTO), ERP Courses on SAP FA & MA Module, Microsoft Dynamics NAV.

Placement

The Institute maintains a placement portal on its web site for qualified members and partially qualified students.[64] This is supplemented with campus placement events and advertising through its professional journals and website.

In early 2010, the ICAI placed three of its freshly qualified Associates, at a record annual salary of US$160,000 each, at Singapore-based agriculture supply chain major Olam International.[65]

Technical standards

ICAI formulates and issues technical standards to be followed by Chartered Accountants and others. Non-compliance of these standards by the members will lead to disciplinary action against them. The technical standards issued by ICAI includes, Accounting Standards, Audit and Assurance Standards, Standards on Internal Audit, Corporate Affairs Standard, Accounting Standards for Local Bodies, etc..

Accounting Standards

As of 2010, the Institute of Chartered Accountants of India has issued 32 Accounting Standards. These are numbered AS-1 to AS-7 and AS-9 to AS-32 (AS-8 is no longer in force since it was merged with AS-26).[66] Compliance with accounting standards issued by ICAI has become a statutory requirement with the notification of Companies (Accounting Standards) Rules, 2006 by the Government of India.[67] Before the constitution of the National Advisory Committee on Accounting Standards (NACAS), the institute was the sole accounting standard setter in India. However NACAS is not an independent body. It can only consider accounting standards recommended by ICAI and advise the Government of India to notify them under the Companies Act, 2013. Further the Accounting Standards so notified are applicable only to companies registered under the companies act, 2013. For all other entities the accounting standards issued the ICAI continue to apply.

Convergence with IFRS

The inception of the idea of convergence of Indian GAAP with IFRS was made by the Prime Minister of India Dr. Manmohan Singh by committing in G20 to align Indian accounting standards with IFRS. Thereafter ICAI has decided to converge its accounting standards with IFRS for accounting periods commencing on or after 1 April 2011 in a phased manner as envisaged in the Roadmap to IFRS formulated by the Ministry of Corporate Affairs. For smooth transition to IFRS, ICAI has taken up the matter of convergence with the National Advisory Committee on Accounting Standards and various regulators such as the RBI, SEBI and IRDA, CBDT. IASB, the issuer of IFRS, is also supporting the ICAI in its endeavours towards convergence.

It has been decided that there shall be two sets of Accounting Standards under the Companies Act. The new set of standards which have been converged with IFRS are now known as Indian Accounting Standards or Ind AS. The Ministry of Corporate Affairs has notified the 35 Ind AS on 25 February 2011.[68] The text of the 35 Ind AS are now available at the Ministry of Corporate Affairs portal.[69] At the same time The Ministry of Corporate Affairs haven't specified the date of implementation of the same. This reluctance of The Ministry of Corporate Affairs to notify the date even when the proposed date is less than a month away is seen as rooted in the strong lobbying by the Corporates in India to defer the implementation. But the president of ICAI. CA.G.Ramaswamy(present) expects that it will be notified soon and there won't be any further deferment.[70]

Audit and Assurance Standards

As of 2010 ICAI has issued 43 Engagement and Quality Control Standards (formerly known as Auditing and Assurance Standards) covering various topics relating to auditing and other engagements.[71] All Chartered Accountants in India are required to adhere to all these standards. If a Chartered Accountant is found not to follow the said standards he is deemed guilty of professional misconduct. These standards are fully compatible with the International Standards on Auditing (ISA) issued by the IAASB of the IFAC except for two standards SA 600 and SA 299, where corresponding provisions do not exist in ISA.[72]

Notable members

Corporate

- Radhe Shyam Agarwal, co-founder and Executive Chairman of Emami

- Srikanth Balachandran, Global CHRO of Bharti Airtel

- Pramod Bhasin, President, CEO, Genpact

- Kumar Mangalam Birla, Chairman of Aditya Birla Group, billionaire, among top 10 richest Indians[73]

- Niranjan Hiranandani, Real estate tycoon, Founder, Hiranandini Group, billionaire, among Top 100 richest Indians

- Krish Iyer, CEO of Walmart India

- Nirmal Jain, founder and Chairman of India Infoline Ltd

- Rakesh Jhunjhunwala, noted Investor ("the Warren Buffett of India"), billionaire, among Top 100 richest Indians

- Shekar Kapur, Film director

- Naina Lal Kidwai, first Indian woman who pursued MBA from Harvard University, Group General Manager and Country Head of HSBC India

- T K Kurien, CEO of Wipro

- H. V. Lodha, Chairman of Birla Corporation, suspended by ICAI in 2014 for malpractice[74]

- R. S. Lodha, former Chairman, Birla Corporation

- T. N. Manoharan, Padma Shri awardee

- Keki Mistry, Vice Chairman & CEO HDFC Bank

- Keshav R Murugesh, Group CEO of WNS Global Services

- George Alexander Muthoot, CEO of Muthoot Group

- Motilal Oswal, Chairman and MD of Motilal Oswal Group

- T.V. Mohandas Pai, Chairman of Manipal Global Education, former CFO of Infosys, Padma Shri awardee

