Greek withdrawal from the eurozone

The Greek withdrawal from the eurozone is the potential exit of Greece from the eurozone monetary union in the 2010s, primarily for the country to deal with its government-debt crisis. The controversial and much discussed possible exit is often referred to as "Grexit", a portmanteau combining the English words "Greek" and "exit".[1][2][3][4][5][6] The term "Graccident" (accidental Grexit) was coined for the case that Greece exited the EU and the euro without intention.

Proponents of the proposal argue that leaving the euro and reintroducing the drachma would dramatically boost exports and tourism and while discouraging expensive imports and thereby give the Greek economy the possibility to recover and stand on its own feet.

Opponents argue that the proposal would impose excessive hardship on the Greek people, as the short-term effects would be a significant consumption and wealth reduction for the Greek population. This may cause civil unrest in Greece and harm the reputation of the eurozone. Additionally, it could cause Greece to align more with non-EU states.

Detailed Events

The term 'Grexit' was coined by the Citigroup economist Ebrahim Rahbari and was introduced by Rahbari and Citigroup's Global Chief Economist Willem H. Buiter on 6 February 2012.[7][8][9]

On 27 January 2015, two days after an early election of the Greek parliament, Alexis Tsipras, leader of the new Syriza ("Coalition of the Radical Left") party, formed a new government. He appointed Yanis Varoufakis as Minister of Finance, a particularly important post in view of the government debt crisis. Since then, the chance of a Grexit or even a 'Graccident' (accidental Grexit) in the near future has been widely discussed.[10][11][12][13]

After the announcement of the bailout referendum on 27 June 2015 speculation rose. That day BBC News reported that "default appears inevitable",[14] though it later removed the online statement.[15] On 29 June 2015 it was announced that Greek banks would remain closed all week, cash withdrawals from banks would be limited to €60 per day, and international money transfers would be limited to urgent pre-approved commercial transfers.[16]

Background

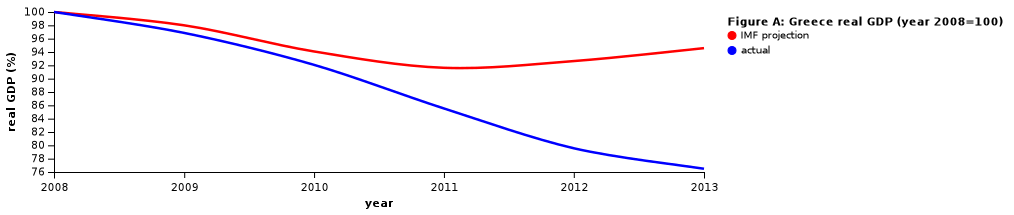

IMF's projection

The International Monetary Fund (IMF) admitted that its forecast about Greek economy was too optimistic: in 2010 it described Greece's first bailout programme as a holding operation that gave the eurozone time to build a firewall to protect other vulnerable members, but in 2012 the unemployment rate of Greece became about 25 percent, compared to IMF's projection of about 15 percent.[17] IMF conceded that it underestimated the damage that austerity programmes would do to the Greek economy,[18] adding that, in terms of Greece's debt, IMF should have considered a debt restructuring earlier.[17][19]

As can be seen from the Figure A, IMF's forecast in the 2010 standby agreement said that the Southern European country would start to grow in real terms after 2011.[19] But in fact the economy continued to shrink, and Greek real GDP in 2013 was about 76 percent of that in 2008.[20][21]

Dynamics

Financial dynamics

In mid-May 2012, the financial crisis in Greece and the impossibility of forming a new government after elections[22] led to strong speculation that Greece would leave the eurozone shortly.[23][24][25][26] This phenomenon had already become known as "Grexit".[27]

Economists who favour this approach to solve the Greek debt crisis argue that a default is unavoidable for Greece in the long term, and that a delay in organising an orderly default (by lending Greece more money throughout a few more years) would just wind up hurting EU lenders and neighbouring European countries even more.[28] Fiscal austerity or a euro exit is the alternative to accepting differentiated government bond yields within the Euro Area. If Greece remains in the euro while accepting higher bond yields, reflecting its high government deficit, then high interest rates would dampen demand, raise savings and slow the economy. An improved trade performance and less reliance on foreign capital would be the result.

