Offshore financial centre

An offshore financial centre (OFC) is a small, low-tax jurisdiction specializing in providing corporate and commercial services to non-resident offshore companies, and for the investment of offshore funds.[2] The term was coined in the 1980s.[3] The International Monetary Fund (IMF) defines an offshore financial centre as "a country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."[4] Although information is still limited, there is strong evidence that OFCs captured a significant amount of global financial flows and functions both as back doors and partners of leading financial centre especially since the 1970s.[5]

Definition

Whether a financial centre is to be characterized as "offshore" is a question of degree.[6][7] Indeed, the IMF Working Paper cited above notes that its definition of an offshore centre would include the United Kingdom and the United States, which are ordinarily counted as "onshore" because of their large populations and inclusion in international organisations such as the G20 and OECD.[4]

The more nebulous term "tax haven" is often applied to offshore centres, leading to confusion between the two concepts. In Tolley's International Initiatives Affecting Financial Havens[8] the author in the Glossary of Terms defines an "offshore financial centre" in forthright terms as "a politically correct term for what used to be called a tax haven." However, he then qualifies this by adding, "The use of this term makes the important point that a jurisdiction may provide specific facilities for offshore financial centres without being in any general sense a tax haven." A 1981 report by the US IRS concludes, "a country is a tax haven if it looks like one and if it is considered to be one by those who care."[9]

With its connotations of financial secrecy and tax avoidance, "tax haven" is not always an appropriate term for offshore financial centres, many of which have no statutory banking secrecy,[10] and most of which have adopted tax information exchange protocols to allow foreign countries to investigate suspected tax evasion.[11] [12]

Views of offshore financial centres tend to be polarised. Proponents suggest that reputable offshore financial centres play a legitimate and integral role in international finance and trade, and that their zero-tax structure allows financial planning and risk management and makes possible some of the cross-border vehicles necessary for global trade, including financing for aircraft and shipping or reinsurance of medical facilities.[13] Proponents point to the tacit support of offshore centres by the governments of the United States (which promotes offshore financial centres by the continuing use of the Foreign Sales Corporation (FSC)) and United Kingdom (which actively promotes offshore finance in Caribbean dependent territories to help them diversify their economies and to facilitate the British Eurobond market). Opponents view them as draining tax revenues away from developed countries by allowing tax arbitrage, and rendering capital flows into and out of developing countries opaque. Very few commentators express neutral views.

Overseas Private Investment Corporation (OPIC), a U.S. government agency, when lending into countries with underdeveloped corporate law, often requires the borrower to form an offshore vehicle to facilitate the loan financing. One could argue that US external aid statutorily cannot even take place without the formation of offshore entities.[14][15]

Scrutiny

Offshore finance has been the subject of increased attention since 2000 and even more so since the April 2009 G20 meeting, when heads of state resolved to "take action" against non-cooperative jurisdictions.[16] Initiatives spearheaded by the Organisation for Economic Co-operation and Development (OECD), the Financial Action Task Force on Money Laundering (FATF) and the International Monetary Fund have had a significant effect on the offshore finance industry.

In 2000 the FATF began a policy of assessing the cooperation of all countries in programmes against money laundering. Considerable tightening up of both regulation and implementation was noted by the FATF over subsequent years (see generally FATF Blacklist). Most of the principal offshore centres considerably strengthened their internal regulations relating to money laundering and other key regulated activities. Indeed, Jersey is now rated as the most compliant jurisdiction internationally, complying with 44 of the "40+9" recommendations.

In 2007 The Economist published a survey of offshore financial centres; although the magazine had historically been hostile towards OFCs, the report represented a shift towards a much more benign view of the role of offshore finance, concluding:

Although international initiatives aimed at reducing financial crime are welcome, the broader concern over OFCs is overblown. Well-run jurisdictions of all sorts, whether nominally on- or offshore, are good for the global financial system.— The Economist, "A survey of offshore finance: Places in the sun",[17] 23 February 2007

The Channel Islands hold that funds generated offshore do indeed go through the Bank of England allowing the UK to benefit from the success of the crown dependencies as offshore centres.

Taxation

Although most offshore financial centres originally rose to prominence by facilitating structures which helped to minimise exposure to tax, tax avoidance has played a decreasing role in the success of offshore financial centres in recent years. Most professional practitioners in offshore jurisdictions refer to themselves as "tax neutral" since, whatever tax burdens the proposed transaction or structure will have in its primary operating market, having the structure based in an offshore jurisdiction will not create any additional tax burdens.

