Copula (probability theory)

In probability theory and statistics, a copula is a multivariate probability distribution for which the marginal probability distribution of each variable is uniform. Copulas are used to describe the dependence between random variables. Their name comes from the Latin for "link" or "tie", similar but unrelated to grammatical copulas in linguistics. Copulas have been used widely in quantitative finance to model and minimize tail risk[1] and portfolio optimization applications.[2]

Sklar's Theorem states that any multivariate joint distribution can be written in terms of univariate marginal distribution functions and a copula which describes the dependence structure between the variables.

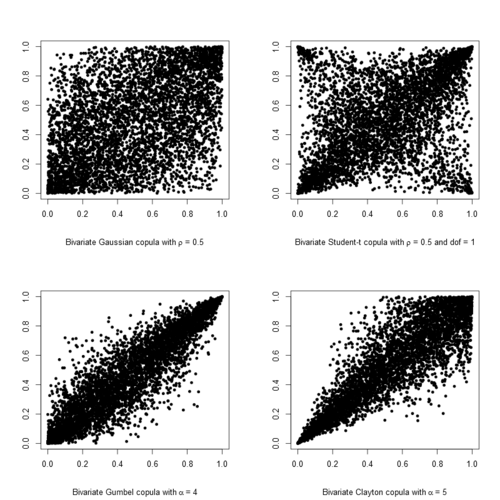

Copulas are popular in high-dimensional statistical applications as they allow one to easily model and estimate the distribution of random vectors by estimating marginals and copulae separately. There are many parametric copula families available, which usually have parameters that control the strength of dependence. Some popular parametric copula models are outlined below.

Mathematical definition

Consider a random vector . Suppose its marginals are continuous, i.e. the marginal CDFs are continuous functions. By applying the probability integral transform to each component, the random vector

has uniformly distributed marginals.

The copula of is defined as the joint cumulative distribution function of :

The copula C contains all information on the dependence structure between the components of whereas the marginal cumulative distribution functions contain all information on the marginal distributions.

The importance of the above is that the reverse of these steps can be used to generate pseudo-random samples from general classes of multivariate probability distributions. That is, given a procedure to generate a sample from the copula distribution, the required sample can be constructed as

The inverses are unproblematic as the were assumed to be continuous. The above formula for the copula function can be rewritten to correspond to this as:

Definition

In probabilistic terms, is a d-dimensional copula if C is a joint cumulative distribution function of a d-dimensional random vector on the unit cube with uniform marginals.[3]

In analytic terms, is a d-dimensional copula if

- , the copula is zero if one of the arguments is zero,

- , the copula is equal to u if one argument is u and all others 1,

- C is d-non-decreasing, i.e., for each hyperrectangle the C-volume of B is non-negative:

- where the .

For instance, in the bivariate case, is a bivariate copula if , and for all and .

Sklar's theorem

Sklar's theorem,[4] named after Abe Sklar, provides the theoretical foundation for the application of copulas. Sklar's theorem states that every multivariate cumulative distribution function

of a random vector can be expressed in terms of its marginals and a copula . Indeed:

In case that the multivariate distribution has a density , and this is available, it holds further that

where is the density of the copula.

The theorem also states that, given , the copula is unique on , which is the cartesian product of the ranges of the marginal cdf's. This implies that the copula is unique if the marginals are continuous.

The converse is also true: given a copula and margins then defines a d-dimensional cumulative distribution function.

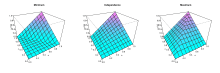

Fréchet–Hoeffding copula bounds

The Fréchet–Hoeffding Theorem (after Maurice René Fréchet and Wassily Hoeffding [5]) states that for any Copula and any the following bounds hold:

The function W is called lower Fréchet–Hoeffding bound and is defined as

The function M is called upper Fréchet–Hoeffding bound and is defined as

The upper bound is sharp: M is always a copula, it corresponds to comonotone random variables.

The lower bound is point-wise sharp, in the sense that for fixed u, there is a copula such that . However, W is a copula only in two dimensions, in which case it corresponds to countermonotonic random variables.

In two dimensions, i.e. the bivariate case, the Fréchet–Hoeffding Theorem states

Families of copulas

Several families of copulae have been described.

