M&T Bank

|

| |

| Public | |

| Traded as |

NYSE: MTB S&P 500 Component |

| Industry | Financial services |

| Founded | August 30,1856 |

| Headquarters |

One M&T Plaza Buffalo, New York United States |

Key people |

Robert G. Wilmers, Chairman and CEO René F. Jones, CFO Mark J. Czarnecki, President |

| Products |

Consumer Banking Corporate Banking Investment Banking Investment Management Global Wealth Management |

| Revenue |

|

|

| |

| Total assets |

|

| Total equity |

|

Number of employees | 16,331 (2016) [1] |

| Website | www.mtb.com |

M&T Bank Corporation is a United States bank holding company. Founded in 1856 in Western New York state as "Manufacturers and Traders Trust Company", the company headquarters are in Buffalo.

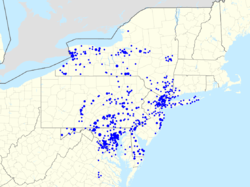

As of 2014, M&T Bank held $134.4 billion in assets, making it the 17th largest commercial bank holding company in the U.S.[2] It operates more than 800 branches in New York, New Jersey, Pennsylvania, Maryland, Delaware, Virginia, West Virginia, and Washington, D.C. New Jersey and Connecticut. It also operates private wealth offices across the United States and in Europe.

Warren Buffett's Berkshire Hathaway financial investment syndicate owns 5.66% of M&T's shares. The bank owns the original Buffalo Savings Bank building in downtown Buffalo. M&T Bank also sponsors M&T Bank Stadium, home of the Baltimore Ravens. M&T Bank is the official bank of the Buffalo Bills in Western New York Their home Stadium New Era Field in Orchard Park, New York

History

From 1987 to 2009, M&T Bank acquired 20 companies. In December 1987 M&T Acquired East New York Savings. In January 1989 M&T Acquired Monroe Savings Bank of Rochester, New York In September 1990 M&T Acquired part of the Assets of Empire of America Savings bank in Buffalo, New York along with KeyBank and others. In May 1991 M&T acquired part of the Assets of Golddome Bank in Buffalo, New York along with KeyBank and others. In July 1992 M&T acquired Central Trust and Endicott Trust of Rochester, New York and Binghamton, New York. In December 1994 M&T acquired Chemical Bank Branches of Hudson Valley, New York. Also Ithaca Bancorp of Ithaca, New York. In July 1995 M&T Acquired Chase Manhattan Branches of Hudson Valley, New York. In January 1997 M&T acquired Green Point Bank Branches of Westchester, New York. In June 1999 M&T acquired First National Bank of Rochester of Rochester, New York. In 1998, M&T Bank acquired the assets of OnBank in Syracuse, New York. In September 1999 M &T Bank acquired 29 Chase Branches of Buffalo, Jamestown, and Binghamton, New York. <http://www.bizjournals.com/buffalo/stories/1999/05/31/daily9.html> In October 2000 Keystone Financial of Central Pennyslvania was Acquired by M&T. In February 2001 Premier Nation Bancorp was acquired by M&T.

In 2003, M&T Bank acquired Allfirst Bank of Baltimore, a subsidiary of Allied Irish Banks (NYSE: AIB) of Ireland. AIB formed Allfirst in 1999 by merging its newly acquired Dauphin Deposit Corp. in the state capital of Harrisburg, in Pennsylvania with two other recent properties: the old First National Bank of Maryland (later controlled by holding firm, First Maryland Bancorp) one of the top banks in Baltimore and Maryland, which it had acquired in 1997, and The York Bank of York, Pennsylvania. M&T's acquisition went through the year after Allfirst in its brief life was found to have lost $691 million in the John Rusnak currency trading scandal. The acquisition was M&T's largest, both in terms of assets acquired and as a percentage of M&T's prior asset size. At the direction of Irish government financial regulators, AIB sold off its 22% ownership of M&T in Autumn 2010.

On July 1, 2006, M&T Bank completed the acquisition of 21 Citibank branches in Buffalo and Rochester, scooping up the branches, employees, and accounts held at those branches.[3]

In July 2007, M&T Bank announced plans to acquire Partners Trust Financial Group, which included 33 branches in upstate New York. M&T Bank completed the acquisition on November 30, 2007.

In December 2007, M&T completed the purchase of 12 First Horizon National Corporation branches in the greater Washington D.C. and Baltimore markets.