A number of pressure groups suggest that offshore financial centres engage in "unfair tax competition" by having no, or very low tax burdens, and have argued that such jurisdictions should be forced to tax both economic activity and their own citizens at a higher level. Another criticism levelled against offshore financial centres is that while sophisticated jurisdictions usually have developed tax codes which prevent tax revenues leaking from the use of offshore jurisdictions, less developed nations, who can least afford to lose tax revenue, are unable to keep pace with the rapid development of the use of offshore financial structures.[18][19]

Regulation

Offshore centres benefit from a low burden of regulation. An extremely high proportion of hedge funds (which characteristically employ high risk investment strategies) who register offshore are presumed to be driven by lighter regulatory requirements rather than perceived tax benefits.[20] Many capital markets bond issues are also structured through a special purpose vehicle incorporated in an offshore financial centre specifically to minimise the amount of regulatory red-tape associated with the issue.

Offshore centres have historically been seen as venues for laundering the proceeds of illicit activity.[19] However, following a move towards transparency during the 2000s and the introduction of strict anti–money laundering (AML) regulations, some now argue that offshore are in many cases better regulated than many onshore financial centres.[21][22] For example, in most offshore jurisdictions, a person needs a licence to act as a trustee, whereas (for example) in the United Kingdom and the United States, there are no restrictions or regulations as to who may serve in a fiduciary capacity.[23] The leading offshore financial centres are more compliant with the Financial Action Task Force on Money Laundering's '40+9' recommendations than many OECD countries.[24]

Some commentators have expressed concern that the differing levels of sophistication between offshore financial centres will lead to regulatory arbitrage,[25] and fuel a race to the bottom, although evidence from the market seems to indicate the investors prefer to utilise better regulated offshore jurisdictions rather than more poorly regulated ones.[26] A study by Australian academic found that shell companies are more easily set up in many OECD member countries than in offshore jurisdictions.[27] A report by Global Witness, Undue Diligence, found that kleptocrats used OECD banks rather than offshore accounts as destinations for plundered funds.[28]

Confidentiality

Critics of offshore jurisdictions point to excessive secrecy in those jurisdictions, particularly in relation to the beneficial ownership of offshore companies, and in relation to offshore bank accounts. However, banks in most jurisdictions will preserve the confidentiality of their customers, and all of the major offshore jurisdictions have appropriate procedures for law enforcement agencies to obtain information regarding suspicious bank accounts, as noted in FATF ratings.[29] Most jurisdictions also have remedies which private citizens can avail themselves of, such as Anton Piller orders, if they can satisfy the court in that jurisdiction that a bank account has been used as part of a legal wrong.

Similarly, although most offshore jurisdictions only make a limited amount of information with respect to companies publicly available, this is also true of most states in the U.S.A., where it is uncommon for share registers or company accounts to be available for public inspection. In relation to trusts and unlimited liability partnerships, there are very few jurisdictions in the world that require these to be registered, let alone publicly file details of the people involved with those structures.

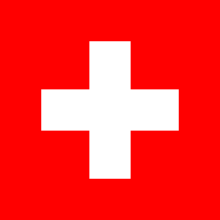

Statutory banking secrecy is a feature of several financial centres, notably Switzerland and Singapore.[30] However, many offshore financial centres have no such statutory right. Jurisdictions including Aruba, the Bahamas, Bermuda, the British Virgin Islands, the Cayman Islands, Jersey, Guernsey, the Isle of Man and the Netherlands Antilles have signed tax information exchange agreements based on the OECD model, which commits them to sharing financial information about foreign residents suspected of evading home-country tax.[31]

Effects on international trade

Offshore centres act as conduits for global trade and ease international capital flows. International joint ventures are often structured as companies in an offshore jurisdiction when neither party in the venture party wishes to form the company in the other party's home jurisdiction in order to avoid paying taxes there. Although most offshore financial centres still charge little or no tax, the increasing sophistication of onshore tax codes has meant that there is often little tax benefit relative to the cost of moving a transaction structure offshore.[32]