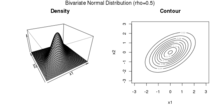

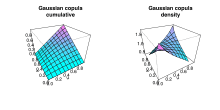

Gaussian copula

The Gaussian copula is a distribution over the unit cube . It is constructed from a multivariate normal distribution over by using the probability integral transform.

For a given correlation matrix , the Gaussian copula with parameter matrix can be written as

where is the inverse cumulative distribution function of a standard normal and is the joint cumulative distribution function of a multivariate normal distribution with mean vector zero and covariance matrix equal to the correlation matrix . While there is no simple analytical formula for the copula function, , it can be upper or lower bounded, and approximated using numerical integration.[6][7] The density can be written as[8]

where is the identity matrix.

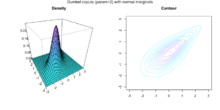

Archimedean copulas

Archimedean copulas are an associative class of copulas. Most common Archimedean copulas admit an explicit formula, something not possible for instance for the Gaussian copula. In practice, Archimedean copulas are popular because they allow modeling dependence in arbitrarily high dimensions with only one parameter, governing the strength of dependence.

A copula C is called Archimedean if it admits the representation[9]

where is a continuous, strictly decreasing and convex function such that . is a parameter within some parameter space . is the so-called generator function and is its pseudo-inverse defined by

Moreover, the above formula for C yields a copula for if and only if is d-monotone on .[10] That is, if it is times differentiable and the derivatives satisfy

for all and and is nonincreasing and convex.

Most important Archimedean copulas

The following tables highlight the most prominent bivariate Archimedean copulas, with their corresponding generator. Note that not all of them are completely monotone, i.e. d-monotone for all or d-monotone for certain only.

| Name of Copula | Bivariate Copula | parameter |

|---|---|---|

| Ali-Mikhail-Haq[11] | ||

| Clayton[12] | ||

| Frank | ||

| Gumbel | ||

| Independence | ||

| Joe |

| name | generator | generator inverse |

|---|---|---|

| Ali-Mikhail-Haq[11] | ||

| Clayton[12] | ||

| Frank | ||

| Gumbel | ||

| Independence | ||

| Joe |

Expectation for copula models and Monte Carlo integration

In statistical applications, many problems can be formulated in the following way. One is interested in the expectation of a response function applied to some random vector .[13] If we denote the cdf of this random vector with , the quantity of interest can thus be written as

If is given by a copula model, i.e.,

this expectation can be rewritten as

In case the copula C is absolutely continuous, i.e. C has a density c, this equation can be written as

and if each marginal distribution has the density it holds further that

If copula and margins are known (or if they have been estimated), this expectation can be approximated through the following Monte Carlo algorithm:

- Draw a sample of size n from the copula C

- By applying the inverse marginal cdf's, produce a sample of by setting

- Approximate by its empirical value:

Empirical copulas

When studying multivariate data, one might want to investigate the underlying copula. Suppose we have observations

from a random vector with continuous margins. The corresponding "true" copula observations would be

However, the marginal distribution functions are usually not known. Therefore, one can construct pseudo copula observations by using the empirical distribution functions

instead. Then, the pseudo copula observations are defined as

The corresponding empirical copula is then defined as

The components of the pseudo copula samples can also be written as , where is the rank of the observation :

Therefore, the empirical copula can be seen as the empirical distribution of the rank transformed data.

Applications

Quantitative finance

In risk/portfolio management, copulas are used to perform stress-tests and robustness checks that are especially important during “downside/crisis/panic regimes” where extreme downside events may occur (e.g., the global financial crisis of 2007–2008).

The formula was also adapted for financial markets and was used to estimate the probability distribution of losses on pools of loans or bonds. The users of the formula have been criticized for creating "evaluation cultures" that continued to use simple copulæ despite the simple versions being acknowledged as inadequate for that purpose.[14] During a downside regime, a large number of investors who have held positions in riskier assets such as equities or real estate may seek refuge in ‘safer’ investments such as cash or bonds. This is also known as a flight-to-quality effect and investors tend to exit their positions in riskier assets in large numbers in a short period of time. As a result, during downside regimes, correlations across equities are greater on the downside as opposed to the upside and this may have disastrous effects on the economy. [15] [16] For example, anecdotally, we often read financial news headlines reporting the loss of hundreds of millions of dollars on the stock exchange in a single day; however, we rarely read reports of positive stock market gains of the same magnitude and in the same short time frame.

