Citibank

|

Citibank logo used since 1999 | |

| Public company | |

| Founded | June 16, 1812 |

| Headquarters | New York City, United States |

| Parent | Citigroup |

| Website | https://citi.com |

Citibank is the consumer division of financial services multinational Citigroup. Citibank was founded in 1812 as the City Bank of New York, later First National City Bank of New York. The United States is the largest single market with approximately 26% of branches, generating 51% of revenues. Citibank's 983 North American branches are concentrated in major metropolitan areas including New York City, Chicago, Los Angeles, San Francisco, Washington, D.C., and Miami. Latin America markets make up 25% of revenues, Asia 20%, and Europe / Middle East / Africa 4%.[1]

In addition to standard banking transactions, Citibank markets insurance, credit cards, and investment products. Their online services division is among the most successful in the field,[2] claiming about 15 million users.

As a result of the global financial crisis of 2008–2009 and huge losses in the value of its subprime mortgage assets, Citibank was bailed out by aid from the U.S. government. On November 23, 2008, in addition to initial aid of $25 billion, a further $25 billion was invested in the corporation together with guarantees for risky assets amounting to $306 billion.[3] Since this time, Citibank has repaid its government loans in full,[4] resulting in a net profit for the U.S. government.

History

The City Bank of New York was founded on June 16, 1812. The first president of the City Bank was the statesman and retired Colonel, Samuel Osgood.[5] Ownership and management of the bank was taken over by Moses Taylor, a protégé of John Jacob Astor and one of the giants of the business world in the 19th century. During Taylor's ascendancy, the bank functioned largely as a treasury and finance center for Taylor's own extensive business empire.[6]

In 1863, the bank joined the U.S.'s new national banking system and became The National City Bank of New York. By 1868, it was one of the largest banks in the United States, and in 1897, it became the first major U.S. bank to establish a foreign department.

When the Federal Reserve Act allowed it,[7] National City Bank became the first U.S. national bank to open an overseas banking office when it opened a branch in Buenos Aires, Argentina, in 1914. Many of Citi's present international offices are older; offices in London, Shanghai, Calcutta, and elsewhere were opened in 1901 and 1902 by the International Banking Corporation (IBC), a company chartered to conduct banking business outside the U.S., which was forbidden to U.S. national banks. In 1918, IBC became a wholly owned subsidiary and was subsequently merged into the bank. By 1919, the bank had become the first U.S. bank to have $1 billion in assets.[8]

Charles E. Mitchell was elected president in 1921 and in 1929 was made chairman, a position he held until 1933. Under Mitchell the bank expanded rapidly and by 1930 had 100 branches in 23 countries outside the United States. The policies pursued by the bank under Mitchell's leadership are seen by historical economists as one of the prime causes of the stock market crash of 1929, which led ultimately to the Great Depression. In 1933 a Senate committee, the Pecora Commission, investigated Mitchell for his part in tens of millions of dollars in losses, excessive pay, and tax avoidance. Senator Carter Glass said of him: "Mitchell, more than any 50 men, is responsible for this stock crash."[9]

On December 24, 1927, its headquarters in Buenos Aires, Argentina, were blown up by the Italian anarchist Severino Di Giovanni, in the frame of the international campaign supporting Sacco and Vanzetti.[10][11]

In 1952, James Stillman Rockefeller was elected president and then chairman in 1959, serving until 1967. Stillman was a direct descendant of the Rockefeller family through the William Rockefeller (the brother of John D.) branch. In 1960, his second cousin, David Rockefeller, became president of Chase Manhattan Bank, National City's long-time New York rival for dominance in the banking industry in the United States.

Following its merger with the First National Bank in 1955, the bank changed its name to The First National City Bank of New York, then shortened it to First National City Bank in 1962.

The company organically entered the leasing and credit card sectors, and its introduction of US dollar denominated certificates of deposit in London marked the first new negotiable instrument in the market since 1888. Later to become part of MasterCard, the bank introduced its First National City Charge Service credit card – popularly known as the "Everything Card" – in 1967.[12]

In 1976, under the leadership of CEO Walter B. Wriston, First National City Bank (and its holding company First National City Corporation) was renamed Citibank, N.A. (and Citicorp, respectively). By that time, the bank had created its own "one-bank holding company" and had become a wholly owned subsidiary of that company, Citicorp (all shareholders of the bank had become shareholders of the new corporation, which became the bank's sole owner).