Recently, several studies have examined the impact of offshore financial centres on the world economy more broadly, finding the high degree of competition between banks in such jurisdictions to increase liquidity in nearby onshore markets. Proximity to small offshore centres has been found to reduce credit spreads and interest rates,[33] while a paper by James Hines concluded, "by every measure credit is more freely available in countries which have close relationships with offshore centres."[34]

Low-tax financial centres are becoming increasingly important as conduits for investment into emerging markets. For instance, 44% of foreign direct investment (FDI) into India came through Mauritius last year,[35] while over two thirds of FDI into Brazil came through offshore centres.[36] Blanco & Rogers find a positive correlation between proximity to an offshore centre and investment for least developed countries (LDCs); a $1 increase in FDI to an offshore centre translates to an average increase of $0.07 in FDI for nearby developing countries.[37]

Offshore financial structures

The bedrock of most offshore financial centres is the formation of offshore structures – typically:

Offshore structures are formed for a variety of reasons. They include:

- Asset holding vehicles. Many corporate conglomerates employ a large number of holding companies, and often high-risk assets are parked in separate companies to prevent legal risk accruing to the main group (i.e. where the assets relate to asbestos, see the English case of Adams v Cape Industries). Similarly, it is quite common for fleets of ships to be separately owned by separate offshore companies to try to circumvent laws relating to group liability under certain environmental legislation.

- Asset protection. Wealthy individuals who live in politically unstable countries utilise offshore companies to hold family wealth to avoid potential expropriation or exchange control restrictions in the country in which they live. These structures work best when the wealth is foreign-earned, or has been expatriated over a significant period of time (aggregating annual exchange control allowances).[39]

- Avoidance of forced heirship provisions. Many countries from France to Saudi Arabia (and the U.S. State of Louisiana) continue to employ forced heirship provisions in their succession law, limiting the testator's freedom to distribute assets upon death. By placing assets into an offshore company, and then having probate for the shares in the offshore determined by the laws of the offshore jurisdiction (usually in accordance with a specific will or codicil sworn for that purpose), the testator can sometimes avoid such strictures.

- Collective Investment Vehicles. Mutual funds, Hedge funds, unit trusts and SICAVs are formed offshore to facilitate international distribution. By being domiciled in a low tax jurisdiction investors only have to consider the tax implications of their own domicile or residency.

- Derivatives and securities trading. Wealthy individuals often form offshore vehicles to engage in risky investments, such as derivatives and global securities trading, which may be extremely difficult to engage in directly onshore due to cumbersome financial markets regulation.

- Exchange control trading vehicles. In countries where there is either exchange control or is perceived to be increased political risk with the repatriation of funds, major exporters often form trading vehicles in offshore companies so that the sales from exports can be "parked" in the offshore vehicle until needed for further investment. Trading vehicles of this nature have been criticised in a number of shareholder lawsuits which allege that by manipulating the ownership of the trading vehicle, majority shareholders can illegally avoid paying minority shareholders their fair share of trading profits.

- Joint venture vehicles. Offshore jurisdictions are frequently used to set up joint venture companies, either as a compromise neutral jurisdiction (see for example, TNK-BP) and/or because the jurisdiction where the joint venture has its commercial centre has insufficiently sophisticated corporate and commercial laws.

- Stock market listing vehicles. Successful companies who are unable to obtain a stock market listing because of the underdevelopment of the corporate law in their home country often transfer shares into an offshore vehicle, and list the offshore vehicle. Offshore vehicles are listed on the NASDAQ, Alternative Investment Market, the Hong Kong Stock Exchange and the Singapore Stock Exchange.

- Trade finance vehicles. Large corporate groups often form offshore companies, sometimes under an orphan structure to enable them to obtain financing (either from bond issues or by way of a syndicated loan) and to treat the financing as "off-balance-sheet" under applicable accounting procedures. In relation to bond issues, offshore special purpose vehicles are often used in relation to asset-backed securities transactions (particularly securitisations).

- Creditor avoidance. Highly indebted persons may seek to escape the effect of bankruptcy by transferring cash and assets into an anonymous offshore company.[40]

- Market manipulation. The Enron and Parmalat scandals demonstrated how companies could form offshore vehicles to manipulate financial results.