The implementation of Grexit would have to occur "within days or even hours of the decision being made"[29][30] due to the high volatility that would result. It would have to be timed at one of the public holidays in Greece.[31]

International law dynamics

Some European scholars have insisted on the shaky legal grounds upon which the "troika" composed of the EU Commission, the European Central Bank and the IMF has pursued the harsh macroeconomic adjustment plans imposed on Greece, claiming they infringe upon Greece's sovereignty and interfere in the internal affairs of an independent EU nation-state: "the overt infringements on Greek sovereignty we're witnessing today, with EU policy makers now double-checking all national data and carefully 'monitoring' the work of the Greek government sets a dangerous precedent."[32]

These scholars have argued that a withdrawal from the Eurozone would give the Greek government more room for maneuver to conduct public policies propitious for long-term growth and social equity.[32]

2012 Plan Z

"Plan Z" is the name given to a 2012 plan to enable Greece to withdraw from the eurozone in the event of Greek bank collapse.[33] It was drawn up in absolute secrecy by small teams totalling approximately two dozen officials at the EU Commission (Brussels), the European Central Bank (Frankfurt) and the IMF (Washington).[33] Those officials were headed by Jörg Asmussen (ECB), Thomas Wieser (Euro working group), Poul Thomsen (IMF) and Marco Buti (European Commission).[33] To prevent premature disclosure no single document was created, no emails were exchanged, and no Greek officials were informed.[33] The plan was based on the 2003 introduction of new dinars into Iraq by the Americans and would have required rebuilding the Greek economy and banking system ab initio, including isolating Greek banks by disconnecting them from the TARGET2 system, closing ATMs, and imposing capital and currency controls.[33]

Implementation

The prospect of Greece leaving the euro and dealing with a devalued drachma prompted many people to start withdrawing their euros from the country's banks.[34] In the nine months to March 2012 deposits in Greek banks had already fallen 13% to €160,000,000,000.[30]

A victory for anti-bailout lawmakers in the 17 June 2012 election would likely trigger an even bigger bank run, said Dimitris Mardas, associate professor of economics at the University of Thessaloniiki. Greek authorities, Mardas predicted, would respond by imposing controls on the movement of money for as long as it takes for the panic to subside.[34]

Against this plan, a political initiative, the so-called Menoume Europi was founded in 2012 by students in Oxford University,[35] and it spread among Greek students in other European universities. The first demonstration took place in Athens, Syntagma Square in June 2012 in between two major elections that brought to the country political instability and financial insecurity.

A Grexit, assuming that it coincided with adoption of a new currency, would require preparation, for example with capacity for banknote stamping or printing a stock of new banknotes. However, information leaking out on such preparations might lead to negative dynamic effects, like bank runs. Conversely, leaving the Eurozone, but retaining the Euro as de facto currency, would avoid the practical issues and relieve the country of the burden of its Eurozone responsibilities.

In the event of a new currency being introduced, all banks would close for several days to allow old (Euro) banknotes to be stamped to denote that they were now drachmas, and/or a newly printed currency to be distributed to bank branches for distribution to the public when banks reopened. The British money printing company De La Rue was, according to rumours on 18 May 2012, preparing to print new drachma notes based on old moulds, which De La Rue refused to confirm.[30] The typical time between an order for a new currency being placed and the delivery of the banknotes is about six months.[36]

Wolfson Economics Prize

In July 2012, the Wolfson Economics Prize, a prize for the "best proposal for a country to leave the European Monetary Union", was awarded to a Capital Economics team led by Roger Bootle, for their submission titled "Leaving the Euro: A Practical Guide."[37] The winning proposal argued that a member wishing to exit should introduce a new currency and default on a large part of its debts. The net effect, the proposal claimed, would be positive for growth and prosperity. It also called for keeping the euro for small transactions and for a short period of time after the exit from the eurozone, along with a strict regime of inflation-targeting and tough fiscal rules monitored by "independent experts".