- Girish Paranjpe, Venture Capitalist

- Deepak Parekh, Chairman of Housing Development Finance Corporation & HDFC Bank

- Suresh Prabhakar Prabhu, Incumbent Minister of Railways, Government of India

- Piyush Goyal, Incumbent Minister of Power, Coal, New and Renewable Energy, Government of India

- Aditya Puri, MD of HDFC Bank

- Aroon Purie, founder and editor-in-chief of India Today and Chief Executive of the India Today Group

- Chitra Ramkrishna, CEO of National Stock Exchange (NSE)

- Prannoy Roy, Chairman of NDTV[75]

- Raman Roy, "Father of BPO in India"

- Subhash Runwal, Founder and Chairman of Runwal Group, billionaire, among Top 100 richest Indians

- N.J. Yasaswy, Founder of ICFAI Business School

Other

- Subhash Chandra Baheria, Member of the 16th Lok Sabha, from Bhilwara, Rajasthan

- Raghav Chadha, Politician, Aam Aadmi Party

- Thomas Chazhikadan, Member of Legislative Assembly, Government of Kerala

- Anil R. Dave, Judge of the Supreme Court of India

- Piyush Goyal, Minister of Power, Coal, New and Renewable Energy

- Vishaka Hari, singer of Harikatha

- Gurumurthy, Co-Convenor of the Swadeshi Jagaran Manch, journalist

- Bhupen Khakhar, painter

- K. Rahman Khan, Minister of Minority Affairs in UPA-II, former Deputy Chairman of the Rajya Sabha

- Atul Satya Koushik, Indian theatre director and playwright

- Suresh Prabhu, Railway Minister, Government of India

- Harish Salve, Padma Bhushan, former Solicitor General of India

- Narendra Kumar Salve, former Union minister and President of Board of Control for Cricket in India (BCCI)

- Kirit Somaiya, Politician, MP, BJP

- Sanjay Subrahmanyan, musician

- Rameshwar Thakur, Former Union Minister of India, Governor of Madhya Pradesh, Karnataka, Odisha, Andhra Pradesh

- G. Venkateswaran, film producer

See also

References

- ↑ "Key statistics" (PDF). ICAI. 1 April 2014. Retrieved 7 June 2015.

- ↑ "Student Number". ICAI. Retrieved 5 February 2016.

- ↑ "Archived copy". Archived from the original on 26 March 2015. Retrieved 2015-04-12.

- 1 2 Act No. XXXVIII of 1949. See "Chartered Accountants Act 1949 as amended in 2006"

- ↑ Ranking of Accountancy bodies as per World Ranking Guide Blog

- ↑ "Finmin eyes ICAI role in GST roll-out". The Financial Express. 3 July 2008. Retrieved 10 February 2011.

- ↑ "List of Founding Members of IFAC". International Federation of Accountants. Retrieved 14 February 2011.

- ↑ "List of SAFA Member Institutions". South Asian Federation of Accountants. Archived from the original on 24 January 2011. Retrieved 14 February 2011.

- ↑ "Members of CAPA from India". Confederation of Asian and Pacific Accountants. Retrieved 14 February 2011.

- ↑ "Setting up of Section 25 company for XBRL India". XBRL International. Retrieved 28 February 2011.

- ↑

- ↑ "ICAI Logo was conceptualised by Sri Aurobindo". The Chartered Accountant. 55 (01): 112. July 2006.

- ↑ "New logo for Indian CAs – an initiative in brand building". Digital Inspiration. Retrieved 9 February 2011.

- ↑ "Guidelines to use CA Logo" (PDF). ICAI. Retrieved 9 February 2011.

- ↑ "Mission of ICAI". Member details. South Asian Federation of Accountants. Archived from the original on 9 October 2011. Retrieved 9 February 2011.

- ↑ G.P.Kapadia (1973). History of the Accountancy Profession in India. ISBN 978-0-439-41111-0.

- ↑ Government of India Notification No.22-A(8)47 dated 1 May 1948. Copy of the notification available in page 28, July 2010 edition of The Chartered Accountant journal

- ↑ "Against Discrimination: Struggle for the Designation of Chartered". The Chartered Accountant. 1. 59: 24. July 2010.

- ↑ "Against Discrimination: Struggle for the Designation of Chartered". The Chartered Accountant. 1. 59: 23. July 2010.

- ↑ "CA Day: Chartered Accountants Day India Celebrations July 1". Weeksupdate.com. Retrieved 14 February 2011.

- ↑ "Now, chartered accountants can prefix `CA' to their name". The Hindu Business Line. 27 January 2006. Retrieved 10 February 2011.

- ↑ "ICAI Key Statistics" (PDF). ICAI. Retrieved 27 March 2015.

