Federal political financing in Canada

The fair and transparent financing of political parties, candidates, and election campaigns is a key determinant in the health and proper functioning of a democracy. How political parties and candidates at the federal level are funded in Canada is described by issues such as funding mechanisms, relative levels of public and private funding, levels of democratic participation, and questions of fairness and transparency.[1][2][3][4][5][6]

Overview

Canada's federal political parties receive the most significant portion of public funding at election times that is based on what they have spent through electoral expense reimbursements.[7]

Between elections, Canada's federal political parties have as their two primary sources of funding:[7][8]

- Political contributions from individuals subsidized through tax credits – allocated according to monetary contributions.

- Per-vote subsidies – allocated according to the votes of Canadians.

These sources of funding determine, along with loans and secondary revenue sources, how much money the federal political parties have available to spend.[7][9]

| Subsidized political contributions | Per-vote subsidy | Total | |

|---|---|---|---|

| Party level | Riding level | ||

| $33.3 million | $12.7 million | $27.7 million | $73.7 million |

| $46 million | |||

| 62.4% | 37.6% | 100% | |

(Source: Elections Canada[10])

Public funding

Public funding of Canada's federal political parties is allocated in two ways:[6][7][9]

- Per-vote subsidies (2004 to 2015) - allocated according to the votes of Canadians.

- Electoral expense reimbursements - reimbursements allocated according to party spending during election periods.

The per-vote subsidy (amounting to $27.7 million in 2009), also referred to as the "government allowance", the "quarterly allowance", or the "direct public subsidy", was argued by some political commentators to be the most democratic of the three funding mechanisms: The choices of 100% of voters of eligible parties (13,675,146 individual Canadians or 99% of all valid votes in the preceding election) are taken into account, all on an equal-basis.[6][7][10][11][12][13][14]

While some argue that political contributions are democratic by virtue of being completely voluntary, statistics show that upper income individuals make the large majority of political contributions and stand to gain the most by way of tax incentives for those contributions.

The electoral expense reimbursement, which accounts for the largest part of the public financing following an election ($54 million in 2009), reimburses 50%-60% of a party's expenses on elections - the more a party spends during an election, the more public funds they get back.[7][9]

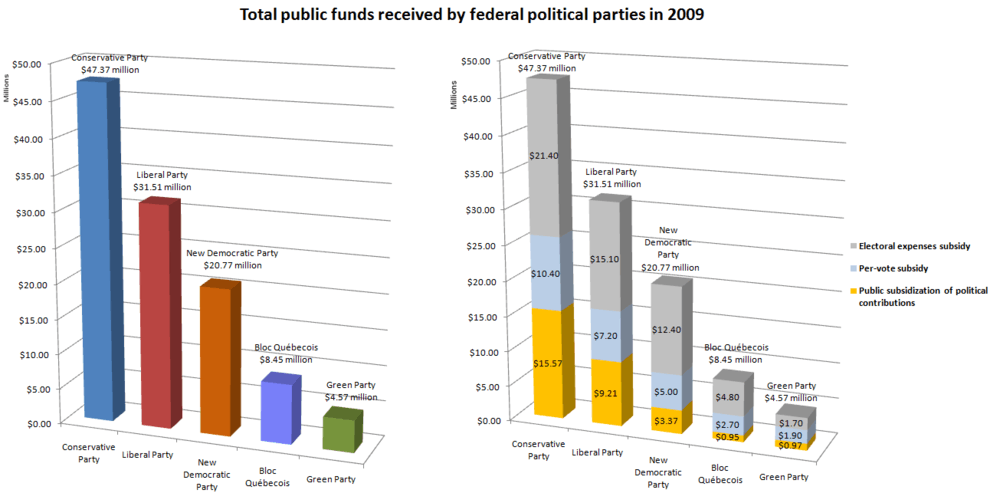

| Political party | Electoral expense reimbursements | Per-vote subsidy | Total public funding | ||

|---|---|---|---|---|---|

| Conservative Party | $21.4 | $10.4 | $15.57 | $47.37 | 42.0% |

| Liberal Party | $15.1 | $7.2 | $9.21 | $31.51 | 28.0% |

| New Democratic Party | $12.4 | $5.0 | $3.37 | $20.77 | 18.4% |

| Bloc Québécois | $4.8 | $2.7 | $0.95 | $8.45 | 7.5% |

| Green Party | $1.7 | $1.9 | $0.97 | $4.57 | 4.1% |

| Total (top 5 parties) | $55.4 | $27.2 | $30.07 | $112.7 | |

| Percentage of the overall public funding | 49% | 24% | 27% |

(Tax credits approximate. Electoral expenses reimbursements include estimated riding/candidate level reimbursements. Sources: Elections Canada, Globe and Mail[7][10])

Per-vote subsidy to 2015

Until 2015, for each registered federal political party that received at least 2% of all valid votes in the preceding general election or at least 5% of the valid votes in the electoral districts in which it had a candidate, the per-vote subsidy, also referred to as the "government allowance", gave the party an inflation-indexed subsidy each year of $2.04 per vote received in the preceding election.[7]

