James Harris Simons

| James Harris Simons | |

|---|---|

|

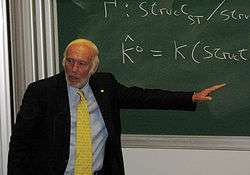

Simons speaking at the Differential Geometry, Mathematical Physics, Mathematics and Society conference in 2007 in Bures-sur-Yvette. | |

| Born |

1938 (age 77–78) Newton, Massachusetts |

| Alma mater |

MIT (BS) UC Berkeley (PhD) |

| Occupation |

Professor, Stony Brook University Founder and CEO of Renaissance Technologies |

| Known for |

Chern–Simons form Renaissance Technologies |

| Net worth |

|

| Spouse(s) |

Barbara Simons Marilyn Hawrys Simons[2] |

| Children | 3[2] |

| Parent(s) |

Matthew Simons Marcia Kantor |

| Awards | Oswald Veblen Prize (1976)[3] |

James Harris "Jim" Simons (born 1938) is an American mathematician, hedge fund manager, and philanthropist. He is a code breaker and studies pattern recognition.[4] Simons is the co-inventor, with Shiing-Shen Chern, of the Chern–Simons form - Chern and Simons (1974), and contributed to the development of string theory by providing a theoretical framework to combine geometry and topology with quantum field theory.[5] Simons was a professor of mathematics at Stony Brook University and was also the former chair of the Mathematics Department at Stony Brook.

In 1982, Simons embarked a business career where he founded Renaissance Technologies, a private hedge fund based in New York City with over $25 billion under management. Simons retired at the end of 2009 as CEO of one of the world's most successful hedge fund firms.[6] Simons' net worth is estimated to be $16.5 billion.[1]

Simons lives with his wife Marilyn H. Simons in Manhattan and Long Island, and is the father of five children; two of his children died young under tragic circumstances—a drowning and an auto crash.

Simons shuns the limelight and rarely gives interviews, citing Benjamin the Donkey in Animal Farm for explanation: "God gave me a tail to keep off the flies. But I'd rather have had no tail and no flies."[7] On October 10, 2009, Simons announced he would retire on January 1, 2010 but remain at Renaissance as nonexecutive chairman.[8]

In 2016, asteroid 6618 Jimsimons,[9] discovered by Clyde Tombaugh in 1936, was named after Simons by the International Astronomical Union in honor of his numerous contributions to mathematics and philanthropy.

Early life and education

James Harris Simons was born to a Jewish family,[10] the only child of Marcia (née Kantor)[11] and Matthew Simons, and raised in Brookline, Massachusetts.[12] His father owned a shoe factory.[13]

He received a Bachelor of Science in mathematics from the Massachusetts Institute of Technology in 1958[14] and a Ph.D., also in mathematics, from the University of California, Berkeley, under supervision of Bertram Kostant in 1961, at the age of 23.[14]

Business career

| |

|

| |

|

|

Renaissance Technologies

For more than two decades, Simons' Renaissance Technologies' hedge funds, which trade in markets around the world, have employed mathematical models to analyze and execute trades, many automated. Renaissance uses computer-based models to predict price changes in financial instruments. These models are based on analyzing as much data as can be gathered, then looking for non-random movements to make predictions.

Renaissance employs specialists with non-financial backgrounds, including mathematicians, physicists, signal processing experts and statisticians. The firm's latest fund is the Renaissance Institutional Equities Fund (RIEF).[17] RIEF has historically trailed the firm's better-known Medallion fund, a separate fund that contains only the personal money of the firm's executives.[18]

- "It's startling to see such a highly successful mathematician achieve success in another field," says Edward Witten, professor of physics at the Institute for Advanced Study in Princeton, NJ, and considered by many of his peers to be the most accomplished theoretical physicist alive... (Gregory Zuckerman, "Heard on the Street", Wall Street Journal, July 1, 2005).

In 2006, Simons was named Financial Engineer of the Year by the International Association of Financial Engineers. In 2007, he was estimated to have personally earned $2.8 billion,[19] $1.7 billion in 2006,[20] $1.5 billion in 2005,[21] (the largest compensation among hedge fund managers that year)[22] and $670 million in 2004.