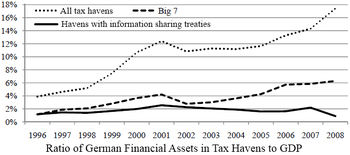

- Tax evasion. Although numbers are difficult to ascertain, it is widely believed that individuals in wealthy nations unlawfully evade tax through not declaring gains made by offshore vehicles that they own. Multinationals including GlaxoSmithKline and Sony have been accused of transferring profits from the higher-tax jurisdictions in which they are made to zero-tax offshore centres.[41]

Ship and aircraft registrations

Many offshore financial centres also provide registrations for ships (notably Bahamas and Panama) or aircraft (notably Aruba, Bermuda and the Cayman Islands).

Aircraft are frequently registered in offshore jurisdictions where they are leased or purchased by carriers in emerging markets but financed by banks in major onshore financial centres. The financing institution is reluctant to allow the aircraft to be registered in the carrier's home country (either because it does not have sufficient regulation governing civil aviation, or because it feels the courts in that country would not cooperate fully if it needed to enforce any security interest over the aircraft), and the carrier is reluctant to have the aircraft registered in the financier's jurisdiction (often the United States or the United Kingdom) either because of personal or political reasons, or because they fear spurious lawsuits and potential arrest of the aircraft.

For example, in 2003, state carrier Pakistan International Airlines re-registered its entire fleet in the Cayman Islands as part of the financing of its purchase of eight new Boeing 777s; the U.S. bank refused to allow the aircraft to remain registered in Pakistan, and the airline refused to have the aircraft registered in the U.S.[42]

Insurance

A number of offshore jurisdictions promote the incorporation of captive insurance companies within the jurisdiction to allow the sponsor to manage risk. In more sophisticated offshore insurance markets, onshore insurance companies can also establish an offshore subsidiary in the jurisdiction to reinsure certain risks underwritten by the onshore parent, and thereby reduce overall reserve and capital requirements. Onshore reinsurance companies may also incorporate an offshore subsidiary to reinsure catastrophic risks.

Bermuda's insurance and re-insurance market is now the third largest in the world.[43] There are also signs the primary insurance market is becoming increasingly focused upon Bermuda; in September 2006 Hiscox PLC, the FTSE 250 insurance company announced that it planned to relocate to Bermuda citing tax and regulatory advantages.[44]

Collective investment vehicles

Many offshore jurisdictions specialise in the formation of collective investment schemes, or mutual funds. The market leader is the Cayman Islands, estimated to house about 75% of world’s hedge funds and nearly half the industry's estimated $1.1 trillion of assets under management,[45] followed by Bermuda, although a market shift has meant that a number of hedge funds are now formed in the British Virgin Islands. As at year end 2005, there were 7,106 hedge funds registered in the Cayman Islands, 2,372 hedge funds in the British Virgin Islands and 1,182 in Bermuda.[46] These figures do not include other collective investment vehicles. See also the recent survey by Deloitte in Hedgeweek.[47]

But the greater appeal of offshore jurisdictions to form mutual funds is usually in the regulatory considerations. Offshore jurisdictions tend to impose few if any restrictions on what investment strategy the mutual funds may pursue and no limitations on the amount of leverage which mutual funds can employ in their investment strategy. Many offshore jurisdictions (Bermuda, British Virgin Islands, Cayman Islands and Guernsey) allow promoters to incorporate segregated portfolio companies (or SPCs) for use as mutual funds; the unavailability of a similar corporate vehicle onshore has also helped fuel the growth of offshore incorporated funds.

Banking

Traditionally, a number of offshore jurisdictions offered banking licences to institutions with relatively little scrutiny. International initiatives have largely stopped this practice, and very few offshore financial centres will now issue licences to offshore banks that do not already hold a banking licence in a major onshore jurisdiction. The most recent reliable figures for offshore banks indicates that the Cayman Islands has 285[48] licensed banks, the Bahamas [49] has 301. By contrast, the British Virgin Islands only has seven licensed offshore banks.