The per-vote subsidy was removed in stages after the passing of the Keeping Canada’s Economy & Jobs Growing Act, a bill introduced by the Conservative Party in October 2011.[15]

Previous to 2015:

Of the three ways in which federal parties are allocated public funding, many on the political left claim the per-vote subsidy is largely seen as the most democratic. 100% of the voters of eligible parties (99% of all voters in the preceding election) have a say, with their input treated on equal basis (1 voter, 1 vote).[2][3][4][5][6][7][11][12][14][16][17]

The subsidy entered into effect on January 1, 2004, at $1.75 per vote (indexed to the Consumer Price Index) as part of a set of amendments made by the Jean Chrétien government to the Canada Elections Act which for the first time set limits on political contributions by individuals and organizations (corporations, unions, non-profit groups). The per-vote subsidy was introduced to replace the reliance of political parties and candidates on corporate, union, and wealthy donors in order to reduce the political influence of such donors.[2][5][18]

The subsidy was reduced to $1.53 by the Harper government on April 1, 2012, and was reduced on each subsequent April 1, until its elimination in 2015.[14]

Public subsidy of contributions

Political contributions are publicly subsidized via a personal income tax credit that credits 75% of the first $400 contributed, 50% of the amount between $400 and $750, and 33.33% of the amount over $750, up to a maximum tax credit of $650 (reached when contributions by an individual total $1,275 in one calendar year.) For the current maximum political contribution of $1,100 that can be given to the national organization of each party, the tax credit is $591.67, representing a subsidy of 53.79%.[5][9][19][20]

| Political party | Party level | Riding level | Total | ||||

|---|---|---|---|---|---|---|---|

| Contributions received | Number of contributors | Percentage of contributors | Contributions received | Number of contributors | Percentage of contributors | Contributions received | |

| Conservative Party | $17,702,201.05 | 101,385 | 55.75% | $5,646,513.18 | 41,227 | 43% | $23,348,714.23 |

| Liberal Party | $9,060,916.11 | 37,876 | 20.83% | $4,760,216.56 | 30,426 | 31% | $13,821,132.67 |

| New Democratic Party | $4,008,521.11 | 23,704 | 13.03% | $1,046,588.50 | 11,484 | 12% | $5,055,109.61 |

| Green Party | $1,123,094.64 | 9,115 | 5.01% | $331,588.29 | 5,551 | 6% | $1,454,682.93 |

| Bloc Québécois | $621,126.24 | 6,052 | 3.33% | $805,538.64 | 7,297 | 8% | $1,426,664.88 |

| Christian Heritage Party | $284,420.20 | 953 | 0.52% | $102,147.66 | 751 | 1% | $386,567.86 |

| Animal Alliance Environment | $292,950.20 | 1,816 | 1.00% | $0.00 | 0 | 0% | $292,950.20 |

| Communist Party | $88,184.44 | 628 | 0.35% | $0.00 | 0 | 0% | $88,184.44 |

| Marxist-Leninist Party | $39,130.00 | 85 | 0.05% | $0.00 | 0 | 0% | $39,130.00 |

| Rhinoceros Party | $13,950.00 | 19 | 0.01% | $0.00 | 0 | 0% | $13,950.00 |

| People's Political Power Party | $13,288.00 | 20 | 0.01% | $0.00 | 0 | 0% | $13,288.00 |

| Canadian Action Party | $10,635.00 | 63 | 0.03% | $0.00 | 0 | 0% | $10,635.00 |

| Libertarian Party of Canada | $6,587.44 | 40 | 0.02% | $0.00 | 0 | 0% | $6,587.44 |

| Western Block Party | $5,260.00 | 56 | 0.03% | $0.00 | 0 | 0% | $5,260.00 |

| Progressive Canadian Party | $5,018.00 | 40 | 0.02% | $2,774.00 | 24 | 0% | $7,792.00 |

| Marijuana Party | $2,610.00 | 6 | 0.00% | $700.00 | 2 | 0% | $3,310.00 |

| Total | $33,277,892.43 | 181,858 | 100% | $12,696,066.83 | 96,762 | 100% | $45,973,959.26 |

(Source: Elections Canada, Statement of Contributions Received, Part 2a[10])

(Note: The actual numbers of unique individual contributors are likely to be less than the totals shown as multiple anonymous contributions of under $20 by the same person are counted as separate contributors, and contributions made by the same person to both the riding level and at the party level, to different ridings, and/or to different parties are also all counted as separate contributors.)

