Economy of Cyprus

|

Nicosia is the island's financial hub | |

| Currency | 1 euro (ευρώ) = 100 cents (σεντ) |

|---|---|

| Calendar year | |

Trade organisations | European Union, Commonwealth, WTO |

| Statistics | |

| GDP |

|

| GDP rank |

108th (nominal)[2] 126th (PPP)[3] |

GDP growth |

|

GDP per capita |

|

GDP by sector | services 87.1%, industry 10.6%, agriculture 2.4% (2014 est.) |

| −1.4% (November 2016)[6] | |

Population below poverty line |

|

| 32.4 (2013)[8] | |

Labour force | 356,700 (2013 est.) |

Labour force by occupation | services 80.1%, industry 16%, agriculture 3.9% (2013 est.) |

| Unemployment |

|

Average gross salary | €1,738 per month (Q3 2015)[10] |

Main industries | tourism, food and beverage processing, cement and gypsum, ship repair and refurbishment, textiles, light chemicals, metal products, wood, paper, stone and clay products |

|

| |

| External | |

| Exports |

|

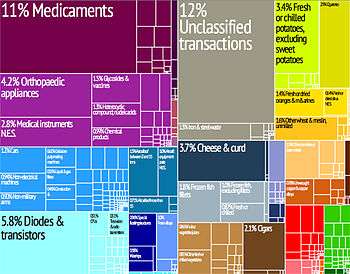

Export goods | citrus, potatoes, pharmaceuticals, cement, clothing |

Main export partners |

|

| Imports |

|

Import goods | consumer goods, petroleum and lubricants, machinery, transport equipment |

Main import partners |

|

| Public finances | |

|

€19.044 billion ( | |

|

€196 million ( | |

| Revenues | 39.0% of GDP (2015 est.)[13] |

| Expenses | 40.1% of GDP (2015 est.)[13] |

Foreign reserves | $1.258 billion (September 2012)[18] |

The economy of Cyprus is classified by the World Bank as a high-income economy,[19] and was included by the International Monetary Fund in its list of advanced economies in 2001.[20] Erratic growth rates in the 1990s reflected the economy's vulnerability to swings in tourist arrivals, caused by political instability on the island and fluctuations in economic conditions in Western Europe.

On 1 January 2008, the country adopted the euro as its official currency, replacing the Cypriot pound at an irrevocable fixed exchange rate of CYP 0.585274 per EUR 1.00.

The 2012–13 Cypriot financial crisis, part of the wider European debt crisis, has dominated the country's economic affairs in recent times. In March 2013, the Cypriot government reached an agreement with its eurozone partners to split the country's second biggest bank, the Cyprus Popular Bank (also known as Laiki Bank), into a "bad" bank which would be wound down over time and a "good" bank which would be absorbed by the larger Bank of Cyprus. In return for a €10 billion bailout from the European Commission, the European Central Bank and the International Monetary Fund, the Cypriot government would be required to impose a significant haircut on uninsured deposits[21] Insured deposits of €100,000 or less would not be affected.[22][23][24] After a three-and-a-half-year recession, Cyprus returned to growth in the first quarter of 2015.[25] Cyprus successfully concluded its three-year financial assistance programme at the end of March 2016, having borrowed a total of €6.3 billion from the European Stability Mechanism and €1 billion from the IMF.[26][27] The remaining €2.7 billion of the ESM bailout was never dispensed, due to the Cypriot government's better than expected finances over the course of the programme.[26][27]

Economy in the government-controlled area

Cyprus has an open, free-market, service-based economy with some light manufacturing. Internationally, Cyprus promotes its geographical location as a "bridge" between East and West, along with its educated English-speaking population, moderate local costs, good airline connections, and telecommunications.