List of main offshore financial centres and tax havens

- See also the list of Non-Cooperative Countries or Territories (FATF Blacklist)

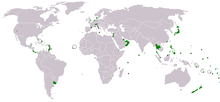

A list of jurisdictions considered by the IMF in 2000 to be OFCs is published online.[50] Many offshore financial centres are current or former British colonies or Crown Dependencies,[51] and often refer to themselves simply as offshore jurisdictions. The U.S. National Bureau of Economic Research has suggested that roughly 15% of the countries in the world are tax havens, that these countries tend to be small and affluent, and are more likely to be successful tax havens. The following jurisdictions are considered the major destinations:

-

Bahamas, which has a considerable number of registered vessels. The Bahamas used to be the dominant force in the offshore financial world, but fell from favour in the 1970s after independence.[52]

Bahamas, which has a considerable number of registered vessels. The Bahamas used to be the dominant force in the offshore financial world, but fell from favour in the 1970s after independence.[52] -

Bermuda, which is market leader for captive insurance, and also has a strong presence in offshore funds and aircraft registration.

Bermuda, which is market leader for captive insurance, and also has a strong presence in offshore funds and aircraft registration. -

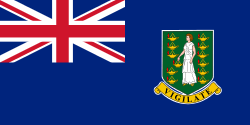

British Virgin Islands, which has the largest number of offshore companies.[53]

British Virgin Islands, which has the largest number of offshore companies.[53] -

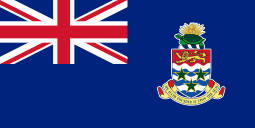

Cayman Islands, which has the largest value of assets under management in offshore funds, and is also the strongest presence in the U.S. securitisation market.

Cayman Islands, which has the largest value of assets under management in offshore funds, and is also the strongest presence in the U.S. securitisation market. -

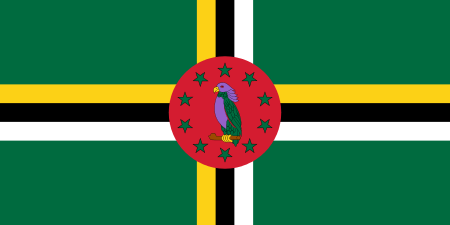

Dominica, which has the largest number of offshore companies formed in recent years. In recent years is now becoming a major financial center for offshore banks.

Dominica, which has the largest number of offshore companies formed in recent years. In recent years is now becoming a major financial center for offshore banks. -

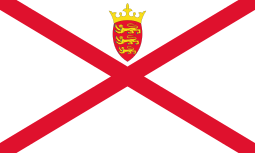

Jersey is the most international of the British Crown dependencies, all of which can be counted as offshore centres. Jersey has particularly strong banking and funds management sectors and a high concentration of professional advisers including lawyers and fund managers.[54]

Jersey is the most international of the British Crown dependencies, all of which can be counted as offshore centres. Jersey has particularly strong banking and funds management sectors and a high concentration of professional advisers including lawyers and fund managers.[54] -

Luxembourg, which is the market leader in Undertakings for Collective Investments in Transferable Securities (UCITS) and is believed to be the largest offshore Eurobond issuer, although no official statistics confirm this.

Luxembourg, which is the market leader in Undertakings for Collective Investments in Transferable Securities (UCITS) and is believed to be the largest offshore Eurobond issuer, although no official statistics confirm this. -

Mauritius is used for both inward and outward investment platform for Asian, African and European countries, it has the effective commercial and legal infrastructure required to support the development of a global network. The island nation has a number of double taxation agreements and is listed on the OECD list of jurisdictions that have substantially implemented internationally agreed tax and transparency standards.

Mauritius is used for both inward and outward investment platform for Asian, African and European countries, it has the effective commercial and legal infrastructure required to support the development of a global network. The island nation has a number of double taxation agreements and is listed on the OECD list of jurisdictions that have substantially implemented internationally agreed tax and transparency standards. -

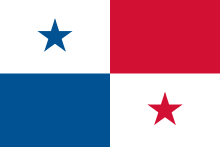

Panama, which is a significant international maritime centre. Although Panama (with Bermuda) was one of the earliest offshore corporate domiciles, Panama lost significance in the early 1990s.[55] Panama is now second only to the British Virgin Islands in volumes of incorporations.[56]

Panama, which is a significant international maritime centre. Although Panama (with Bermuda) was one of the earliest offshore corporate domiciles, Panama lost significance in the early 1990s.[55] Panama is now second only to the British Virgin Islands in volumes of incorporations.[56] -

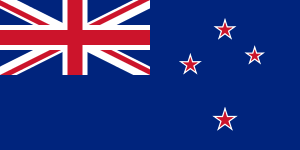

New Zealand, the remotest jurisdiction, has the advantage of being a true primary jurisdiction but with a tough but practical regulatory regime. It is well positioned for the Asian market but retains close ties to Europe.