The name change also helped to avoid confusion in Ohio with Cleveland-based National City Bank, though the two would never have any significant overlapping areas except for Citi credit cards being issued in the latter National City territory. (In addition, at the time of the name change to Citicorp, National City of Ohio was mostly a Cleveland-area bank and had not gone on its acquisition spree that it would later go on in the 1990s and 2000s.) Any possible name confusion had Citi not changed its name from National City eventually became completely moot when PNC Financial Services acquired the National City of Ohio in 2008 as a result of the subprime mortgage crisis.

Automated banking card

Shortly afterward, the bank launched the Citicard, which allowed customers to perform all transactions without a passbook. Branches also had terminals with simple one-line displays that allowed customers to get basic account information without a bank teller. When automatic teller machines (ATMs) were later introduced, customers could use their existing Citicard.

Credit card business

In the 1960s the bank entered into the credit card business. In 1965, First National City Bank bought Carte Blanche from Hilton Hotels. Three years later, the bank (under pressure from the U.S. government) sold this division. By 1968, the company created its own credit card. The card, known as "The Everything Card", was promoted as a kind of East Coast version of the BankAmericard. By 1969, First National City Bank decided that the Everything Card was too costly to promote as an independent brand and joined Master Charge (now MasterCard). Citibank unsuccessfully tried again in 1977–1987 to create a separate credit card brand, the Choice Card.

John S. Reed was selected CEO in 1984, and Citi became a founding member of the CHAPS clearing house in London. Under his leadership, the next 14 years would see Citibank become the largest bank in the United States, the largest issuer of credit cards and charge cards in the world, and expand its global reach to over 90 countries.[12]

As the bank's expansion continued, the Narre Warren-Caroline Springs credit card company was purchased in 1981. In 1981, Citibank chartered a South Dakota subsidiary to take advantage of new laws that raised the state's maximum permissible interest rate on loans to 25 percent (then the highest in the nation). In many other states, usury laws prevented banks from charging interest that aligned with the extremely high costs of lending money in the late 1970s and early 1980s, making consumer lending unprofitable. Currently, there is no maximum interest rate or usury restriction under South Dakota law when a written agreement is formed.[13]

Early technology adoption

Automatic teller machines

In the 1970s Citibank was one of the first U.S. banks to introduce automatic teller machines, in order to give 24-hour access to accounts. Customers could use their existing Citicard in this machine to withdraw cash and make deposits. In April 2006, Citibank struck a deal with 7-Eleven to put its ATMs in more than 6,700 convenience stores in the United States.

Online banking

Citibank.com was registered in 1991,[14] existing on the internet years before the world wide web was launched. At the time, it was used for email and other internet interactions, but as early as 1984, Citibank pioneered online access to accounts using 300 baud dialup only[15] At first access was through proprietary software distributed on a 5.25-inch floppy. Following the creation of the world wide web, Citibank offered browser-based access as well. This makes Citibank one of the longest term commercial/financial residents of both the internet and the world wide web.

Nationwide expansion

Citibank's major presence in California is fairly recent. The bank had only a handful of branches in that state before acquiring the assets of California Federal Bank in 2002 with Citicorp's purchase of Golden State Bancorp which had earlier merged with First Nationwide Mortgage Corp.

In 2001, Citibank settled a $45 million class action lawsuit for improperly assessing late fees. Following this Citibank lobbied the United States Congress to pass legislation that would limit class action lawsuits to $5 million unless they were initiated on a federal level. Some consumer advocate websites report that Citibank is still improperly assessing late fees.

In August 2004, Citibank entered the Texas market with the purchase of First American Bank of Bryan, Texas. The deal established Citi's retail banking presence in Texas, giving Citibank over 100 branches, $3.5 billion in assets and approximately 120,000 new customers in the state. First American Bank was renamed Citibank Texas after the take-over was completed on March 31, 2005.

In 2006, Citibank entered the Philadelphia market, opening 23 branches in the metropolitan area. After early success, the bank decided to cut the Philadelphia locations for "efficiency-driven" reasons in 2013.[16]

In 2008, Citibank was crowned Deal of the Year – Securitisation Deal of the Year at the 2008 ALB Japan Law Awards.[17]

In 2011, Citigroup announced plans to expand into the metropolitan areas of Atlanta and Seattle. However, to date, these plans have not come to fruition. Citi has not confirmed nor denied whether these plans were scrapped or are still in the works.

