Economy of Pakistan

|

Karachi, the financial centre of Pakistan | |

| Currency |

Pakistani rupee (PKR) Rs.1 = 100 [1]Paisas 1 USD = 104.6PKR (Aug 2016) |

|---|---|

| 1 July – 30 June | |

Trade organisations | ECO, SAFTA, ASEAN, WIPO and WTO |

| Statistics | |

| GDP |

$285 billion (nominal, 2016)[2] $982 billion (PPP, 2016) [3] |

| GDP rank |

25th (PPP) 41st (nominal) |

GDP growth | 4.71% (2015-16)[4][5] |

GDP per capita |

$1,550 (nominal; 141st;2016)[2] $5,384 (PPP; 132nd; 2016)[2] |

GDP by sector | agriculture: 25.1%, industry: 21.3%, services: 53.6% (2014 est.) |

| 1.8% (July 2015)[6] | |

Population below poverty line | 29.30% (2013)[7] |

Labour force | 57.60 million (2014–15)[8] |

Labour force by occupation | agriculture: 43%, []: 15.2%, manufacturing: 13.3%, wholesale and retail: 9.2%, transport and communication: 7.3% (2012–13)[8] |

| Unemployment | 6.5% (2015 est.)[9] |

Main industries | textiles and apparel, food processing, pharmaceuticals, construction materials, chemicals, cement, mining, machinery, steel, engineering, software and hardware, automobiles, motorcycle and auto parts, electronics, paper products, fertiliser, shrimp, defence products, shipbuilding |

| 138th (2015)[10] | |

| External | |

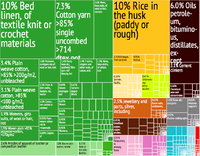

| Exports | Total $30 billion (2014-15 est.), Goods $24.131 billion, Services $5.741 billion[11] |

Export goods |

Textiles ($13,653 million) Vegetable Products ($3,094 million) Mineral ($1,698 million) Leather ($1,237 million) Food and Beverages ($956 million) Animal Farming ($756 million) Manufactured Items ($571 million) Metals ($531 million) Plastic ($505 million) Chemical ($489 million) [11] |

Main export partners |

|

| Imports | Total $50.123 billion (2014-15 est.), Goods $41.280 billion, Services $8.843 billion [13] |

Import goods |

Food $4.15 billion Machinery $5.05 billion Transport Vehicles $1.66 billion Textile $2.29 billion Fertilizers and other chemicals $6.86 billion Raw metal $2.7 billion Refined Petroleum $9.02 billion Crude Petroleum=$5.75 billion |

Main import partners |

|

| Public finances | |

| 61.8% of GDP (2014–15)[15] | |

| Revenues |

|

| Expenses |

|

|

Standard & Poor's:[17] B (Domestic) B (Foreign) B (T&C Assessment) Outlook: Positive[18] Moody's: B2[19] Outlook: Stable | |

Foreign reserves |

|

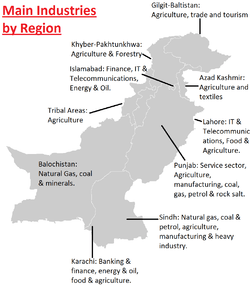

The economy of Pakistan is the 25th largest in the world in terms of purchasing power parity (PPP), and 38th largest in terms of nominal gross domestic product. Pakistan has a population of over 190 million (the world's 6th-largest), giving it a nominal GDP per capita of $1,550, which ranks 132nd in the world. However, Pakistan's undocumented economy is estimated to be 36% of its overall economy, which is not taken into consideration when calculating per capita income.[21] Pakistan is a developing country[22][23][24] and is one of the Next Eleven, the eleven countries that, along with the BRICS, have a potential to become one of the world's large economies in the 21st century.[25] However, after decades of war and social instability, as of 2013, serious deficiencies in basic services such as railway transportation and electric power generation had developed.[26] The economy is semi-industrialized, with centres of growth along the Indus River.[27][28][29] Primary export commodities include textiles, leather goods, sports goods, chemicals and carpets/rugs.[30]

Growth poles of Pakistan's economy are situated along the Indus River;[28][31] the diversified economies of Karachi and major urban centers in the Punjab, coexisting with lesser developed areas in other parts of the country.[28] The economy has suffered in the past from internal political disputes, a fast-growing population, mixed levels of foreign investment.[26] Foreign exchange reserves are bolstered by steady worker remittances, but a growing current account deficit – driven by a widening trade gap as import growth outstrips export expansion – could draw down reserves and dampen GDP growth in the medium term.[32] Pakistan is currently undergoing a process of economic liberalization, including privatization of all government corporations, aimed to attract foreign investment and decrease budget deficit.[33] In 2014, foreign currency reserves crossed $18.4 billion[34] which has led to stable outlook on the long-term rating by Standard & Poor's.[35][36] In 2016, BMI Research report named Pakistan as one of the ten emerging economies with a particular focus on of its manufacturing hub.[37]

In October 2016, the IMF chief Christine Lagarde confirmed her economic assessment in Islamabad that Pakistan's economy was 'out of crisis'[38] The World Bank predicts that by 2018, Pakistan's economic growth will increase to a "robust" 5.4% due to greater inflow of foreign investment, namely from the China-Pakistan Economic Corridor.[39] According to the World Bank, poverty in Pakistan fell from 64.3% in 2002 to 29.5% in 2014.[40] Pakistan's fiscal position continues to improve as the budget deficit has fallen from 6.4% in 2013 to 3.8% in 2016.[41][42] The country's improving Macroeconomic position has led to Moody's upgrading Pakistan's debt outlook to "stable".[43]

Economic history

First five decades

Pakistan was a very poor and predominantly agricultural country when it gained independence in 1947. Pakistan's average economic growth rate in the first five decades (1947–1997) has been higher than the growth rate of the world economy during the same period. Average annual real GDP growth rates[44] were 6.8% in the 1960s, 4.8% in the 1970s, and 6.5% in the 1980s. Average annual growth fell to 4.6% in the 1990s with significantly lower growth in the second half of that decade.[45]

Recent decades

This is a chart of trend of gross domestic product of Pakistan at market prices estimated[46] by the International Monetary Fund with figures in millions of Pakistani Rupees. See also[45]

| Year | Gross Domestic Product | US Dollar Exchange | Inflation Index (2000=100) | Per Capita Income (as % of US) |

|---|---|---|---|---|

| 1960 | 20,058 | 4.76 Pakistani Rupees | 3.37 | |

| 1965 | 31,740 | 4.76 Pakistani Rupees | 3.40 | |

| 1970 | 51,355 | 4.76 Pakistani Rupees | 3.26 | |

| 1975 | 131,330 | 9.91 Pakistani Rupees | 2.36 | |

| 1978 | 283,460 | 9.97 Pakistani Rupees | 21 | 2.83 |

| 1985 | 569,114 | 16.28 Pakistani Rupees | 30 | 2.07 |

| 1990 | 1,029,093 | 21.41 Pakistani Rupees | 41 | 1.92 |

| 1995 | 2,268,461 | 30.62 Pakistani Rupees | 68 | 2.16 |

| 2000 | 3,826,111 | 51.64 Pakistani Rupees | 100 | 1.54 |

| 2005 | 6,581,103 | 59.86 Pakistani Rupees | 126 | 1.71 |

| 2014 | 22,032,565 | 105.95 Pakistani Rupees | 260 | |

| 2016 | 45,680,351 | 104.55 Pakistani Rupees | 370 | 2.71 |

Economic resilience

Background

Historically, Pakistan's overall economic output (GDP) has grown every year since a 1951 recession. Despite this record of sustained growth, Pakistan's economy had, until a few years ago, been characterised as unstable and highly vulnerable to external and internal shocks. However, the economy proved to be unexpectedly resilient in the face of multiple adverse events concentrated into a four-year (1998–2002) period —

- the Asian financial crisis;

- economic sanctions – according to Colin Powell, Pakistan was "sanctioned to the eyeballs";[47]

- The global recession of 2001–2002;

- a severe drought – the worst in Pakistan's history, lasting about four years;

- the post-9/11 military action in neighbouring Afghanistan, with a massive influx of refugees from that country;

Macroeconomic reform and prospects

According to many sources, the Pakistani government has made substantial economic reforms since 2000,[48] and medium-term prospects for job creation and poverty reduction are the best in nearly a decade.

In 2005, the World Bank reported that

- "Pakistan was the top reformer in the region and the number 10 reformer globally – making it easier to start a business, reducing the cost to register property, increasing penalties for violating corporate governance rules, and replacing a requirement to license every shipment with two-year duration licences for traders."[49]

Doing business

The World Bank (WB) and International Finance Corporation's flagship report Ease of Doing Business Index 2015 ranked Pakistan 138 among 189 countries around the globe. The top five countries were Singapore, New Zealand, the United States, Hong Kong and United Kingdom.[50]

Many Western companies refuse to do business with Pakistan and cite problems of courrption, lack of resources and lack of infrastructure as key problems.[51]

The economy today

Today the Nominal GDP of Pakistan is 270.96 billion USD which is better than its last decades performance due to high growth rate.[52]

Economic comparison of Pakistan 1999–2008

In 2016 the Atlantic Media Company (AMC) of the United States has ranked Pakistan as a relatively stronger economy in the South Asian markets and expected that it will grow rapidly during days ahead. AMC said that during the period January–July this year, Indian 100 point index was 6.67% while Karachi Stock Exchange (KSE) had achieved 100 point index of 17 percent.