New Zealand, the remotest jurisdiction, has the advantage of being a true primary jurisdiction but with a tough but practical regulatory regime. It is well positioned for the Asian market but retains close ties to Europe. -

Switzerland: taxes in Switzerland are levied by the Swiss Confederation, the cantons and the municipalities. Switzerland is sometimes considered a tax haven due to its general low rate of taxation, its political stability as well as the various tax exemptions or reductions available to Swiss companies doing business abroad, or foreign persons residing in Switzerland.

Switzerland: taxes in Switzerland are levied by the Swiss Confederation, the cantons and the municipalities. Switzerland is sometimes considered a tax haven due to its general low rate of taxation, its political stability as well as the various tax exemptions or reductions available to Swiss companies doing business abroad, or foreign persons residing in Switzerland.

Global Financial Centres Index

Reputation and standards of regulation vary across the range of offshore centres. The 2010 Global Financial Centres Index (GFCI) gathers data on all International Financial Centres and lists the following, in order, as the world's five leading offshore finance centres:[57]

In December 2009 a group of professional services firms and businesses with offices in the GFCI's leading offshore financial centres, established the International Financial Centres Forum (IFC Forum).[58] According to its website, the IFC Forum aims to provide authoritative and balanced information about the role of the small international financial centres in the global economy.

Recent developments

EU withholding tax

The European Union has recently made a large number of offshore financial centres (Barbados and Bermuda being the notable exceptions) sign up to the European Union withholding tax and exchange of information directive. Under those regulations, brought into force by local law, banks in those jurisdictions which hold accounts for EU resident nationals must either deduct a 15% withholding tax (which is split between the offshore jurisdiction and the country of the account holder's residence), or permit full exchange of information with the country of the national's residence.

A number of larger jurisdictions, including notably Hong Kong and Singapore, refused to sign up to the directive. On implementation, the directive recouped far less money than anticipated,[59] although it is disputed whether this is because the regulations lacked effectiveness, or because the predicted amount of funds in offshore bank accounts transpired to have been greatly exaggerated. Similarly, the widely predicted capital flight to Hong Kong and Singapore appears not to have materialised.

A ruling by the Special Commissioners in the United Kingdom in May 2006 permitted Revenue authorities to compel UK based banks to release information on offshore bank deposits where illegality is suspected, even where the customer had elected to pay a withholding tax rather than to exchange information.[60]

OECD List

In its 2000 report Towards Global Tax Competition,[61] the Organisation for Economic Co-operation and Development (OECD) identified 47 jurisdictions as tax havens based on the existence of preferential tax regimes for financial services and the absence of procedures for exchange of tax information. Between 2000 and April 2002, 31 jurisdictions made formal commitments to implement the OECD’s standards of transparency and exchange of information and were removed from the list of tax havens.

Andorra, Liechtenstein, Liberia, Monaco, the Marshall Islands, Nauru and Vanuatu did not make commitments to transparency and exchange of information at that time and were identified in April 2002 by the OECD’s Committee on Fiscal Affairs as "uncooperative tax havens". All of these jurisdictions subsequently reversed this position and were no longer deemed tax havens.

After G20 leaders agreed to crack down on tax havens on during 2009 G20 London Summit in April 2009, the OECD published a list of countries that still needed to implement internationally agreed tax standards.[62]

In May 2009, the OECD's Committee on Fiscal Affairs decided to remove all three remaining jurisdictions – Andorra, Liechtenstein and Monaco – from the list of uncooperative tax havens in the light of their commitments to implement the OECD standards of transparency and effective exchange of information and the timetable they set for the implementation. As a result, no jurisdiction is currently listed as an uncooperative tax haven by the Committee on Fiscal Affairs.[63]

See also

- Corporate haven

- Financial Secrecy Index

- International Financial Centre

- List of offshore financial centres

- Offshore 2020

- Panama Papers

- Tax exporting

- Tax haven

References

- ↑ Shafik Hebous (2011) "Money at the Docks of Tax Havens: A Guide", CESifo Working Paper Series No. 3587, p. 9

- ↑ Harari, Morgan; Meinzer, Markus; Murphy, Richard (2012-10-01). "Financial Secrecy, Banks and the Big 4 Firms of Accountants" (PDF). Tax Justice Network. Retrieved 2016-04-06.