Since gaining independence from the United Kingdom in 1960, Cyprus has had a record of successful economic performance, reflected in strong growth, full employment conditions and relative stability. The underdeveloped agrarian economy inherited from colonial rule has been transformed into a modern economy, with dynamic services, industrial and agricultural sectors and an advanced physical and social infrastructure. The Cypriots are among the most prosperous people in the Mediterranean region, with GDP per capita surpassing $26,000 in 2014.[1]

Their standard of living is reflected in the country's "very high" Human Development Index,[28] and Cyprus is ranked 23rd in the world in terms of the Quality-of-life Index.[29] However, after more than three decades of unbroken growth, the Cypriot economy contracted in 2009.[30] This reflected the exposure of Cyprus to the Great Recession and European debt crisis. In recent times, concerns have been raised about the state of public finances and spiralling borrowing costs. Furthermore, Cyprus was dealt a severe blow by the Evangelos Florakis Naval Base explosion in July 2011, with the cost to the economy estimated at €1–3 billion, or up to 17% of GDP.[31]

The economic achievements of Cyprus during the preceding decades have been significant, bearing in mind the severe economic and social dislocation created by the Turkish invasion of 1974 and the continuing occupation of the northern part of the island by Turkey. The Turkish invasion inflicted a serious blow to the Cyprus economy and in particular to agriculture, tourism, mining and quarrying: 70 percent of the island’s wealth-producing resources were lost, the tourist industry lost 65 percent of its hotels and tourist accommodation, the industrial sector lost 46 percent, and mining and quarrying lost 56 percent of production. The loss of the port of Famagusta, which handled 83 percent of the general cargo, and the closure of Nicosia International Airport, in the buffer zone, were additional setbacks.

The success of Cyprus in the economic sphere has been attributed, inter alia, to the adoption of a market-oriented economic system, the pursuance of sound macroeconomic policies by the government as well as the existence of a dynamic and flexible entrepreneurship and a highly educated labor force. Moreover, the economy benefited from the close cooperation between the public and private sectors.

In the past 30 years, the economy has shifted from agriculture to light manufacturing and services. The services sector, including tourism, contributes almost 80% to GDP and employs more than 70% of the labor force. Industry and construction account for approximately one-fifth of GDP and labor, while agriculture is responsible for 2.1% of GDP and 8.5% of the labor force. Potatoes and citrus are the principal export crops. After robust growth rates in the 1980s (average annual growth was 6.1%), economic performance in the 1990s was mixed: real GDP growth was 9.7% in 1992, 1.7% in 1993, 6.0% in 1994, 6.0% in 1995, 1.9% in 1996 and 2.3% in 1997. This pattern underlined the economy's vulnerability to swings in tourist arrivals (i.e., to economic and political conditions in Cyprus, Western Europe, and the Middle East) and the need to diversify the economy. Declining competitiveness in tourism and especially in manufacturing are expected to act as a drag on growth until structural changes are effected. Overvaluation of the Cypriot pound prior to the adoption of the euro in 2008 had kept inflation in check.

Trade is vital to the Cypriot economy—the island is not self-sufficient in food and until the recent offshore gas discoveries had few known natural resources—and the trade deficit continues to grow. Cyprus must import fuels, most raw materials, heavy machinery, and transportation equipment. More than 50% of its trade is with the rest of the European Union, especially Greece and the United Kingdom, while the Middle East receives 20% of exports. In 1991, Cyprus introduced a value-added tax (VAT), which is at 19% as of 13/01/2014. Cyprus ratified the new world trade agreement (General Agreement on Tariffs and Trade, GATT) in 1995 and began implementing it fully on 1 January 1996. EU accession negotiations started on 31 March 1998, and concluded when Cyprus joined the organization as a full member in 2004.

