Corporatocracy

| Part of the Politics series | ||||||||

| Basic forms of government | ||||||||

|---|---|---|---|---|---|---|---|---|

| Power structure | ||||||||

|

||||||||

| Power source | ||||||||

|

||||||||

| Power ideology | ||||||||

|

||||||||

| Politics portal | ||||||||

Corporatocracy /ˌkɔːrpərəˈtɒkrəsi/, is a recent term used to refer to an economic and political system controlled by corporations or corporate interests.[1] It is most often used today as a term to describe the current economic situation in a particular country, especially the United States.[2][3] This is different from corporatism, which is the organisation of society into groups with common interests. Corporatocracy as a term is often used by observers across the political spectrum.[2][4][5][6][7][8][9][10][11][12][13][14][15]

Economist Jeffrey Sachs described the United States as a corporatocracy in The Price of Civilization (2011).[16] He suggested that it arose from four trends: weak national parties and strong political representation of individual districts, the large U.S. military establishment after World War II, big corporate money financing election campaigns, and globalization tilting the balance away from workers.[16]

This collective is what author C Wright Mills in 1956 called the Power Elite, wealthy individuals who hold prominent positions in corporatocracies. They control the process of determining a society's economic and political policies.[17]

The concept has been used in explanations of bank bailouts, excessive pay for CEOs, as well as complaints such as the exploitation of national treasuries, people, and natural resources.[18] It has been used by critics of globalization,[19] sometimes in conjunction with criticism of the World Bank[20] or unfair lending practices,[18] as well as criticism of "free trade agreements".[19]

Characteristics

Edmund Phelps published an analysis in 2010 theorizing that the cause of income inequality is not free market capitalism, but instead is the result of the rise of corporatization.[21] Corporatization, in his view, is the antithesis of free market capitalism. It is characterized by semi-monopolistic organizations and banks, big employer confederations, often acting with complicit state institutions in ways that discourage (or block) the natural workings of a free economy. The primary effects of corporatization are the consolidation of economic power and wealth with end results being the attrition of entrepreneurial and free market dynamism.

His follow-up book, Mass Flourishing, further defines corporatization by the following attributes: power-sharing between government and large corporations (exemplified in the U.S. by widening government power in areas such as financial services, healthcare, and energy through regulation), an expansion of corporate lobbying and campaign support in exchange for government reciprocity, escalation in the growth and influence of financial and banking sectors, increased consolidation of the corporate landscape through merger and acquisition (with ensuing increases in corporate executive compensation), increased potential for corporate/government corruption and malfeasance, and a lack of entrepreneurial and small business development leading to lethargic and stagnant economic conditions.[22][23]

United States

In the United States, several of the characteristics described by Phelps are apparent. With regard to income inequality, the 2014 income analysis of University of California, Berkeley economist Emmanuel Saez confirms that relative growth of income and wealth is not occurring among small and mid-sized entrepreneurs and business owners (who generally populate the lower half of top one per-centers in income),[24] but instead only among the top .1 percent of income distribution ... whom Paul Krugman describes as "super-elites – corporate bigwigs and financial wheeler-dealers."[25][26]... who earn $2,000,000 or more every year.[27][28]

Share of income

Corporate power can also increase income inequality. Joseph Stiglitz wrote in May 2011: "Much of today’s inequality is due to manipulation of the financial system, enabled by changes in the rules that have been bought and paid for by the financial industry itself—one of its best investments ever. The government lent money to financial institutions at close to zero percent interest and provided generous bailouts on favorable terms when all else failed. Regulators turned a blind eye to a lack of transparency and to conflicts of interest." Stiglitz explained that the top 1% got nearly "one-quarter" of the income and own approximately 40% of the wealth.[29]

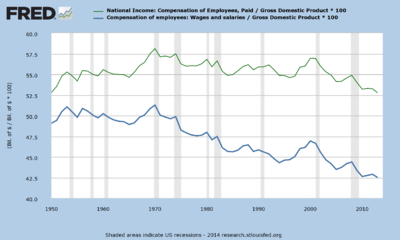

Measured relative to GDP, total compensation and its component wages and salaries have been declining since 1970. This indicates a shift in income from labor (persons who derive income from hourly wages and salaries) to capital (persons who derive income via ownership of businesses, land and assets).[30] Wages and salaries have fallen from approximately 51% GDP in 1970 to 43% GDP in 2013. Total compensation has fallen from approximately 58% GDP in 1970 to 53% GDP in 2013.[31]

To put this in perspective, five percent of U.S. GDP was approximately $850 billion in 2013. This represents an additional $7,000 in compensation for each of the 120 million U.S. households. Larry Summers estimated in 2007 that the lower 80% of families were receiving $664 billion less income than they would be with a 1979 income distribution (a period of much greater equality), or approximately $7,000 per family.[32]