Academic and scientific career

Simons' mathematical work has primarily focused on the geometry and topology of manifolds. His 1962 Berkeley PhD thesis, written under the direction of Bertram Kostant, gave a new and more conceptual proof of Berger's classification of the holonomy groups of Riemannian manifolds, which is now a cornerstone of modern geometry. He subsequently began to work with Shing-Shen Chern on the theory of characteristic classes, eventually discovering the Chern–Simons secondary characteristic classes of 3-manifolds, which are deeply related to the Yang-Mills functional on 4-manifolds, and have had a profound effect on modern physics. These and other contributions to geometry and topology led to Simons becoming the 1976 recipient of the AMS Oswald Veblen Prize in Geometry. In 2014, he was elected to the National Academy of Sciences of the USA.[23]

In 1964, Simons worked with the National Security Agency to break codes.[24] Between 1964 and 1968, he was on the research staff of the Communications Research Division of the Institute for Defense Analyses (IDA) and taught mathematics at the Massachusetts Institute of Technology and Harvard University, ultimately joining the faculty at Stony Brook University. In 1968, he was appointed chairman of the math department at Stony Brook University.

Simons was asked by IBM in 1973 to attack the block cipher Lucifer, an early but direct precursor to the Data Encryption Standard (DES).[25]

Simons founded Math for America, a nonprofit organization, in January 2004 with a mission to improve mathematics education in United States public schools by recruiting more highly qualified teachers. He funds a variety of research projects.

Philanthropy

Simons and his second wife, Marilyn Hawrys Simons, co-founded the Simons Foundation in 1994, a charitable organization that supports projects related to education and health, in addition to scientific research.[2] In memory of his son Paul, whom he had with his first wife, Barbara Simons, he established Avalon Park, a 130-acre (0.53 km2) nature preserve in Stony Brook. In 1996, 34-year-old Paul was killed by a car driver while riding a bicycle near the Simons home. Another son, Nick Simons, drowned at age 24 while on a trip to Bali in Indonesia in 2003. Nick had worked in Nepal. The Simons have become large donors to Nepalese healthcare through the Nick Simons Institute.[26][27]

In 2004, Simons founded Math for America with an initial pledge of $25 million from the Simons Foundation, a pledge he later doubled in 2006.[28]

Also in 2006, Simons donated $25 million to Stony Brook University through the Stony Brook Foundation, the largest donation ever to a State University of New York school.[29]

On February 27, 2008, then Gov. Eliot Spitzer announced a $60 million donation by the Simons Foundation to found the Simons Center for Geometry and Physics at Stony Brook, the largest gift to a public university in New York state history.[30]

In December 2008, it was reported that the Stony Brook University Foundation, of which Simons is chair emeritus, lost $5.4 million in Bernard Madoff’s Ponzi scheme.[31]

Via the foundation, he and Marilyn also funded the renovation of the building housing the mathematics department at MIT, which in 2016 was named after the two of them.[32]

Political contributions

Simons is a major contributor to Democratic Party political action committees. According to the Center for Responsive Politics, Simons is currently ranked the #5 donor to federal candidates in the 2016 election cycle, coming behind co-CEO Robert Mercer, who is ranked #1 and generally donates to Republicans.[33] Simons has donated $7 million to Hillary Clinton's Priorities USA Action,[34] $2.6 million to the House and Senate Majority PACs, and $500,000 to EMILY's List.[33] He also donated $25,000 to Republican Senator Lindsey Graham's super PAC.[33] Since 2006 Simons has contributed about $30.6 million to federal campaigns.[33] Since 1990, Renaissance Technologies has contributed $59,081,152 to federal campaigns and since 2001, has spent $3,730,000 on lobbying.[35]

Boardroom appointments

Simons serves as trustee of Brookhaven National Laboratory, the Institute for Advanced Study, Rockefeller University, the Mathematical Sciences Research Institute in Berkeley and a trustee of Stony Brook University.[36] He is also a member of the Board of the MIT Corporation.

Controversies

According to the Wall Street Journal in May 2009, Simons was questioned by investors on the dramatic performance gap of Renaissance Technologies' portfolios. The Medallion Fund, which has been available exclusively to current and past employees and their families, surged 80% in 2008 in spite of hefty fees; the Renaissance Institutional Equities Fund (RIEF), owned by outsiders, lost money in both 2008 and 2009; RIEF declined 16% in 2008.[37]