Copulas are useful in portfolio/risk management and help us analyse the effects of downside regimes by allowing the modelling of the marginals and dependence structure of a multivariate probability model separately. For example, consider the stock exchange as a market consisting of a large number of traders each operating with his/her own strategies to maximize profits. The individualistic behaviour of each trader can be described by modelling the marginals. However, as all traders operate on the same exchange, each trader's actions have an interaction effect with other traders'. This interaction effect can be described by modelling the dependence structure. Therefore, copulas allow us to analyse the interaction effects which are of particular interest during downside regimes as investors tend to herd their trading behaviour and decisions.

Previously, scalable copula models for large dimensions only allowed the modelling of elliptical dependence structures (i.e., Gaussian and Student-t copulas) that do not allow for correlation asymmetries where correlations differ on the upside or downside regimes. However, the recent development of vine copulas[17] (also known as pair copulas) enables the flexible modelling of the dependence structure for portfolios of large dimensions. [18] The Clayton canonical vine copula allows for the occurrence of extreme downside events and has been successfully applied in portfolio choice and risk management applications. The model is able to reduce the effects of extreme downside correlations and produces improved statistical and economic performance compared to scalable elliptical dependence copulas such as the Gaussian and Student-t copula.[19] Other models developed for risk management applications are panic copulas that are glued with market estimates of the marginal distributions to analyze the effects of panic regimes on the portfolio profit and loss distribution. Panic copulas are created by Monte Carlo simulation, mixed with a re-weighting of the probability of each scenario.[20]

As far as derivatives pricing is concerned, dependence modelling with copula functions is widely used in applications of financial risk assessment and actuarial analysis – for example in the pricing of collateralized debt obligations (CDOs).[21] Some believe the methodology of applying the Gaussian copula to credit derivatives to be one of the reasons behind the global financial crisis of 2008–2009.[22][23] Despite this perception, there are documented attempts of the financial industry, occurring before the crisis, to address the limitations of the Gaussian copula and of copula functions more generally, specifically the lack of dependence dynamics. The Gaussian copula is lacking as it only allows for an elliptical dependence structure, as dependence is only modeled using the variance-covariance matrix.[24] This methodology is limited such that it does not allow for dependence to evolve as the financial markets exhibit asymmetric dependence, whereby correlations across assets significantly increase during downturns compared to upturns. Therefore, modeling approaches using the Gaussian copula exhibit a poor representation of extreme events.[25][26] There have been attempts to propose models rectifying some of the copula limitations.[26][27][28]

While the application of copulas in credit has gone through popularity as well as misfortune during the global financial crisis of 2008–2009,[29] it is arguably an industry standard model for pricing CDOs. Copulas have also been applied to other asset classes as a flexible tool in analyzing multi-asset derivative products. The first such application outside credit was to use a copula to construct an implied basket volatility surface,[30] taking into account the volatility smile of basket components. Copulas have since gained popularity in pricing and risk management [31] of options on multi-assets in the presence of volatility smile/skew, in equity, foreign exchange and fixed income derivative business. Some typical example applications of copulas are listed below:

- Analyzing and pricing volatility smile/skew of exotic baskets, e.g. best/worst of;

- Analyzing and pricing volatility smile/skew of less liquid FX cross, which is effectively a basket: C = S1/S2 or C = S1·S2;

- Analyzing and pricing spread options, in particular in fixed income constant maturity swap spread options.

- Value-at-Risk forecasting and portfolio optimization to minimize tail risk for US and international equities.[32]

- Improving the estimates of the expected return and variance-covariance matrix for input into sophisticated mean-variance optimization strategies.[33]

- Statistical arbitrage strategies including pairs trading.[34]

Civil engineering

Recently, copula functions have been successfully applied to the database formulation for the reliability analysis of highway bridges, and to various multivariate simulation studies in civil,[35] mechanical and offshore engineering.[36] Researchers are also trying these functions in field of transportation to understand interaction of individual driver behavior components which in totality shapes up the nature of an entire traffic flow.