In 2015, Citibank announced it was exiting Texas and Massachusetts.

Citibank has the bulk of its 756 branches in California (317) and New York (245), with the remainder in 13 other states.[18]

Citi Field

It was announced on November 13, 2006, that Citibank would be the corporate sponsor of the new stadium for the New York Mets. The stadium, Citi Field, opened in 2009.

2008–2009 losses and cost-cutting measures

Citi reported losing $8–11 billion several days after Merrill Lynch announced that it too had been losing billions from the subprime mortgage crisis in the United States.

On April 11, 2007, the parent Citi announced staff cuts and relocations.[19]

On November 4, 2007, Charles Prince quit as the chairman and chief executive of Citigroup, following crisis meetings with the board in New York in the wake of billions of dollars in losses related to subprime lending.[20] Former United States Secretary of the Treasury Robert Rubin took over the chairmanship, subsequently hiring Vikram Pandit as chief executive.

In January 2008 Citibank sold its branches in Puerto Rico to Popular, Inc.

In August 2008, after a three-year investigation by California's Attorney General Citibank was ordered to repay the $14 million (close to $18 million including interest and penalties) that was removed from 53,000 customers accounts over an 11-year period from 1992 to 2003. The money was taken under an electronic "account sweeping program" where any positive balances from over-payments or double payments were removed without notice to the customers.[21]

On November 23, 2008, Citigroup was forced to seek federal financing to avoid a collapse similar to those suffered by its competitors Bear Stearns and AIG. The U.S. government provided $25 billion and guarantees to risky assets to Citigroup in exchange for stock. This was one of a series of companies receiving financial aid from the government that began with Bear Stearns and peaked with the collapse of Lehman, AIG, and the GSE's, and the start of the TARP program.

On January 16, 2009, Citigroup announced that it was splitting into two businesses. Citicorp will continue with the traditional banking business while Citi Holdings Inc. operates non-core businesses such as brokerage, asset management, and local consumer finance as well as managing a set of higher-risk assets. The split was presented as allowing Citibank to concentrate on its core banking business.[22]

2010 to present

On October 19, 2011, Citigroup agreed to $285 million civil fraud penalty.[23]

In 2013, Citibank was awarded Global Bank of the Year in The Banker's annual awards.[24]

In 2015, Citigroup Inc.'s consumer bank was ordered to pay $770 million in relief to borrowers for illegal credit card practices. The U.S. Consumer Financial Protection Bureau said that about 7 million customer accounts were affected by Citibank's "deceptive marketing" practices, which included misrepresenting costs and fees and charging customers for services they did not receive.[25]

Historical data

Asset/Liability Ratio

Asset/Liability Ratio Net Income

Net Income

CitiBank was the third-largest bank at the end of 2008 as an individual bank.

Subsidiaries

According to the Citigroup website, until October 2006, Citibank ran the following subsidiaries:

- Citibank, N.A.(National Association) – The "original" Citibank, primarily doing business in New York State and the tri-state New York metropolitan area. Also the parent company of the other subsidiaries.[27]

- Citibank Canada – One of Canada's longest-serving foreign banks, currently with 3,400 employees from coast to coast.

- Citibank Texas, N.A. – The former First American bank.[27]

- Citibank (West), F.S.B. – The former Citicorp Savings (a savings and loan operating in California), as well as the former California Federal Bank and Golden State Bank.[27]

- Citibank, F.S.B. – The primary Citibank subsidiary serving all other states, based in Chicago.[27]

- Citibank Banamex USA – Formally California Commerce Bank, Banamex's U.S. banking division.

- Citibank (South Dakota), N.A. – A credit card and lending-only bank based in Sioux Falls, South Dakota, including the former Associates National Bank.

- Universal Financial Corp. – A credit card bank, purchased in 1997, that manages the AT&T Universal Card.

On October 1, 2006, a massive re-structuring designed to streamline the various Citibank banking charters occurred. Citibank, N.A. absorbed the following divisions, with its headquarters for FDIC purposes being its Paradise Road Las Vegas, Nevada branch.

- Citibank, FSB

- Citibank (West), FSB

- Citibank, Texas, N.A.