Multinationals

Lotte, ChinaMobile, Toyota, Haier, GDF-Suez, Citi, Colgate-Palmolive, Shell, Hutchinson, Marriott Hotels, Coca Cola, McDonalds, Telenor, Nestlé, Honda, GSK, Movenpick Hotels, Linde Groupe, Standard Chartered, Yamaha, ABB, Novartis, ICBC, Pepsi, Unilever, Uber, Abbott Labs, Johnson & Johnson, McKinsey, Excelerate Energy, Total, eni spa, OMV, UEPL, YUM! brands, Gunvor, Emaar, Deutsche Bank, SIEMENS, Sanofi, Orix, Otsuka, Nike, maybank, metro AG, Vitol, Omantel, g.e., AzkoNobel, BASF, Vestas, Temasek, FrieslandCampina International Holding BV, Audi, Philip Morris International, DPW, Oxford University Press, IBM, The Bank of Tokyo-Mitsubishi UFJ, Mol Group, Tetra Pak, Philips, Vopak, Abraaj, British American Tobacco, Schlumberger, Allianz, Exterran, Toni&Guy, Deloitte, etisilat, P&G, KSB, Hyperstar-Carrefour, Nippon Paint, Wyndham Hotels, 3M, Stora Enso Oyj, DHL, FedEx, Ace Insurance, Visa, Agility Logistics, Huawei, Nielsen, Samba Bank, Abu Dhabi Group, Serena Hotels , Emirates Logistics, Samsung, Descon.

Stock market

In the first four years of the twenty-first century, Pakistan's KSE 100 Index was the best-performing stock market index in the world as declared by the international magazine "Business Week".[54] The stock market capitalisation of listed companies in Pakistan was valued at $5,937 million in 2005 by the World Bank.[55] But in 2008, after the General Elections, uncertain political environment, rising militancy along western borders of the country, and mounting inflation and current account deficits resulted in the steep decline of the Karachi Stock Exchange. As a result, the corporate sector of Pakistan has declined dramatically in recent times. However, the market bounced back strongly in 2009 and the trend continues in 2011. By 2014 the stock market burst into uncharted territories as the benchmark KSE 100 Index rose 907 points (3.1%) and shot past the 30,000-point barrier to close at a new record high, this came days after Moody’s announced that it was upgrading the outlook of 5 major Pakistani banks from Negative to Stable, resulting in heavy buying in the banking sector. The rally was supported by heavy buying in the oil and gas and cement sectors.[56] An article published in The Journal of Developing Areas of Tennessee State University in the US, economist Mete Feridun investigates the exchange rate movements in the Pakistani foreign exchange market using the market micro structure approach, shedding more lights on the dynamics of the Pakistani Stock Exchange.[57]

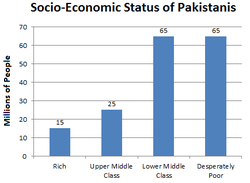

Middle class

As of 2013, according to Macro Economic Insights, a research firm in Islamabad, the size of the Pakistani middle class is conservatively estimated at approximately 70 million, out of a total population of about 186 million. This represents 40% of the population of the country.[58]

On measures of income inequality, the country ranks slightly better than the median. In late 2006, the Central Board of Revenue estimated that there were almost 2.8 million income-tax payers in the country.[59] However, by 2013, the number of taxpayers was drastically reduced to just 768,000 out of a total population of 190 million, meaning that only 0.57% of the population pay taxes[60]

Poverty levels have decreased by 10% since 2001[61] Foreign Companies which provide for Pakistani middle classes have been very successful. For example, demand for Unilever products have recently been so high that even after doubling production the Anglo-Dutch company struggled to meet demand and its chairman stated "Pakistanis can’t seem to have enough".[62]

Poverty alleviation expenditures

Pakistan government spent over 1 trillion Rupees (about $16.7 billion) on poverty alleviation programmes during the past four years, cutting poverty from 35% in 2000–01 to 29.3% in 2013.[64] Rural poverty remains a pressing issue, as development there has been far slower than in the major urban areas.

Employment

The high population growth in the past few decades has ensured that a very large number of young people are now entering the labor market. Even though it is among the six most populous Asian nations. In the past, excessive red tape made firing from jobs, and consequently hiring, difficult.[65] Significant progress in taxation and business reforms has ensured that many firms now are not compelled to operate in the underground economy.[66]

In late 2006, the government launched an ambitious nationwide service employment scheme aimed at disbursing almost $2 billion over five years.[67][68]

Mean wages were $0.98 per man-hour in 2009. Rate of unemployment is 15%.

High inflation and limited wage growth have drawn more women into the workforce to feed their families.[69]

Government sector is also contributing in employment and according to estimate 4.5 million people are employed by federal, provincial and local governments in different sectors from Armed forces to education and health.[70]

Tourism

Tourism in Pakistan has been stated as being the tourism industry's "next big thing". Pakistan, with its diverse cultures, people and landscapes, has attracted 90 million tourists to the country, almost double to that of a decade ago. Due to threat of terrorism the number of foreigner tourists has gradually declined and the shock of 2013 Nanga Parbat tourist shooting has terribly adversely effected the tourism industry.[71] As of 2016 tourism has begun to recover in Pakistan, albeit gradually.[72]

Revenue

Although the country is a Federation with constitutional division of taxation powers between the Federal Government and the four provinces, the revenue department of the Federal Government, the Federal board of Revenue, collects almost 95% of the entire national revenue. The Federal Board of Revenue collected nearly two trillion rupees ($24 p .1 billion) in taxes in the 2007–2008 financial year,[73] while it collected about 1558 billion ($18.3 billion) during FY 2010–2011.

Currency system

Rupee

The basic unit of currency is the Rupee, ISO code PKR and abbreviated Rs, which is divided into 100 paisas. Currently the newly printed 5,000 rupee note is the largest denomination in circulation. Recently the SBP has introduced all new design notes of Rs. 10, 20, 50, 100, 500, 1000 and 5000.

The Pakistani Rupee was pegged to the Pound sterling until 1982, when the government of General Zia-ul-Haq, changed it to managed float. As a result, the rupee devalued by 38.5% between 1982/83 many of the industries built by his predecessor suffered with a huge surge in import costs. After years of appreciation under Zulfikar Ali Bhutto and despite huge increases in foreign aid the Rupee depreciated.

Foreign exchange rate

The Pakistani rupee depreciated against the US dollar until around the start of the 21st century, when Pakistan's large current-account surplus pushed the value of the rupee up versus the dollar. Pakistan's central bank then stabilised by lowering interest rates and buying dollars, in order to preserve the country's export competitiveness

| Year | Highest ↑ | Lowest ↓ | ||||

|---|---|---|---|---|---|---|

| Date | Rate | Date | Rate | |||

| 1996 | PKR 30.930 | |||||

| 1997 | PKR 35.266 | |||||

| 1998 | PKR 40.185 | |||||

| 1999 | PKR 44.550 | |||||

| 2000 | PKR 51.90 | |||||

| 2001 | PKR 53.6482 | |||||

| 2002 | PKR 61.9272 | |||||

| 2003 | PKR 59.7238 | |||||

| 2005 | PKR 57.752 | |||||

| 2006 | PKR 58.000 | |||||

| 2009 | 05 Aug | PKR 60.75 | 01 Nov | PKR 60.50 | ||

| 2010 | October 10 | PKR 80.00 | 01 Apr | PKR 63.50 | ||

| Source: PKR exchange rates in USD, SBP | ||||||

Foreign exchange reserves

Pakistan maintains foreign reserves with State Bank of Pakistan. The currency of the reserves was solely US dollar incurring speculated losses after the dollar prices fell during 2005, forcing the then Governor SBP Ishrat Hussain to step down. In the same year the SBP issued an official statement proclaiming diversification of reserves in currencies including Euro and Yen, withholding ratio of diversification.

Following the international credit crisis and spikes in crude oil prices, Pakistan's economy could not withstand the pressure and on October 11, 2008, State Bank of Pakistan reported that the country's foreign exchange reserves had gone down by $571.9 million to $7749.7 million.[74] The foreign exchange reserves had declined more by $10 billion to a level of $6.59 billion.

Structure of economy

The economy of the Islamic Republic of Pakistan is suffering with high inflation rates well above 26%. Over 1,081 patent applications were filed by non-resident Pakistanis in 2004 revealing a new-found confidence.[75] Agriculture accounted for about 53% of GDP in 1947. While per-capita agricultural output has grown since then, it has been outpaced by the growth of the non-agricultural sectors, and the share of agriculture has dropped to roughly one-fifth of Pakistan's economy. In recent years, the country has seen rapid growth in industries (such as apparel, textiles, and cement) and services (such as telecommunications, transportation, advertising, and finance).

Major Sectors

Primary

Agriculture

The most important crops are wheat, sugarcane, cotton, and rice, which together account for more than 75% of the value of total crop output. Pakistan's largest food crop is wheat. In 2005, Pakistan produced 21,591,400 metric tons of wheat, more than all of Africa (20,304,585 metric tons) and nearly as much as all of South America (24,557,784 metric tons), according to the FAO.[76] The country is expected to harvest 47 to 64 million tons of wheat in 2015. Pakistan has also cut the use of dangerous pesticides dramatically.[77]

Pakistan is a net food exporter, except in occasional years when its harvest is adversely affected by droughts. Pakistan exports rice, cotton, fish, fruits (especially Oranges and Mangoes), and vegetables and imports vegetable oil, wheat, pulses and consumer foods. The country is Asia's largest camel market, second-largest apricot and ghee market and third-largest cotton, onion and milk market. The economic importance of agriculture has declined since independence, when its share of GDP was around 53%. Following the poor harvest of 1993, the government introduced agriculture assistance policies, including increased support prices for many agricultural commodities and expanded availability of agricultural credit. From 1993 to 1997, real growth in the agricultural sector averaged 5.7% but has since declined to about 4%. Agricultural reforms, including increased wheat and oilseed production, play a central role in the government's economic reform package.