- ↑ Roberts, Richard (1994-03-01). Offshore Financial Centres. Edward Elgar Publishing. ISBN 9781858981550.

- 1 2 IMF working paper: Concept of Offshore Financial Centers: In Search of an Operational Definition; Ahmed Zoromé; IMF Working Paper 07/87; April 1, 2007. (PDF) . Retrieved on 2011-11-02.

- ↑ Coispeau, Olivier (2016). Finance Masters, a Brief History of International Financial Centers in the last Millennium. World Scientific. ISBN 9789813108820.

- ↑ On or Off?. CFO.com (2007-03-01). Retrieved on 2011-11-02.

- ↑ "On or off?". The Economist. 22 February 2007.

- ↑ Tim Bennett (2001) Tolley's International Initiatives Affecting Financial Havens. ISBN 0-406-94264-1.

- ↑ United States IRS, Tax Havens and their Use by United States Taxpayers: An Overview, 1981.

- ↑ Archive"FACTBOX-Status of bank secrecy protection in Europe". Reuters. Reuters. 11 August 2009.

- ↑ OECD PROGRESS REPORT. A PROGRESS REPORT ON THE JURISDICTIONS SURVEYED BY THE OECD GLOBAL FORUM IN IMPLEMENTING THE INTERNATIONALLY AGREED TAX STANDARD

- ↑ Horowitz, Richard. "International Financial Centres and the US Government". IFC Review. Retrieved 2016-04-05.

- ↑ IFC Forum. IFC Forum. Retrieved on 2011-11-02.

- ↑ "Who We Are". Overseas Private Investment Corporation. Retrieved 2016-04-05.

- ↑ Reauthorize or Retire the Overseas Private Investment Corporation?. Cato Institute. Retrieved on 2013-10-26.

- ↑ G20 Communiqué. g20.org. 2 April 2009

- ↑ "Places in the sun". The Economist.

- ↑ The missing millions. The cost of tax dodging to developing countries supported by the Scottish government. A Christian Aid report. September 2009

- 1 2 Global Financial Integrity – New Report Finds Developing Country Governments Lose $100 Billion Annually Due to Trade Mispricing. Gfintegrity.org (2010-02-12). Retrieved on 2011-11-02.

- ↑ "They Cayman, They Saw, They Conquered". May 2006. Archived from the original on 12 October 2007. Retrieved 16 May 2006.

- ↑ Washington, The. (2004-02-09) ''Washington Times'' – Commentary. Washtimes.com. Retrieved on 2011-11-02.

- ↑ ''Financial Times'' – Financial standards under fire. Ft.com (2007-05-01). Retrieved on 2011-11-02.

- ↑ Although such regulation has been proposed with the EU en passant in the 3rd EU Money Laundering Directive.

- ↑ "International Financial Centre - IFC Forum".

- ↑ Financial News – Home – breaking news, comment, analysis, blogs. Efinancialnews.com. Retrieved on 2011-11-02.

- ↑ Dharmapala, Dhammika & Hines Jr., James R. (2009). "Which Countries Become Tax Havens?".

- ↑ The G20 and Tax: Haven hypocrisy, The Economist, March 26, 2009

- ↑ Undue Diligence. How banks do business with corrupt regimes. A report by Global Witness, March 2009. globalwitness.org

- ↑ Financial Action Task Force (FATF). Fatf-gafi.org. Retrieved on 2011-11-02.

- ↑ Wealth – Asset Management – Financial News – latest headlines. Wealth-bulletin.com. Retrieved on 2011-11-02.

- ↑ Tax Information Exchange Agreements (TIEAs). Oecd.org. Retrieved on 2011-11-02.

- ↑ Hines, J., 'International Financial Centers and the World Economy' 2009: 34

- ↑ Rose, A.; Spiegel, M. "Offshore Financial Centers: Parasites or symbionts?" (PDF).

- ↑ Hines, J., 'International Financial Centers and the World Economy' 2009: 4

- ↑ Indian Department of Industrial Policy and Promotion, FDI Statistics, September 2009

- ↑ World Bank, World Investment Statistics 2009

- ↑ L. Blanco & C. Rodgers, Are tax havens good neighbors? An LDC perspective. Social Science Electronic Publishing. July 10, 2009

- ↑ See for example Panama Private Interest Foundation

- ↑ Legitimate asset protection against future political or economic risk should be distinguished from unlawfully attempting to evade creditors; see below.