The Roger Bootle/Capital Economics plan also suggested that "key officials" should meet "in secret" one month before the exit is publicly announced, and that eurozone partners and international organisations should be informed "three days before". The judges of the Wolfson Economics Prize found that the winning plan was the "most credible solution" to the question of a member state leaving the eurozone.

Earlier exit proposals

In March 2010, other contrarian financial economists had argued in favor of such a swift exit strategy combined with a massive (but not total) cancellation of public debt: "The only sensible option at this stage is for the EU to engineer some kind of 'orderly default' on (some of) Greece's public debt which would then allow Athens to withdraw from the Eurozone and reintroduce its national currency the drachma at a debased rate."[32]

Immediate economic fallout inside Greece

On 29 May 2012 the National Bank of Greece (not to be confused with the central bank, the Bank of Greece) warned that "[a]n exit from the euro would lead to a significant decline in the living standards of Greek citizens." According to the announcement, per capita income would fall by 55%, the new national currency would depreciate by 65% vis-à-vis the euro, and the recession would deepen to 22%. Furthermore, unemployment would rise from its current 22% to 34% of the work force, and inflation, which was then at 2%, would soar to 30%.[38]

According to the Greek think-tank Foundation for Economic and Industrial Research (IOBE), a new drachma would lose half or more of its value relative to the euro.[34] This would drive up inflation, and reduce the purchasing power of the average Greek. At the same time, the country's economic output would drop, putting more people out of work where one in five is already unemployed. The prices of imported goods would skyrocket, putting them out of reach for many.[34]

Analyst Vangelis Agapitos estimated that inflation under the new drachma would quickly reach 40 to 50 per cent to catch up with the fall in the new currency's value.[34] To stop the falling value of the drachma, interest rates would have to be increased to as high as 30 to 40 per cent, according to Agapitos.[34] People would then be unable to pay off their loans and mortgages and the country's banks would have to be nationalised to stop them from going under, he predicted.[34]

IOBE head of research Aggelos Tsakanikas foresaw an increase in crime as a consequence of a Grexit, as people struggled to pay bills. "We won’t see tanks in the streets and violence, we won’t see people starving in the streets, but crime could very well rise".[34]

Political opinion

The centre-right New Democracy party has accused the leftist SYRIZA of supporting withdrawal from the euro. However, SYRIZA's leader, Alexis Tsipras, has stated that Greece should not leave the eurozone and return to the drachma because "...we will have poor people, who have drachmas, and rich people, who will buy everything with euros."[39] Public opinion also mostly favours keeping the euro.[40]

Of all the political parties which won seats in the parliamentary election in May 2012, only the Communist KKE expressed support for leaving the euro, and indeed for leaving the European Union.[41] However, its General Secretary, Dimitris Koutsoumpas, pondered: "The exit from the EU and the euro will be hazardous, a blind alley unless it is combined with a concrete plan, a programme for the economy and society, with a new organization of society, i.e. a socialist society with the socialization of the concentrated means of production, unilateral cancelation of the debt, working class and people's power."[42]

On 21 August 2015, 25 MPs from SYRIZA split from the party and formed Popular Unity, which fully supports leaving the euro.[43] In the September 2015 Greek legislative election, the party won only 2.8% of the popular vote, winning no seats.