Majority of the population, directly or indirectly, dependent on this sector. It contributes about 24 percent of Gross Domestic Product (GDP) and accounts for half of employed labor force and is the largest source of foreign exchange earnings.[78]

Pakistan's Top Ten commodities by export value in 2011 were:[79]

| Commodity | Value [1000 USD] |

|---|---|

| Wheat | 674424 |

| Cotton lint | 359341 |

| Flour of Wheat | 352014 |

| Tangerines, mandarins, clem. | 120893 |

| Potatoes | 102185 |

| Cattle meat | 71729 |

| Maize | 70028 |

| Cotton Waste | 65707 |

| Dates | 64081 |

| Vegetables fresh nes | 53136 |

Pakistan's principal natural resources are arable land and water. About 25% of Pakistan's total land area is under cultivation and is watered by one of the largest irrigation systems in the world. Pakistan irrigates three times more acres than Russia. Pakistan agriculture also benefits from year round warmth. Agriculture accounts for about 23% of GDP and employs about 44% of the labour force. Zarai Taraqiati Bank Limited is the largest financial institution geared towards the development of agriculture sector through provision of financial services and technical expertise.

Pakistan is one of the world's largest producers of the following commodities according to FAOSTAT, the statistical arm of the Food and Agriculture Organisation of The United Nations, given here with the 2008 ranking:

| Name | Global rank |

|---|---|

| Apricot | 3rd |

| Buffalo Milk | 2nd |

| Chickpea | 3rd |

| Cotton, lint | 4th |

| Cotton, Seed | 3rd |

| Dates | 5th |

| Mango | 6th |

| Onion, dry | 4th |

| Oranges | 11th |

| Rice, paddy | 11th |

| Sugarcane | 5th |

| Tangerines | 9th |

| Wheat | 8th |

Mining

Pakistan is endowed with significant mineral resources and is emerging as a very promising area for prospecting/exploration for mineral deposits. Based on available information, the country's more than 6,00,000 km² of outcrops area demonstrates varied geological potential for metallic and non-metallic mineral deposits. Except oil, gas and nuclear minerals regulated at federal level, minerals are a provincial subject, under the constitution of the Islamic Republic of Pakistan. Provincial governments are responsible for development and exploitation of minerals, besides, enforcing regulatory regime. In line with the constitutional framework the federal and provincial governments have jointly set out Pakistan's first National Mineral Policy in 1995, duly implemented by the provinces, providing appropriate institutional and regulatory framework and equitable and internationally competitive fiscal regime.

In the recent past, exploration by government agencies as well as by multinational mining companies presents ample evidence of the occurrences of sizeable minerals deposits. Recent discoveries of a thick oxidised zone underlain by sulphide zones in the shield area of the Punjab province, covered by thick alluvial cover have opened new vistas for metallic minerals exploration. Pakistan has a large base for industrial minerals. The discovery of coal deposits having over 175 billion tones of reserves at Thar in the Sindh province has given an impetus to develop it as an alternate source of energy. There is vast potential for precious and dimension stones.

The enforcement of Mineral Policy (1995) has paved the way to expand mining sector activities and attract international investment in this sector. International mining companies have responded favorably to the NMP and presently at least four are engaged in mineral projects development.

Currently about 52 minerals are under exploitation although on small scale. The major production is of coal, rock salt and other industrial and construction minerals. The current contribution of the mineral sector to the GDP is about 0.5% and likely to increase considerably on the development and commercial exploitation of Saindak & Reco Diq copper and gold deposits (world's largest gold mine), Duddar zinc lead, Thar coal and gemstone deposits.

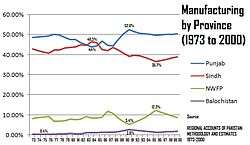

Secondary

Industry

Pakistan's industrial sector accounts for about 24% of GDP. Cotton textile production and apparel manufacturing are Pakistan's largest industries, accounting for about 66% of the merchandise exports and almost 40% of the employed labour force.[80] Other major industries include cement, fertiliser, edible oil, sugar, steel, tobacco, chemicals, machinery, and food processing.

The government is privatizing large-scale industrial units, and the public sector accounts for a shrinking proportion of industrial output, while growth in overall industrial output (including the private sector) has accelerated. Government policies aim to diversify the country's industrial base and bolster export industries. Large Scale Manufacturing is the fastest-growing sector in Pakistani economy[81] Major Industries include textiles, fertiliser, cement, oil refineries, dairy products, food processing, beverages, construction materials, clothing, paper products and shrimp

In Pakistan SMEs have a significant contribution in the total GDP of Pakistan, according to SMEDA and Economic survey reports, the share in the annual GDP is 40% likewise SMEs generating significant employment opportunities for skilled workers and entrepreneurs. Small and medium scale firms represent nearly 90% of all the enterprises in Pakistan and employ 80% of the non-agricultural labor force. These figures indicate the potential and further growth in this sector.[65]

Pakistan's largest corporation are mostly involved in utilities like oil, gas and telecommunication:

| Rank[82] | Name | Headquarters | Revenue (Mil. $) |

|---|---|---|---|

| 1. | Pakistan State Oil | Karachi | 13,094[83] |

| 2. | Pak-Arab Refinery | Qasba Gujrat | 3,000 |

| 3. | Sui Northern Gas Pipelines Limited | Lahore | 2,520 |

| 4. | Shell Pakistan | Karachi | 2,380 |

| 5. | Oil and Gas Development Company | Islamabad | 2,230 |

| 6. | National Refinery | Karachi | 1,970 |

| 7. | Hub Power Company | Hub, Balochistan | 1,970 |

| 8. | K-Electric | Karachi | 1,951[84] |

| 9. | Attock Refinery | Rawalpindi | 1,740 |

| 10. | Attock Petroleum | Rawalpindi | 1,740 |

| 11. | Pakistan Telecommunication Company | Islamabad | 1,326 |

| 12. | Engro Corporation | Karachi | 1,012[85] |

| 13. | Fauji Fertilizer Company Limited | Rawalpindi | 754 |

Construction material

In 1947, Pakistan had inherited four cement plants with a total capacity of 0.5 million tons. Some expansion took place in 1956–66 but could not keep pace with the economic development and the country had to resort to imports of cement in 1976–77 and continued to do so till 1994–95. The cement sector consisting of 27 plants is contributing above Rs 30 billion to the national exchequer in the form of taxes. However, by 2013, Pakistan's cement is fast-growing mainly because of demand from Afghanistan and countries boosting real estate sector, In 2013 Pakistan exported 7,708,557 metric tons of cement.[86] Pakistan has installed capacity of 44,768,250 metric tons of cement and 42,636,428 metric tons of clinker. In the 2012–2013 cement industry in Pakistan became the most profitable sector of economy.[87]

Information Communication Technology Industry

Information Communication Technology (ICT) industry grossed over $4.8 billion in 2013. However, it is expected to exceed the $13 billion mark by 2018.[88] A marked increase in software export figures are an indication of this booming industry’s potential. The total number of IT companies increased to 1306 and the total estimated size of IT industry is $2.8 billion. In 2007, Pakistan was for the first time featured in the Global Services Location Index by A.T. Kearney and was rated as the 30th best location for offshoring.[89] By 2009, Pakistan had improved its rank by ten places to reach 20th.[90] According to Pakistan Startup report, there are about 1 million freelancers working from Pakistan mainly via elance, oDesk and freelancer – world’s famous online market places that count Pakistan among top 5 freelancing nations.

Defence Industry

The defence industry of Pakistan, under the Ministry of Defence Production, was created in September 1951 to promote and coordinate the patchwork of military production facilities that have developed since independence.It is currently actively participating in many joint production projects such as Al Khalid 2, advance trainer aircraft, combat aircraft, navy ships and submarines. Pakistan is manufacturing and selling weapons to over 40 countries, bringing in $20 million annually.The country’s arms imports increased by 119 per cent between the 2004–2008 and 2009–13, with China providing 54pc and the USA 27pc of Pakistan’s imports.

Textiles

Most of the Textile Industry is established in Punjab. 10% of United States imports regarding clothing and other form of textiles is covered by Pakistan.[91]

Other

As of 2010, Pakistan is one of the largest users of CNG (compressed natural gas) in the world. Presently, more than 3,000 CNG stations are operating in the country in 99 cities and towns, and 1000 more would be set up in the next two years. It has provided employment to over 50,000 people in Pakistan, but the CNG industry is struggling to survive the 2013 energy crisis.[92][93]

Services

Pakistan's service sector accounts for about 53.3% of GDP.[94] Transport, storage, communications, finance, and insurance account for 24% of this sector, and wholesale and retail trade about 30%. Pakistan is trying to promote the information industry and other modern service industries through incentives such as long-term tax holidays.