Electoral expense reimbursement

When an election takes place, perhaps the most significant source of public funding for the federal political parties is the election expenses reimbursement which subsidizes 50% of the national campaign expenses of any party that obtains at least 2 per cent support, or at least 5 per cent in the ridings (electoral districts) in which they presented candidates. In addition to this, the parties' riding organizations are also reimbursed 60% of all expenses incurred by their candidates in each riding where they obtained at least 10% of the votes, plus 100% of allowable "personal expenses". The reimbursements are also referred to as "government rebates", "government transfers", or "election rebates".[7]

Under this subsidy, the more a party spends, the more they are subsidized. The subsidy therefore magnifies the public funds allocated by tax credits on political contributions and by the per-vote subsidies. It also means that loans to political parties and their candidates can play a significant role in determining how much public money is received by the parties.[7]

During the 2008 election, the Conservatives spent the most, and, as a result, received the largest reimbursements under this public subsidy in 2009.[7]

| Political party | National expense reimbursements received | Riding expense reimbursements received | Total expense reimbursements | Share of the reimbursements to top 5 parties |

|---|---|---|---|---|

| Conservative Party | $9.7 | $11.7 | $21.4 | 39% |

| Liberal Party | $7.3 | $7.8 | $15.1 | 27% |

| New Democratic Party | $8.4 | $4.1 | $12.4 | 23% |

| Bloc Québécois | $2.4 | $2.4 | $4.8 | 9% |

| Green Party | $1.1 | $0.6 | $1.7 | 3% |

| Total (top 5 parties) | $28.90 | $26.60 | $55.5 | |

| (Riding expense reimbursements estimated. Source: Globe and Mail[7]) | ||||

Distribution of public funding amongst parties

Private funding

Private funding of the federal political parties occurs through political contributions made by individuals, but these contributions are vastly subsidized by public funds disbursed through tax credits.

For political contributions up to $400, the tax credit is 75%.[6][7]

In 2009, the maximum yearly contribution limit was $1,100 to a given federal political party and $1,100 to a given party's riding associations. For that maximum contribution limit of $1,100, the tax credit is $591.67, representing a subsidy of 53.79%.[9]

Of the $46 million in political contributions received in 2009 by federal party organizations and riding associations, between $28.5 million and $31 million of the contributions was publicly funded - through tax credits amounting to between 62% and 67.5% - while between $15 million and $17.5 million was net private funding.[10]

| Political party | Total net private funding received ($Mil) | Total public funding received ($Mil) | Total funding received ($Mil) | % private | % public | Votes received in 2008 | Public funding per vote received (in $'s) | Share of the vote (in 2008) | Share of the public funding of top 5 parties |

|---|---|---|---|---|---|---|---|---|---|

| Conservative Party | $7.78 | $47.37 | $55.15 | 14.11% | 85.89% | 5,208,796 | $9.09 per vote | 37.65% | 42.04% |

| Liberal Party | $4.61 | $31.51 | $36.12 | 12.76% | 87.24% | 3,633,185 | $8.67 per vote | 26.26% | 27.97% |

| New Democratic Party | $1.69 | $20.77 | $22.46 | 7.52% | 92.48% | 2,515,561 | $8.26 per vote | 18.18% | 18.43% |

| Bloc Québécois | $0.48 | $8.45 | $8.93 | 5.38% | 94.62% | 1,379,991 | $6.12 per vote | 9.98% | 8% |

| Green Party | $0.48 | $4.57 | $5.05 | 9.50% | 90.50% | 937,613 | $4.87 per vote | 6.78% | 4.06% |

| Total (top 5 parties) | $15.04 | $112.67 | $127.71 | 11.78% | 88.22% | 13,675,146 | $8.24 per vote |

(Public funding includes electoral expenses reimbursements. Tax credits estimated. Sources: Elections Canada, Globe and Mail[7][10])

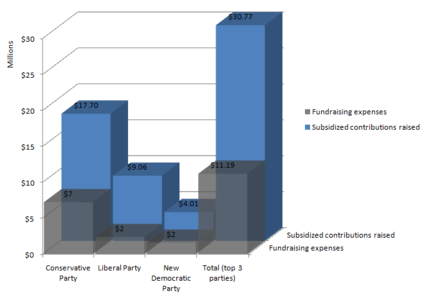

Cost of fundraising

In order to solicit political monetary contributions, fundraising is a major focus for many parties that involves hiring fundraising experts, and employing sophisticated database systems, email lists, newsletters, and telemarketing.[8][13][22][23]

The Conservative Party, for example, is reported to make phone calls or send letters to about 200,000 people a month, and conducts surveys to collect and feed information on the views of individuals into its database referred to as CIMS, an acronym for "Constituent Information Management System". The information stored in the database is then used to customize mailings and phone calls for each targeted donor to appeal to them specifically on issues that they are known to react more strongly to.[22][23]

Other associated overhead for fundraising include legal consultation, processing, accounting, auditing, and reporting costs.

