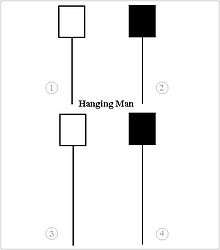

Hanging man (candlestick pattern)

Main article: Candlestick pattern

Hanging man patterns are found in uptrends

A hanging man is a type of bearish reversal pattern, made up of just one candle, found in an uptrend of price charts of financial assets. It has a long lower wick and a short body at the top of the candlestick with little or no upper wick. In order for a candle to be a valid hanging man most traders say the lower wick must be two times greater than the size of the body portion of the candle, and the body of the candle must be at the upper end of the trading range.

See also

- Hammer — Hanging man pattern found in a downtrend

External links

- Video and chart examples of hanging man pattern

- Hanging man pattern at onlinetradingconcepts.com

- Bearish Hanging man at candlesticker.com

- Hanging man definition at investopedia.com

- Hanging Man Information at candlecharts.com

- Hanging Man Explained at chartscorner.com

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

This article is issued from Wikipedia - version of the 9/30/2013. The text is available under the Creative Commons Attribution/Share Alike but additional terms may apply for the media files.