Communication

After the deregulation of the telecommunication industry, the sector has seen an exponential growth. Pakistan Telecommunication Company Ltd has emerged as a successful Forbes 2000 conglomerate with over US $1 billion in sales in 2005. The mobile telephone market has exploded fourteen-fold since 2000 to reach a subscriber base of 91 million users in 2008, one of the highest mobile teledensities in the entire world.[95] In addition, there are over 6 million landlines in the country with 100% fibre-optic network and coverage via WLL in even the remotest areas.[96] As a result, Pakistan won the prestigious Government Leadership award of GSM Association in 2006.[97]

The World Bank estimates that it takes about 3 days to get a phone connection in Pakistan.[98]

In Pakistan, the following are the top mobile phone operators:

- Mobilink (Parent: VimpelCom Ltd., Netherland)

- Ufone (Parent: PTCL (Etisalat), Pakistan/UAE)

- Telenor (Parent: Telenor, Norway)

- Zong (Parent: China Mobile, China)

By March 2009, Pakistan had 91 million mobile subscribers – 25 million more subscribers than reported in the same period in 2008. In addition to the 3.1 million fixed lines, while as many as 2.4 million are using Wireless Local Loop connections. Sony Ericsson, Nokia and Motorola along with Samsung and LG remain the most popular brands among customers.[95]

Since liberalisation, over the past four years, the Pakistani telecom sector has attracted more than $9 billion in foreign investments.[99] During 2007–08, the Pakistani communication sector alone received $1.62 billion in Foreign Direct Investment (FDI) – about 30% of the country’s total foreign direct investment.

Present growth of state-of-the-art infrastructures in the telecoms sector during the last four years has been the result of the PTA's vision and implementation of the deregulation policy. Paging and mobile (cellular) telephones were adopted early and freely. Cellular phones and the Internet were adopted through a rather laissez-faire policy with a proliferation of private service providers that led to the fast adoption. With a rapid increase in the number of Internet users and ISPs, and a large English-speaking population, Pakistani society has seen an unparalleled revolution in communications.

According to the PC World,[100] a total of 6.37 billion text messages were sent through Acision messaging systems across Asia Pacific over the 2008/2009 Christmas and New Year period. Pakistan was amongst the top five ranker with one of the highest SMS traffic with 763 million messages.

Pakistan is ranked 4th in terms of broadband Internet growth in the world, as the subscriber base of broadband Internet has been increasing rapidly. The rankings are released by Point Topic Global broadband analysis, a global research centre.[101]

- Pakistan has more than 20 million Internet users in 2009.[102] The country is said to have a potential to absorb up to 50 million mobile phone Internet users in the next 5 years thus a potential of nearly 1 million connections per month.

- Almost all of the main government departments, organisations and institutions have their own websites.

- The use of search engines and instant messaging services is also booming. Pakistanis are some of the most ardent chatters on the Internet, communicating with users all over the world. Recent years have seen a huge increase in the use of online marriage services, for example, leading to a major re-alignment of the tradition of arranged marriages.

- As of 2007 there were six cell phone companies operating in the country with nearly 90 million mobile phone users in the country.

- There were 140 million mobile phone users in Pakistan in 2014, eighth largest in the world.

- Wireless local loop and the landline telephony sector has also been liberalised and private sector has entered thus increasing the teledensity rate. In mid-2008, the Local Loop installed capacity reached around 5.5 million.[103]

- Telecom industry created of 80,000 jobs directly and 500,000 jobs indirectly.

The Federal Bureau of Statistics provisionally valued this sector at Rs.982,353 million in 2005 thus registering over 91% growth since 2000.[104]

Transportation

Pakistan International Airlines, the flagship airline of Pakistan's civil aviation industry, has turnover exceeding $25 billion in 2015.[105] The government announced a new shipping policy in 2006 permitting banks and financial institutions to mortgage ships.[106] Private sector airlines in Pakistan include Airblue, which serves the main cities within Pakistan in addition to destinations in the Gulf and Manchester in the United Kingdom. The other private carrier is Shaheen Air International whose network covers the main cities of Pakistan and the Gulf.

A massive rehabilitation plan worth $1 billion over five years for Pakistan Railways has been announced by the government in 2005.[107] A new rail link trial has been established from Islamabad to Istanbul, via the Iranian cities of Zahedan, Kerman and Tehran. It is expected to promote trade, tourism, especially for exports destined for Europe (as Turkey is part of Europe and Asia).[108][109]

Finance

Pakistan's banking sector has remained remarkably strong and resilient during the world financial crisis in 2008–09, a feature which has served to attract a substantial amount of FDI in the sector. Stress tests conducted on June 2008 data indicate that the large banks are relatively robust, with the medium and small-sized banks positioning themselves in niche markets. Banking sector turned profitable in 2002. Their profits continued to rise for the next five years and peaked to Rs 84.1 ($1.1 billion) billion in 2006.

The credit card market continued its strong growth with sales crossing the 1 million mark in mid-2005.[110] Since 2000 Pakistani banks have begun aggressive marketing of consumer finance to the emerging middle class, allowing for a consumption boom (more than a 7-month waiting list for certain car models) as well as a construction bonanza.

The Federal Bureau of Statistics provisionally valued this sector at Rs.311,741 million in 2005 thus registering over 166% growth since 2000.[104]

An article published in Journal of the Asia Pacific Economy by Mete Feridun of University of Greenwich in London with his Pakistani colleague Abdul Jalil presents strong econometric evidence that financial development fosters economic growth in Pakistan.[111]

Housing

The property sector has expanded twenty-threefold since 2001, particularly in metropolises like Lahore.[112] Nevertheless, the Karachi Chamber of Commerce and Industry estimated in late 2006 that the overall production of housing units in Pakistan has to be increased to 0.5 million units annually to address 6.1 million backlog of housing in Pakistan for meeting the housing shortfall in next 20 years. The report noted that the present housing stock is also rapidly aging and an estimate suggests that more than 50% of stock is over 50 years old. It is also estimated that 50% of the urban population now lives in slums and squatter settlements. The report said that meeting the backlog in housing, besides replacement of out-lived housing units, is beyond the financial resources of the government. This necessitates putting in place a framework to facilitate financing in the formal private sector and mobilise non-government resources for a market-based housing finance system.[113]

The Federal Bureau of Statistics provisionally valued this sector at Rs.185,376 million in 2005 thus registering over 49% growth since 2000.[104]

Minor Sectors

The Federal Bureau of Statistics provisionally valued this sector at Rs.389,545 million in 2005 thus registering over 65% growth since 2000.[104] The Federal Bureau of Statistics provisionally valued this sector at Rs.631,229 million in 2005 thus registering over 78% growth since 2000.[104] The Federal Bureau of Statistics provisionally valued this sector at Rs.1,358,309 million in 2005 thus registering over 96% growth since 2000. The wholesale and retail trade is the largest sub-sector of the services. Its share in the overall services sector is estimated at 31.5 percent. The wholesale and retail trade sector is based on the margins taken by traders on the transaction of commodities traded. In 2012–13, this sector grew at 2.5 percent as compared to 1.7 percent in the last year.

Energy

For years, the matter of balancing Pakistan's supply against the demand for electricity has remained a largely unresolved matter. Pakistan faces a significant challenge in revamping its network responsible for the supply of electricity. While the government claims credit for overseeing a turnaround in the economy through a comprehensive recovery, it has just failed to oversee a similar improvement in the quality of the network for electricity supply. Most cities in Pakistan receive substantial sunlight throughout the year, which would suggest good conditions for investment in solar energy. If the rich people in Pakistan are shifted to solar energy that they should be forced to purchase solar panels, the shortfall can be controlled. this will make the economy boost again as before 2007. According to an econometric analysis published in Quality & Quantity by Mete Feridun of University of Greenwich and his colleague Muhammad Shahbaz, economic growth in Pakistan leads to electricity consumption but not vice versa.[114]

Chemicals and pharmaceuticals

Foreign trade, remittances, aid, and investment

Investment

Foreign direct investment (FDI) in Pakistan soared by 180.6 percent year-on-year to US$2.22 billion and portfolio investment by 276 per cent to $407.4 million during the first nine months of fiscal year 2006, the State Bank of Pakistan (SBP) reported on 24 April. During July–March 2005–06, FDI year-on-year increased to $2.224 billion from only $792.6 million and portfolio investment to $407.4 million, whereas it was $108.1 million in the corresponding period last year, according to the latest statistics released by the State Bank.[116] Pakistan has achieved FDI of almost $8.4 billion in the financial year 06/07, surpassing the government target of $4 billion.[117] Foreign investment had significantly declined by 2010, dropping by 54.6% due to Pakistan's political instability and weak law and order, according to the Bank of Pakistan.[118]

Business regulations have been overhauled along liberal lines, especially since 1999. Most barriers to the flow of capital and international direct investment have been removed. Foreign investors do not face any restrictions on the inflow of capital, and investment of up to 100% of equity participation is allowed in most sectors. Unlimited remittance of profits, dividends, service fees or capital is now the rule. Business regulations are now among the most liberal in the region. This was confirmed by the World Bank's Ease of Doing Business Index report published in September 2009 ranking Pakistan (at 85th) well ahead of neighbours like China (at 89th) and India (at 133rd).[119]

Pakistan is attracting private equity and was the ranked as number 20 in the world based on the amount of private equity entering the nation. Pakistan has been able to attract a portion of the global private equity investments because of economic reforms initiated in 2003 that have provided foreign investors with greater assurances for the stability of the nation and their ability to repatriate invested funds in the future.[120]

Tariffs have been reduced to an average rate of 16%, with a maximum of 25% (except for the car industry). The privatization process, which started in the early 1990s, has gained momentum, with most of the banking system privately owned, and the oil sector targeted to be the next big privatization operation.