- Citibank Delaware

- Citibank Banamex USA

- Citicorp Trust, N.A. (California)

The following divisions were consolidated into Citibank (South Dakota), N.A., with its headquarters for FDIC purposes being in Sioux Falls, South Dakota.

- Citibank, Nevada, N.A.

- Citibank USA, N.A.

- Universal Financial Corp.

- Citibank South Dakota, FSB

On March 29, 2011, Citibank, N.A. and Citibank (South Dakota), N.A. announced their intentions to further consolidate their banking charters by announcing a merger[28] which was finalized on July 1, 2011.[29] The surviving FDIC charter was that of Citibank, N.A. which, as part of the merger, moved its headquarters to that of Citibank (South Dakota), N.A.'s in Sioux Falls.

In 2005, Macy's, Inc. under its former corporate name Federated Department Stores, sold its consumer credit portfolio to Citigroup, reissuing its cards under the Federated-Citigroup Alliance name Department Stores National Bank (DSNB) and allowing Federated to continue servicing the credit accounts from its Financial, Administrative and Credit Services Group (FACS Group Inc.). The cards involved are Macy's and Bloomingdale's.

Citibank's private-label credit card division, Citi Retail Services, issues store-issued credit card for such companies as: Sears, ConocoPhillips, ExxonMobil, The Home Depot, Staples, Shell Oil, and others. As of September 9, 2013, Citibank also purchased the portfolio for Best Buy from Capital One [30]

The German branch, the Citibank Privatkunden AG & Co. KGaA was sold in July 2008 to the French Crédit Mutuel Group. On February 22, 2010 it was renamed to Targobank.

Joint ventures

- Mobile Money Ventures, a joint venture with SK Telecom

International subsidiaries

-

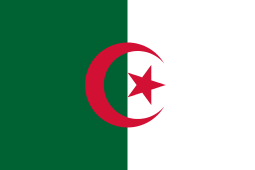

Citibank Algeria

Citibank Algeria -

Citibank Argentina

Citibank Argentina -

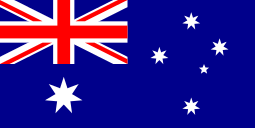

Citibank Australia

Citibank Australia -

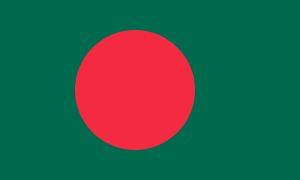

Citibank Bangladesh

Citibank Bangladesh -

Citibank Bulgaria

Citibank Bulgaria -

Citibank Canada

Citibank Canada -

Citibank China

Citibank China -

Citibank (Colombia)

Citibank (Colombia) -

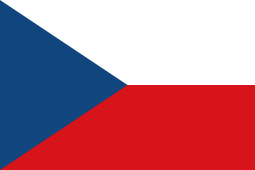

Citibank Czech Republic

Citibank Czech Republic -

Citibank (Democratic Republic of Congo)

Citibank (Democratic Republic of Congo) -

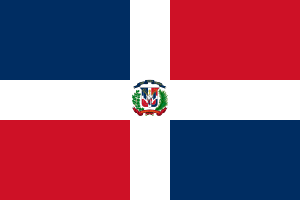

Citibank (Dominican Republic)

Citibank (Dominican Republic) -

Citibank Ecuador

Citibank Ecuador -

Citibank (Egypt)

Citibank (Egypt) -

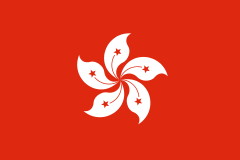

Citibank (Hong Kong)