Not receiving this income may have led many families to increase their debt burden, a significant factor in the 2007–2009 subprime mortgage crisis, as highly leveraged homeowners suffered a much larger reduction in their net worth during the crisis. Further, since lower income families tend to spend relatively more of their income than higher income families, shifting more of the income to wealthier families may slow economic growth.[33]

Effective corporate tax rates

As another indication of U.S. corporate political influence, U.S. corporate effective tax rates have also fallen significantly, from 29% in 2000 to 17% in 2013. Corporate tax payments have not kept pace with profit growth.[34]

Some large U.S. corporations have used a strategy called tax inversion to change their headquarters to a non-U.S. country to reduce their tax liability. About 46 companies have reincorporated in low-tax countries since 1982, including 15 since 2012. Six more plan to do so in 2015.[35]

Stock buybacks versus wage increases

One indication of increasing corporate power was the removal of restrictions on their ability to buy back stock, contributing to increased income inequality. Writing in the Harvard Business Review in September 2014, William Lazonick blamed record corporate stock buybacks for reduced investment in the economy and a corresponding impact on prosperity and income inequality. Between 2003 and 2012, the 449 companies in the S&P 500 used 54% of their earnings ($2.4 trillion) to buy back their own stock. An additional 37% was paid to stockholders as dividends. Together, these were 91% of profits. This left little for investment in productive capabilities or higher income for employees, shifting more income to capital rather than labor. He blamed executive compensation arrangements, which are heavily based on stock options, stock awards and bonuses for meeting earnings per share (EPS) targets. EPS increases as the number of outstanding shares decreases. Legal restrictions on buybacks were greatly eased in the early 1980s. He advocates changing these incentives to limit buybacks.[36][37]

In the 12 months to March 31, 2014, S&P 500 companies increased their stock buyback payouts by 29% year on year, to $534.9 billion.[38] U.S. companies are projected to increase buybacks to $701 billion in 2015 according to Goldman Sachs, an 18% increase over 2014. For scale, annual non-residential fixed investment (a proxy for business investment and a major GDP component) was estimated to be about $2.1 trillion for 2014.[39][40]

Industry concentration

Brid Brennan of the Transnational Institute explained how concentration of corporations increases their influence over government: ”It’s not just their size, their enormous wealth and assets that make the TNCs [transnational corporations] dangerous to democracy. It’s also their concentration, their capacity to influence, and often infiltrate, governments and their ability to act as a genuine international social class in order to defend their commercial interests against the common good. It is such decision making power as well as the power to impose deregulation over the past 30 years, resulting in changes to national constitutions, and to national and international legislation which has created the environment for corporate crime and impunity."[41][42]

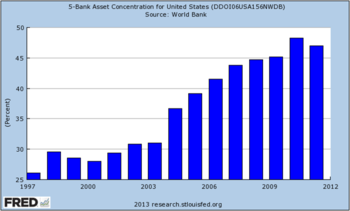

An example of such industry concentration is in banking. The top 5 U.S. banks had approximately 30% of the U.S. banking assets in 1998; this rose to 45% by 2008 and to 48% by 2010, before falling to 47% in 2011.[43]

The Economist also explained how an increasingly profitable corporate financial and banking sector caused Gini coefficients to rise in the U.S. since 1980: "Financial services' share of GDP in America doubled to 8% between 1980 and 2000; over the same period their profits rose from about 10% to 35% of total corporate profits, before collapsing in 2007–09. Bankers are being paid more, too. In America the compensation of workers in financial services was similar to average compensation until 1980. Now it is twice that average."[44]

The summary argument, considering these findings, is that if corporatization is the consolidation and sharing of economic and political power between large corporations and the state ... then a corresponding concentration of income and wealth (with resulting income inequality) is an expected by-product of such a consolidation.[41]

Corporate influence on legislation

Corporations have significant influence on the regulations and regulators that monitor them. For example, Senator Elizabeth Warren explained in December 2014 how an omnibus spending bill required to fund the government was modified late in the process to weaken banking regulations. The modification made it easier to allow taxpayer-funded bailouts of banking "swaps entities", which the Dodd-Frank banking regulations prohibited. She singled out Citigroup, one of the largest banks, which had a role in modifying the legislation. She also explained how both Wall Street bankers and members of the government that formerly had worked on Wall Street stopped bi-partisan legislation that would have broken up the largest banks. She repeated President Theodore Roosevelt's warnings regarding powerful corporate entities that threatened the "very foundations of Democracy."[45]

Historical corporatocracies

Several companies that typify corporatocracy power structures are listed below by incorporation date:

India

- 1600: Company rule in India by the British East India Company

- 1602: Dutch East India Company

- 1616: Danish East India Company

- 1664: French East India Company

Caribbean

- 1621: Dutch West India Company

- 1671: Danish West India Company

- 1674: French West India Company

Canada

- 1670: The Hudson's Bay Company which operated as not only a monopoly, but the de facto government, in parts of North America which would later become Canada and the United States

Africa

- 1672: Compagnie du Sénégal

- 1879: International Association of the Congo

- 1889: Company rule in Rhodesia by the British South Africa Company

Central America

- 1899: United Fruit Company (which later became Chiquita Brands International), operating as a banana republic in Guatemala, Costa Rica, and Honduras

- 1924: Standard Fruit Company (which later became Dole Food Company), operating as a banana republic in Honduras and other countries

Corporations have held the right to vote in some jurisdictions. For example, Livery Companies currently appoint most of the voters for the City of London Corporation, which is the municipal government for the area centered on the financial district.

Fictional corporatocracies

- Cloud Atlas

- Continuum

- The Caldari State of EVE Online

- Jennifer Government

- MaddAddam Trilogy

- Omni Consumer Products

- Rollerball

- Buy n Large in the Pixar film WALL-E

- War, Inc.

- Weyland-Yutani of the Alien franchise

- The Conglomerate, from Mirror's Edge Catalyst

- The United States Government in Marvel 2099*

- Snow Crash

- The Confederacy of Independent Systems in Star Wars

- The Kel-Morian Combine, from the Starcraft universe

- Vault-Tec Corporation, from Fallout universe

See also

- Anti-corporate activism

- Banana republic

- Capitalist state

- Conflict theories

- Corporate capitalism

- Corporate crime

- Corporate republic

- Corporate statism

- Corporate scandal

- Crony capitalism

- Elite theory

- Fascism

- Inverted totalitarianism

- Megacorporation

- Military–industrial complex

- Neo-feudalism

- Oligarchy

- Plutocracy

- The powers that be (phrase)

- Proprietary colony

- Socialism for the rich and capitalism for the poor

- State monopoly capitalism

- Too big to fail

- Works

- The Corporation (film)

- The Power Elite (book)

- Zeitgeist: The Movie

References

- ↑ "Corporatocracy". Oxford Dictionaries. Retrieved May 29, 2012.

/ˌkôrpərəˈtäkrəsē/ .... a society or system that is governed or controlled by corporations:

- 1 2 Jamie Reysen (October 4, 2011). "At Boston's Dewey Square, a protest of varied voices". Boston Globe. Retrieved 2012-01-04.

... Corporatocracy is the new Fascism ...

- ↑ Will Storey (October 6, 2011). "D.C. Occupied, More or Less". The New York Times. Retrieved 2012-01-04.

... we’ve surrendered our nation to a corporatocracy ...

- ↑ Linda A. Mooney; David Knox; Caroline Schacht (2009). Understanding Social Problems. Cengage Learning. p. 256. ISBN 9780495504283.

- ↑ Bruce E. Levine (March 16, 2011). "The Myth of U.S. Democracy and the Reality of U.S. Corporatocracy". Huffington Post. Retrieved 2012-01-10.

Americans are ruled by a corporatocracy: a partnership of "too-big-to-fail" corporations, the extremely wealthy elite, and corporate-collaborator government officials.

- ↑ David Sirota (November 17, 2010). "The Most Honest -- and Disturbing -- Admission About the Corporatocracy I've Ever Seen". Huffington Post. Retrieved 2012-01-04.

- ↑ Will Oremus (Oct 19, 2011). "OWS Protesters May Demand "Robin Hood" Tax: The magazine that sparked the protests calls for a 1-percent levy on financial transactions.". Slate Magazine. Retrieved 2012-01-04.

- ↑ Scott Manley (March 3, 2011). "Letters to the editor: Union busting". Pittsburgh Post-Gazette. Retrieved 2012-01-04.

- ↑ Robert Koehler (December 18, 2011). "The language of empire: In official statements and in media reporting, continued war and ongoing American domination are a given". Baltimore Sun. Retrieved 2012-01-04.

... the corporatocracy and its subservient media. ...

- ↑ Carl Gibson (November 2, 2011). "The Corporatocracy Is the 1 Percent". Huffington Post. Retrieved 2012-01-04.

Note: spokesman and organizer for US Uncut

- ↑ Andy Webster (November 10, 2011). "Yearning to Breathe Free on the Web". The New York Times. Retrieved 2012-01-04.

- ↑ Naomi Wolf (5 November 2011). "How to Occupy the moral and political high ground: The worldwide protest can be a critical force for change if it follows some simple rules". The Guardian. Retrieved 2012-01-04.