The recent improvements in the economy and the business environment have been recognised by international rating agencies such as Moody’s and Standard and Poor’s (country risk upgrade at the end of 2003). 47.1% increase in Net FDI in 2014–2015 (July–October) as compared to 2013–14 (July–October).[121]

Foreign acquisitions and mergers

With the rapid growth in Pakistan's economy, foreign investors are taking a keen interest in the corporate sector of Pakistan. In recent years, majority stakes in many corporations have been acquired by multinational groups.

- PICIC by Singapore-based Temasek Holdings for $339 million

- Union Bank by Standard Chartered Bank for $487 million

- Prime Commercial Bank by ABN Amro for $228 million

- PakTel by China Mobile for $460 million

- PTCL by Etisalat for $1.8 billion

- Additional 57.6% shares of Lakson Tobacco Company acquired by Philip Morris International for $382 million

The foreign exchange receipts from these sales are also helping cover the current account deficit.[122]

Foreign trade

Pakistan's hard currency reserves have grown rapidly. Improved fiscal management, greater transparency and other governance reforms have led to upgrades in Pakistan's credit rating. Together with lower global interest rates, these factors have enabled Pakistan to prepay, refinance and reschedule its debts to its advantage. Despite the country's current account surplus and increased exports in recent years, Pakistan still has a large merchandise-trade deficit. The budget deficit in fiscal year 1996–97 was 6.4% of GDP. The budget deficit in fiscal year 2003–04 is expected to be around 4% of GDP.

In the late 1990s Pakistan received about $2.5 billion per year in loan/grant assistance from international financial institutions (e.g., the IMF, the World Bank, and the Asian Development Bank) and bilateral donors.[123] Increasingly, the composition of assistance to Pakistan shifted away from grants toward loans repayable in foreign exchange. All new U.S. economic assistance to Pakistan was suspended after October 1990, and additional sanctions were imposed after Pakistan's May 1998 nuclear weapons tests. The sanctions were lifted by president George W. Bush after Pakistani president Musharraf allied Pakistan with the U.S. in its war on terror. Having improved its finances, the government refused further IMF assistance, and consequently the IMF programme was ended.[124] The government is also reducing tariff barriers with bilateral and multilateral agreements.

While the country has a current account surplus and both imports and exports have grown rapidly in recent years, it still has a large merchandise-trade deficit. This deficit amounted to over €15 billion in 2010.[125] The budget deficit in fiscal year 2004–2005 was 3.4% of GDP. The budget deficit in fiscal year 2005–06 is expected to be over 4% of GDP. Economists believe that the soaring trade deficit would have an adverse impact on Pakistani rupee by depreciating its value against dollar (1 US $ = 60 Rupees (March 2006) ) and other currencies.

One of the main reasons that contributed to the increase in trade deficit is the increased imports of earthquake relief related items, especially tents, tarpaulin and plastic sheets to provide temporary shelter to the survivors of earthquake of October 8, 2005, in Azad Jammu and Kashmir and parts of Khyber-Pakhtunkhwa, an official said. The rise in the trade gap was also fuelled by high oil import prices, food items, machinery and automobiles.

The Petroleum Ministry says that this year the bill of oil imports was expected to reach $6.5 billion against $4.6 billion in the last fiscal year, which is the main reason behind the all-time high trade deficit.

The EU is the single largest trading partner of Pakistan absorbing over one-third of the exports in 2003. In 2010, the EU accounted for 12.4% of Pakistani imports and 22.6% of its exports.[125]

The public debt of the country has surged by almost 100% to Rs12.024 trillion as of 31 March 2011 – 2012 from Rs6.055 trillion in 2007–2008. The trade deficit has increased by 14.5% and current account deficit has swelled by $3.39 billion despite the fact that the country received $10.8 billion in workers’ remittances in 10 months of the current financial.[126]

Exports

Pakistan's exports increased more than 100% from $7.5 billion in 1999 to stand at $18 billion in the financial year 2007–2008.[127]

Pakistan exports rice, oranges, mangoes, furniture, cotton fiber, cement, tiles, marble, textiles, clothing, leather goods, sports goods (renowned for footballs/soccer balls), cutlery, surgical instruments, electrical appliances, software, carpets and rugs, ice cream, livestock meat, chicken, powdered milk, wheat, seafood (especially shrimp/prawns), vegetables, processed food items, Pakistani-assembled Suzukis (to Afghanistan and other countries), defence equipment (submarines, tanks, radars), salt, onyx, engineering goods, and many other items. Pakistan produces and exports cements to Asia and the Middle East. In August 2007, Pakistan started exporting cement to India to fill in the shortage there caused by the lack of Cement Industry.[128] Russia is a growing market for Pakistani exporters. In 2009/2010 the export target of Pakistan was US $20 billion.[129] As of April 2011, Pakistans exports stand at US $25 billion.

External imbalances

Pakistan suffered a merchandise trade deficit of $13.528 billion for the financial year 2006–07. The gap has considerably widened since 2002–03 when the deficit was only $1.06 billion.[130] Services sector deficit for 2006–2007 stood at $4.125 billion which equals the services export of $4.125 billion for the same year.[131]

The combined deficit in services and goods stand at $17.653 billion which is approx 83.5% of country's total export of $21.136 (Goods and services). The rise in the trade gap has been attributed to high oil import bill, and rise in the prices of food items, machinery and automobiles.

Current account – Current account deficit for 2006–07 reached $7.016 billion up by 41% over previous year's $4.490 billion.

Since the beginning of 2008, Pakistan's economic outlook has taken a dramatic downturn. Security concerns stemming from the nation's role in the War on Terror have created great instability and led to a decline in FDI from a height of approximately $8 bn to $3.5bn for the current fiscal year. Concurrently, the insurgency has forced massive capital flight from Pakistan to the Gulf. Combined with high global commodity prices, the dual impact has shocked Pakistan's economy, with gaping trade deficits, high inflation and a crash in the value of the Rupee, which has fallen from 60–1 USD to over 80-1 USD in a few months. For the first time in years, it may have to seek external funding as Balance of Payments support. Consequently, S&P lowered Pakistan’s foreign currency debt rating to CCC-plus from B, just several notches above a level that would indicate default. Pakistan’s local currency debt rating was lowered to B-minus from BB-minus. Credit agency Moody’s Investors Service cut its outlook on Pakistan’s debt to negative from stable due to political uncertainty, though it maintained the country’s rating at B2. The cost of protection against a default in Pakistan’s sovereign debt trades at 1,800 basis points, according to its five-year credit default swap, a level that indicates investors believe the country is already in or will soon be in default.[132]

The middle term, however, may be less turbulent, depending on the political environment. The EIU hsd estimated that inflation should drop back to single digits in 2010, and that growth would pick up to over 5% per annum by 2011. However, the unprecedented floods of 2010 which encapsulated 20% of Pakistan's land area, have caused a monetary damage estimated to be in excess of $10bn, as a result of which real growth is almost flat and EIU's original targets will have to be revised. Much like previous natural disasters which have afflicted Pakistan, the floods of 2010 inflicted damage of epic proportions. However, the philanthropic nature of Pakistani people and widespread coverage by a fiercely independent and established media has proven yet again that Pakistan is an incredibly resilient nation.[52]

Economic aid

Pakistan receives economic aid from several sources as loans and grants. The International Monetary Fund (IMF), World Bank (WB), Asian Development Bank (ADB), etc. provides long-term loans to Pakistan. Pakistan also receives bilateral aid from developed and oil-rich countries.

The Asian Development Bank will provide close to $6 billion development assistance to Pakistan during 2006–9.[133] The World Bank unveiled a lending programme of up to $6.5 billion for Pakistan under a new four-year, 2006–2009, aid strategy showing a significant increase in funding aimed largely at beefing up the country's infrastructure.[134] Japan will provide $500 million annual economic aid to Pakistan.[135] In November 2008, the International Monetary Fund (IMF) has approved a loan of 7.6 Billion to Pakistan, to help stabilise and rebuild the country's economy.

More recently the government of Pakistan received an economic aid of US $5bn dollars out of which the US pledge of $1bn was described as a down-payment on the previously announced $1.5bn already promised to Pakistan for each of the next five years. The European Union promised $640m over four years, while reports said Saudi Arabia had pledged $700m over two years.[136] Overall Friends of Pakistan had pledged $1.6 billion in aid, which would help Pakistan move forward on its way to self-reliance.

The China–Pakistan Economic Corridor is being developed with $46 billion of Chinese loans and grants.

Remittances

The remittances of Pakistanis living abroad has played important role in Pakistan's economy and foreign exchange reserves. The Pakistanis settled in Western Europe and North America are important sources of remittances to Pakistan. Since 1973 the Pakistani workers in the oil rich Arab states have been sources of billions dollars of remittances.