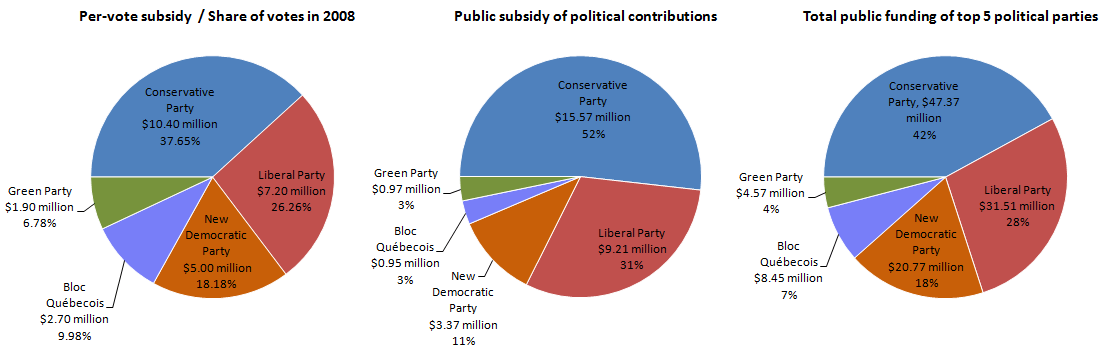

| Political party | Contributions raised | Fundraising expenses | % Overhead |

|---|---|---|---|

| Conservative Party | $17,702,201.05 | $7,222,907 | 40.80% |

| Liberal Party | $9,060,916.11 | $2,377,395 | 26.24% |

| New Democratic Party | $4,008,521.11 | $1,594,566 | 39.78% |

| Total (top 3 parties) | $30,771,638.27 | $11,194,868.00 | 36.38% |

(Sources: Elections Canada, Globe and Mail[10][22][24])

In 2009, the overhead cost of fundraising for the top three parties exceeded the net private funds they raised. They spent a combined $11.2 million on fundraising at the party level (riding-level expenses not included), according to their 2009 annual party returns, to raise approximately $10.3 million in net private funds.[10]

The corrupting influence of fundraising

In 2006, it was revealed during the Liberal leadership contest that one candidate, Joe Volpe, had received a total of $108,000 in contributions from 20 individuals that were all in some way connected to the top corporate executives of Apotex Pharmaceuticals. Each of the 20 individuals - which included 11-year-old twin boys and a 14-year-old boy - gave exactly $5,400, the maximum allowed at the time.[5][25]

According to political financing expert Louis Massicotte, a political scientist from Université Laval, political systems that rely heavily on political contributions from individuals can encourage corruption. In 2010-2011, it was discovered that corporations had been funnelling money to major provincial political parties by disguising the corporate funds as individual political contributions made by their employees, circumventing the political fundraising laws. Former employees of one corporation flatly admitted that political contributions had illicitly been made in their name.[26]

At the provincial level in Quebec, the far-reaching influence of fundraisers over everything from the selection of judges to the distribution of construction contracts fuelled widespread demand for a public inquiry into political corruption, and caused the Jean Charest Liberal government and other major political parties to agree to increase the provincial per-vote subsidy as a way to reduce the influence of party bagmen (influence peddling political fundraisers) over government decisions and policies.[26]

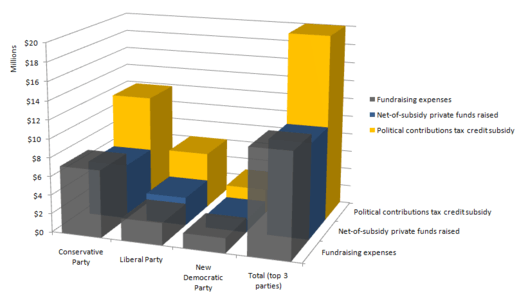

Lack of transparency

Political parties are only required to report the identities of contributors that have given a total of over $200 to one riding association or the central organization. For donations of $200 or less, receipts must be kept by the individual riding associations, but Elections Canada has no way to keep track of them. Completely anonymous contributions of $20 or less are permitted.[27][28][29]

.png)

| Party-level | Riding-level | Combined | ||||

|---|---|---|---|---|---|---|

| Number of listed contributors | 40,712 | 22.39% | 16,398 | 16.95% | 57,110 | 20.50% |

| Number of unlisted contributors of amounts of $200 or less | 139,140 | 76.51% | 51,491 | 53.21% | 190,631 | 68.42% |

| Total number of anonymous contributors of amounts of $20 or less | 2,006 | 1.10% | 28,873 | 29.84% | 30,879 | 11.08% |

| Total number of contributors | 181,858 | 96,762 | 278,620 | |||

| Total number of contributors not identified to Election Canada | 141,146 | 77.61% | 80,364 | 83.05% | 221,510 | 79.50% |

(Source: Elections Canada[10])

In 1997, Industry Minister John Manley only disclosed the identities of individuals and corporations who contributed $10,150 and $15,800, respectively, to his re-election campaign. However, he did not disclose where $74,664 - received through his riding association - had originally come from.[5][30]

In July 2002, Paul Martin refused to reveal the names of donors to his leadership campaign, claiming that new disclosure rules brought in a month earlier applied only to current cabinet and not to a former cabinet minister as he was, and that he did not think it would be fair to name people who had donated to his campaign before the new disclosure rules were in effect.[25]

In October 2002, Stephen Harper initially did not reveal the names of anyone who had donated to his leadership campaign. While he later quietly posted a few names - those of 54 donors who had given more than $1,075 each - he continued to keep secret the identities of 10 other large donors and the names of more than 9,000 donors who each gave sums of less than $1,000 each.[25]