On July 22, 2014, Simons was subject to bipartisan condemnation by the U.S. Senate Permanent Subcommittee on Investigations for the use of complex barrier options to shield day-to-day trading (usually subject to higher ordinary income tax rates) as long-term capital gains. “Renaissance Technologies was able to avoid paying more than $6 billion in taxes by disguising its day-to-day stock trades as long term investments,” said Sen. John McCain (R., Ariz.), the committee’s ranking Republican, in his opening statement. “Two banks and a handful of hedge funds developed a complex financial structure to engage in highly profitable trades while claiming an unjustified lower tax rate and avoiding limits on trading with borrowed money,” said Sen. Carl Levin (D., Mich.) in his prepared remarks.[38]

An article published in the New York Times in 2015 said that Simons was involved in one of the biggest tax battles of the year, with Renaissance Technologies being "under review by the I.R.S. over a loophole that saved their fund an estimated $6.8 billion in taxes over roughly a decade."[39]

Wealth

Simons earned an estimated $2.5 billion in 2008,[40] and with an estimated net worth of $16.5 billion,[1] he is ranked by Forbes as the 50th-richest person in the world[1] and the 26th-richest person in America.[1] He was named by the Financial Times in 2006 as "the world's smartest billionaire".[41]

In 2011, he was included in the 50 Most Influential ranking of Bloomberg Markets Magazine.

Simons owns a motor yacht, named Archimedes. It was built at the Dutch yacht builder Royal Van Lent and delivered to Simons in 2008.[42]

Selected works

- "Minimal Cones, Plateau's Problem, and the Bernstein Conjecture". Proc Natl Acad Sci U S A. 58 (2): 410–411. August 1967. doi:10.1073/pnas.58.2.410. PMC 335649

. PMID 16578656.

. PMID 16578656. - with Shiing-Shen Chern: "Some Cohomology Classes in Principal Fiber Bundles and Their Application to Riemannian Geometry". Proc Natl Acad Sci U S A. 68 (4): 791–794. April 1971. doi:10.1073/pnas.68.4.791. PMC 389044

. PMID 16591916.

. PMID 16591916. - with Jean-Pierre Bourguignon and H. Blaine Lawson: "Stability and gap phenomena for Yang-Mills fields". Proc Natl Acad Sci U S A. 76 (4): 1550–1553. April 1979. doi:10.1073/pnas.76.4.1550. PMC 383426

. PMID 16592637.

. PMID 16592637. - "Minimal varieties in riemannian manifolds". Annals of Mathematics. 88 (1): 62–105. July 1968. doi:10.2307/1970556.

- with Shiing-Shen Chern: "Characteristic forms and geometric invariants". Annals of Mathematics. 99 (1): 48–69. January 1974. doi:10.2307/1971013.

See also

- Chern–Simons theory

- Chern–Simons form

- The Quants: How a New Breed of Math Whizzes Conquered Wall Street and Nearly Destroyed It

Notes

- 1 2 3 4 5 Forbes: "The World's Billionaires: James Simons" September 2016

- 1 2 3 Teitelbaum, Richard (January 2008). "The Code Breaker". Bloomberg Markets Magazine. Bloomberg LP. Retrieved January 7, 2010.

- ↑ http://www.nytimes.com/2014/07/08/science/a-billionaire-mathematicians-life-of-ferocious-curiosity.html?_r=0

- ↑ "More Money than God".

- ↑ "Remarks on Chern-Simon Theory" (PDF). American Mathematical Society. January 15, 2009. Retrieved March 31, 2016.

- ↑ "RenTec's Jim Simons Retiring At End Of Year". Market Folly. October 8, 2009. Archived from the original on June 17, 2010. Retrieved June 17, 2012.

- ↑ "Seed Interview: James Simons". Seed. September 19, 2006. Retrieved July 23, 2013.

- ↑ "Renaissance Founder Simons, Computer Trading Pioneer, to Retire". Bloomberg. October 9, 2009.

- ↑ IAU Minor Planet Center

- ↑ "The Jewish Billionaires of Forbes". jspace.com. March 14, 2012. Retrieved September 7, 2013.

- ↑ Boston Globe: "Marcia (Kantor) Simons Obituary" retrieved March 31, 2013

- ↑ Bloomberg: "Simons at Renaissance Cracks Code, Doubling Assets (Update1)" By Richard Teitelbaum November 27, 2007

- ↑ "The Secret World of Jim Simons". iimagazine.com.

- 1 2 "James Simons". Mathematics Genealogy Project. AMS. Retrieved August 8, 2014.

- ↑ "A Rare Interview with the Mathematician Who Cracked Wall Street". TED (conference). March 2015. Retrieved September 26, 2015.

- ↑ "Carnegie Medals of Philanthropy presented at the Scottish Parliament". The Scottish Parliament. October 2013. Retrieved September 26, 2015.