Investment climate

The Cyprus legal system is founded on English law, and is therefore familiar to most international financiers. Cyprus's legislation was aligned with EU norms in the period leading up to EU accession in 2004. Restrictions on foreign direct investment were removed, permitting 100% foreign ownership in many cases. Foreign portfolio investment in the Cyprus Stock Exchange was also liberalized.[32] In 2002 a modern, business-friendly tax system was put in place with a 10% corporate tax rate, the lowest in the EU. Cyprus has concluded treaties on double taxation with more than 40 countries, and, as a member of the Eurozone, has no exchange restrictions. Non-residents and foreign investors may freely repatriate proceeds from investments in Cyprus.[32]

Role as a financial hub

In the years following the dissolution of the Soviet Union it gained great popularity as a portal for investment from the West into Russia and Eastern Europe.[33] More recently, there have been increasing investment flows from the West through Cyprus into Asia (particularly China and India), South America and the Middle East. In addition, businesses from outside the EU use Cyprus as their entry-point for investment into Europe. The business services sector remains the fastest growing sector of the economy, and had overtaken all other sectors in importance. CIPA has been fundamental towards this trend.[34] As of 2016, CySEC (the Financial Regulator), regulates many of the worlds biggest brands in retail forex as they generally see it as an efficient way to get an EU operating license and industry know-how.[35][36]

Oil and gas

In 2011, Noble Energy estimated that a pipeline to Leviathan gas field could be in operation as soon as 2014 or 2015.[37] Surveys suggest more than 100 trillion cubic feet (2.831 trillion cubic metres) of reserves lie untapped in the eastern Mediterranean basin between Cyprus and Israel - almost equal to the world's total annual consumption of natural gas.[38]

Role as a shipping hub

Cyprus constitutes one of the largest ship management centers in the world; around 50 ship management companies and marine-related foreign enterprises are conducting their international activities in the country while the majority of the largest ship management companies in the world have established fully fledged offices on the island.[39] Its geographical position at the crossroads of three continents and its proximity to the Suez Canal has promoted merchant shipping as an important industry for the island nation. Cyprus has the tenth-largest registered fleet in the world, with 1,030 vessels accounting for 31,706,000 dwt as of 1 January 2013.[40][41]

Tourism

Tourism is an important factor of the island state’s economy, culture, and overall brand development. With over 2 million tourist arrivals per year, it is the 40th most popular destination in the world. However, per capita of local population it ranks 6th.[42][43] The industry has been honored with various international awards, spanning from the Sustainable Destinations Global Top 100, VISION on Sustainable Tourism, Totem Tourism and Green Destination titles bestowed to Limassol and Paphos in December 2014.[44][45][46] The island beaches have been awarded with 53 Blue Flags. Cyprus became a full member of the World Tourism Organization when it was created in 1975.[47] According to the World Economic Forum's 2013 Travel and Tourism Competitiveness Index, Cyprus' tourism industry ranks 29th in the world in terms of overall competitiveness. In terms of Tourism Infrastructure, in relation to the tourism industry Cyprus ranks 1st in the world. The Cyprus Tourism Organization has a status of a semi-governmental organisation charged with overseeing the industry practices and promoting the island worldwide.[48]

Trade

In 2008 fiscal aggregate value of goods and services exported by Cyprus was in the region of $1.53 billion. It primarily exported goods and services such as citrus fruits, cement, potatoes, clothing and pharmaceuticals. At that same period total financial value of goods and services imported by Cyprus was about $8.689 billion. Prominent goods and services imported by Cyprus in 2008 were consumer goods, machinery, petroleum and other lubricants, transport equipment and intermediate goods.

Cypriot trade partners

Traditionally Greece has been a major export and import partner of Cyprus. In fiscal 2007, it amounted for 21.1 percent of total exports of Cyprus. At that same period it was responsible for 17.7 percent of goods and services imported by Cyprus. Some other important names in this regard are UK and Italy.