Both the Greek government and the EU favour Greece staying within the Euro and believe this to be possible. However, some commentators believe an exit is likely. In February 2015, the former head of the US Federal Reserve, Alan Greenspan, said "it is just a matter of time" for Greece to withdraw from the eurozone,[44] and former United Kingdom Chancellor of the Exchequer Kenneth Clarke described it as inevitable.[45]

A leaked document reveals that, during informal discussion with one of the European leaders, UK Prime Minister David Cameron suggested that Greece might be better off if it leaves the eurozone. British officials declined to make their comments on the leaked document.[46]

Economics criticism

Richard Koo, chief economist for Nomura, accused IMF and EU of basing their negotiation position on unrealistic assumptions. As Koo pointed out, IMF's argument was that if the austerity programme had been implemented as assumed, no further debt relief would have been needed under 2012's framework.[47] The EU's argument was that Greece encountered a difficult situation in 2015 because it delayed implementation of structural reforms. Koo said that the argument was highly unrealistic because structural reforms do not work in a short run, adding that the US did not benefit from the Reaganomics structural reforms during Reagan's era.[47] After publishing documents which admit that the southern European country needs debt relief and a moratorium on debt repayment for 30 years,[48] the IMF was only "slowly beginning to understand" the Greek economy, said Koo.[47]

2015 Grexit speculation

In January 2015, speculation about a Greek exit from the eurozone was revived when Michael Fuchs, who is deputy leader of the center-right CDU/CSU faction in the German Bundestag, was quoted on 31 December 2014: "The time when we had to rescue Greece is over. There is no more blackmail potential. Greece is not systemically relevant for the euro." A following article in the weekly Spiegel citing sources from Wolfgang Schäuble's ministry of finance further spurred these speculations. Both German and international media widely interpreted this as the Merkel government tacitly warning Greek voters from voting for SYRIZA in the upcoming legislative election of 25 January 2015.[49]

Germany's largest selling tabloid, the right-wing populist Bild, raised further anger when it compared Greece to an unfair footballer: "What happens to a footballer who breaks the rules and does a crude foul? – He leaves the pitch. He is sent off as a punishment. No question."[50]

The German government's interference in the January 2015 elections in Greece was strongly criticized by leaders of European Parliament groups including Socialists & Democrats (S&D), the liberal ALDE and the Greens/EFA group, when S&D president Gianni Pittella said, "German right-wing forces trying to act like a sheriff in Greece or any other member states is not only unacceptable but above all wrong."[51] It has also been criticized by the German opposition party The Greens', with its speaker Simone Peter calling the debate over a Grexit "highly irresponsible".[50]

Economists of German Commerzbank said that preventing a Greek exit was still desirable for Germany, since a Greek exit would wipe out billions of euros in European taxpayer money, and "it would be much easier politically to renegotiate a compromise with Greece, albeit a lame one, and thus maintain the fiction that Greece will pay back its loans at some point in time."[52]

FTSE "considers Grexit following the election to be highly unlikely...".[53]

On 9 February, UK Prime Minister David Cameron chaired a meeting to discuss any possible ramifications in the event of an exit.[54] According to a Bloomberg report George Osborne said at the meeting of the G-20 finance ministers in Istanbul: "A Greek exit from the euro would be very difficult for the world economy and potentially very damaging for the European economy."[55]

In February 2015 the Russian government stated that it would offer Greece aid but would only provide it in rubles.[56]

Kathimerini reported that after 16 February Eurogroup talks Commerzbank AG increased the risk of Greece exiting the euro to 50%.[57] The expression used by Time for these talks is "Greece and the Euro Zone dance on the precipice".[58]

After an emergency meeting of eurozone finance ministers (20 February 2015), European leaders agreed to extend Greece’s bailout for further four months.[59]

By late June 2015 negotiations on a deal had collapsed, and Prime Minister Alexis Tsipras called a referendum for 5 July on the revised proposals from the IMF and the EU, which he said that his government would campaign against. The referendum was defeated by a margin of 61% to 39%. Eurozone finance ministers have refused to extend the bailout.