- ↑ Baker, Nathaniel (June 24, 2005). "Renaissance Readies Long-Biased Strat". Institutional Investor.

- ↑ Zuckerman, Gregory (July 1, 2005). "Renaissance's Man: James Simons Does The Math on Fund". The Wall Street Journal. pp. C1. Retrieved August 6, 2015.

- ↑ Andersen, Jenny (April 16, 2008). "Wall Street Winners Get Billion-Dollar Paydays". The New York Times. Retrieved January 7, 2010.

- ↑ Jenny Anderson and Julie Creswell (April 24, 2007). "Make Less Than $240 Million? You're Off Top Hedge Fund List". The New York Times.

- ↑ Shell, Adam (May 26, 2006). "$363M is average pay for top hedge fund managers". USA Today. Retrieved August 15, 2006.

- ↑ "Top hedge fund manager had take-home pay of $1.5 billion in 2005 on 5% fee and 44% of gains". Finfacts.com. May 26, 2006.

- ↑ "James H. Simons Elected to the National Academy of Sciences - Stony Brook University Newsroom". stonybrook.edu.

- ↑ Broad, William (July 7, 2014). "Seeker, Doer, Giver, Ponderer: A Billionaire Mathematician's Life of Ferocious Curiosity". New York Times.

- ↑ Levy, Steven (2001). Crypto: secrecy and privacy in the new code war. Penguin. p. 356. ISBN 0-14-024432-8.

- ↑ Nepalnews Mercantile Communications Pvt. Ltd

- ↑ US family donates Rs 380 m medical for Nepal

- ↑ Roekbe, Joshua (September 19, 2006). "Putting his money where his math is". Seed. Retrieved March 4, 2015.

- ↑ "Stony Brook Announces $25 Million Gift From Renowned Former Math Chair Jim Simons". stonybrook.edu.

- ↑ Arenson, Karen W. (February 27, 2008). "$60 Million Gift for Stony Brook". The New York Times. Retrieved May 5, 2010.

- ↑ "Simons's Stony Brook University Fund Caught in Madoff Fraud". Bloomberg. December 16, 2008.

- ↑ "MIT names historic Building 2, home of mathematics, in honor of James '58 and Marilyn Simons". MIT News. Massachusetts Institute of Technology. 2016-03-30. Retrieved 2016-06-24.

- 1 2 3 4 Bowers, John (7 June 2016). "A hedge fund house divided: Renaissance Technologies". OpenSecrets Blog. Center for Responsive Politics. Retrieved 9 June 2016.

- ↑ Who are the Super PACs’ Biggest Donors? By Al Shaw, ProPublica. Updated December 7, 2012

- ↑ "Organizations: Renaissance Technologies". OpenSecrets.org. Center for Responsive Politics. Retrieved 9 June 2016.

- ↑ "Board of Trustees". Stony Brook University. Retrieved March 3, 2014.

- ↑ Pulliam, Susan; Strasburg, Jenny (May 15, 2009). "Simons Questioned by Investors: Disparity Is Seen in Running of Two Renaissance Funds". Retrieved 29 December 2015.

- ↑ "Simons Subject to bipartisan Condimnation for Tax Strategies".

- ↑ Scheiber, Noam; Cohendec, Patricia (29 December 2015). "For the Wealthiest, a Private Tax System That Saves Them Billions". The New York Times. Retrieved 29 December 2015.

- ↑ Allstair, Barr (March 25, 2009). "Top managers' pay dropped 48% last year". MarketWatch. Retrieved January 7, 2010.

- ↑ "Alternative Rich List". FT.com. September 22, 2006. Retrieved November 8, 2007.

- ↑ "Superyacht Archimedes". SuperYachtFan.

External links

- The Code Breaker – January 2008 Bloomberg Markets article on Simons and Renaissance

- The Simons Foundation

- Titan's Millions Stir Up Research Into Autism

- James Harris Simons at the Mathematics Genealogy Project

- Putting His Money Where His Math Is – September 2006 article in Seed Magazine.

- Nick Simons Institute

- Jim Simons Latest Portfolio

- James Simons on mathematics, common sense and good luck: my life and careers, MIT

- Jim Simons Speaks: Just No to Google and Goldman Sachs

- James Simons (1-hour interview, May 2015) - Numberphile

- Speech at MIT

- A rare interview with the mathematician who cracked Wall Street - Ted Talk

- Video of Carnegie Medal ceremony on YouTube