Eurozone crisis

In 2012, Cyprus became affected by the Eurozone financial and banking crisis. In June 2012, the Cypriot government announced it would need €1.8 billion of foreign aid to support the Cyprus Popular Bank, and this was followed by Fitch down-grading Cyprus's credit rating to junk status.[49] Fitch said Cyprus would need an additional €4 billion to support its banks and the downgrade was mainly due to the exposure of Bank of Cyprus, Cyprus Popular Bank and Hellenic Bank (Cyprus's 3 largest banks) to the Greek financial crisis.[49]

In June 2012 the Cypriot finance minister, Vassos Shiarly, stated that the European Central Bank, European commission and IMF officials are to carry out an in-depth investigation into Cyprus' economy and banking sector to assess the level of funding it requires. The Ministry of Finance rejected the possibility that Cyprus would be forced to undergo the sweeping austerity measures that have caused turbulence in Greece, but admitted that there would be "some negative repercussion".[50]

In November 2012 international lenders negotiating a bailout with the Cypriot government have agreed on a key capital ratio for banks and a system for the sector's supervision. Both commercial banks and cooperatives will be overseen by the Central Bank and the Ministry of Finance. They also set a core Tier 1 ratio - a measure of financial strength - of 9% by the end of 2013 for banks, which could then rise to 10% in 2014.[51]

In 2014, Harris Georgiades pointed that exiting the Memorandum with the European troika required a return to the markets. This he said, required “timely, effective and full implementation of the program.” The Finance Minister stressed the need to implement the Memorandum of understanding without an additional loan.[52]

In 2015, Cyprus was praised by the President of the European Commission for adopting the austerity measures and not hesitating to follow a tough reform program.[53][54]

In 2016, Moody's Investors Service changed its outlook on the Cypriot banking system to positive from stable, reflecting the view that the recovery will restore banks to profitability and improve asset quality. The quick economic recovery was driven by tourism, business services and increased consumer spending. Creditor confidence was also strengthened, allowing Bank of Cyprus to reduce its Emergency Liquidity Assistance to €2.0 billion (from €9.4 billion in 2013).[55] Within the same period, Bank of Cyprus Chairman Josef Ackermann urged the European Union to pledge financial support for a permanent solution to the Cyprus dispute.[56]

Economy of Northern Cyprus

The economy of Northern Cyprus is about one-fifth the size of the economy of the government-controlled area, while GDP per capita is around half. Because the de facto administration is recognized only by Turkey, it has had much difficulty arranging foreign financing, and foreign firms have hesitated to invest there. The economy mainly revolves around the agricultural sector and government service, which together employ about half of the work force.

The tourism sector also contributes substantially into the economy. Moreover, the small economy has seen some downfalls because the Turkish lira is legal tender. To compensate for the economy's weakness, Turkey has been known to provide significant financial aid. In both parts of the island, water shortage is a growing problem, and several desalination plants are planned.

The economic disparity between the two communities is pronounced. Although the economy operates on a free-market basis, the lack of private and government investment, shortages of skilled labor and experienced managers, and inflation and the devaluation of the Turkish lira continue to plague the economy.

Trade with Turkey

Turkey is by far the main trading partner of Northern Cyprus, supplying 55% of imports and absorbing 48% of exports. In a landmark case, the European Court of Justice (ECJ) ruled on 5 July 1994 against the British practice of importing produce from Northern Cyprus based on certificates of origin and phytosanitary certificates granted by the de facto authorities. The ECJ decided that only goods bearing certificates of origin from the internationally recognized Republic of Cyprus could be imported by EU member states. The decision resulted in a considerable decrease of Turkish Cypriot exports to the EU: from $36.4 million (or 66.7% of total Turkish Cypriot exports) in 1993 to $24.7 million in 1996 (or 35% of total exports) in 1996. Even so, the EU continues to be the second-largest trading partner of Northern Cyprus, with a 24.7% share of total imports and 35% share of total exports.

The most important exports of Northern Cyprus are citrus and dairy products. These are followed by rakı, scrap and clothing.[57]

Assistance from Turkey is the mainstay of the Turkish Cypriot economy. Under the latest economic protocol (signed 3 January 1997), Turkey has undertaken to provide loans totalling $250 million for the purpose of implementing projects included in the protocol related to public finance, tourism, banking, and privatization. Fluctuation in the Turkish lira, which suffered from hyperinflation every year until its replacement by the Turkish new lira in 2005, exerted downward pressure on the Turkish Cypriot standard of living for many years.