Questioned on whether the referendum would be a euro-drachma dilemma, Greece's finance minister, Yanis Varoufakis, said that European Treaties make provisions for an exit from the EU but do not make any provisions for an exit from the Eurozone. A referendum as a choice involving exit from the Eurozone would violate EU Treaties and EU Law.[60]

Theorized effects on world economies

Effect upon the European economy

Claudia Panseri, head of equity strategy at Société Générale, speculated in late May 2012 that eurozone stocks could plummet up to 50 percent in value if Greece makes a disorderly exit from the eurozone.[61] Bond yields in other European nations could widen 1 percent point to 2 percent points, negatively affecting their ability to service their own sovereign debts.[61]

But, as early as March 2010, other European financial economists had supported the notion of a swift Greek withdrawal from the Eurozone and the simultaneous reintroduction of its former national currency the drachma at a debased rate, arguing that the European economy as a whole would eventually benefit from such a policy change: "Such an abrupt readjustment might be painful at first, but it will ultimately strengthen the Greek economy and make the Eurozone more cohesive, and thus better at confronting the difficult economic circumstances and dealing with them."[32]

Effect upon the world economy

Europe in 2010 accounted for 25 percent of world trade, according to Deutsche Bank.[61] Economic depression within the European economy would ripple worldwide and slow global growth.[61] However, Greece represents just a small fraction—less than 2 per cent—of European gross domestic product (GDP).

Legality

A working paper published by the European Central Bank concluded:[62]

… that negotiated withdrawal from the EU would not be legally impossible even prior to the ratification of the Lisbon Treaty, and that unilateral withdrawal would undoubtedly be legally controversial; that, while permissible, a recently enacted exit clause is, prima facie, not in harmony with the rationale of the European unification project and is otherwise problematic, mainly from a legal perspective; that a Member State's exit from EMU, without a parallel withdrawal from the EU, would be legally inconceivable; and that, while perhaps feasible through indirect means, a Member State's expulsion from the EU or EMU, would be legally next to impossible.

In the legal literature, the question of whether a country can unilaterally leave the Eurozone without leaving the EU is controversial. Jens Dammann has taken the view that under certain conditions, it is possible for a Member State to end its membership in the Eurozone without leaving the European Union.[63]

See also

- Euroization

- Greek bailout referendum, 2015

- Multi-speed Europe

- Withdrawal from the European Union

- Brexit

- Frexit

- Irexit

References

- ↑ Economist Who Coined ‘Grexit’ Now Says Greece Will Stay in Euro. By Flavia Krause-Jackson. Bloomberg Business, 28 June 2015

- ↑ A year in a word: Grexit. By Ralph Atkins. Financial Times, 23 December 2012

- ↑ "‚Grexit' - Wer hat's erfunden?". citifirst.com.

- ↑ "«SNB kann die Zinsen auf minus 5 Prozent senken»". 1 September 2015 – via Handelszeitung.

- ↑ "Grexit – What does Grexit mean?". Gogreece.about.com. 10 April 2012. Retrieved 16 May 2012.

- ↑ Buiter, Willem and Ebrahim Rahbari (6 February 2012). "Rising Risks of Greek Euro Area Exit" (PDF). Citigroup. Archived from the original on 30 May 2012. Retrieved 17 May 2012.

- ↑ Economist Who Coined ‘Grexit’ Now Says Greece Will Stay in Euro. By Flavia Krause-Jackson. Bloomberg Business, 28 June 2015

- ↑ A year in a word: Grexit. By Ralph Atkins. Financial Times, 23 December 2012

- ↑ "‚Grexit' - Wer hat's erfunden?". citifirst.com.

- ↑ lefigaro.fr 18. February 2015: À quoi ressemblerait la sortie de l'euro de la Grèce

- ↑ sueddeutsche.de 4. March 2015: Tsipras will die Machtprobe – und wird sie verlieren. - Die Grundregel der Finanzmarkt-Kommunikation in Krisenzeiten lautet: Klappe halten. Doch Athen tut alles, um seine hilfsbereiten Euro-Partner zu verprellen. Der Austritt Griechenlands aus der Währungsunion steht bevor.

- ↑ Deutsche Welle: «Ο Βαρουφάκης πρέπει να παρουσιάσει έργο»

- ↑ spiegel.de 7. März 2015: Interview mit Alexis Tsipras Zitat: SPIEGEL: Many experts now fear a "Graccident"—Greece's accidental exit from the euro. If the ECB doesn't agree to your T-Bills, that's exactly what might happen. Tspiras: I cannot imagine that. People won't risk Europe's disintegration over a T-Bill of almost €1.6 billion.