Reliability engineering

Copulas are being used for reliability analysis of complex systems of machine components with competing failure modes. [37]

Warranty data analysis

Copulas are being used for warranty data analysis in which the tail dependence is analysed [38]

Turbulent combustion

Copulas are used in modelling turbulent partially premixed combustion, which is common in practical combustors. [39] [40]

Medicine

Copula functions have been successfully applied to the analysis of neuronal dependencies [41] and spike counts in neuroscience [42]

Weather research

Copulas have been extensively used in climate- and weather-related research.[43]

Random vector generation

Large synthetic traces of vectors and stationary time series can be generated using empirical copula while preserving the entire dependence structure of small datasets.[44] Such empirical traces are useful in various simulation-based performance studies.[45]

References

- ↑ Low, R.K.Y.; Alcock, J.; Faff, R.; Brailsford, T. (2013). "Canonical vine copulas in the context of modern portfolio management: Are they worth it?". Journal of Banking & Finance. 37 (8). doi:10.1016/j.jbankfin.2013.02.036.

- ↑ Low, R.K.Y.; Faff, R.; Aas, K. (2016). "Enhancing mean–variance portfolio selection by modeling distributional asymmetries". Journal of Economics and Business. doi:10.1016/j.jeconbus.2016.01.003.

- ↑ Nelsen, Roger B. (1999), An Introduction to Copulas, New York: Springer, ISBN 0-387-98623-5

- ↑ Sklar, A. (1959), "Fonctions de répartition à n dimensions et leurs marges", Publ. Inst. Statist. Univ. Paris, 8: 229–231

- ↑ "J J O'Connor and E F Robertson" (March 2011). "Biography of Wassily Hoeffding". School of Mathematics and Statistics, University of St Andrews, Scotland. Retrieved 8 November 2011.

- ↑ Botev, Z. I. (2016). "The normal law under linear restrictions: simulation and estimation via minimax tilting". Journal of the Royal Statistical Society: Series B (Statistical Methodology). doi:10.1111/rssb.12162.

- ↑ See for instance

- ↑ Arbenz, Philipp (2013). "Bayesian Copulae Distributions, with Application to Operational Risk Management—Some Comments". Methodology and Computing in Applied Probability. 15 (1): 105–108. doi:10.1007/s11009-011-9224-0.

- 1 2 3 Nelsen, R. B. (2006). An Introduction to Copulas, Second Edition. New York, NY 10013, USA: Springer Science+Business Media Inc. ISBN 978-1-4419-2109-3.

- ↑ McNeil, A. J.; Nešlehová, J. (2009). "Multivariate Archimedean copulas, d-monotone functions and 1-norm symmetric distributions". Annals of Statistics. 37 (5b): 3059–3097. doi:10.1214/07-AOS556.

- 1 2 Ali, M.M., Mikhail, N.N. and Haq, M.S. (1978). A class of bivariate distributions including the bivariate logistic. J. Multivariate Anal. 8, 405-412

- 1 2 Clayton, David G. (1978). "A model for association in bivariate life tables and its application in epidemiological studies of familial tendency in chronic disease incidence". Biometrika. 65 (1): 141–151. doi:10.1093/biomet/65.1.141. JSTOR 2335289.

- ↑ Alexander J. McNeil, Rudiger Frey and Paul Embrechts (2005) "Quantitative Risk Management: Concepts, Techniques, and Tools", Princeton Series in Finance

- ↑ MacKenzie, Donald; Spears, Taylor (June 2012). "The Formula That Killed Wall Street"? The Gaussian Copula and the Material Cultures of Modelling (pdf) (Technical report). University of Edinburgh School of Social and Political Sciences.

- ↑ Longin, F; Solnik, B (2001), "Extreme correlation of international equity markets", Journal of Finance, 56 (2): 649–676, doi:10.1111/0022-1082.00340

- ↑ Ang, A; Chen, J (2002), "Asymmetric correlations of equity portfolios", Journal of Financial Economics, 63 (3): 443–494, doi:10.1016/s0304-405x(02)00068-5

- ↑ Cooke, R.M.; Joe, H.; Aas, K. (January 2011). Kurowicka, D.; Joe, H., eds. Dependence Modeling Vine Copula Handbook (PDF). World Scientific. pp. 37–72. ISBN 978-981-4299-87-9.