The de facto authorities have instituted a free market in foreign exchange and permit residents to hold foreign-currency denominated bank accounts. This encourages transfers from Turkish Cypriots living abroad.

See also

References

- 1 2 3 4 5 "Report for Selected Countries and Subjects". World Economic Outlook Database, October 2016. Washington, D.C.: International Monetary Fund. 4 October 2016. Retrieved 26 October 2016.

- ↑ "Gross domestic product 2015" (PDF). World Bank. 11 October 2016. Retrieved 26 October 2016.

- ↑ "Gross domestic product 2015, PPP" (PDF). World Bank. 11 October 2016. Retrieved 26 October 2016.

- ↑ "Latest Figures: GDP Growth Rate, 3rd Quarter 2016 (flash estimate)". Nicosia: Statistical Service of Cyprus. 15 November 2016. Retrieved 16 November 2016.

- ↑ "GDP up by 0.3% in the euro area and by 0.4% in the EU28" (PDF). Luxembourg: Eurostat. 15 November 2016. Retrieved 16 November 2016.

- ↑ "CONSUMER PRICE INDEX (CPI): NOVEMBER 2016" (PDF). Nicosia: Statistical Service of Cyprus. 1 December 2016. Retrieved 1 December 2016.

- ↑ "People at risk of poverty or social exclusion by age and sex". Luxembourg: Eurostat. 7 October 2016. Retrieved 11 October 2016.

- ↑ "Gini coefficient of equivalised disposable income (source: SILC)". Luxembourg: Eurostat. 29 October 2014. Retrieved 6 November 2014.

- ↑ "Euro area unemployment at 9.8%" (PDF). Luxembourg: Eurostat. 1 December 2016. Retrieved 1 December 2016.

- ↑ "Latest Figures: Average Monthly Earnings of Employees by Quarter, 3rd Quarter 2015". Nicosia: Statistical Service of Cyprus. 29 December 2015. Retrieved 5 January 2016.

- ↑ "Ease of Doing Business in Cyprus". Doing Business 2016. World Bank Group. Retrieved 5 January 2016.

- ↑ "Government debt fell to 91.2% of GDP in euro area" (PDF). Luxembourg: Eurostat. 24 October 2016. Retrieved 26 October 2016.

- 1 2 3 "Provision of deficit and debt data for 2015 - second notification" (PDF). Luxembourg: Eurostat. 21 October 2016. Retrieved 26 October 2016.

- ↑ "Fitch Upgrades Cyprus to 'B+'; Outlook Positive". London: Fitch Ratings. 23 October 2015. Retrieved 26 October 2015.

- ↑ "Moody's upgrades Cyprus's government bond rating to B3 and assigns stable outlook". London: Moody's Investors Service. 14 November 2014. Retrieved 16 November 2014.

- ↑ "Sovereigns Ratings List". Standard & Poor's. Retrieved 24 October 2014.

- ↑ "S&P upgrades Cyprus on commitment to bailout deal". Yahoo! Finance. 24 October 2014. Retrieved 16 November 2014.

- ↑ "International Reserves and Foreign Currency Liquidity". International Monetary Fund. 15 November 2012. Retrieved 6 December 2012.

- ↑ "Country and Lending Groups". World Bank. Retrieved 2 August 2011.

- ↑ "World Economic Outlook Database May 2001". International Monetary Fund. Retrieved 2 August 2011.

- ↑ Higgins, Andrew (31 March 2013). "As Banks in Cyprus Falter, Other Tax Havens Step In". The New York Times. Retrieved 24 October 2013.

- ↑ "Eurogroup Statement on Cyprus". Eurogroup. 25 March 2013. Retrieved 30 March 2013.

- ↑ Jan Strupczewski; Annika Breidthardt (25 March 2013). "Last-minute Cyprus deal to close bank, force losses". Reuters. Retrieved 25 March 2013.