- ↑ Paul Kirby (27 June 2015). "Greek debt crisis: Is Grexit inevitable?". BBC News. Retrieved 29 June 2015.

Default appears inevitable and there is a growing risk of Greece lurching out of the single currency - which has come to be known as Grexit.

- ↑ Paul Kirby (27 June 2015). "Greek debt crisis: Is Grexit inevitable?". BBC News. Retrieved 1 July 2015.

The European Central Bank (ECB) has said it won't extend emergency funding for the banks and there is a growing risk of Greece lurching out of the single currency - which has come to be known as Grexit.

- ↑ "Greek debt crisis: Banks to remain shut all week". BBC News. 29 June 2015. Retrieved 29 June 2015.

- 1 2 IMF admits mistakes on Greece bailout BBC News, Business, 5 June 2013

- ↑ IMF concedes it made mistakes on Greece M. Steves and I. Talley, The Wall Street Journal, Europe, 5 June 2013

- 1 2 Greece:Staff report on request for stand-by arrangement IMF, Country report No. 10/110 (2010)

- ↑ Breaking Greece P. Krugman, The Conscience of a Liberal, The New York Times, 25 June 2015

- ↑ OECD, National Accounts of OECD Countries detailed tables 2006-2013, Volume 2014/2

- ↑ Xypolia, Ilia (May 2012). "Sorry, folks..the wake is ove". London Progressive Journal. Retrieved 15 October 2012.

- ↑ "Huge Sense of Doom Among 'Grexit' Predictions". CNBC. 14 May 2012. Retrieved 17 May 2012.

- ↑ Ross, Alice (14 May 2012). "Grexit and the euro: an exercise in guesswork". Financial Times. Retrieved 16 May 2012.

- ↑ Boot, Alexander (14 May 2012). "From 'Grexit' to 'Spain in the neck': It's time for puns, neologisms and break-ups". Daily Mail. London. Retrieved 16 May 2012.

- ↑ "Grexit Greek Exit From The Euro". Maxfarquar.com. 14 May 2012. Retrieved 16 May 2012.

- ↑ Heath, Allister (14 May 2012). "Grexit will happen much more quickly than politicians think". City A.M. Retrieved 16 May 2012.

- ↑ Louise Armitstead (23 June 2011). "EU accused of 'head in sand' attitude to Greek debt crisis". The Telegraph. London. Retrieved 24 September 2011.

- ↑ Apps, Peter (20 May 2012). "Birth of new Greek drachma would be pained, rushed". Reuters. Archived from the original on 30 May 2012. Retrieved 30 May 2012.

- 1 2 3 Randow, Jana; Thesing, Gabi (23 May 2012). "War-Gaming Greek Euro Exit Shows Hazards in 46-Hour Weekend". Bloomberg News. Archived from the original on 30 May 2012. Retrieved 30 May 2012.

- ↑ "Who, What, Why: How would Greece switch currencies?". BBC News. 11 June 2012.

- 1 2 3 4 Firzli, M. Nicolas (1 March 2010). "Greece and the EU Debt Crisis". The Vienna Review. Vienna. Archived from the original on 1 March 2010. Retrieved 30 Jan 2015.

- 1 2 3 4 5 Peter Spiegel, "Inside Europe's Plan Z", Financial Times, 14 May 2014

- 1 2 3 4 5 6 7 8 Hadjicostis, Menelaos (25 May 2012). "Greece's euro exit a recipe for hardship". The Hamilton Spectator. Archived from the original on 30 May 2012. Retrieved 30 May 2012.

- ↑ "Greek youths are getting ready to cry out,". grreporter.info.

- ↑ Wallop, Harry (29 May 2012). "De La Rue silent on deal to print Drachma". The Daily Telegraph. London. Archived from the original on 31 May 2012. Retrieved 31 May 2012.