- ↑ Aas, K; Czado, C; Bakken, H (2009), "Pair-copula constructions of multiple dependence", Insurance: Mathematics and Economics, 44 (2): 182–198, doi:10.1016/j.insmatheco.2007.02.001

- ↑ Low, R; Alcock, J; Brailsford, T; Faff, R (2013), "Canonical vine copulas in the context of modern portfolio management: Are they worth it?", Journal of Banking and Finance, 37 (8): 3085–3099, doi:10.1016/j.jbankfin.2013.02.036

- ↑ Meucci, Attilio (2011), "A New Breed of Copulas for Risk and Portfolio Management", Risk, 24 (9): 122–126

- ↑ Meneguzzo, David; Vecchiato, Walter (Nov 2003), "Copula sensitivity in collateralized debt obligations and basket default swaps", Journal of Futures Markets, 24 (1): 37–70, doi:10.1002/fut.10110

- ↑ Recipe for Disaster: The Formula That Killed Wall Street Wired, 2/23/2009

- ↑ MacKenzie, Donald (2008), "End-of-the-World Trade", London Review of Books (published 2008-05-08), retrieved 2009-07-27

- ↑ Low, R; Alcock, J; Brailsford, T; Faff, R (2013), "Canonical vine copulas in the context of modern portfolio management: Are they worth it?", Journal of Banking and Finance, 37 (8): 3085–3099, doi:10.1016/j.jbankfin.2013.02.036

- ↑ Low, R; Alcock, J; Brailsford, T; Faff, R (2013), "Canonical vine copulas in the context of modern portfolio management: Are they worth it?", Journal of Banking and Finance, 37 (8): 3085–3099, doi:10.1016/j.jbankfin.2013.02.036

- 1 2 Lipton, Alexander; Rennie, Andrew. Credit Correlation: Life After Copulas. World Scientific. ISBN 978-981-270-949-3.

- ↑ Donnelly, C; Embrechts, P, (2010). "The devil is in the tails: actuarial mathematics and the subprime mortgage crisis". ASTIN Bulletin 40(1), 1–33.

- ↑ Brigo, D; Pallavicini, A; Torresetti, R (2010). Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and dynamic Models. Wiley and Sons.

- ↑ Jones, Sam (April 24, 2009), "The formula that felled Wall St", Financial Times

- ↑ Qu, Dong, (2001). "Basket Implied Volatility Surface". Derivatives Week (4 June.).

- ↑ Qu, Dong, (2005). "Pricing Basket Options With Skew". Wilmott Magazine (July.).

- ↑ Low, R.K.Y.; Alcock, J.; Faff, R.; Brailsford, T. (2013). "Canonical vine copulas in the context of modern portfolio management: Are they worth it?". Journal of Banking & Finance. 37 (8). doi:10.1016/j.jbankfin.2013.02.036.

- ↑ Low, R.K.Y.; Faff, R.; Aas, K. (2016). "Enhancing mean–variance portfolio selection by modeling distributional asymmetries". Journal of Economics and Business. doi:10.1016/j.jeconbus.2016.01.003.

- ↑ Rad, Hossein; Low, Rand Kwong Yew; Faff, Robert (2016-04-27). "The profitability of pairs trading strategies: distance, cointegration and copula methods". Quantitative Finance. 0 (0): 1–18. doi:10.1080/14697688.2016.1164337. ISSN 1469-7688.

- ↑ Thompson, David; Kilgore, Roger (2011), "Estimating Joint Flow Probabilities at Stream Confluences using Copulas", Transportation Research Record, 2262: 200–206, doi:10.3141/2262-20, retrieved 2012-02-21

- ↑ Zhang, Yi; Beer, Michael; Quek, Ser Tong (2015-07-01). "Long-term performance assessment and design of offshore structures". Computers & Structures. 154: 101–115. doi:10.1016/j.compstruc.2015.02.029.