The 7 million-strong Pakistani diaspora, contributed US$11.2 billion to the economy in FY2011.[137] The major source countries of remittances to Pakistan include UAE, US, Saudi Arabia, GCC countries (including Bahrain, Kuwait, Qatar and Oman), Australia, Canada, Japan, UK and EU countries like Norway, Switzerland, etc.[138]

The State Bank of Pakistan (SBP) has announced that remittances sent home by overseas Pakistani workers have crossed the $10 billion mark for the first time in the country’s history as the figure reached $10.1 billion in 11 months (July–May) of the current financial year. The 11-month figure was $2.07 billion or 25 per cent more than $8.09 billion worth of remittances received in the same period of the previous year. In May, overseas workers remitted over $1 billion, which was the third consecutive month that remittances crossed this mark. The country received $1.05 billion, $1.03 billion and $1.05 billion in March, April and May respectively. Citing reasons for the sharp increase in remittances, analysts say that a crackdown on the illegal Hundi and Hawala money transfer systems, swift processing and transfer of money by the banking channel and incentives for overseas Pakistanis have encouraged them to utilise legal channels. The flow of charity money after last summer floods has also given a boost to the remittances this year, they say. In the July–May period, remittances from Saudi Arabia, UAE, US, GCC countries (including Bahrain, Kuwait, Qatar and Oman), UK and EU countries were $2.38 billion, $2.33 billion, $1.86 billion, $1.18 billion, $1.09 billion and $320.93 million respectively. In comparison, remittances stood at $1.72 billion, $1.84 billion, $1.61 billion, $1.13 billion, $793.91 million and $229.74 million respectively in July–May 2009–10. Remittances received from Norway, Switzerland, Australia, Canada, Japan and other countries during the 11 months amounted to $926.86 million against $740.96 million in the same period last year.[139] Governor, State Bank of Pakistan (SBP) Yaseen Anwar said during first ten months of FY2011/12, remittances from overseas Pakistanis rose by 20.2% to $10.88 billion, which helped Balance of Payments (BoP) despite widening of trade deficit. Pakistan’s fiscal challenges are well known and documented. The Pakistani diaspora of around 10 million sent home around $7.9 billion in the first six months of FY2014 and remittances are expected to touch around $16 billion at the end of FY 2014 thus help easing balance of payment crisis.[140] This spillover to the rest of economy is equally clear. He explained that at start of year (July 2011), external conditions appeared daunting due to rising oil prices and lack of external financing.[141]

Government finances

Fiscal budget summary

- Fiscal year: 1 July – 30 June

- Budget outlay: Rs 3.259 trillion (FY2010/11)

- Revenues: $19.8 billion

- Expenditures:

- Debt – external: $50 billion (2010 est.)

- Economic aid – recipient: $1.2 billion (FY2010/11)

Revenues and taxation

Pakistan has a low tax/GDP ratio, which it is trying to improve. The current tax-to-GDP ration is estimated to be between 8%–9% which is far below developing other countries of the region such as India (15%) and Sri Lanka (18%). Recently, Pakistan's coalition government proposed the idea of imposing a Reformed General Sales tax which was modelled along the lines of VAT. However, with the war on terror having engulfed Pakistan's economy, the politically unpopular bill was not approved in the senate/parliament and has afforded some respite to the people of Pakistan who are already suffering from a stagnant economy and rampant inflation.[142]

Expenditures (and the economic costs of War on Terror)

Government expenditures were $25 billion (2006 est.)

Pakistan has sustained immense socio-economic costs of being a partner in the international counter terrorism campaign. According to government estimates, the war on terror cost the Pakistani economy nearly US$8 billion a year in terms of lost exports, foreign investment, privatisation, industrial output, tax collection (see table below for the government's estimation of the cost of ‘War on Terror’ to Pakistan as published in an IMF report).[143]

| (Rs billion) | 2004/05 | 2005/06 | 2006/07 | 2007/08 | 2008/09 |

|---|---|---|---|---|---|

| Direct Cost | 67.103 | 78.060 | 82.499 | 108.527 | 114.033 |

| Indirect Cost* | 192.000 | 222.720 | 278.400 | 375.840 | 563.760 |

| Total | 259.103 | 300.780 | 360.899 | 484.367 | 677.793 |

'*On account of loss of exports, foreign investment, privatisation, industrial output, tax collection, etc.

According to the IMF, the anti-terrorist campaign following the 9/11 attacks in the United States strained Pakistan’s budget, as allocations for law enforcement agencies had to be increased significantly, eroding resources for development in the country. In addition to human sufferings and resettlement costs, development projects are afflicted with delays which ultimately resulted in large cost over-runs. The heightened sense of uncertainty has contributed to capital flight and slowed down domestic economic activity, creating unease among foreign investors. There has also been massive unemployment in the terror-inflicted regions, as frequent bombings and worsening law and order situation have taken a toll on the socio-economic fabric of the country.[143]

Sovereign bonds

Pakistan is expected to sell a dual-tranche sovereign bond worth $750 million on 23 March 2006 that analysts said should ensure a favourable reception in the bond market. The 10-year tranche would be $500 million and the 30-year portion $250 million. Pricing is expected during New York trading hours on 23 March 2006. The sources said that the 10-year tranche was expected to be priced at around 100125%, while the longer-dated tranche was expected to be sold at around 70.875%, the top end of the indicative yield range of 3.75 to 10.875%.

The bonds, consisting of 10-year and 30-year tranches, had generated $1.5 billion in orders and a total size of as much as $1.25 billion had been anticipated for what is Pakistan’s third foray into the international debt market since 2004.[144]

The Government of Pakistan has been raising money from the international debt market from time to time.

The details of amount raised in various issues are as follows:

1999 – $6230 million

2004 – $5000 million @ 6.75%[145]

2005 – $6000 million worth Islamic bonds[144][146]

2007 – $7500 million @ 6.875% worth Euro Bonds which were highly over subscribed[147]

Income distribution

- Gini Index: 41

- Household income or consumption by percentage share:

- lowest 10%: 4.1%

- highest 10%: 27.7% (1996)

- middle 10%: 10.4%

See also

By province and administrative unit:

- Economy of Azad Kashmir

- Economy of Balochistan, Pakistan

- Economy of the Federally Administered Tribal Areas

- Economy of Islamabad

- Economy of Khyber Pakhtunkhwa

- Economy of Punjab, Pakistan

- Economy of Sindh

- Economy of Karachi

- Economy of Lahore

- Economy of Faisalabad

- Economy of Rawalpindi

Other

- 2011 Pakistan federal budget

- Agriculture in Pakistan

- Economic effects of 2010 Pakistan floods

- Economic history of Pakistan

- Economy of the OIC

- Industry of Pakistan

- List of Pakistani Districts by Human Development Index

- List of Pakistani provinces by gross domestic product

- List of Pakistanis by net worth

- List of tariffs in Pakistan

- Ministry of Commerce (Pakistan)

- Ministry of Finance (Pakistan)

- Pakistan Board of Investment

- Prize Bonds[148]

- Science and technology in Pakistan

- Trade Development Authority of Pakistan

- Trading Corporation of Pakistan

Further reading

- Gabol, Nasir (1990). Privatisation in Pakistan,. Paris, France: Organisation for Economic Cooperation and Development. ISBN 92-64-15310-1.

- Ahmad, Viqar and Rashid Amjad. 1986. The Management of Pakistan’s Economy, 1947–82. Karachi: Oxford University Press.

- Ali, Imran. 1997. ‘Telecommunications Development in Pakistan’, in E.M. Noam (ed.), Telecommunications in Western Asia and the Middle East. New York: Oxford University Press.

- Ali, Imran. 2001a. ‘The Historical Lineages of Poverty and Exclusion in Pakistan’. Paper presented at Conference on Realm, Society and Nation in South Asia. National University of Singapore.

- Ali, Imran. 2001b. ‘Business and Power in Pakistan’, in A.M. Weiss and S.Z. Gilani (eds), Power and Civil Society in Pakistan. Karachi: Oxford University Press.

- Ali, Imran. 2002. ‘Past and Present: The Making of the State in Pakistan’, in Imran Ali, S. Mumtaz and J.L. Racine (eds), Pakistan: The Contours of State and Society. Karachi: Oxford University Press.

- Ali, Imran, A. Hussain. 2002. Pakistan National Human Development Report. Islamabad: UNDP.

- Ali, Imran, S. Mumtaz and J.L. Racine (eds). 2002. Pakistan: The Contours of State and Society. Karachi: Oxford University Press.

- Amjad, Rashid. 1982. Private Industrial Investment in Pakistan, 1960–70. London: Cambridge University Press.

- Andrus, J.R. and A.F. Mohammed. 1958. The Economy of Pakistan. Stanford: Stanford University Press.

- Bahl, R., & Cyan, M. (2009). Local Government Taxation in Pakistan (No. paper0909). International Center for Public Policy, Andrew Young School of Policy Studies, Georgia State University.

- Barrier, N.G. 1966. The Punjab Alienation of Land Bill of 1900. Durham, NC: Duke University South Asia Series.

- Jahan, Rounaq. 1972. Pakistan: Failure in National Integration. New York: Columbia University Press.

- Kessinger, T.G. 1974. Vilyatpur, 1848–1968. Berkeley and Los Angeles: University of California Press.

- Kochanek, S.A. 1983. Interest Groups and Development: Business and Politics in Pakistan. New Delhi: Oxford University Press.

- LaPorte, Jr, Robert and M.B. Ahmad. 1989. Public Enterprises in Pakistan. Boulder, Colorado: Westview Press.

- Latif, S.M. 1892. Lahore. Lahore: New Imperial Press, reprinted 1981, Lahore: Sandhu Printers.

- Low, D.A. (ed.). 1991. The Political Inheritance of Pakistan. London: Macmillan.

- Noman, Omar. 1988. The Political Economy of Pakistan. London: KPI.

- Papanek, G.F. 1967. Pakistan’s Development: Social Goals and Private Incentives. Cambridge, Massachusetts: Harvard University Press.

- Raychaudhuri, Tapan and Irfan Habib (eds). 1982. The Cambridge Economic History of India, 2 vols. Cambridge: Cambridge University Press

- White, L.J. 1974. Industrial Concentration and Economic Power. Princeton, N.J.: Princeton University Press.