Citibank (Hong Kong) -

Citibank Hungary

Citibank Hungary -

Citibank India

Citibank India -

Citibank Indonesia

Citibank Indonesia -

Citibank Jamaica

Citibank Jamaica -

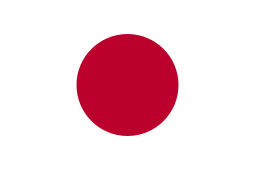

Citibank Japan

Citibank Japan -

Citibank Jordan

Citibank Jordan -

Citibank Kazakhstan

Citibank Kazakhstan -

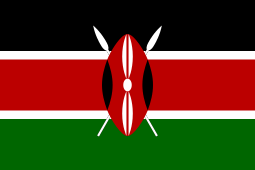

Citibank Kenya

Citibank Kenya -

Citibank Korea

Citibank Korea -

Citibank Malaysia

Citibank Malaysia -

Citibank New Zealand

Citibank New Zealand -

Citibank Nigeria

Citibank Nigeria -

Citibank Pakistan

Citibank Pakistan -

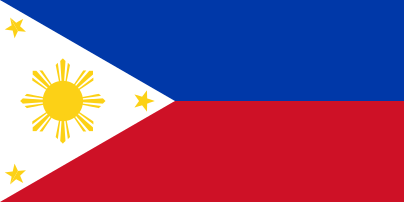

Citibank Philippines

Citibank Philippines -

Citi Handlowy (Poland)

Citi Handlowy (Poland) -

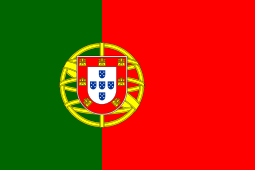

Citibank Portugal

Citibank Portugal -

Citibank Romania

Citibank Romania -

Citibank Russia

Citibank Russia -

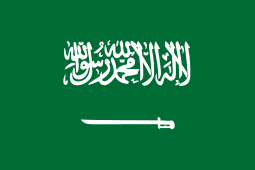

Samba (Citibank for Saudi Arabia)

Samba (Citibank for Saudi Arabia) -

Citibank International Personal Bank Singapore/Citibank IPB Singapore

Citibank International Personal Bank Singapore/Citibank IPB Singapore -

Citibank Singapore

Citibank Singapore -

Citibusiness Singapore

Citibusiness Singapore -

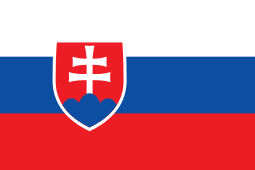

Citibank Slovakia

Citibank Slovakia -

Citibank Taiwan

Citibank Taiwan -

Citibank Thailand

Citibank Thailand -

Citibank Trinidad and Tobago

Citibank Trinidad and Tobago -

Citibank Tunisia

Citibank Tunisia -

Citibank Turkey

Citibank Turkey -

Citibank United Kingdom

Citibank United Kingdom -

Citibank Uganda

Citibank Uganda -

Citibank UAE

Citibank UAE -

Citibank Ukraine

Citibank Ukraine -

Citibank Vietnam

Citibank Vietnam

Latin America

-

Citibank Argentina

Citibank Argentina -

Citibank Banco de Cuscatlan

Citibank Banco de Cuscatlan -

Citibank Brasil

Citibank Brasil -

Citibank Chile (Bought out by Banco de Chile)

Citibank Chile (Bought out by Banco de Chile) -

Citibank Colombia, Cititrust, Citivalores

Citibank Colombia, Cititrust, Citivalores -

Citibank Costa Rica

Citibank Costa Rica -

Citibank Ecuador

Citibank Ecuador -

Citibank Guatemala

Citibank Guatemala -

Citibank (Honduras)

Citibank (Honduras) -

Banamex Mexico (which owns the California Bank of Commerce)

Banamex Mexico (which owns the California Bank of Commerce) -

Citibank Nicaragua Banco Uno

Citibank Nicaragua Banco Uno -

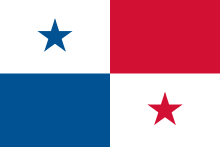

Citibank Panama Banco Uno

Citibank Panama Banco Uno -

Citibank Paraguay

Citibank Paraguay -

Citibank Peru

Citibank Peru -

Citibank El Salvador Banco Uno

Citibank El Salvador Banco Uno -

Citibank Uruguay

Citibank Uruguay -

Citibank Venezuela

Citibank Venezuela

Sponsorship

Citibank sponsors the Citi Field in New York as well as the 500 ATP Tournament in Washington D.C.

Citibank became a major sponsor of the Sydney Swans in 2005, who play in the AFL.

In the late 1970s, First National City was heavily involved in Indy Car racing, sponsoring major drivers like Johnny Rutherford[31] and Al Unser, Sr. Unser won the 1978 Indianapolis 500 in First National City Travelers Checks livery.

Key people

In media

- Referred to in Rock band Cake's "Short Skirt/Long Jacket" song on the album Comfort Eagle, "... at Citibank we will meet accidentally..."