- ↑ "Leaving the Euro: A Practical Guide" full text

- ↑ Tagaris, Karolina (29 May 2012). "Biggest Greek bank warns of dire euro exit fallout". Reuters. Archived from the original on 30 May 2012. Retrieved 30 May 2012.

- ↑ Ο Alexis Tsipras στο CNN. YouTube. 17 May 2012.

- ↑ "Clear lead for SYRIZA in Public Issue poll; support for euro at 71%". phantis.com. Retrieved 13 July 2015.

- ↑ BBC News report 15 June 2012 – "Greek election is euro versus drachma, Samaras says"

- ↑ "The day after the elections the KKE will be at the forefront of the struggles". Communist Party of Greece. 10 January 2015. Retrieved 5 July 2015.

- ↑ "Greece crisis: Syriza rebels form new party". 21 August 2015 – via www.bbc.com.

- ↑ "Greece: Greenspan predicts exit from euro inevitable", BBC News, 8 February 2015

- ↑ Jon Stone, "Tory grandee Ken Clarke warns euro exit is 'inevitable' as Greece's supporters rally in London", The Independent, 15 February 2015

- ↑ Cameron told EU leader Greek exit from euro may be best option A. Nardelli and N. Watt, The Guardian, Politics, 26 June 2015

- 1 2 3 Nomura slams the IMF: The Greek bailout is highly unrealistic O. Williams-Grut, Business Insider, Finance, 15 July 2015

- ↑ IMF stuns Europe with call for massive Greek debt relief A. Evans-Pritchard, The Daily Telegraph, 14 July 2015

- ↑ "Germany Does Care About a Greek Exit". 2015-01-05. Retrieved 2015-01-06.

- 1 2 Wagstyl, Stefan (2015-01-05). "Angela Merkel faces growing dilemma over Greece". Financial Times. Retrieved 2015-01-07.

- ↑ O'Brien, James (2015-01-05). "MEPs criticise German 'interference' in Greek elections". The Parliament Magazine. Retrieved 2015-01-07.

- ↑ Alderman, Liz (2015-01-05). "Euro Countries Take Tough Line Toward Greece". New York Times. Retrieved 2015-01-07.

- ↑ http://www.ftse.com/products/indices/grexit

- ↑ "UK plans for possible Greek euro exit". BBC News. 11 February 2015.

- ↑ Svenja O'Donnell (10 February 2015). "G-20 Finance Ministers Urge Greek Aid Deal to Avoid Euro Region Splinter". Bloomberg.com.

- ↑ Dow Jones Newswires Russia Fin Min: Could Only Provide Greece With Rubles If Athens Asks 10 February 2015

- ↑ "Greek euro exit risk raised by Commerzbank as talks break down - Business - ekathimerini.com". ekathimerini.com. Retrieved 13 July 2015.

- ↑ Geoffrey Smith / Fortune. "Greece and Eurozone Dance on the Precipice". Time.

- ↑ Alderman, Liz; Kanter, James (20 February 2015). "Eurozone Officials Reach Accord With Greece to Extend Bailout". The New York Times. Retrieved 2015-06-23.

- ↑ "As it happened – Yanis Varoufakis' intervention during the 27th June 2015 Eurogroup Meeting".

- 1 2 3 4 Barnato, Katy (25 May 2012). "Greek Exit Could Trigger 50% Fall in Euro Stocks: Analyst". CNBC. Archived from the original on 30 May 2012. Retrieved 30 May 2012.

- ↑ Athanassiou, Phoebus (December 2009), Withdrawal and Expulsion from the EU and EMU: Some Reflections (PDF), European Central Bank, p. 4, SSRN 1517760

- ↑ Jens Dammann: "The Right to Leave the Eurozone" Texas International Law Journal, Volume 48 Issue 2 pp. 126–155, (PDF).

External links

- "Viewpoints: What if Greece exits euro"? 14 May 2012 BBC News

- "'Bloody doomsday machine': How shock waves will reach the US if Greece drops the euro". Associated Press, 16 June 2012.

- Greece Debt Crisis 19 June 2012

- Why A Grexit Is Not Going To Happen 31 August 2012