In 2009, an annual report by Global Integrity, an independent non-profit organization that tracks corruption trends around the world, said that Canada posted a slight "downward tick" based on secrecy surrounding political financing and gaps in government accountability.[31]

According to Global Integrity, "Canada is a really interesting case" in that while, it had a generally positive rating, there are "unique gaps in the system that are strange," including the fact that political financing loans to candidates are confidential.[31]

According to Ottawa-based Democracy Watch: "Government integrity continues to be undermined by loopholes that allow secret donations to some candidates."[31]

Loopholes in contributions limits

Elections Canada confirmed in 2007 that individuals could illegally contribute as much as $60,500 over the $1,100 limit and not be detected - simply by donating $200 to each of a party's 308 riding associations.[27][28][29]

Elections Canada claimed that it currently cannot track donations of $200 or less because "we do not get the receipts" from the individual riding associations.[28] Under current regulations, a party's individual riding associations are only required to report the identities of contributors with total contributions to the riding of over $200. Contributions of $200 or less are allowed to be reported in aggregate, with no break-down by contributor required that would allow for proper cross-checking across a party's ridings associations.[27][28][29]

At the time, the NDP called for the loophole to be plugged. The Conservative government responded that "this is no more a loophole than the fact that someone can break the law by fraudulently misstating their income on their income tax." It rejected calls by the opposition for Elections Canada to be given new measures and tools to be able to detect multiple donations across a party's ridings that exceed the contribution limit.[29]

Debate over the subsidies

The Conservative Party has targeted the per-vote subsidy for elimination, while favouring the generous public subsidy of private political contributions. All of the other major Canadian parties - the Liberals, NDP, Bloc, and Green Party - oppose the elimination of the per-vote subsidy.[3][6][12][13][32][33]

The Conservative government first tried to eliminate the per-vote subsidy in November 2008, just after the federal election of October 14, 2008. He had not brought up the issue before Canadian voters during the election campaign, but on November 27 - only days into his new mandate that began November 18 - he attempted to eliminate the per-vote subsidy through a provision tucked within a fiscal update - and designated the update as a confidence motion that would trigger the fall of the government, and the prospect of another election, unless passed.[13][33][34][35][36][37][38]

The Conservative government's move was seen by opposition members and other observers as a partisan attempt to bankrupt the other political parties and further increase his own party's financial advantage, and as a direct attack on the democratic process.[2][6][8][13][16][26][33][36][37][38]

The move and its packaging as a confidence motion prompted the Liberals and the NDP to take steps toward forming a coalition government in the event the confidence motion was defeated. Suddenly faced with losing power, Harper sought the prorogation of Canada's Parliament.[13][26][33][34][35][36][37][38]

Canada's Parliament was shut down from December 4, 2008, to January 26, 2009, allowing the Conservative government to avoid the confidence vote that it would have lost, and it backtracked on its attempt to eliminate the subsidy.[36][37][38][39][40][41][42]

"His reputation as a peerless political chess-master is now somewhat in tatters, following what most perceive as an atypical near-fatal miscalculation over a Fall Economic and Fiscal Statement that lacked economic credibility and proposed the elimination of per vote subsidies for political parties. Faced with an opposition revolt, Harper first unusually retreated on the latter proposal, and then bought time by proroguing Parliament on December 4 to avoid a loss of confidence vote on December 8."

In January 2011, however, the Conservative government again brought back its aim to eliminate the per-vote subsidy, over the opposition of all the other major parties, while continuing to favour the generous public subsidy of political contributions. Prime Minister Harper stated: "There are already generous credits and incentives in the tax system to encourage people to give to political parties today." He vowed that he would make the elimination of the per-vote subsidy a campaign pledge in the next federal election.[12]

Green Party Leader Elizabeth May spoke against the attempt to eliminate the per-vote subsidy, saying that doing so would once again concentrate influence in the hands of those with deeper pockets, instead of giving voters a voice, and she stated her belief that the 2004 campaign finance reforms that introduced the per-vote subsidy are the "one area we've gotten really right" compared with the United States. Liberal deputy leader Ralph Goodale stated: "Mr. Harper’s position is, essentially, let the big and the wealthy and the most privileged run the show and all the other voices should simply be silenced."[12]

In spite of the clear opposition by the other parties, in a campaign pledge in April 2011, Stephen Harper vowed to unilaterally eliminate the per-vote subsidy if he wins a majority.[32][34] He stated: "Canadian political parties already have enormous tax advantages, there are credits when you donate to political parties, there are rebates when political parties do spending."[16]

Bloc Québécois leader Gilles Duceppe accused Harper of seeking to cripple all other parties, stating: "Its runs against democracy. Parties trying to break through, like the Greens, would have practically no means. That guy would be happy with no opposition and no Parliament."[43]

"Do we want to go back to the days where money, and those who can finance campaigns, determine the nature of our democracy?"