- Ziring, Lawrence. 1980. Pakistan: The Enigma of Political Development. Boulder, Colorado: Folkestone.

- Ali, Imran. 1987. ‘Malign Growth? Agricultural Colonisation and the Roots of Backwardness in the Punjab’, Past and Present, 114

- Ali, Imran. August 2002. ‘The Historical Lineages of Poverty and Exclusion in Pakistan’, South Asia, XXV(2).

- Ali, Imran and S. Mumtaz. 2002. ‘Understanding Pakistan—The Impact of Global, Regional, National and Local Interactions’, in Imran Ali, S. Mumtaz and J.L. Racine (eds), Pakistan: the Contours of State and Society. Karachi: Oxford University Press.

- Hasan, Parvez. 1998. Pakistan’s Economy at the Crossroads: Past Policies and Present Imperatives. Karachi: Oxford University Press.

- Hussain, Ishrat. 1999. Pakistan: The Economy of an Elitist State. Karachi: Oxford University Press.

- Khan, Shahrukh Rafi. 1999. Fifty Years of Pakistan’s Economy: Traditional Topics and Contemporary Concerns. Karachi: Oxford University Press.

- Kibria, Ghulam. 1999. Shattered Dream: Understanding Pakistan’s Development. Karachi: Oxford University Press.

- Kukreja, Veena. 2003. Contemporary Pakistan: Political Processes, Conflicts and Crises. New Delhi: Sage Publications.

- Zaidi, S. Akbar. 1999. Issues in Pakistan’s Economy. Karachi: Oxford University Press

- Faheem, Khan. 2010. Issues in Pakistan’s Economy. Peshawar:

References

- ↑ Dawn Newspaper

- 1 2 3 "Pakistan Economy, IMF". Retrieved 2015-11-10.

- ↑ http://www.imf.org/external/pubs/ft/weo/2016/01/weodata/weorept.aspx?pr.x=66&pr.y=10&sy=2016&ey=2016&scsm=1&ssd=1&sort=country&ds=.&br=1&c=564&s=NGDP%2CNGDPD%2CPPPGDP&grp=0&a=

- ↑ http://www.pakistantoday.com.pk/2016/06/07/features/missing-gdp-growth-target/

- ↑ "World Bank forecasts for Pakistan, June 2016" (PDF). World Bank. Retrieved 27 September 2016.

- ↑ "Inflation dips to 12-year low at 1.8% in July". The Express Tribune. Aug 4, 2015. Retrieved Aug 4, 2015.

- ↑ http://data.worldbank.org/country/pakistan

- 1 2 "Labor Force Survey 2012-13" (PDF). Pakistan Bureau of Statistics. Retrieved 23 June 2014.

- ↑ "The World Factbook". cia.gov.

- ↑ . World Bank http://www.doingbusiness.org/data/exploreeconomies/pakistan/. Retrieved 2015-10-29. Missing or empty

|title=(help) - 1 2

- ↑ "Export Partners of Pakistan". CIA World Factbook. 2012. Retrieved 2013-07-23.

- ↑

- ↑ "Import Partners of Pakistan". The Observatory of Economic Complexity. 2014. Retrieved 2013-07-23.

- ↑ Zaman, Qamar (2013-06-12). "Sinking in: Pakistan to be in Rs14t debt quagmire by end of fiscal 2013 – The Express Tribune". Tribune.com.pk. Retrieved 2014-01-11.

- 1 2 http://www.imf.org/external/pubs/ft/weo/2016/01/weodata/weorept.aspx?pr.x=79&pr.y=9&sy=2016&ey=2016&scsm=1&ssd=1&sort=country&ds=.&br=1&c=564&s=GGR%2CGGR_NGDP%2CGGX%2CGGX_NGDP&grp=0&a=

- ↑ "Sovereigns rating list". Standard & Poor's. Retrieved 31 October 2016.

- ↑ Mangi, Faseeh (5 May 2015). "S&P Follows Moody's to Raise Pakistan Outlook as Growth Quickens". bloomberg.com.

- ↑ https://www.moodys.com/research/Moodys-upgrades-Pakistans-bond-ratings-to-B2-with-a-stable--PR_325728

- ↑ http://www.radio.gov.pk/22-Oct-2016/forex-reserves-surpass-over-24bn-dar#disqus_thread

- ↑ "The Secret Strength of Pakistan's Economy". Bloomberg.

- ↑ Faryal Leghari (3 January 2007). "GCC investments in Pakistan and future trends". Gulf Research Center. Retrieved 12 February 2008.

- ↑ "Quid Pro Quo 45 – Tales of Success" (PDF). Muslim Commercial Bank of Pakistan. 2007. p. 2. Archived from the original (PDF) on 16 February 2008. Retrieved 12 February 2008.

- ↑ Malcolm Borthwick (1 June 2006). "Pakistan steels itself for sell-offs". BBC News. Retrieved 12 February 2008.

- ↑ Tavia Grant (8 December 2011). "On 10th birthday, BRICs poised for more growth". The Globe and Mail. Toronto. Retrieved 4 January 2012.

- 1 2 Declan Walsh (18 May 2013). "Pakistan, Rusting in Its Tracks". The New York Times. Retrieved 19 May 2013.

natural disasters and entrenched insurgencies, abject poverty and feudal kleptocrats, and an economy near meltdown

- ↑ Henneberry, S. (2000). "An analysis of industrial–agricultural interactions: A case study in Pakistan". Agricultural Economics. 22: 17–27. doi:10.1016/S0169-5150(99)00041-9.

- 1 2 3 "World Bank Document" (PDF). 2008. p. 14. Retrieved 2 January 2010.

- ↑ "Pakistan Country Report" (PDF). RAD-AID. 2010. pp. 3, 7. Retrieved 26 December 2011.

- ↑ Pakistan Economy

- ↑ Archived 20 July 2009 at the Wayback Machine.

- ↑ World Bank Country Classification Groups, (July 2006 data)

- ↑ "Privatisation process: Govt to sell assets in sole offering". The Express Tribune.

- ↑ State Bank of Pakistab. "Foreign Currency Reserve" (PDF).

- ↑ "Foreign currency reserves cross $10b mark". The Express Tribune.

- ↑ "Outlook stable: S&P affirms Pakistan's ratings at 'B-/B'". The Express Tribune.

- ↑ "These are the '10 emerging markets of the future'". World Economic Forum. Retrieved 2016-07-31.

- ↑ http://nation.com.pk/national/25-Oct-2016/pakistan-economy-out-of-crisis-imf

- ↑ http://www.dawn.com/news/1295477/world-bank-projects-54-per-cent-growth-rate-for-pakistan-in-2018

- ↑ https://www.geo.tv/latest/120232-Pakistan-shows-highest-economic-growth-in-eight-years-World-Bank

- ↑ http://www.pkrevenue.com/finance/budget-20162017-fiscal-deficit-target-set-at-3-8-percent/

- ↑ http://tribune.com.pk/story/1047563/budgetary-operations-performance-improves-budget-deficit-at-1-7/

- ↑ https://www.moodys.com/research/Moodys-upgrades-Pakistans-bond-ratings-to-B3-with-a-stable--PR_325728

- ↑ Archived 4 March 2013 at the Wayback Machine.

- 1 2 Archived 13 November 2010 at the Wayback Machine.

- ↑ "Edit/Review Countries". imf.org.

- ↑ "Bush administration puts pressure on Pakistan (Sept 13 2001)". CNN. 2001-09-13. Archived from the original on 21 October 2007. Retrieved 2007-12-04.

- ↑

- ↑ "Doing Business in 2006: South Asian Countries Pick up Reform Pace, says World Bank Group; India Ranks 116th, 25 Places After China; Pakistan Among Top 10 Reformers". September 12, 2005. Retrieved 2006-06-03.

- ↑ "in Pakistan – Doing Business – The World Bank Group". Doing Business. Retrieved 2010-07-29.

- ↑ "Western companies continue to exit Pakistan citing corruption". Retrieved 2015-08-24.

- 1 2 "Pakistan economic data| Country briefings". The Economist. Archived from the original on 11 June 2010. Retrieved 2010-07-29.

- ↑ "The Benefits of the English Language for Individuals and Societies: Quantitative Indicators from Cameroon, Nigeria, Rwanda, Bangladesh and Pakistan" (PDF). Retrieved 2012-09-02.

- ↑ Shirajiv, Sirimane. "'Pakistan-Sri Lanka trade zooming to US$ one billion mark'". Retrieved 23 May 2007.

- ↑ "Data – Finance". Web.worldbank.org. Archived from the original on 5 April 2010. Retrieved 2010-07-29.

- ↑ "Weekly review: KSE-100 crosses 30,000 points to hit all-time high". The Express Tribune.

- ↑ Jalil, Abdul and Feridun, Mete (2010) Explaining exchange rate movements: An application of the market microstructure approach on the Pakistani foreign exchange market. The Journal of Developing Areas, 44 (1). pp. 255-265. ISSN 0022-037X (print), 1548–2278 (on-line) (doi:10.1353/jda.0.0083)

- ↑ "Pakistan, Land of Entrepreneurs". Businessweek. 2012-11-29. Retrieved 2014-01-11.

- ↑ "CBR expects to receive 1.75 million tax returns -DAWN – Business; October 11, 2006". DAWN. Retrieved 2010-07-29.

- ↑ "BBC News - Stop extra UK aid to Pakistan unless taxes increase, urge MPs". Bbc.co.uk. 2013-04-04. Retrieved 2014-01-11.

- ↑ "Business | South Asian economies gather pace". BBC News. 2005-08-12. Retrieved 2010-07-29.