... one per cent – a corporatocracy that, without transparency or accountability, ...

- ↑ Naomi Wolf (2011-11-01). "The people versus the police". China Daily. Retrieved 2012-01-04.

... Their enemy is a global "corporatocracy" that has purchased governments and legislatures ...

- ↑ Anita Simons (October 24, 2011). "Occupy Wall Street will go down in history". Maui News. Retrieved 2012-01-04.

... we all have different personal objectives, such as ending corporatocracy, ...

- ↑ Katy Steinmetz (November 9, 2011). "Wednesday Words: Herman's 'Cain-Wreck,' Male Cleavage and More". Time Magazine. Retrieved 2012-01-04.

...Occupy vocab: corporatocracy. ...

- 1 2 Sachs, Jeffrey (2011). The Price of Civilization. New York: Random House. pp. 105, 106, 107. ISBN 978-1-4000-6841-8.

- ↑ Doob, Christopher (2013). Social Inequality and Social Stratification (1st ed.). Boston: Pearson. p. 143.

- 1 2 John Perkins (March 2, 2011). "Ecuador: Another Victory for the People". Huffington Post. Retrieved 2012-01-04.

- 1 2 Roman Haluszka (Nov 12, 2011). "Understanding Occupy's message". Toronto Star. Retrieved 2012-01-04.

- ↑ Andy Webster (August 14, 2008). "Thoughts on a 'Corporatocracy'". The New York Times. Retrieved 2012-01-04.

- ↑ Capitalism vs Corporatism - Edmund Phelps Columbia University. January 11, 2010).

- ↑ Phelps, Edmund (August 25, 2013). Mass Flourishing: How Grassroots Innovation Created Jobs, Challenge, and Change (1st ed.). Princeton University Press. p. 392. ISBN 0691158983.

- ↑ Edward Glaeser (18 October 2013). "Book Review: 'Mass Flourishing' by Edmund Phelps". Wall Street Journal. Retrieved 21 September 2015.

- ↑ The CFO Alliance Executive Compensation Survey 2013

- ↑ We Are The 99.9%, Paul Krugman, New York Times, November 24, 2011.

- ↑ Derek Thompson. "How You, I, and Everyone Got the Top 1 Percent All Wrong". The Atlantic. Retrieved 21 September 2015.

- ↑ The Distribution of US Wealth, Capital Income and Returns since 1913, Emmanuel Saez, Gabriel Zucman, March 2014

- ↑ Phil DeMuth. "Are You Rich Enough? The Terrible Tragedy Of Income Inequality Among The 1%". Forbes. Retrieved 21 September 2015.

- ↑ Joseph E. Stiglitz. "Of the 1%, by the 1%, for the 1%". Vanity Fair. Retrieved 21 September 2015.

- ↑ "Monetary policy and long-term trends". Retrieved 21 September 2015.

- ↑ "FRED Graph". Retrieved 21 September 2015.

- ↑ Larry Summers. "Harness market forces to share prosperity". Retrieved 21 September 2015.

- ↑ Mian, Atif and, Sufi, Amir (2014). House of Debt. University of Chicago. ISBN 978-0-226-08194-6.

- ↑ "FRED Graph". Retrieved 21 September 2015.

- ↑ "Tax Inversion". BloombergView.com. Retrieved 21 September 2015.

- ↑ "Profits Without Prosperity". Harvard Business Review. Retrieved 21 September 2015.

- ↑ Harold Meyerson (26 August 2014). "In corporations, it's owner-take-all". Washington Post. Retrieved 21 September 2015.

- ↑ "US share buybacks and dividends hit record". Financial Times. Retrieved 21 September 2015.

- ↑ BEA-GDP Press Release-Q3 2014 Advance Estimate-October 30, 2014

- ↑ Cox-Stock Buybacks Expected to Jump 18% in 2015-November 11, 2014

- 1 2 "The State of Corporate Power". Transnational Institute. Retrieved 21 September 2015.

- ↑ "State of Power 2014". Transnational Institute. Retrieved 21 September 2015.

- ↑ "5-Bank Asset Concentration for United States". Retrieved 21 September 2015.

- ↑ "Unbottled Gini". The Economist. Retrieved 21 September 2015.

- ↑ Remarks by Senator Warren on Citigroup and its bailout provision. YouTube. 12 December 2014. Retrieved 21 September 2015.

External links

- lecture on Corporatocracy John Perkins lecture on Corporatocracy

- Teaching for Democracy in an Age of Corporatocracy by Christine E. Sleeter, Teachers College, Columbia University.

- Crimes of Globalization: The Impact of U.S. Corporatocracy in Third World Countries by John Flores-Hidones