Other observers - including Canada's former Chief Electoral Officer Jean-Pierre Kingsley - have suggested that the subsidy of political contributions and subsidy of election expenses should also be examined, since both - to a far greater extent - have the effect of forcing taxpayers to fund parties they do not personally support.[5][6][8][34][44]

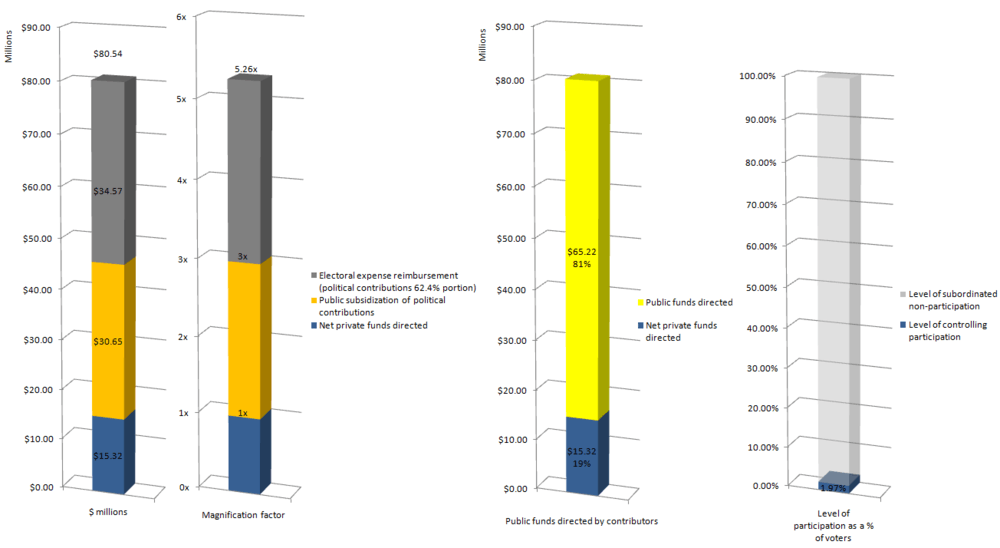

Level of participation in determining funding

In 2009, a national total of 181,858 individuals (out of 23,677,639 registered voters in 2008) made political contributions to a federal political party organization, resulting in a 0.77% fraction of registered voters directing over $33 million in subsidized contributions - almost two-thirds of it publicly funded - toward their preferred parties. Over 55% of these individuals were Conservative party supporters.[10]

A national total of 96,762 individuals also made political contributions at the riding association level to a federal political party, resulting in a 0.4% fraction of registered voters directing over $12 million in subsidized contributions - over 60% of it from public funds - toward their preferred parties.[10]

Combined, the number of unique individuals that made political contributions in 2009 to a federal political party, either at the national party organization level or riding level, or both, is somewhere between 196,186 and 278,620 individuals - representing between just 0.8% and 1.2% of the number of registered voters from 2008.[10]

Rounding to the nearest percentage, only 1% of registered voters directed $46 million - representing over 62% of the primary funding received by parties - toward their preferred party, with nearly two-thirds of that - $28.5-$31 million - in public funds directed without the consent of 99% of registered voters.[7][10]

| Funding method | Number of participants | Level of participation / % controlling (as a % of voters) | Level of non-participation / % subordinate (as a % of voters) | Net private funding | Public funding | % of the primary public funding | % of the overall primary funding of parties |

|---|---|---|---|---|---|---|---|

| Subsidized political contributions | 196,186 - 278,620 | 1.4% - 2.0% | 98% - 98.6% | $15.0-$17.5 million | $28.5-$31.0 million | 50.7% - 52.8% | 62.4% |

| Per-vote subsidy | 13,675,146 | 98.9% | 1.1% | - | $27.7 million | 47.2%- 49.3% | 37.6% |

(Source: Elections Canada[10])

Composition of participation

With the per-vote subsidy, 100% of voters of eligible parties (99% of all valid votes in 2009) participate in determining the distribution of the funds, and do so all on an equal basis. The participants are all the Canadian citizens over the age of 18 that voted in the preceding federal election, and numbered 13,675,146 Canadians in 2009.

With political contributions, the participants - numbering only a nationwide total of between 196,186 and 278,620 unique individuals in 2009, and representing less than 1.2% of the number of registered voters - tend to be individuals that have more disposable income. The poor, by and large, do not make political contributions, and, according to University of Calgary political finance expert Lisa Young, people that have more comfortable means, and that can expect to obtain a larger tax credit against their income, are more likely to make political contributions.[4][13][32]

According to McMaster University political scientist Henry Jacek, political contributions tend to come from the wealthy, and not the poor. It is also clear from other jurisdictions in the world that political donors typically are people that have more disposable income.[13][32]

While political contributions can only be made by Canadian citizens, there is no age restriction in place, which allows political contributions to be made in the name of children to bypass contribution limits.