- ↑ Archived 12 August 2010 at the Wayback Machine.

- ↑ "Need for a new paradigm - DAWN.COM". Archives.dawn.com. 2010-04-27. Retrieved 2014-01-11.

- ↑ http://data.worldbank.org/country/pakistan

- 1 2 "HRM significance and SME sector -Business Recorder – Articles and Letters; 11 April 2011". Business Recorder. 2011-04-11.

- ↑ CIA – The World Factbook – Rank Order – Unemployment rate

- ↑ "Rs100bn employment scheme launched -DAWN – Top Stories; September 06, 2006". DAWN. 2006-09-06. Retrieved 2010-07-29.

- ↑ "NBP offers 5 packages for Rozgar Scheme -DAWN – Business; September 06, 2006". DAWN. 2006-09-06. Retrieved 2010-07-29.

- ↑ ELLICK, ADAM B. " Necessity Pushes Pakistani Women Into Jobs and Peril." New York Times, 26 December 2010.

- ↑ "Government Jobs in Pakistan".

- ↑ "Extremism Mars Daughter of Alps | Pakistan Alpine Institute". Pakistanalpine.com. Retrieved 2014-01-11.

- ↑ http://www.brecorder.com/pakistan/industries-a-sectors/328271-pakistans-tourism-industry-gradually-recovering.html

- ↑ Pakistan News Service – PakTribune

- ↑ "Forex Currency Rates Pakistan - Forex Open Market Rates - Prize Bond Draw Result - Rates and schedule - Finance News & Updates". Forexpk.com. 2014-01-06. Retrieved 2014-01-11.

- ↑ Archived 9 August 2007 at the Wayback Machine.

- ↑ "FAOSTAT Database Results". Retrieved 2006-06-03.

- ↑ http://www.fao.org/newsroom/en/field/2007/1000497/index.html

- ↑ "Agriculture Statistics". pbs.gov.pk.

- ↑ PAKISTAN-FAOSTAT

- ↑ "World Bank Document" (PDF). Retrieved 2010-07-29.

- ↑ uploader. "Associated Press Of Pakistan ( Pakistan's Premier NEWS Agency ) - Manufacturing sector grows by 5.2 percent". app.com.pk.

- ↑ "The growth of the "billion dollar club" in Pakistan". The Express Tribune.

- ↑ Financial Highlights- PSO

- ↑ "Financial Data - K-Electric". ke.com.pk.

- ↑ More Desk. "PTCL is the largest revenue generator in listed telecom market". moremag.pk.

- ↑ "All Pakistan Cement Manufacturers Association Export Data". Apcma.com. Retrieved 15 October 2013.

- ↑ Bhutta, Zafar (21 May 2013). "Can't get enough: Soaring profits not enough for cement industry". Tribune.com.pk. Retrieved 15 October 2013.

- ↑ "Upward move: Pakistan's ICT sector to cross $10b mark, says P@SHA". The Express Tribune.

- ↑ Archived 27 October 2011 at the Wayback Machine.

- ↑ "Geography of Offshoring is Shifting | News & media". Atkearney.com. Retrieved 2010-07-29.

- ↑

- ↑ "Tackling the energy crisis". Nation.com.pk. Retrieved 2014-01-11.

- ↑

- ↑ Archived 13 November 2010 at the Wayback Machine.

- 1 2 "Business Recorder [Pakistan's First Financial Daily]". Brecorder.com. 2004-01-01. Retrieved 2010-07-29.

- ↑ IT sector export about $600 million a year: minister. Business Recorder. Retrieved on 16 February 2008

- ↑ https://web.archive.org/web/20060904133739/http://www.gsmworld.com/news/press_2006/press06_14.shtml. Archived from the original on 4 September 2006. Retrieved 25 August 2006. Missing or empty

|title=(help) - ↑ Pakistan: Growth and Export Competitiveness, World Bank Document No. 35499-PK, Table 6.7, page 116. Issued 25 April 2006

- ↑ "Leading News Resource of Pakistan". Daily Times. Archived from the original on 11 June 2010. Retrieved 2010-07-29.

- ↑ "Guess Which County Texts the Heaviest". PCWorld. 1 February 2009.

- ↑ "Leading News Resource of Pakistan". Daily Times. 2008-12-03. Archived from the original on 11 June 2010. Retrieved 2010-07-29.

- ↑ "Internet Users in Pakistan hit 17.5 Million Mark – ProPakistani". Propakistani.pk. Retrieved 2010-07-29.

- ↑ "Pakistan Broadband Overview | Broadband Country Overview". Point Topic. 2010-01-11. Retrieved 2010-07-29.

- 1 2 3 4 5 (PDF) https://web.archive.org/web/20070619224443/http://www.statpak.gov.pk/depts/fbs/statistics/national_accounts/table4.pdf. Archived from the original (PDF) on 19 June 2007. Retrieved 19 June 2007. Missing or empty

|title=(help) - ↑ PIAC Annual report 2005

- ↑ "Ports and shipping of Pakistan". Pakakhbar.com. Retrieved 2010-07-29.

- ↑ "Pakistan Railways to undertake Rs60bn rehabilitation plan -DAWN – National; 4 July 2005". DAWN. 2005-07-04. Retrieved 2010-07-29.

- ↑ "Pakistan-Turkey rail trial starts". BBC News. 2009-08-14. Retrieved 2010-05-01.

- ↑ "Pakistan, Turkey and Iran plan rail container service Rail transport, Pakistan Intermodal, Rail transport, Turkey rail transport, Pakistan Railways, Akhtar, Saaed". Worldcargonews.com. 2009-04-08. Retrieved 2010-07-29.

- ↑ "Credit cards gaining popularity -DAWN – Business; August 20, 2005". DAWN. 2005-08-20. Retrieved 2010-07-29.

- ↑ Jalil, Abdul and Feridun, Mete (2011) Impact of financial development on economic growth: empirical evidence from Pakistan. Journal of the Asia Pacific Economy , 16 (1). pp. 71-80. ISSN 1354-7860 (print), 1469-9648 (online) (doi:10.1080/13547860.2011.539403)

- ↑ Pakistan's post-9/11 economic boom BBC News, 21 September 2006

- ↑ 0.5 million housing units needed annually to meet shortfall: KCCI Business Recorder, 7 October 2006

- ↑ Shahbaz, Muhammad and Feridun, Mete (2012) Electricity consumption and economic growth empirical evidence from Pakistan. Quality & Quantity, 46 (5). pp. 1583–1599. ISSN 0033-5177 (print), 1573-7845 (Online) (doi:10.1007/s11135-011-9468-3)

- ↑ "CIA Worldbook". CIA. 2012-05-12. Retrieved 2012-05-12.

- ↑ FDI into Pakistan jumps 180.6% in 1st 9 months of FY06

- ↑ Archived 11 June 2010 at the Wayback Machine.

- ↑ "Significant Decline In Foreign Investment To Pakistan". Malick, Sajid Ibrahim. 2010-02-15. Retrieved 2010-11-01.

- ↑ "Rankings – Doing Business – The World Bank Group". Doing Business. Retrieved 2010-07-29.

- ↑ https://web.archive.org/web/20080302082938/http://pewatch.blogspot.com/2007/11/private-equity-in-pakistan-israel-and.html. Archived from the original on 2 March 2008. Retrieved 29 December 2007. Missing or empty

|title=(help) - ↑ "Welcome to the Board of Investment". boi.gov.pk.

- ↑ Mohiuddin Aazim. "Rising foreign stakes in local companies". dawn.com.

- ↑ Macroeconomic Stability of Pakistan: The Role of the IMF and World Bank (1997–2003) Faisal Cheema, Programme in Arms Control, Disarmament, and International Security (ACDIS), University of Illinois at Urbana-Champaign, May 2004

- ↑ Pakistani Newspaper Article, 2004

- 1 2 "Pakistan" (PDF). European Commission Trade. Retrieved 2011-09-29.

- ↑ Economic Survey 2011-12: Govt scores perfect 0, The News International, 01 June 2012

- ↑ Archived 27 June 2008 at the Wayback Machine.

- ↑ https://web.archive.org/web/20070821043020/http://in.news.yahoo.com/070803/139/6j021.html. Archived from the original on 21 August 2007. Retrieved 4 July 2011. Missing or empty

|title=(help) - ↑ "Russia is a growing market for Pakistani exporters". Freshplaza.com. Retrieved 2014-01-11.

- ↑ Archived 13 November 2010 at the Wayback Machine.

- ↑ Current account deficit up by 41pc -DAWN – Business; 22 July 2007

- ↑ "Should Pakistan default on its debt? – GupShup Forums". Paklinks.com. Archived from the original on 11 June 2010. Retrieved 2010-07-29.

- ↑ "Business Recorder [Pakistan's First Financial Daily]". Brecorder.com. 2004-01-01. Retrieved 2010-07-29.

- ↑ "World Bank plans 6.5 bln usd lending to Pakistan". Forbes.com. January 2, 2006. Archived from the original on 4 September 2006. Retrieved March 6, 2006.

- ↑ "Japan to resume USD 500 mn annual funding for Pak". Chennai, India: The Hindu News Update Service. May 29, 2006. Archived from the original on 30 September 2007. Retrieved 2006-06-03.

- ↑ "IMF Approves Pakistan Loan Package". VOA News. Voice of America. 25 November 2008. Retrieved 1 January 2009.

- ↑ "Pakistan | State Bank of Pakistan" (PDF). sbp.org. Retrieved 2011-07-15.