- ↑ Section 6 of the Chartered Accountants Act, 1949 provides, "No member of the Institute shall be entitled to practise (whether in India or elsewhere) unless he has obtained from the Council a certificate of practice".

- ↑ "Chartered Accountants (Amendment) Bill, 2010" (PDF). PRS Legislative Research. Retrieved 10 February 2011.

- ↑ Section 226(1) of Companies Act, 2013 requires that an auditor be a Charterednt.

- ↑ Section 12(2) of the Chartered Accountants Act, 1949 provides, "The President shall be the chief executive Authority of the Council"

- ↑ "The Institute of Chartered Accountants of India (ICAI) has elected CA. 12". Press Information Bureau, Government of India. Retrieved 14 February 2011.

- ↑ List of Presidents of India, Institute of Chartered Accountants of India

- ↑ Code of Ethics (PDF) (11th ed.). The Institute of Chartered Accountants of India. January 2009. p. 365. ISBN 978-81-8441-180-5. Retrieved 16 March 2011.

- ↑ Section 21C of the Chartered Accountants Act, 1949

- ↑ As decided in case law: Talluri Srinivas Vs. The Institute Of Chartered Accountants of India 2010 (174) DLT 537 by the Delhi High Court with reference to the Satyam Computer Services Limited scam

- ↑ "Maytas fraud to be probed". Deccan Chronicle. 20 January 2009. Archived from the original on 4 February 2011. Retrieved 14 February 2011.

- ↑ "List of Persons/Members found guilty under First & Second Schedule.". The Institute of Chartered Accountants of India. Retrieved 15 February 2011.

- ↑ "ICAI to seek power to punish audit firms with govt nod". Business Standard. 25 August 2010. Retrieved 14 February 2011.

- ↑ "ICAI wants Rs1 crore fine on erring audit firms". The Economic Times. 12 February 2011. Retrieved 14 February 2011.

- 1 2 The Chartered Accountants Regulations, 1988

- 1 2 http://us.talentlens.com/quality-of-hire/worlds-toughest-tests-and-final-exams

- ↑ http://icai.thetaxinfo.com/2014/01/ca-final-november-2013-toppers-and-pass-percentage/

- ↑ "ICAI Annual Report 2009-2010 Pg:113" (PDF). ICAI. Retrieved 5 March 2011.

- ↑ http://caultimates.in/faqs-related-to-cpt-course/

- ↑ http://www.cacracker.com/ca-cpt-passing-marks-rule-applicability-30-for-each-section/

- 1 2 ICAI Board of Studies Announcement of the new scheme of education, 2008.

- ↑ ICAI – Chartered Accountants (CA) Exams.

- ↑ Working Hours for Article Assistants

- ↑ ICAI notification against coaching classes during office hours, 28 January 2010

- ↑ http://icai.org/new_post.html?post_id=11030&c_id=347

- ↑ CPT is exempt for the following class of Individuals

- ↑ CPT Exam

- 1 2 "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ ICAI Signed MoU with ICAEW, ICAI website

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-23.

- ↑ "Institute of Chartered Accountants India". www.cpaaustralia.com.au. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICA India". www.cpaireland.ie. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-23.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "Students' Handbook on Forensic Accounting". fraudexpress. Retrieved 2014-05-18.

- ↑ Placement portal Archived 20 March 2016 at the Wayback Machine.

- ↑ "Chartered Accountant top salary zooms to Rs70 lakh". The Economic Times. 6 March 2010. Retrieved 12 March 2011.

- ↑ "Accounting Standards issued by the ICAI". Accounting Standards Board. Retrieved 12 March 2011.

- ↑ Companies (Accounting Standards) Rules, 2006

- ↑ "Govt notifies 35 accounting standards in line with IFRS". Business Standard. 25 February 2011. Retrieved 26 February 2011.

- ↑ "35 Indian Accounting Standards (Ind AS)". Ministry of Corporate Affairs, Government of India. Archived from the original on 1 March 2011. Retrieved 26 February 2011.

- ↑ "Govt deferred IFRS implementation". The Economic Times. 26 February 2011. Retrieved 28 February 2011.

- ↑ "Auditing, Review and Other Standards (formerly known as AAS) – Complete Text". Auditing and Assurance Standards Board of the Institute of Chartered Accountants of India. Retrieved 12 March 2011.

- ↑ D.S.Rawat (2011). Students' Guide to Auditing Standards. Preface to Fourteenth Edition: Taxmann. pp. I–7. ISBN 978-81-7194-826-0.

- ↑ "#10 Kumar Birla". India's 100 Richest People 2015. Forbes. Retrieved 22 December 2015.

- ↑ "ICAI suspends Harsh Lodha, Aditya Lodha for 3 months". Business Standard. BS Reporter. Retrieved 27 April 2014.

- ↑ "Prannoy Roy in list of Famous Chartered Accountants in India".