In 2006, Liberal leadership candidate Joe Volpe returned $27,000 in political contributions that had been made in the name of children - after it was revealed that his campaign donors included 11-year-old twin boys and a 14-year-old boy who donated $5,400 each, the allowed maximum. The children and several other donors that had contributed the maximum allowable $5,400 each - for a total of $108,000 - were all in some way connected to the top corporate executives of one pharmaceutical company. No law was broken.[5][25]

Magnification of the choices of contributors

While only a tiny fraction of registered voters make political contributions, their net contributions get magnified several times over by the public subsidy of political contributions and the public subsidy of election expenses.[7][10]

Over half of all the public funding for federal parties in 2009 was effectively directed by less than 1.2% of the number of registered voters in Canada, without participation by 99% of registered voters.[7][10]

Overall, the subsidy of political contributions resulted in 64.2% of all of the funding in 2009 being directed according to the partisan preferences of less than 1.2% of registered voters.[7][10]

Consequences of eliminating the per-vote subsidy

Elimination of the per-vote subsidy, with all other things remaining equal, would mean that a very small number of individuals - somewhere between 0.8% and 1.2% of registered voters in 2009 - would control and direct 100% of all the funding to their preferred political parties and candidates.[10]

By the same token, approximately 98-99% of all registered voters would no longer have any participation in how any of the funding is directed - including having no say at all in how any of the taxpayer money involved gets allocated.[10][16]

In April 2011, Canada's former Chief Electoral Officer Jean-Pierre Kingsley, who served in the position for 17 years, stated that if the per-vote subsidy were to be eliminated, there would be an increased risk of Canada's political parties turning back toward corporations to obtain money, also to the detriment of Canadian democracy.[5]

"Parties will have to find ways of getting money. And there may well be pressure to come back to funding from corporate sources—the very things we've attempted to eliminate and have successfully eliminated. Which would bring us back to a regime where donations not by individuals but through other interests, political parties would be beholden to, other than normal Canadians."

The elimination of the per-vote subsidy could also have the effect of further reducing an already low voter turnout by removing an incentive that encourages many Canadian citizens to vote. Under the first-past-the-post system, the per-vote subsidy ensures that a voter's participation at the ballot box will at least still make a difference even if their preferred riding candidate has very little chance of winning or is assured of a win.[3]

Announced elimination of the per-vote subsidy

On May 25, 2011, just three weeks after the election that gave them majority power, the Conservatives announced that their June 6 federal budget would include the elimination of the per-vote subsidy.[37][38][45][46]

NDP leader Jack Layton voiced his opposition to the plan, saying that "it's wrong", and "opens the door for big money to come back into politics," and he worried about the impact this will have on democracy in Canada.[37][45][47]

The Conservative government's move was seen by many as motivated by a desire to destroy the Liberal party and cripple all other parties, not by concern over taxpayer dollars. According to University of Ottawa professor Errol Mendes: "You can see what's happening here, they're moving toward a process of eventually cutting the feet out from all the major opposition parties."[17][47][48][49][50]

Interim Liberal leader Bob Rae stated: "I can’t think of anything more wrong than a spirit of vindictiveness at the heart of a majority government." He said the Liberals would oppose the plan, and stated: "The notion that there’s public support for the political process and political parties is widely accepted in a great many democratic countries around the world."[17][47][48][49]

"It is a mean-spirited attempt by the Harper government to limit the resources of other parties and to create a situation where the wealthiest will have the most influence. The simple and very inexpensive per-vote subsidy is a very fair way to ensure that parties would be funded based on their popular support, allowing them the resources to represent those that support their respective views."

According to political scientist Ned Franks of Queen's University, the elimination of the per-vote subsidy will mean that political parties with a rich support base will now be far better off than parties whose supporters are poorer or who are not the type to make political donations. He stated that the move greatly favours the Conservative party: "There's only one party who benefits, and — surprise, surprise — it's the Conservatives."

Layton stated the move was anti-democratic since it would benefit parties with access to rich people, and handicap parties with a lower-income voting base. "I think that our democracy is better served if ideas have equal opportunity in the competition for Canadians' consideration, and that's what public financing is designed to do. Take away public financing and what you're basically saying is those with the best ability to raise money get to have their ideas heard, and I don't think that's helpful for a democratic society."[45][51]

See also

- The 2008–2009 Prorogation of Parliament

- Prorogation in Canada

- In and Out scandal

- Elections in Canada

- Elections Canada

- Chief Electoral Officer (Canada)

- Canadian electoral system

- Voter turnout in Canada

- Campaign finance

- Political finance

- Political party funding

- Party subsidies

- Political funding in Australia

- Party funding in Austria

- Party finance in Germany

- Political funding in Ireland

- Party funding in Israel

- Political funding in Japan

- Party funding in the Netherlands

- Political funding in New Zealand

- Party finance in Sweden

- Political funding in the United Kingdom

- Campaign finance in the United States

- Money trail

- Occupy Canada

References

- ↑ Democracy and Political Party Financing

- 1 2 3 4 Party subsidy is democracy in action

- 1 2 3 4 Don't Scrap the Voter Subsidy

- 1 2 3 Harper plan would undermine democracy

- 1 2 3 4 5 6 7 8 9 10 Political parties could be forced to return to big money corporate funding if per-vote subsidies scrapped, says Kingsley

