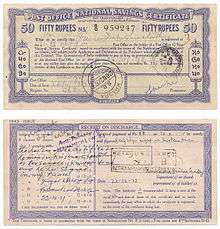

National Savings Certificates (India)

National Savings Certificates, popularly known as NSC, is an Indian Government Savings Bond, primarily used for small savings and income tax saving investments in India. It is part of the postal savings system of Indian Postal Service (India Post).

These can be purchased from any Post Office in India by an adult (either in his/her own name or on behalf of a minor), a minor, a trust, and two adults jointly. These are issued for five and ten year maturity and can be pledged to banks as collateral for availing loans. The holder gets the tax benefit under Section 80C of Income Tax Act, 1961.[1][2][3]

Other similar government savings schemes in India include: Public Provident Fund (PPF), Post Office Fixed Deposit, Post Office Recurring Deposit, etc.[4]

Online Tools

There are various tools available online for calculating maturity

History

The certificates were heavily promoted by the Indian government in the 1950s after India's independence, to collect funds for "nation-building".[5]

Investment and returns

For NSC VIII issue

There is no maximum limit for investment. Certificates can be kept as collateral security to get loan from banks. Investment up to INR 1,00,000/- per annum qualifies for IT Rebate under section 80C of Income Tax Act. Trust and HUF cannot invest. Rate of interest effective from 1st April 2016 is 8.10% compounded annually.[6][6] Maturity value of a certificate of INR.100/- purchased on or after 1.4.2014 shall be INR 147.61 after 5 years. However, Interest earned on NSC is taxable under IT Act, 1961.

For NSC IX issue

This issue has been discontinued since 20th December 2015.[7]

There is no maximum limit for investment. INR 100/- grows to INR 234.35 after 10 years. Minimum investment is INR 100/-. The instrument is available for investment in denominations of INR 100/-, 500/-, 1000/-, 5000/- & 10,000/-. A single holder type certificate can be purchased by an adult for himself or on behalf of a minor or to a minor. Rate of interest effective from 1st April 2013 is 8.80% which was revised on 26th March 2013 from 8.9% which was effective from 1st April 2012.[6]

Tools to calculate NSC maturity

You can calculate NSC maturity amount using various tools available online. Such a tool is listed below.

References and sources

- References

- ↑ ":: National Savings Institute ::". National Savings Institute. 2005. Archived from the original on 19 December 2013. Retrieved 31 March 2015.

- ↑ "All you wanted to know about National Savings Certificates". Money Control. Nov 9, 2012. Retrieved March 17, 2013.

- ↑ "Scrap NSC, Kisan Vikas Patra: RBI panel". The Times of india. Jul 23, 2004. Retrieved March 17, 2013.

- ↑ "Interest on savings schemes cut". The hindu. January 15, 2000. Retrieved March 16, 2013.

- ↑ "Minister's Call To Save More". Indian Express. Mar 20, 1950. Retrieved March 17, 2013.

- 1 2 3 "Revision in Interest Rates of Small Savings Scemes w.e.f. 1st April 2013" (PDF). New Delhi: Department of Posts, Ministry of Communications & IT. 26 March 2013. Archived from the original (PDF) on 31 March 2015. Retrieved 31 March 2015.

- ↑ "10-year National Savings Certificate discontinued - The Economic Times". The Economic Times. Retrieved 2016-10-10.

External links

| Wikimedia Commons has media related to National Savings in India. |

- ↑ "10-year National Savings Certificate discontinued". Retrieved 08 Jan 2016. Check date values in:

|access-date=(help)