- ↑ In practice, such attempts are rarely effective. A trustee in bankruptcy will usually have access to all of the debtor's financial records, and will usually have little difficulty tracing where the assets were transferred to. Transfers to defraud creditors are prohibited in most jurisdictions (offshore and onshore) and a bankruptcy trustee usually has little difficulty persuading a local court to nullify the transfer. Despite the poor prognosis for success, applications to courts in offshore jurisdictions seem to indicate that insolvent individuals still try this strategy from time to time, notwithstanding that it is usually a serious criminal offence in both jurisdictions.

- ↑ Morais, Richard C. (28 August 2009). "Illicit Transfer Pricing Endangers Shareholders". Forbes.

- ↑ "PIA pledges its fleet to fake firm". The Times of India.

- ↑ 13 of the world's top 40 reinsurers are based in Bermuda, including American International Underwriters Group, HSBC Insurance Solutions, XL Capital Limited and ACE Limited.

- ↑ Muspratt, Caroline (12 September 2006). "Hiscox to be domiciled in 'favourable' Bermuda". The Daily Telegraph. London.

- ↑ Institutional Investor, 15 May 2006, although statistics in the hedge fund industry are notoriously speculative

- ↑ "London's Cayman Islands: The Empire of the Hedge Funds". Richard Freeman. Archived from the original on 11 March 2007. Retrieved 5 April 2016.

- ↑ All news. Hedgeweek (2011-10-28). Retrieved on 2011-11-02.

- ↑ Cayman Islands Monetary Authority (2006)

- ↑ Not treating Switzerland (with 500) as an offshore financial centre for these purposes.

- ↑ "Offshore Financial Centers -- IMF Background Paper".

- ↑ "What are the most popular offshore jurisdictions?". OIL (incorporations and corporate services).

- ↑ At about this time the jurisdiction was also rocked by a number of banking scandals. It also imposed an ill-advised practice of restricting admission to the Bahamian bar to nationals of the Bahamas, which had a diluting effect on the quality legal talent in the jurisdiction (by preventing the recruitment of expatriates), which is critical to the success of setting up sophisticated offshore structures. Not coincidentally, the rise of Cayman as the dominant force in offshore finance almost precisely mirrors the decline of the Bahamas. See generally Tolley's Tax Havens (2000), ISBN 0-7545-0471-9

- ↑ Over 700,000 offshore companies have been formed in the British Virgin Islands, although only approximately 450,000 remain active (the remainder having been dissolved or struck off). This would account for approximately 42% of the estimated 1.1 million offshore companies incorporated worldwide.

- ↑ Jersey Offshore Business Sectors. Lowtax.net. Retrieved on 2011-11-02.

- ↑ The U.S. led invasion to oust Manuel Noriega in 1989 caused significant market shift away from the jurisdiction, from which it has only relatively recently recovered.

- ↑ Jurisdictions League Table 2006. ils-world.com

- ↑ "The Global Financial Centres Index 8" (PDF). Z/Yen. 2010.

- ↑ "International Financial Centres Forum Launched". Cayman Financial Review. 5 January 2010. Retrieved 16 March 2011.

- ↑ / Tax – Offshore investors beat EU directive to avoid tax. Ft.com (2006-07-07). Retrieved on 2011-11-02.

- ↑ Cowie, Ian (4 May 2006). "Barclays' offshore clients face £1.5bn bill". The Daily Telegraph. London.

- ↑ ''Towards Global Tax Competition''. (PDF) . Retrieved on 2011-11-02.

- ↑ Luxembourg, Switzerland blast G20 tax haven offensive — EUbusiness – legal, business and economic news from Europe and the EU Archived 15 August 2009 at the Wayback Machine.. Eubusiness.com (2009-04-03). Retrieved on 2011-11-02.

- ↑ List of Unco-operative Tax Havens. Oecd.org. Retrieved on 2011-11-02.

External links

- International Financial Centres Forum (IFC Forum)

- The Economist survey on offshore financial centres

- IMF's 2000 report on OFCs

- Lax Little Islands by David Cay Johnston, The Nation, May 13, 2009