- 1 2 3 4 5 6 7 8 Conservatives cutting wrong political subsidy

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 Per-vote subsidy but a fraction of taxpayer support for political parties

- 1 2 3 4 Expanding the debate on party financing

- 1 2 3 4 5 The Electoral System of Canada - Political financing

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 Elections Canada - Political Financing Reports and Database

- 1 2 Voter Turnout at Federal Elections and Referendums, 1867-2008

- 1 2 3 4 5 PM targets party subsidies

- 1 2 3 4 5 6 7 8 Subsides for parties, for and against

- 1 2 3 Opposition parties accept defeat on per-vote subsidy

- ↑ "Minister of Finance Introduces the Keeping Canada's Economy & Jobs Growing Act". Department of Finance Canada. Retrieved 21 September 2015.

- 1 2 3 4 Killing vote subsidy bad for democracy

- 1 2 3 4 5 Harper ‘trying to annihilate the opposition’ by killing per-vote subsidies, says Grit MP Easter

- ↑ Regulating Political Donations

- ↑ Limits on Contributions

- ↑ Political contribution tax credits

- ↑ Breakdown of Paid Election Expenses by Expense Category and Registered Political Party - 2008 General Election

- 1 2 3 Experts say Tories 'extraordinarily successful' at fundraising on wedge issues, hope and fear

- 1 2 Liberal election debacle was years in the making

- ↑ Elections Canada - Statements of Assets and Liabilities and Statements of Revenues and Expenses - 2009 Fiscal Period

- 1 2 3 4 Political contributions: money, money, money

- 1 2 3 4 Harper, Quebec differ on per-vote subsidy

- 1 2 3 Our Democracy for Sale, Still

- 1 2 3 4 Loophole tears lid off political donations

- 1 2 3 4 Ottawa refuses to close donation loophole

- ↑ Election Financing's Black Hole

- 1 2 3 Lax rules on political financing No. 1 global corruption threat: report

- 1 2 3 4 5 The per-vote subsidy: Political welfare or the great leveller?

- 1 2 3 4 Opposition outraged by party cuts

- 1 2 3 4 Defence of subsidies for political parties not a sound-bite issue

- 1 2 Harper’s plan to scrap per-vote subsidies to political parties would create two-party state, says Nanos

- 1 2 3 4 5 U.S. cables dissect Canada’s leaders: WikiLeaks

- 1 2 3 4 5 6 NDP will ‘live with’ subsidy fate

- 1 2 3 4 5 Harper to axe political subsidies

- ↑ Parliament shut down till Jan. 26

- ↑ Conservative PM Uses Rare Act To Suspend Parliament

- ↑ A Parliament of shutdowns

- ↑ Canadian Leader Shuts Parliament

- ↑ Harper vows to scrap per-vote subsidies

- ↑ Comparing the per-vote subsidies to all federal political subsidies

- 1 2 3 June 6 budget will phase out per-vote subsidy

- ↑ Opposition to contest recycled budget

- 1 2 3 Plan to phase out per-vote subsidies seen as ploy to kill Liberals

- 1 2 Tory budget to chop per-vote subsidy

- 1 2 Clement defends elimination of $2-per-vote

- ↑ Parties face first cut to per-vote taxpayer subsidy

- ↑ Budget due June 6 will phase out political subsidies

External links

- http://www.idea.int/political-finance/country.cfm?id=37

- http://www.idea.int/publications/funding-of-political-parties-and-election-campaigns/upload/foppec-p8.pdf

- "Changes needed to democratize Canada's political finance system" and 'Our Democracy for Sale, Still by Duff Conacher, Democracy Watch

- Per-vote subsidy but a fraction of taxpayer support for political parties The Globe and Mail, January 23, 2011

- Comparing the per-vote subsidies to all federal political subsidies The Hill Times, January 20, 2011

- Expanding the debate on party financing The Globe and Mail, August 12, 2010, updated January 23, 2011

-

- Elections Canada

- Political Financing

- Financial Reports Database

- Information Sheets

- Lax rules on political financing No. 1 global corruption threat: report CBC News

- Election Financing's Black Hole Maclean's Magazine

- Experts say Tories 'extraordinarily successful' at fundraising on wedge issues, hope and fear The Hill Times, November 22, 2010

- Harper, Quebec differ on per-vote subsidy The Canadian Press, April 1, 2011

- Defence of subsidies for political parties not a sound-bite issue April 2, 2011

- Campaign and Election Finance in Canada

- Democracy and Political Party Financing Chief Electoral Officer's Speech, May 2003

- Political contributions: money, money, money

- Party subsidy is democracy in action Kathleen Cross, Simon Fraser University, April 16, 2011

- Don't scrap the voter subsidy April 12, 2011

- Harper plan would undermine democracy April 13, 2011

- Political parties could be forced to return to big money corporate funding if per-vote subsidies scrapped April 11, 2011

- Conservatives cutting wrong political subsidy David Akin, June 9, 2011