- ↑ "Eurogroup signs off on bailout agreement reached by Cyprus and troika". Ekathimerini. Greece. 25 March 2013. Retrieved 25 March 2013.

- ↑ "Cyprus growth welcome but fragile – finmin". Cyprus Weekly. 13 May 2015. Retrieved 13 May 2015.

- 1 2 "Cyprus successfully exits ESM programme". Luxembourg: European Stability Mechanism. 31 March 2016. Retrieved 31 March 2016.

- 1 2 "Επισήμως εκτός μνημονίου η Κύπρος". Kathimerini (in Greek). Athens. 31 March 2016. Retrieved 31 March 2016.

- ↑ "Human Development Index (HDI) - 2011 Rankings". United Nations Development Programme. Retrieved 4 November 2011.

- ↑ "The Economist Intelligence Unit's quality-of-life index" (PDF). Economist Intelligence Unit. 2005. Retrieved 2 August 2011.

- ↑ "Report for Selected Countries and Subjects". World Economic Outlook Database, April 2014. Washington, D.C.: International Monetary Fund. 8 April 2014. Retrieved 16 April 2014.

- ↑ Kambas, Michele (30 July 2011). "Cyprus too slow in making cuts". Cyprus Mail. Nicosia. Retrieved 30 July 2011.

- 1 2 Cyprus will continue to fight against money laundering FT.com 20 August 2007

- ↑ "The midget and the mighty". Economist. 6 August 2012.

- ↑ Investments worth Billions in the Pipeline Cyprus-Mail - 13 September 2012

- ↑ FX Empire: CySEC Regulated Brokers

- ↑ The Current State of the Reform Process in Cyprus

- ↑ Oil and gas for Cyprus and Israel Economist.com 15 November 2011

- ↑ Cyprus hopes gas export income will flow by 2019 Reuters.com 6 July 2012

- ↑ Limassol Based Shipping Companies CyprusShipping.com

- ↑ "Review of Maritime Transport 2013" (PDF). Geneva: United Nations Conference on Trade and Development. Retrieved 16 November 2014.

- ↑ Lloyds Ship Management Directory

- ↑ "Cyprus Travel & Tourism - Climbing to new heights." (PDF). Accenture. World Travel and Tourism Council. 2006. Archived from the original (PDF) on 12 February 2012. Retrieved 2007-03-02.

- ↑ "Economy Statistics - Tourist arrivals (per capita) (most recent) by country". Nationmaster. Retrieved 2010-01-29.

- ↑ KPMG: Cyprus Tourism Market Report

- ↑ Tourism in Cyprus: Recent Trends and Lessons from the Tourist Satisfaction Survey

- ↑ World Travel Guide

- ↑ "UNWTO member states". World Tourism Organization (UNWTO). Retrieved 2007-03-02.

- ↑ "Travel and Tourism Competitiveness Index". World Economic Forum. 2011. Retrieved 2011-06-01.

- 1 2 "Cyprus's credit rating cut to junk status by Fitch". BBC News Online. 25 June 2012. Retrieved 25 June 2012.

- ↑ "Cyprus says EU, IMF officials to start assessing next week how much bailout money needed - from Associated Press". WashingtonPost.com. 2012-06-28. Retrieved 2012-06-28.

- ↑ Cyprus, troika agree on bank supervision, capital ratio Reuters 17/11/12

- ↑ Financial Mirror: Bank restrictions to be lifted by Spring 2014, says Cyprus Finance Minister

- ↑ Business Insider: EU's Juncker praises Cyprus recovery after bailout

- ↑ Cyprus Mail: Eurogroup full of praise for Cyprus but some obligations remain

- ↑ Gold Magazine: Moody`s Changes Outlook on Cypriot Banking System to Positive from Stable

- ↑ BoC’s Ackermann urges EU to pledge financial support for solution

- ↑ TRNC Ministry of Economy and Energy, Department of Trade. Dış Ticaret İthalat ve İhracat İstatistikleri 2010, p. VI.