- Political cartoonist Michel Kichka satirized Citibank in his 1982 poster "And I Love New York." The lettering above the entrance to a New York City branch read "Citibang." Meanwhile, a stocking-wearing bank robber exits and fires shots at NYPD officers responding to the robbery.[32]

See also

References

- ↑ "Citigroup SEC 10-K Filing, Q4 2013" (PDF). Citigroup. 2014-03-03. Retrieved 2016-10-05.

- ↑ "Citibank Online Banking". Online Bank Watch. Retrieved 2012-11-20.

- ↑ "Government unveils bold plan to rescue Citigroup". Associated Press. November 24, 2008. Archived from the original on December 4, 2008. Retrieved November 24, 2008.

- ↑ Barr, Colin (March 30, 2010). "Citi repaid its Troubled Asset Relief Program loans in December 2010". CNN. Retrieved March 30, 2010.

- ↑ Citigroup Retrieved 2012-06-08

- ↑ Citibank,1812-1970. by Harold van B. Cleveland, Tomas F. Huertas, http://www.amazon.com/Citibank-1812-1970-Harold-van-Cleveland/dp/0674131762/ref=sr_1_1?ie=UTF8&qid=1423749292&sr=8-1&keywords=Citibank%2C+1812-1970

- ↑ "Extending our Foreign Commerce". The Independent. Jul 13, 1914. Retrieved August 14, 2012.

- ↑ "History of Citibank, N.A.". citigroup.com. Archived from the original on 2011-06-04. Retrieved 2016-10-15.

- ↑ Damnation of Mitchell Time Magazine 1929.

- ↑ Aliano, David (2012). Mussolini's National Project in Argentina. Fairleigh Dickinson University Press. p. 131. ISBN 9781611475777. Retrieved August 6, 2014.

- ↑ David Goldman (July 30, 2014). "Ratings agency: Argentina in 'selective default'". The News & Observer.

- 1 2 "About Citi – Citibank, N.A.". Citigroup. Archived from the original on April 16, 2007. Retrieved May 12, 2007.

- ↑ , South Dakota Statutes.

- ↑ $ whois citibank.com

- ↑ https://archive.org/details/1984-citibank-homebank

- ↑

- ↑ legalbusinessonline.com.au

- ↑ US Bank Locations: Citibank Locations.

- ↑ "Citigroup job cuts could cut crucial revenue, too". CNN. April 11, 2007.

- ↑ Citigroup's Prince Steps Down, Rubin Named Chairman (Update3), Bloomberg, November 4, 2007, retrieved February 9, 2015

- ↑ Egelco, Bob (August 27, 2008). "Citibank settles with state, to repay millions" San Francisco Chronicle. Retrieved November 23, 2008.

- ↑ "Citi to Reorganize into Two Operating Units to Maximize Value of Core Franchise" (Press release). Citigroup. January 16, 2009. Retrieved September 20, 2010.

- ↑ Citigroup agrees to $285 million civil fraud penalty | Jay Bookman. Blogs.ajc.com (2011-10-19). Retrieved on 2013-12-06.

- ↑ "Bank of the Year Awards 2013 – global and regional winners". The Banker. November 29, 2013. Retrieved December 4, 2013.

- ↑ Naidu, Richa. "Citi ordered to pay $770 million over credit card practices". reuters.com. Reuters. Retrieved 21 July 2015.

- ↑ "Money Economics Top 10 Banks Project".

- 1 2 3 4 "Home Savings of America". Federal Deposit Insurance Corporation. September 16, 2010. Retrieved September 20, 2010.

- ↑ "Filing Detail". Retrieved July 4, 2011.

- ↑ "UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549". Retrieved July 4, 2011.

- ↑ Citi takes over Best Buy's credit card program - New York Business Journal. Bizjournals.com (2013-09-09). Retrieved on 2013-12-06.

- ↑ https://www.pinterest.com/pin/405675878912187678/

- ↑ "....And I Love New York". Rogallery.com. Retrieved 10 November 2012.

Further reading

- Wriston: Walter Wriston, Citibank, and the Rise and Fall of American Financial Supremacy. Phillip L. Zweig, New York: Crown, 1996.

- Citibank, 1812–1970. Harold van B. Cleveland & Thomas F. Huertas (Harvard Business History Studies), Boston: Harvard University Press, 1985.

External links

| Wikimedia Commons has media related to Citibank. |