- ↑ Pham, Hong (2003), Handbook of Reliability Engineering, Springer, pp. 150–151

- ↑ Wu, S. (2014), "Construction of asymmetric copulas and its application in two-dimensional reliability modelling", European Journal of Operational Research, 238: 476–485, doi:10.1016/j.ejor.2014.03.016

- ↑ Ruan, S.; Swaminathan, N; Darbyshire, O (2014), "Modelling of turbulent lifted jet flames using flamelets: a priori assessment and a posteriori validation", Combustion Theory and Modelling, 18 (2): 295–329, doi:10.1080/13647830.2014.898409

- ↑ Darbyshire, O.R.; Swaminathan, N (2012), "A presumed joint pdf model for turbulent combustion with varying equivalence ratio", Combustion Science and Technology, 184 (12): 2036–2067, doi:10.1080/00102202.2012.696566

- ↑ Eban, E; Rothschild, R; Mizrahi, A; Nelken, I; Elidan, G (2013), Carvalho, C; Ravikumar, P, eds., "Dynamic Copula Networks for Modeling Real-valued Time Series" (PDF), Journal of Machine Learning Research, 31

- ↑ Onken, A; Grünewälder, S; Munk, MH; Obermayer, K (2009), Aertsen, Ad, ed., "Analyzing Short-Term Noise Dependencies of Spike-Counts in Macaque Prefrontal Cortex Using Copulas and the Flashlight Transformation", PLoS Computational Biology, 5 (11): e1000577, doi:10.1371/journal.pcbi.1000577, PMC 2776173

, PMID 19956759

, PMID 19956759 - ↑ Schölzel, C.; Friederichs, P. (2008). "Multivariate non-normally distributed random variables in climate research – introduction to the copula approach". Nonlinear Processes in Geophysics. 15 (5): 761–772. doi:10.5194/npg-15-761-2008.

- ↑ Strelen, Johann Christoph (2009). "T ools for Dependent Simulation Input with Copulas". SIMUTools. doi:10.1145/1537614.1537654.

- ↑ Bandara, H. M. N. D.; Jayasumana, A. P. (Dec 2011). "On Characteristics and Modeling of P2P Resources with Correlated Static and Dynamic Attributes". IEEE GLOBECOM: 1–6.

Further reading

- The standard reference for an introduction to copulas. Covers all fundamental aspects, summarizes the most popular copula classes, and provides proofs for the important theorems related to copulas

- Roger B. Nelsen (1999), "An Introduction to Copulas", Springer. ISBN 978-0-387-98623-4

- A book covering current topics in mathematical research on copulas:

- Piotr Jaworski, Fabrizio Durante, Wolfgang Karl Härdle, Tomasz Rychlik (Editors): (2010): "Copula Theory and Its Applications" Lecture Notes in Statistics, Springer. ISBN 978-3-642-12464-8

- A reference for sampling applications and stochastic models related to copulas is

- Jan-Frederik Mai, Matthias Scherer (2012): Simulating Copulas (Stochastic Models, Sampling Algorithms and Applications). World Scientific. ISBN 978-1-84816-874-9

- A paper covering the historic development of copula theory, by the person associated with the "invention" of copulas, Abe Sklar.

- Abe Sklar (1997): "Random variables, distribution functions, and copulas – a personal look backward and forward" in Rüschendorf, L., Schweizer, B. und Taylor, M. (eds) Distributions With Fixed Marginals & Related Topics (Lecture Notes – Monograph Series Number 28). ISBN 978-0-940600-40-9

- The standard reference for multivariate models and copula theory in the context of financial and insurance models

- Alexander J. McNeil, Rudiger Frey and Paul Embrechts (2005) "Quantitative Risk Management: Concepts, Techniques, and Tools", Princeton Series in Finance. ISBN 978-0-691-12255-7

External links

- Hazewinkel, Michiel, ed. (2001), "Copula", Encyclopedia of Mathematics, Springer, ISBN 978-1-55608-010-4

- Copula Wiki: community portal for researchers with interest in copulas

- A collection of Copula simulation and estimation codes

- Thorsten Schmidt (2006) "Coping with Copulas"

- Copulas & Correlation using Excel Simulation Articles

- Chapter 1 of Jan-Frederik Mai, Matthias Scherer (2012) "Simulating Copulas: Stochastic Models, Sampling Algorithms, and Applications"

- ↑ Zhang, Yi; Beer, Michael; Quek, Ser Tong (2015-07-01). "Long-term performance assessment and design of offshore structures". Computers & Structures. 154: 101–115. doi:10.1016/j.compstruc.2015.02.029.