In December 2008, M&T Bank announced its intention to buy Baltimore-based Provident Bank of Maryland (formerly Provident Savings Bank of Baltimore City, established 1886), and completed the deal the following May.[4]

On August 28, 2009, the Federal Deposit Insurance Corporation (FDIC) seized Bradford Bank, and sold all its deposits and most assets to M&T.[5] M&T and the FDIC agreed to share future losses on $338 million worth of Bradford's assets.[6]

In May 2011, M&T completed the acquisition of Wilmington Trust for $351 million in a stock-for-stock transaction.[7]

On August 27, 2012, M&T announced its intention to purchase Hudson City Bancorp for $3.7 billion, including $25 billion in deposits and $28 billion in loans, plus 135 brick-and-mortar branch locations including 97 in New Jersey.[8][9] The acquisition was delayed for an unprecedented three years due to a money laundering case involving an M&T branch, before it was finalized on November 1, 2015.[10]

Financial performance

M&T Bank has been profitable every quarter since the late 1970s. In the financial crisis of 2008 and 2009, M&T was one of only two banks in the S&P 500 that didn't lower its dividend.

In 2007, M&T ranked 496th on the Fortune 500 company list. In 2009, M&T fell to number 535 on the same list, but continued to be one of the companies on the S&P 500 stock index.

As of January 2012, M&T owed $381.5 million to the U.S. government Troubled Asset Relief Program.[11] In August 2012, M&T bank repaid the U.S. government in full for the TARP bailout.

Wilmington Trust

Wilmington Trust is a subsidiary of M&T Bank Corporation, offering global corporate and institutional services, private banking, investment management, and fiduciary services.

Money laundering

In June 2014, a U.S. District Judge ordered M&T Bank to forfeit $560,000 in drug proceeds that was laundered through its Perry Hall, Maryland, branch. At least eight times from 2011 to 2013, Deanna Bailey, a drug dealer,[12] went to the branch and had head teller Sabrina Fitts convert cash — amounts from $20,000 to $100,000 — into larger bills. Fitts accepted a 1 percent transaction fee in exchange for not filing a Currency Transaction Report. This violated the Bank Secrecy Act of 1970 which requires all transactions of more than $10,000 to be reported to the Internal Revenue Service.[13]

M&T Bank's pending acquisition of Hudson City Bancorp was held up for more than three years by the Federal Reserve Board, which was unconvinced that the bank's anti-laundering controls were strong enough.[14][15] Approval was finally granted in September 2015, and the acquisition was finalized on November 1st of that year.[16]

Associations

References

- 1 2 3 4 "Form 10K FY2015". M&T Bank. Retrieved March 7, 2016.

- ↑ Kline, Allissa (December 10, 2014). "M&T climbs to 17th among nation's largest banks". Buffalo Business First. Retrieved December 11, 2014.

- ↑ Appelbaum, Binyamin (December 20, 2008). "M&T Agrees to Buy Provident Bank". The Washington Post. Retrieved May 12, 2010.

- ↑ "M&T Acquisition History". M&T Bank. Retrieved September 5, 2010.

- ↑ "Md. thrift seized". The Baltimore Sun. 2009-08-29. Retrieved 2009-08-29.

- ↑ "Feds seize Bradford Bank; M&T to buy assets". The Business Review. 2009-08-29. Retrieved 2009-08-20.

- ↑ "M&T acquires Delaware Bank for $351 million". Latest acquisition. Rochester Business Journal. Retrieved 2 November 2010.

- ↑ Epstein, Jonathan D. (27 August 2012). "M&T to expand in New Jersey with Hudson City purchase". The Buffalo News. Archived from the original on August 31, 2012. Retrieved 27 August 2012.

- ↑ "M&T Bank to Buy Hudson City Bancorp for $3.7 Billion". New York Times. Aug 27, 2012.

- ↑ "M&T Bank Completes Acquisition of Hudson City After 3-Year Delay". November 2, 2015.

- ↑ Gordon, Marcy, "Report: Taxpayers still owed $133B from bailout", Associated Press via Atlanta Journal-Constitution, January 26, 2012. Retrieved 2012-01-26.

- ↑ "Baltimore Drug Dealer Sentenced In Money Laundering Scheme". www.justice.gov. Retrieved 2016-11-11.

- ↑ "M&T Bank ordered to forfeit $560,000 of laundered drug proceeds". Baltimore Sun. June 18, 2014. Retrieved October 16, 2014.

- ↑ "Fed Cites M&T for Anti-Money Laundering Problems". Wall Street Journal. June 18, 2013. Retrieved October 16, 2014.

- ↑ "Drug money-laundering probe costs M&T $560K". Business Journals. June 18, 2014. Retrieved October 16, 2014.

- ↑ "M&T Bank Completes Acquisition of Hudson City After 3-Year Delay". November 2, 2015.

- ↑ http://www.rebny.com/content/rebny/en/directory/member-firms.html

External links

-

- Business data for M&T Bank: Google Finance

- Yahoo! Finance

- Reuters

- SEC filings